Socially excessive product complexity. ∗ Richard Martin May 7, 2004

advertisement

Socially excessive product complexity.∗

Richard Martin†

May 7, 2004

Abstract

We investigate a monopolist’s choice of product complexity and price. Consumers

bear an opportunity cost that is positively related to the level of product complexity.

It is assumed that the more complex the product, the larger the investment in time

and energy necessary for the consumer to make the good operational. Consumers differ

by the features they desire. However, all consumers dislike the excessive complexity

associated with extraneous features. On the production side of the economy, features

are costly to add to a product. However, if a firm produces more than one variety

of its product, it incurs a switching cost associated with the change in production.

Thus, the monopolist faces a tradeoff when deciding the level of product complexity. If

the monopolist cannot capture all consumer surplus, it creates a distortion where the

monopolist will choose to produce excessively complex goods. The monopolist bears

the full cost of reducing product complexity, but captures only part of the benefit.

Key Words: Characteristics, switching costs, opportunity cost

JEL: D11,D21,D60,L12

∗

Preliminary, please do not cite. This paper is dedicated to anyone who still does not know how to

program their VCR.

†

School of Economics and Finance, Victoria University of Wellington, PO Box 600 Wellington, New

Zealand. email: Richard.Martin@vuw.ac.nz

1

1

Introduction

One annoying feature of modern consumer electronics is the investment of time necessary to

make the products operational. It is natural to assume that this time cost is increasing in the

level of complexity of the good. Thus, firms should be keen to reduce the complexity of their

goods, as higher opportunity costs reduce the surplus that can be extracted from consumers.

This raises the question: Why do we observe complex products with many extraneous features, that require a significant investment of time to learn how to operate? One possible

explanation appeals to the fact that different consumers value different features. However,

heterogeneous consumers are not sufficient to explain the observed product complexity. For

if this was the end of the story, firms would custom make their goods, eliminating any features deemed extraneous by a given consumer. However, custom made goods tend to be

costly. Typically, producing many varieties of a good involves switching costs, as production

is shifted from one type to another. Alternatively, if the market was large enough, a firm

could operate several plants each producing a specific model of the good. However, such

a setup would surely result in the unnecessary duplication of fixed costs. In this paper,

switching costs and these incremental increases in fixed cost are functionally equivalent, so

we will use switching costs without loss of generality.

The producer in this model faces a tradeoff. Mass production eliminates the switching

costs associated with producing many varieties of a good. However, with a mass produced

good with many features, consumers bear a larger opportunity cost associated with learning

how to make the good operational. We demonstrate that the firm’s tradeoff can differ

from society’s. The reason is that the firm bears the full cost of reducing complexity, but

only captures part of the benefit. The cost of reducing complexity is the switching cost

associated with custom made goods. The benefit of reduced complexity is the reduction in

the opportunity cost associated with consumers figuring out how to use the product, and a

reduction in the cost of the goods because they have fewer features. Thus, the producer’s

decision will be distorted towards producing overly complex goods.

Product complexity has been studied by other authors, but the focus has been on the

production side of the economy. Hobday (1998) investigates the implications of product

complexity on innovation and market structure. Complex goods are engineering intensive,

and require several producers to work together, often with a large involvement by the end

1

user. In contrast, innovation in mass produced goods is typically unilateral, and the goods

are transacted at arms-length. Handfield & Pagell (1995) study the diffusion of flexible

manufacturing systems, and find that one of the factors that influences the speed of diffusion

is the complexity of the system. They find that the more complex the system, the less likely

firms will invest in flexible manufacturing technology. Taylor & Wiggens (1997) demonstrate

that increased product complexity makes ‘Japanese’ procurement systems more attractive

than the ‘American’, due to the ‘American’ reliance on inspection (and possible rejection) to

provide suppliers with the incentive to provide quality. The driving factor is that the more

complex the good, the more difficult it is to verify quality by inspection.

In this paper, we study the effect of product complexity on both the production and

the consumption sides of the economy. We bring together two branches of consumer theory.

The first branch originated with Becker (1965), which highlights how opportunity cost and

pecuniary costs diverge whenever consumption takes time. The full, or opportunity cost,

of consuming a good must include the foregone value of the time spent consuming. The

second branch originated with Lancaster (1966), where consumers do not value goods per

se, rather they derive utility from the characteristics embodied in a good. In this paper, we

extend this approach by treating the size of the bundle of characteristics as a characteristic

itself: product complexity. The two branches of the literature are brought together when

we assume that an increase in the number of characteristics a good has increases the time

cost of consuming the good. The remainder of the paper is organized as follows. Section 2

outlines the model, and presents the main results of the paper. Section ?? describes how

asymmetric tastes can encourage the firm to custom manufacture its goods, because it allows

for price discrimination.

2

The Model

We employ a simple model that demonstrates the potential distortion in the firm’s behavior.

We trust that the intuition is clear enough that the reader can appreciate the generality of

the result. Suppose that consumers do not value goods per se, instead derive value from the

characteristics that are embodied in goods, as in Lancaster (1966).

We assume that there are only two characteristics that are valued by consumers; call these

2

characteristics a and b. We assume that there are measure one consumers, of three distinct

types: some consumers value characteristic a, some consumers value characteristic b, and

some consumers value both characteristics. Consumers vary not only by the characteristic

they value, but also by their intensity of preference for characteristics. Let θ be a taste

parameter that measures the consumers’ intensity of preference that is distributed uniformly

on [0, 1]. Consumers have unitary demand for characteristics: they demand at most one unit

of any characteristic. Let the density function be f (θ) = 1 − λ for consumers who value both

characteristics, where λ ∈ (0, 1). If we impose symmetry, then f (θ) =

λ

2

for consumers who

value a and b respectively. Of course, the total measure of consumers is one regardless of λ.

A typical consumer that values characteristic i attains the following utility payoffs 1

given the sole purchase of a good that embodies only characteristic i

θ − pi

Ui = θ − pab − t given the sole purchase of a good that embodies both characteristics

0

In the absence of any purchase

for i = {a, b} where pi is the purchase price of a good with characteristic i, and pab is

the price of a good with both characteristics. Let t be the time cost of learning how to use

the product. If the good has an extraneous feature that the consumer does not value, we set

t > 0: otherwise we normalize t = 0. In words, consumers dislike consuming goods that have

extraneous features, because it increases the time cost associated with consuming the good. A

typical consumer that values both characteristics attains the following utility payoffs

θ − pi

2θ − pa − pb

Uc =

2θ − pab

0

given the sole purchase of a good that embodies characteristic i

given the purchase of two goods, each embodying one characteristic

given the sole purchase of a good that embodies both characteristics

In the absence of any purchase

We assume that the firm is aware of the distribution over the taste parameter, but can

not observe the willingness to pay of a particular consumer: The firm is unable to practice

first degree price discrimination.

The firm in this model faces the following costs. If the firm custom makes two goods each

1

Note that we ignore the dominated payoffs associated with a consumer of type i purchases a good only

embodying characteristic −i, where −i denote the characteristic that a consumer of type i does not value.

3

with one characteristic, then both goods cost c per unit, and the firm incurs the switching

cost s once. If the firm mass produces a good that embodies both characteristics, then the

good costs 2c per unit2 , and the firm avoids the switching cost. If the firm performs both

custom manufacturing and mass production, it incurs the switching cost twice.

cqa + cqb + s

2cQ

TC =

cqa + cqb + 2cQ + 2s

0

2.1

given

given

given

given

custom manufacturing of qa and qb

mass production of Q units

both custom manufacturing and mass production

no production

The firm’s problem

The firm must decide whether to custom make two goods each with one characteristic, or

mass-produce a single good with both characteristics, or both. In general, which is optimal

will depend on: the firm’s switching cost, the cost per feature, the consumer’s time cost, and

the proportion of consumers that value only one feature.

If the goods are custom made demand for the good with characteristic i is made up

of two parts. First there is demand from consumers who only value characteristic i: di =

λ

(1

2

− pi ). In addition, there is demand from the consumers who value both characteristics:

dab = (1 − λ)(1 − pi ). Aggregating these two demands yields

Di =

λ

1−

2

(1 − pi )

(1)

for i = {a, b}. The firm maximizes (2) with respect to pa , pb .

πc =

λ

1−

2

which yields solutions pi =

[(1 − pa )(pa − c) + (1 − pb )(pb − c)] − s

1+c

2

(2)

for i = {a, b}. The maximum profits associated with

custom manufacturing the good are given by (3).

πc?

=

λ

1−

2

2

(1 − c)2

−s

2

(3)

Note that we assume for simplicity that the marginal cost of a good increases linearly with the number

of features that it has.If marginal cost increased in the number of features at a decreasing (increasing) rate,

it would exacerbate (alleviate) the tendency of the firm to produce an overly complex good.

4

Now consider the profits associated with mass-producing the good, where both features

are included in the same product. In this case the firm does not incur the switching cost.

However, for some consumers, the product has features that they do not value. These

extraneous features complicate the usage of the good, which implies that if the consumer

does purchase the good, he must make an investment in learning how to use the product that

was not necessary with a custom made good. Demand for a mass produced good (potentially)

comes from all three segments of the consumers. The consumers who value both features do

not incur a time cost, and have a higher choke price than the consumers who value a single

good. If the firm mass produces the good, it faces a kinked demand curve.

If the good is mass produced, and the firm sets a price below 1 − t, then demand is made

up of three parts. First there is demand from consumers who only value characteristic i:

di = λ2 (1 − pab − t), for i = {1, 2}. In addition, there is demand from the consumers who

value both characteristics: dab = (1 − λ)(1 −

pab

).

2

Aggregating these three demands yields

Dm = 1 − λt − (1 + λ)

pab

2

(4)

The firm maximizes (5) with respect to pab , the common price paid by all three types of

consumers.

pab πm3 = 1 − λt − (1 + λ)

(pab − 2c)

2

which yields the solution pab =

1+c(1+λ)−λt

.

1+λ

(5)

The restriction that price must be below 1 − t for

all three segments of the market to be served will be met if λ ≥

c+t

.

1−c

The maximum profits

associated with mass producing the good and selling to all three types is given by (6).

?

πm3

=

((c + t)λ − 1 + c)2

2(1 + λ)

(6)

On the other hand, if the firm sets a price higher than 1 − t, then it sells the good only

to consumers who value both characteristics. In this case demand is

dab = (1 − λ)(1 −

The firm maximizes (8) with respect to pab

5

pab

)

2

(7)

πm1 = (1 − λ)(1 −

pab

)(pab − 2c)

2

(8)

which yields the solution pab = 1 + c, which is always greater than 1 − t. The maximum

profits associated with mass producing the good and selling it only to consumers who value

both features is given by (9).

?

πm1

=

(1 − λ)(1 − c)2

2

(9)

In this paper, we concern ourselves with a distortion that arises due to some consumers

bearing a positive time cost associated with consuming a good that has extraneous features.

If it were more profitable to only sell the mass produced product to consumers that value

both features then there would be no distortion in firm behavior. A necessary condition for

the distortion to exist is that the time cost is actually incurred. To this end, we assume that

?

?

λ is sufficiently large so that πm3

> πm1

. This condition is met when

λ>

2(1 − c)(c + t)

(c + t)2 + (1 − c)2

(10)

Note that this condition is not very restrictive when c and t are small. It can also be

?

shown that if the condition is true, then pab < 1−t whenever πm3

> 0. Recall that pab < 1−t

is the condition that ensures that all three types of consumers consume.

The third option the firm has is to produce three separate goods: one with feature a,

one with feature b, and one with both. In this case, the firm incurs the switching cost twice.

The firm maximizes

πb =

λ

λ

pab

(1 − pa )(pa − c) + (1 − pb )(pb − c) + (1 − λ)(1 −

)(pab − 2c) − 2s

2

2

2

Which yields solutions pi =

1+c

2

(11)

for i = {a, b} and pab = 1+c. Maximum profits associated

with producing both custom made and mass produced goods are

πb? =

2−λ

(1 − c)2 − 2s

4

(12)

Compare (12) with (3). For any positive switching cost, the firm strictly prefers to custom

6

manufacture two goods, compared with manufacturing three goods .3

Using (3) and (6) we find the switching cost sf that equates the profits of custom manufacturing and mass-production, given all three types of consumers purchase.

sf =

λ

1−

2

(1 − c)2 ((c + t)λ − 1 + c)2

−

2

2(1 + λ)

(13)

We will compare (13) with the switching cost that equates welfare, and use this comparison to demonstrate that the firm’s production choice can differ from that which is socially

optimal. We turn now to look at the welfare properties associated with each production

choice.

2.2

Welfare properties

Suppose that the firm chooses to custom make two goods, each with one feature. Aggregate

(inverse) demand is pi = 2−2q−λ

for i = {a, b}. The equilibrium quantity consumed is

2−λ

q ? = 1 − λ2 ( 1−c

) for both goods. Welfare when the goods are custom made is given by

2

(14)

Wc =

Z

q?

0

Z q? 2 − 2q − λ

2 − 2q − λ

− c dqa +

− c dqb − s

2−λ

2−λ

0

(14)

Integration yields

Wc =

3(2 − λ)(1 − c)2

−s

8

(15)

Now consider a firm that chooses to mass-produce a product with both features. We

continue to assume that λ is sufficiently large so it is optimal for the firm to sell its product

to all three types of consumers. The (inverse) demand function for consumers that value

only one feature is p = 1 − t − λq . Total consumption by these consumers in equilibrium is

q1? =

λ

(λ − t − c − λc).

1+λ

The inverse demand curve for consumers who value both features is

3

This would not necessarily be the case if the distribution over θ differed among the three groups. Specifically, consider the case where the consumers who valued only one feature had a greater willingness to pay

per feature than consumers who value both features. If this were the case, then the firm could potentially

benefit by producing all three goods, and charging a different price per feature depending on the number of

features a good had. The firm would set pa + pb > pab . There would be a constraint on prices pi < pab − t

to ensure that consumers of type i would purchase good i rather than consume the good with both features.

7

2q

. Total consumption by these consumers in equilibrium is qb? =

p = 2− 1−λ

(1−λ)(1+2λ−c−cλ+λt)

.

2(1+λ)

Thus welfare under mass-production is given by (16).

Wm =

Z

q1?

0

q

(1 − t − − 2c)dq +

λ

Z

qb?

0

(2 −

2q

− 2c)dq

1−λ

(16)

Integration yields

Wm =

(6 c t − 4 t + 3 c2 + t2 − 2) λ2 + (6 c2 + (6 t − 6) c − 2 t + 2 t2 + 2) λ + 3 (−1 + c)2

4 (1 + λ)

(17)

Using (14) and (17) we find the switching cost sw that equates the welfare associated

with custom manufacturing and mass-production.

sw = −

λ (1 − 6 c + 9 c2 − λ − 6 c λ + 9 c2 λ − 8 λ t + 2 λ t2 + 12 c λ t + 12 c t + 4 t2 − 4 t)

8 (λ + 1)

(18)

The next step we take is to compare sf with sw . Equating the two, and solving for t

yields two roots.

t=

4+4cλ+4c−8λ±2

√

−8 − 4 c λ + 16 c + 2 λ + 10 c2 λ2 + 2 c2 λ − 20 c λ2 − 8 c2 + 10 λ2

2 (−4 + 2 λ)

(19)

(19) tells us the values of t for which the firm’s interests and society’s interests coincide

on the issue of product complexity. We look at a couple special cases in order to obtain

results.

The first example is the limiting case of λ → 1. In this case, almost all consumers value

only one characteristic. In the limit, (19) takes two values: t = 2 − 3c and t = −c. As

both t and c must be positive, only the first solution is meaningful. If 0 < t < 2 − 3c

results in sw > sf . What this implies is that for intermediate values of the switching cost

s, it is more profitable to mass-produce a good that has extraneous features, but welfare

would be higher if the firm custom made its goods. The intuition is that the firm bears the

entire cost of reducing complexity (the switching cost), but captures only part of the benefit

8

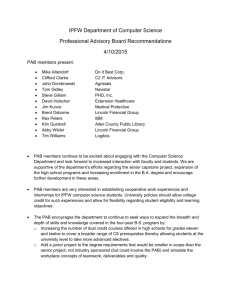

Wc > W m

sw

sf

0

πc > π m

Wm > W c

s

πm > π c

Figure 1: If sf < s < sw the firm chooses to mass-produce a good with extraneous features.

However, welfare would be higher if the firm custom made the goods. For values of s outside

this interval, the interest’s of the firm and society coincide on the issue of product complexity.

(the reduction in the time cost and the ‘per feature’ cost). Note that the existence of the

distortion in behavior depends on the switching cost being an intermediate value between sw

and sf . If the switching cost lies outside of this range, the interests of the firm and society

are congruent on the issue of whether to mass produce or to custom make the good.

If on the other hand t > 2 − 3c, it results in sf > sw . This implies a (potential) distortion

away from mass-production. However, mass production is only a viable option if t < 1 − 2c.

In the region where sf > sw the profits associated with mass production are negative. It is

not meaningful to speak of a distortion away from mass production if the firm would not

mass produce in the first place.

The second example looks at the potential for distortion when there are numerous consumers who value both features. Recall the condition for a mass producing firm to (strictly)

prefer to sell to all three types of consumers rather than to sell to only consumers who value

both features is given by inequality (10). Here we use this bound on λ in order to examine

the behavior of the firm when facing a significant proportion of consumers who value both

features. If one substitutes λ from (10) into 0 = sw − sf and solves for t, the solutions are

t = {−c, 21 −

3c 3

,

2 2

−

5c

}.

2

Again, both c and t must be positive, so in this case we are left

with two solutions.

If t <

1

2

−

3c

2

then sf > sw and there exists a potential distortion towards custom

manufacturing. There are two factors that drive this result. The first stems from the fact

that a mass-producing firm faces a kinked demand curve. Above the kink, all demand comes

from consumers who value both features. Below the kink, demand comes from a mixture of

9

all three types of consumers. Thus, there is a distinction between marginal and inframarginal

consumers. As in Spence (1975), the monopolist is concerned with the effect its choice has on

the marginal consumers, whereas a social planner cares about the effect on all consumers. On

its own, this causes a distortion towards custom manufacturing, as the monopolist distorts its

choice to pander to the few consumers who value only one feature. The fact that t is small

ensures that distortion associated with the monopolist’s partial appropriation of benefits

(associated with reduced complexity) is small in magnitude by comparison. The end result

is that the firm (potentially) distorts production towards custom manufacturing when most

consumers value both characteristics.

, then we return to the case where sw > sf , and there is a

On the other hand, if t > 21 − 3c

2

potential distortion towards excessive product complexity. Once again, there are two factors

at work. Note that for higher values of t and c, the critical value of λ given by inequality (10)

is also larger. This implies that the marginal consumer is more representative of the average

consumer. This implies that the distortion associated with the monopolist pandering to the

marginal consumer is smaller. However, for larger values of t, a larger distortion is created

by the partial appropriation of benefits. Thus, for t >

1

2

−

3c

2

we have the case where the

firm (potentially) chooses a socially excessive level of product complexity.

3

Conclusion

The distortion towards excessive product complexity will be at its worst when firms are

unable to appropriate the surplus created by reducing complexity. Thus, the distortion

should be worse when 1) firms face highly elastic demand, and 2) when firms are unable to

price discriminate. This result is quite similar to standard results in the innovation literature,

and the literature on moral hazard. If an agent does not capture the full benefit associated

with his actions, but bears the full cost, then the agent will not face the correct incentives

to exert effort.

A testable implication of this model is that product complexity should differ in software

that is sold for a profit, vs. open source software. The intuition is that a profit maximizing

firm’s choice of complexity will be distorted by its partial appropriation of benefits, and

potential distinctions between marginal and inframarginal consumers. In contrast, regardless

10

Statistical

Computational

Web Browsing

Office Suite

For Profit

software

S plus

Matlab

Internet Explorer

Microsoft Office

required space

125MBa

90MBc

25.9MBe

210MB+115MBg

Open Source

software

R

Octave

Mozilla Firefox 0.8

Open Office

required space

16.7MBb

65MBd

16.3MBf

250-300MBh

Table 1: Minimum space on hard drive.

a

http://216.211.131.2/support/splus60win/uguide.pdf pg 3.

http://www.r-project.org/

c

http://www.mathworks.com/support/sysreq/current release/windows.html

d

http://www.octave.org/FAQ.html#SEC18

e

Size on disk. Does not include SP1 which is 18.6MB.

f

Size on disk.

g

http://www.microsoft.com/office/previous/xp/sysreqs.asp. Additional 115MB is required if software is

installed on different drive than the operating system.

h

http://www.openoffice.org/dev docs/source/sys reqs 11.html

b

of the motives of individual contributors to an open source collective, one can assume that

the design of the software is socially motivated and is not distorted in its choice of complexity.

We use minimum space required on hard drive as a proxy for product complexity, for various

applications that have for profit and open source variants. See table 1 for the results.

References

Becker, G. S. (1965), ‘A theory of the allocation of time’, The Economic Journal

75(299), 493–517.

Handfield, R. B. & Pagell, M. D. (1995), ‘An analysis of the diffusion of flexible manufacturing systems’, International Journal of Production Economics 39(3), 243–253.

Hobday, M. (1998), ‘Product complexity, innovation and industrial organisation’, Research

Policy 26(6), 689–710.

Lancaster, K. (1966), ‘A new approach to consumer theory’, Journal of Political Economy

74(2), 132–157.

Spence, M. (1975), ‘Monopoly, quality, and regulation’, Bell Journal of Economics 6(2), 417–

429.

11

Taylor, C. R. & Wiggens, S. N. (1997), ‘Competition or compensation: Supplier incentives

under the American and Japanese subcontracting systems’, American Economic Review

87(4), 598–618.

12