Eco-labels and Free Riding

advertisement

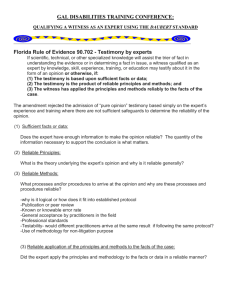

Eco-labels and Free Riding

Peter E. Robertson*

School of Economics, University of New South Wales, Sydney, NSW, 2052, Australia.

September 2003

Abstract

This paper considers the behaviour of environmentally aware consumers in response

to the introduction of international eco-labelling programmes. The principle result is that,

for a global environmental resource, the equilibrium level of damage is independent of the

number of countries that have eco-labelling policies. This result highlights the potential

limitations of eco-labelling policies as a tool for environmental policy. In particular it

emphasises that eco-labelling policies may be undermined by fee-riding behaviour, since

they do not force consumers to internalize external environmental costs.

Keywords: Environmental policy; Trade policy; Eco-labelling; MEAs; Genetically

Modified Organisms, GATT; WTO.

JEL Classification: Q2; Q3; F00; H4.

* Tel. (+61) 29385 3367. Fax (+61) 92313 6337. Email p.robertson@unsw.edu.au. I am grateful for much

helpful advice from Chris Bruce, Arghya Ghosh, Hodaka Morita, Robert Hill, Nancy Olewiler, Bill

Schworm and John Piggott, and for the contributions of seminar participants at the University of New

South Wales and The University of Sydney.

1. Introduction

Over the last decade there has been a rapid expansion in national and international ecolabelling programmes. This has been due to not only the growing demand for

environmental conservation, but also a desire to improve and extend environmental policy

instruments. In particular, many environmental policies whether imposed unilaterally, or as

part of Multi-lateral Environmental Agreements (MEAs), violate the WTO’ principle of

non-discrimination. Since differential tariffs cannot be placed on “like products” defined

according to end use, WTO members cannot impose tariffs on goods that are produced in

an environmentally harmful manner.1.

In these situations eco-labelling has been regarded as a “market friendly” environmental

policy tool. A prominent example of this is the “dolphin-friendly tuna” program, which

was an explicit response to the GATT dispute between Mexico and the USA. Likewise

eco-labelling has been suggested as a solution to the USA’s recent failed attempt to ban

imports of shrimp that is harvested in a manner that prevents high mortality of endangered

sea turtles.2 Other examples include international forestry certification, which arose as an

alternative to boycotts and industrial action, over international trade in tropical

1 Under GATT Article XX WTO member countries may use trade measures to protect animal life and

exhaustible resources, (WTO 1998). However the interpretation of this article itself has been

controversial. In the “the shrimp-turtle dispute”, the Appellate Body of the WTO overturned a Panel

decision that found Article XX could not be invoked to justify trade restrictions based on Process

Production Methods (PPM) criteria. Even so, some observers argue that the conditions required to comply

with Article XX are so restrictive as to render it redundant, (Ranné 1999, Appleton, 1999).

1

hardwood,3 the use of eco-labels in endangered fisheries generally, Deere (1999). More

recently, there has been substantial debate over the regulation of transboundary

movements in genetically modified organisms (GMO’s). In particular labelling

requirements for foods have recently be tightened and extended by the EU, and many

countries including the EU have ratified the Cartagena Protocol on Biosafety, which

explicitly sets out labeliing requirements for exporting countries, (Mackenzie et al 2003,

Nielson and Anderson, 2000). Though this move has been widely applauded by

environmental lobby groups, significantly it is also seen as preparing a replacement policy

for the EU’s 5 year moratorium on imports new GM products, The Economist (2003).4

The purpose of this paper, therefore, is to evaluate the effectiveness of eco-labelling, with

particular attention to international eco-labelling programmes designed to limit the extent

of transboundary, or global environmental problems. The emphasis on transboundary

problems is particularly significant since with nation states, first best policy tools are

available for limiting environmental externalities. As the preceding examples show

however policies to remedy transboundary environmental externalities often conflict with

WTO rules. It is in this context that eco-labelling has been seen as an alternative to more

restrictive policies such as import bans. To investigate these issues we develop a model of

2 The tuna-dolphin dispute initiated the debate over the interpretation of GATT Article XX. For a

discussion of the use of eco-labelling of in the tuna-dolphin and shrimp-turtle disputes, see The

Economist, October 3, 1998.

3 For further discussion of tropical forestry certification schemes, see Swallow and Sedjo, 2000, Crossley

et al, 1997, and Simula, 1997.

4 A useful non-techncal overview of the current scientific debate over the effects of transboundary

movements in GMO’s is the recent UK government inquiry, GM Science review Panel (2003). According

to the repor the current limited range of GM crops, soyabeans, maize and cotton, pose little risk given

adequate monitoring and regulation. Nevertheless, the panel acknowledges that the risks may increase

substantially with the introduction of new crops (GM Science Review Panel 2003, p.23).

2

demand where consumers derive utility from the stock of an environmental good. The

model is designed to highlight the potential flaws in the use of eco-labels, and hence, while

being relatively simple, provides several stark results.

The principle result is that, in an equilibrium with eco-labelling, the level of environmental

damage is independent of a wide range of exogenous variables, including the number of

countries with the eco-labelling programme. Hence as the number of countries with ecolabelling increases, existing eco-label consumers of eco-labelled products can free ride by

reducing their own purchases.

The paper is organised as follows. Section 2 presents a model of consumer demand for a

commodity that has two production processes, one of which has a lower cost to the firm,

but generates a negative environmental externality. The equilibrium demands with and

without eco-labelling are discussed in Sections 3 and Section 4. Some policy implications

are discussed in Section 5 and Section 6 concludes.

2. A model of green consumerism

2.1 Commodities and the production process

A number of recent papers have highlighted different limitations of eco-labelling

programmes. First there are issues of the credibility of the label and the costs of

enforcement. Second there is the problem that the relevant information may simply be too

3

complicated to be incorporates on a label, or for consumers to comprehend.5 Third,

despite their increasing use, significant debate also exists over the potential misuse of

labelling requirements as a technical trade barrier, (WTO 1998a, WTO 1998b; OECD

1997).6

Little attention has been given, however, to the limitations of eco-labelling that might arise

due to free-riding behaviour by consumers. Free riding is likely when the information on

the label principally concerns the effects of the product on an environmental public good.

For instance forestry certification is designed to protect bio-diversity and carbon fixing

properties of rainforests. Similar arguments apply to eco-labelling schemes designed to

protect endangered species, such as sea-turtles.7

In order to sharpen the focus on these issues, I therefore consider a model where ecolabelling results in perfect information regarding environmental costs. I assume an

international economy with m consumers, and an environmental resource, R, which is a

public good. Let ciR be the consumption by consumer i, of a commodity that uses the

resource, R, as an input. The marginal depletion function for each consumer is R − c iR and

m

so the world consumption of the resource using commodity, is C R = ∑ ci . This good is

i =1

referred to below as the R–type good. I assume further that an alternative production

method exists. Thus there is a substitute good, the S–type good, that can be produced

5 Shams (1995), Kirchhoff (2000) and Mason (2001) discuss different aspects of the credibility and

enforcement and monitoring aspects of eco-labelling programmes.

6 This concern is heightened when the labelling information refers to process and production method

(PPM) criteria, since these may reflect differences in factor prices across countries.

4

without resource depletion. Let ciS denote the consumption the S–type good. For

instance, ciS and ciR may both refer to the consumption of shrimp products, but ciS refers

to shrimp that has been captured by trawlers fitted with turtle excluder devices.8

2.2 Consumers

Consumer preferences are described by a quasi-linear utility function

φi ( xi , ciR , ciS , R, C R ) = u i (ciR + ciS , R − C R ) + xi

where

xi

(1.)

the demand for a Hicksian composite commodity. The function

u i (ciR + ciS , R − C R ) is assumed to be strictly concave. Hence u i 1 > 0 , ui 2 > 0 , u i 11 < 0 ,

u i 22 < 0 , u i 11 u i 22 − (u i 12 ) 2 > 0 . In particular, since ui 2 > 0 , individuals derive utility

from the environmental resource and hence, some utility from avoiding consumption of

the R–type good.9 It is evident that each consumer’s contribution to aggregate resource

consumption, C R , may be very small. Nevertheless, as shown below, as long as it is

strictly positive, consumers will be willing to pay some small price premium for

environmentally friendly goods.

7 All but one species of sea turtle are currently threatened with extinction, Liebig (1999).

8 Note however, that WTO trade rules treat the S and R–type goods as a single good, and do not permit

discriminatory policies based on the different production process.

9 Thus we explicitly rule out “irrational” demands for the environment such as warm glow effects. These

would imply that consumers would take action to protect the environment even if they know their actions

have no environmental benefits. While such behaviour may exist to some extent, this would be a weak

behaviour rule on which to design policy tools.

5

Equation (1.) contains four structural assumptions that deserve further comment. First, the

quasi-linear form implies that commodity demands ciR and ciS are a small fraction of each

consumer’s total demand. Hence there are no income effects, and the prices of other

goods, xi , are unaffected by changes in this market. Second the size of the public good is

determined by the aggregate consumption of R–type goods. Third, the commodity

generates the same consumption utility, irrespective of the production process that is used.

Hence the first argument in the utility function is the sum of the consumption of both types

of the commodity. This assumption is inherent in the eco-labelling problem. For instance,

dolphin-safe and non-safe brands of tuna are identical from the point of view their taste.

Finally, because of this, (1.) only holds if there is full information. If there was no labelling,

so that consumers could not identify the environmentally friendly or non-friendly products,

then they will face an information constraint in attempting to maximise (1.). This

information constraint is discussed further in Section 3.

2.3 Firms

To focus on the impact of labelling policies on the demand side, it is useful to keep the

supply side as simple as possible. Specifically assume that there are many price taking

firms who supply ciR and ciS at a constant marginal cost, with the same technology. With

free entry this implies that the supply of both commodities is infinitely elastic at a price

equal to the marginal cost. It is convenient to refer to firms supplying c R as R–type firms,

and firms supplying c S as S–type firms, though a single firm may supply both types.

Production methods that result in resource depletion are assumed to be more costly than

6

methods that conserve the resource. Hence the price of the R–type commodity is less than

the substitute, p S − p R > 0 . For instance in the case of shrimp fishing methods, switching

turtle friendly substitutes is a matter of fitting turtle excluders at a cost of up to $US500

(Ranné 1999).10

3. Preliminary results

3.1 Global equilibrium without eco-labelling

If there is no eco-labelling, then consumers face an information problem in trying to

maximise (1.). They are concerned about the environmental impact of their consumption

choices, but cannot tell the R–type and S–type products apart. Since, firms will exploit this

information constraint if it improves profits, we have the following “lemons” result.

Proposition 1: In any country with no eco-labelling, only R–type firms exist and charge a

price p R . For all consumers in these countries, therefore, ciS = 0.

Proof: Without labels, all S–type firms sell at a price no less than p S . However, since

consumers cannot identify whether a product is from an S-type or R-type firm, R–type

10 The assumption of constant costs rules out some potentially perverse, but potentially interesting,

consequences of eco-labelling. Dosi and Moretto (1998) and Matoo and Singh (1994, 1997) explore these

possibilities further. Since the purpose of this paper is to analyse problems of eco-labelling schemes that

arise from consumer behaviour rather than producer behaviour, it is useful to assume a simple production

structure. Moreover, given the presence of eco-labelling polices in the agriculture, fishing and forestry

industries, it is arguable that a competitive setting is appropriate.

7

firms are able to realise profits by also selling at price p S . All S–type firms will therefore

maximise profits by converting to R–type firms and so there will be no S–type firms.

g

Hence under the assumption of no labelling there is no market for the S–type good.

Consumer i therefore chooses ciR to maximise (1.) subject to ciS = 0, and a budget

constraint. Due to trade restrictions and transport costs, consumers residing in different

countries may face different prices. The budget constraint is therefore y i = piR ciR + xi ,

where y i is income.

An equilibrium consists of m choices of ciR and ciS , that satisfy maximisation of (1.) by

each consumer, given the choices of the other consumers. Thus consumer i maximises

u i (ciR , R − ciR − C −Ri ) + y i − piR ciR

(2.)

m

taking C −Ri ≡ ∑ c Rj , as given.11 The first order condition for i is

j≠i

u i 1 (ciR , R − c iR − C −Ri ) − u i 2 (ciR , R − ciR − C −Ri ) − piR ≤0

(3.)

This says that individuals consume the resource until the marginal utility of the last unit

consumed is equal to the price plus the marginal dis-utility of the decline in the stock.

11 This could be thought of as a strategic decision in the sense that consumers must take into account the

aggregate behaviour of the other m-1 consumers. However it only implies that consumers condition their

choices on the expected aggregate level of R. Thus there is no sense in which we require each consumer to

strategically consider the actions of every other consumer. Nevertheless, in equilibrium, consumer

expectations must be correct. However there is no need to specify an adjustment mechanism that results in

equilibrium outcomes. Rather we merely use the concept of equilibrium as a point of reference to consider

how incentives change in the face of eco-labelling policies.

8

Since (1.) is strictly concave, (2.) is a strictly concave function of ciR , and (3.) describes a

unique maximum value of ciR for any value of C −Ri and R , and piR . Solving (3.) for ciR

therefore gives the demand function, ciR = ri (C −Ri , piR ) . Since this demand function is

conditional upon the aggregate level of environmental damage, in what follows it will be

convenient to refer to it as a reaction function.12

Proposition 2: With no eco-labelling, the consumer’s reaction functions are negatively

sloped in {ciR , C −Ri } space with absolute value between zero and one: − 1 < ∂ciR / ∂C −Ri < 0 .

Proof: See Appendix.

An equilibrium exists if the functions, (3.), intersect with ciR > 0 for some i. Moreover,

since p iR enters (3.) with a negative sign, then by the envelope theorem we have,

∂ciR / ∂piR < 0 .13 Hence a tariff or tax will shift the reaction functions toward the origin in

{ciR , C −Ri } space.14 Since the absolute slope of the reaction functions is less than one,

− 1 < ∂ciR / ∂C −Ri < 0 , any change in C −Ri will only be partially offset by a change in ciR .

Thus, in the absence of eco-labels, tax and tariff policies will: (i) reduce the equilibrium

level of environmental damage by consumers residing in those countries; (ii) increase the

12 Again it may be useful to emphasise that there is no real sense in which consumers are involved in

strategic games with all other consumers. Each individual must consider must only consider the aggregate

consumption of the m-1 other consumers.

13 This application of the envelope theorem is also known as the conjugate pairs theorem. It applies to

unconstrained maximisation problems, for any parameter that enters only one first order condition,

Silberberg (1974).

14 For a further discussion of the optimally of taxes and tariff policies, see Markusen (1975) and Kennedy

(1994).

9

equilibrium level of environmental damage by consumers in other countries, and; (iii)

reduce the overall equilibrium level of damage.

Thus it has been shown that when there are no eco-labels, there is no market for the safe

type good. In this setting, tax and tariff policies may be used to reduce environmental

damage. Given these preliminary results, I can now incorporate eco-labelling to see how

more information might affect consumption choices and the level of environmental

damage.

4. Eco-labels

4.1 Utility maximisation with eco-labels

To consider the effects of eco-labels, suppose that some consumers live in countries that

have perfectly enforced eco-labelling. These consumers, therefore, have full information as

to whether a commodity is produced by S or R–type firms. They choose ciR and ciS to

maximize (1.) subject to the budget constraint y i = piS ciS + piR ciR + x i . Hence consumer i

maximises

u (ciS + ciR , R − ciR − C −Ri ) + y i − piS ciS − piR c iR

(4.)

The first order conditions are

u i 1 (ciR + ciS , R − ciR − C −Ri ) − piS ≤0

(5.)

u i 1 (ciR + ciS , R − ciR − C −Ri ) − u 2 (ciR + ciS , R − ciR − C −Ri ) − piR ≤0

(6.)

10

If ciS > 0 , then (5.) holds with equality. Equating (5.) and (6.) gives

u i 2 (ciR + ciS , R − c iR − C −Ri ) − ( piS − piR ) ≥ 0

(7.)

Equation (7.) shows that the quantity of each good is chosen so that marginal utility of the

environmental resource, is equal to the price premium for the S–type good, piS − piR .

Using these first order conditions we have the following result.

Proposition 3: If (5.) and (6.) hold with equality, the reaction function

ciR = qi (C −Ri , piS , piR ) has a slope of negative one in {ciR , C −Ri } space: ∂ciR / ∂C −Ri = − 1 .

Proof: See Appendix.

Proposition 3 holds for a consumer who purchases both S–type and R–type goods. It is

useful to refer to such a consumer as a marginal consumer. Intuitively it means that if

some consumer increases consumption of R–type goods, marginal consumers will reduce

R–type goods by the same proportion. The fact that one or more consumers may have a

reaction function with a slope of negative one, therefore, has strong implications for the

equilibrium level of environmental damage.

Proposition 4: In an equilibrium where (5.) and (6.) hold with equality for at least one

consumer, the total level of damage is independent of the damage caused by any other

consumer who consumes positive quantities of environmentally unfriendly (R–type) goods.

Proof: See Appendix

11

For example let i denote a marginal consumer, and suppose there is an exogenous change

in C −Ri . From (5.) u i 1 (ciR + ciS , R − ciR − C −Ri ) = p iS , so that marginal utility for this

consumer must remain constant. This consumer therefore substitutes ciR and ciS so that

ciR + ciS and C R = C −Ri + ciR are constant. Thus Proposition 4 shows that the equilibrium

level of environmental damage is independent of all the exogenous variables that

determine the demands of all the other consumers. In particular any changes of

environmental policies in countries that do not have eco-labelling, and hence do not have

any marginal consumers, have no effect on the equilibrium level of world environmental

damage.15

4.3 Corner solutions.

To complete the model we must consider the existence of marginal consumers and also

the behaviour of non–marginal consumers, those who consume either no S–type goods, or

only R–type goods. Thus in this section we characterize these corner solutions.

Consideration of the corner solutions also facilitates a direct comparison between the

labelling and no eco-labelling situations.

First suppose that (5.) is not binding, so that ciS = 0 . In this case it can be seen that (6.)

reduces to (3.). Thus the reaction function for an arbitrary consumer i, must be the same

with and without eco-labels. Further, it can be shown that the point where (5.) becomes

binding is unique.

15 Moreover Lemma 1 in the proof of Proposition 4 shows that this result is a particular instance of a

more general result that holds whenever there is an additive externality and at least one agent has a

12

Proposition 5: For every consumer there is a unique point, ciR , such that ciS = 0 for all

ciR ≥ ciR and ciS > 0 for all ciR < ciR .

Proof: See Appendix

We may now consider the different regions of the reaction functions. First let all points

where ciR ≥ ciR be region (i). Since ciS = 0 in region (i), this is equivalent to the case

where there are no eco-labels. When 0 < c iR < ciR , (5.) and (6.) hold with equality, the

slope is ∂ciR / ∂C −Ri = − 1 . I denote this region (ii). Finally let region (iii) denote all points

where ciR = 0 . The three regions are illustrated in Figure 1. The curve a b g represents the

graph of {ciR , C −Ri } without eco-labels, and the curve a b λ is the reaction function with

eco-labels. From Proposition 4 and 5, they diverge at the point ciR .

Note further that in region (i), (6.) defines a unique value of ciR for every C −Ri . Hence

when (5.) holds with equality, it defines the unique coordinate { ciR , C −Ri }. Define the total

level of damage at this point to be λi = ciR + C −Ri . For any level of C iR ≤λi the consumer

chooses ciS = 0 . Hence λi is level of damage that just induces the consumer to purchase

S–type goods, given the prices piS , piR . Since the total level of damage is constant in

region (ii), then λi = C R at the point ciR = 0 also. Hence λi can be regarded as the

“maximum acceptable” level of damage for consumer i. That is, for any level of damage

reaction function with a slope of negative in all dimensions.

13

C −Ri , if C −Ri ≥ λi the consumer chooses ciR = 0 . The properties of each region are

summarised in Table 1.

Table 1: Regions of the reaction function.

CR

C−Ri

region (i)

C R ≤λi

C −Ri ≤λi − c −Ri

ciR ≥ c R , ciS = 0

region (ii)

C R = λi

λi > C −Ri > λi − c −Ri

ciR > ciR > 0 , ciR > ciS > 0

region (iii)

C R ≥ λi

C −Ri ≥ λi

ciR = 0 , ciS ≥ c R

ciR , ciS

4.3 Characterisation of an equilibrium in the presence of eco-labelling.

Since consumers are heterogeneous, a Nash equilibrium may have some consumers

choosing different levels of consumption.. If all consumers are in region (i), then the

equilibrium must be the same as in the no eco-labelling case. That is ciS = 0 for all i, and

the introduction of eco-labelling has had no effect. This is more likely if the price of the S–

type good is very high. If eco-labels are to have any effect on reducing environmental

damage levels, some consumers must be in region (iii) or (ii). From Propositions 3 and 5,

however, the demands in these regions must lie below the demands that would exist for

the same consumers if there were no eco-labelling. Hence

R

Proposition 6. For any consumer, i, the equilibrium level of consumption, ci , with eco-

labelling must be less than or equal to the level without eco-labelling. Thus the aggregate

14

level of damage under eco-labelling can be no higher than the level that exists without ecolabelling.

Despite this, the eco-labelling policy cannot deliver an optimal level of resource depletion.

Proposition 7. If there is more than one consumer, the level of environmental damage

under eco-labelling will exceed the optimal level.

Proof: See Appendix

Intuitively Proposition 7 holds because the eco-label has solved an information problem,

but not the public good problem. Since eco-labels do not force consumers to internalise

the external environmental costs of R–type goods, they do not result in an optimal level of

environmental damage. While this result is perhaps unsurprising given the structure of the

model, it points nevertheless to a common fallacy that labelling will enable consumers to

internalise all environmental costs.16

Finally, since Proposition 4 depends on there being a consumer in region (ii), it is useful to

consider the conditions for this to hold. To consider this issue, suppose all consumers who

reside in countries with eco-labels, are ordered according to their maximum acceptable

level of damage values, λi .17 Suppose further that there are n ≤m different values of λi ,

and let “type 1” refer to the group of consumers with the lowest value. Then

16 An example is calls for eco-labelling to resolve the shrimp-turtle dispute and the implementation of

ecolabelling as a resolution to the tuna-dolphin dispute. See for instance The Economist, 1998.

17 Since consumers may face different prices, consumers in each group need not be identical.

15

λ1 < λ2 < K < λn , where superscripts refer to consumer types. Using this definition of a

consumer type, I obtain the following result.

Proposition 8: In any pure strategy Nash equilibrium only one consumer type can be in

region (ii) where ciR ≥ 0 , ciS ≥ 0 .

Proof: See Appendix.

Hence if the marginal consumer type is type k, then in an equilibrium, any consumer types

j, where λj < λk will consume no R–type goods – region (iii) – and all consumers types j

where λj > λk , will consume no S–type goods – region (i).18

This is illustrated in Figure 2, for the special case n = 2. This shows consumers of type a

and b where λb > λa . Clearly region (ii) of each reaction function cannot intersect.

Further it can be seen that a’s reaction function can never intersect region (ii) of b’s

reaction function. Two possible equilibria are illustrated. If b’s reaction function is bλb ,

the equilibrium is e, with both consumers in region (i). The only other possibility for an

interior equilibrium is given by the reaction function b ′

λb . In this case the equilibrium is

18 An issue raised by Proposition 8 is that if there are only a few consumers of each type, then only a few

R

consumers can be in region (ii). In this case a large exogenous shock to C− i may force the marginal

consumers into region (i) or (iii). Thus Proposition 4 will only hold if there are a large number of

consumers of each type relative to the size of the exogenous shock considered. The model can be

generalised in an obvious way, however by considering the a distribution of consumer types. A note,

which is available on request, shows that any exogenous changes has little or no effect on the aggregate

level of damage if: (i) the number of consumers of each types is high, (ii) the density of types is high, or;

(iii), if the existing marginal consumer’s have high demand for the commodity, so that

relatively high.

16

∑

i

ciR is

. Consumer a is in region (ii) and b remains in region (i). A third possibility, not shown,

e′

is that the reaction functions do not intersect. In this case a will be in region (iii), and,

depending on the shape of its reaction function, b could be in region (ii) or (iii).

4.4 Discussion

Clearly the principle result in proposition 4 is very stark. In this subsection, therefore, I

briefly discuss the robustness of the results to alternative specifications of the model, and

how the Propositions 4 and 5 are related to other public goods models.

Proposition 4, highlights the implications of the free-riding. Nevertheless it depends on a

number of assumptions that are somewhat unrealistic. In particular it refers to equilibrium

outcomes. There has been no suggestion, however, that an equilibrium would actually be

observed, or that institutions exist to allow consumer behaviour to dynamically adjust

toward this equilibrium. This result therefore, should not be taken as a literal description

of potential outcomes, but simply as a point of reference for thinking about the incentives

created by eco-labelling policies.

It is also useful to consider briefly how robust the results are to the quasi-linear

specification of the utility function. This means that increments to income are spent

entirely on the Hicksian composite good, xi . The assumption is appropriate as long as the

commodity in question is only a small part of the consumer’s budget. This appears

reasonable when considering the examples discussed, such as tuna and shrimp products.19

If we were to adopt a more general specification than (1.), Proposition 4 would no longer

17

hold exactly, due to the presence of income effects. In particular, as shown in the

Appendix, if R is a normal good, then an exogenous increase in C−Ri , by reducing the

consumer’s net income, will cause the consumer to be less willing to substitute toward S–

type goods. In this case the slope of the marginal consumers reaction function will lie

between –1 and 0.

Nevertheless, if, as we would expect, income effects are small, then the slope of the

reaction function will be arbitrarily close to –1. Thus the specification preferences can be

seen as a useful simplification that sharpness the focus of the model on the potential for

free riding behaviour. Under very general conditions we may expect the world equilibrium

level of environmental damage to be unresponsive to exogenous changes, including

changes in the number countries with eco-labelling schemes.

Second, it is informative to consider the source of the neutrality result in relation to other

public goods results. It is well know that in the pure public goods model with quasi-linear

preferences, the total supply of a public good is independent of the number of subscribers,

Olson (1965).20 The present model, however is more complex. The R–type good is an

impure public “good”, since it not only affects the environmental stock, but also

contributes to private utility. Moreover, while (1.) specifies that utility is linear in the

19 See Vivas (1987) for a further discussion of the applicability of this assumption.

20 The result is derived from the fact that public goods externalities are additive. See Cornes and Sandler

(1996) for a full discussion. This result is different from another common neutrality result involving

income transfers, as discussed for example by Bergstrom, Blume and Varian (1986), and in an

environmental context by Copeland and Taylor (1995).

18

Hicksian composite good, it also specifies a completely general functional relationship

between the private good ciR + ciS and the public good R − C R .

Hence this eco-labelling model is very different from the pure public goods model.

Nevertheless a similar neutrality result holds due to the fact that: (i) the R and S–type

goods are perfect consumption substitutes so that consumption utility only depends on the

sum ciR + ciS , and; (ii) in equilibrium, their total demand is constant, due to perfect

competition on the production side of the model. Intuitively, by purchasing the S–type

good rather than the R–type good, consumers make a contribution to the environmental

resource at a constant cost equal to piS − piR . Since this “contribution” does not change

the sum ciR + ciS , it does not affect consumers utility except via the increase in the

environmental resource. Thus pure public goods neutrality result is retained, due to the

inherent structure of the eco-labelling problem.

5. Trade and Multi-lateral Eco-labelling Agreements

As discussed in the introduction, the WTO’s stance on process production method (PPM)

based trade measures, and recent deliberations over the interpretation of Article XX, have

made eco-labelling an apparently attractive policy option. The analysis herein has shown,

however, that under fairly general conditions world levels of environmental damage may

be insensitive to the number of countries that have eco-labelling programmes, even if there

is substantial consumer demand for these products.

19

For example, suppose the USA has an eco-label on shrimp sold in the USA. Consumers

who are purchasing turtle–friendly shrimp are, by definition, in region (ii) or (iii) and have

values of λ greater than or equal to the current equilibrium damage levels. Other

consumers may be purchasing only cheaper brands that do no have the eco-label, region

(i), or simply not purchasing shrimp at all.

Next suppose a MEA protecting sea turtles, or an environmental clause in a trade

agreement, is introduced so that consumers in other countries may now choose to

consume turtle–friendly shrimp. Propositions 4 and 9 suggest that the US consumers who

initially consume turtle–friendly shrimp, will now have a greater incentive to consume the

non–friendly variety. This substitution occurs on a one–to–one basis, and so multilateral

eco-labelling may have very little or no affect on the mortality rate sea turtles.

The model also sheds light on consumer awareness surveys that show that consumers

willingness to pay for the German Blue Angel eco-label, declined significantly during the

last decade, OECD (1997).21 As shown in Table 1, this decline in German consumer

demand corresponds with a rapid growth of eco-labels in other countries.22 It is not

unreasonable to suppose that, as implied by proposition 4, some of the decline in demand

was due to an awareness of increasing consumer demand for environmentally safe goods

in the rest of the world.

21 The survey’s were conducted by the Federal Environment Ministry of Germany. They show that

Germany’s Blue Angel eco-label was extremely successful when it was introduced in 1977. Consumer

support fell between 1992 and 1996, and between 1994 and 1996, willingness to pay more for Blue Angel

products declined from 59% to 35% in West Germany and from 24% to 17% in East Germany (OECD

1997, p.60).

22 The OECD (1997) attributes this to consumer confusion due to the proliferation of different labels.

20

Table 1: The Evolution of Regional Eco-Labelling Programmes

Programme

Country

Number of Number of

Product

Products

Groups, 1996 in 1996

Blue Angel

Environmental Choice

Nordic Swan

Eco-Mark

Good Green Buy

Green Seal

Environmental Choice

Environmental Choice

Ecomark

NF Environment

Austrian Eco-label

Ecomark

Green Label Singapore

Stichting Milieukeur

EU Eco-Label Award

Environmentally Friendly

Germany

Canada

Finland, Sweden, Iceland, Norway

Japan

Sweden

USA

New Zealand

Australia

India

France

Austria

Rep. Of Korea

Singapore

Netherlands

European Union

Croatia

75

48

45

71

27

19

3206

1600

> 1000

2023

695

318

5

200

11

24

Date

Introduced

1977

1988

1989

1989

1990

1990

1990

1991

1991

1991

1991

1992

1992

1992

1992

1993

Source: OECD (1997), Vossenaar (1997).

The model also suggests that multilateral eco-labelling has interesting implications for the

pattern of trade. In the preceding examples, USA shrimp consumers and German Blue

Angel consumers will increase the aggregate national demand for cheaper non–safe

brands. Thus a country that exports non–safe commodities, for instance a country that

endowed tropical rainforest but no plantation forestry, may experience in increase in

export demand from countries that have marginal consumers in the initial equilibrium – for

instance USA and Germany in the examples above.23 Moreover model implies that the

incentives for producers of S–type goods to lobby for import barriers against

environmentally unsafe, R–type, goods will be greatest when many other countries also

have similar eco-labelling programmes.

21

A tariff, or any other policy that affects the prices of the safe and non-safe commodities,

can reduce global environmental levels, according to Proposition 4, as long as it alters the

prices faced by marginal consumers. Thus, in the examples above, Germany or the USA

could prevent the increase in demand for non–safe brands by imposing taxes and tariffs in

response to the adoption of eco-labelling by other countries. In this case, however, the

eco-labelling policy itself is essentially redundant. Likewise, it can be seen that a MEA that

removes PPM tariffs between member countries, but at the same time extends an ecolabelling scheme to all member countries, is likely to result in an increase in damage levels.

6. Conclusion

Since a number of recent trade–environment disputes have failed to meet the WTO’s

requirements for exemptions, the use of eco-labels has attracted increasing interest from

environmental and free trade lobby groups. This paper has analysed a partial equilibrium

model of consumer demand for a commodity that can be produced using environmentally

safe or harmful methods. In this setting, the public good aspect of environmental

conservation means that consumers attempt to free-ride on other consumers’ purchases of

safe brands.

The principle result concerns the behaviour of consumers who purchase environmentally

friendly brands. In response to an exogenous change in the level of environmental damage,

23 For example consider a country that endowed tropical rainforest but no plantation forestry. Such a

country may be a developing country, though as shown by Antweiler, Copeland and Taylor (2001), it is

not necessarily the case that low income countries export pollution intensive goods.

22

these consumers will face incentives to increase or reduce their purchases of the

environmentally friendly and unfriendly goods.

The model shows that, for marginal consumers, this substitution occurs on a one–to–one

basis. The behaviour of these consumers means that the equilibrium level of world damage

may be constant. Conditions were derived under which the level of damage will be

independent of a range of exogenous variables, including the number of countries with

eco-labelling policies.

While the model is not intended to be a literal description of consumer behaviour, it does

nevertheless highlight the potential limitations of eco-labelling programmes. In particular

they raise doubts over the merits of multilateral environmental agreements that promote

eco-labelling, and suggest that eco-labels are likely to be a poor substitute for more

mandatory policies, that force consumers to internalise environmental costs.

References

Aidt, Toke S., “Political internalization of economic externalities and environmental

Policy”, Journal of Public Economics, 69, 1-16, 1998.

Antweiler, Werner; Copeland, Brian R; Taylor, M Scott , “Is Free Trade Good for the

Environment?”, American Economic Review, 91, 4, September 2001, pp. 877-908.

Appleton, Arthur E., “Shrimp/Turtle: Untangling the Nets’, Journal of International

Economic Law, 2, 3, 447-96, 1999.

23

Bergstrom, T., L. Blume and H. Varian, On the Private Provision of Public Goods,

Journal of Public Economics, 29, 1, 25-49, 1986

Copeland, Brian R. and Scott Taylor, “Trade and Transboundary Pollution,” The

American Economic Review, 85, 4, 716-737, 1995.

Cornes, Richard and Todd Sandler, The Theory of Externalities, Public Goods, and Club

Goods 2nd Edition, Cambridge University Press, Cambridge, 1996.

Crossley, Rachel, Carlos Primo Braga and Panayotis Varangis. “Is there a Commercial

Case for Tropical Timber Certification, in Zarrilli, Simonetta, Veena Jha and René

Vossenaar (eds), Eco-Labelling and International Trade, Macmillan Press, U.K., 1997.

Deere, Carolyn. Eco-labelling and Sustainable Fisheries, IUNC: Washington and FAO

Rome, 1999.

Dosi, Cesare and Michele Moretto, “Is Eco-Labelling a Reliable Environmental Policy

Measure?”, Mimeo, University of Padova, July 1998.

Kennedy P.W. “Equilibrium Pollution Taxes in Open Economies with Imperfect

Competition,” Journal of Environmental Economics and Management, 27, 49-63, 1994.

Kirchhoff, Stefanie, “Green Business and Blue Angels: A Model of Voluntary

Overcompliance with Asymmetric Information” Environmental and Resource Economics,

15, 4, 403-20, 2000.

24

Liebig, Klaus. “The WTO and the Trade-Environment Conflict’, Intereconomics: Review

of International Trade and Development, March/April, 83-90, 1999.

Lloyd, Peter J. “The Problem of Optimal Environmental Policy Choice”, in Kym Anderson

and Richard Blackhurst, (eds) The Greening of World Trade Issues, Harvester

Wheatsheaf, U.K. 1992.

Mackenzie, R., Françoise Burhenne-Guilmin, Antonio G.M. La Viña and Jacob D.

Werksman, An Explanatory Guide to the Cartagena Protocol on Biosafety, IUCN

Environmental Policy and Law Paper No. 46, The World Conservation Union, 2003

Mason, Charles. “On the Economics of Eco-labelling”, Paper presented at the EAERE

Conference, Southampton, 2001.

Mattoo, Aaditya and Harsha V. Singh. “Eco-Labelling: Policy Considerations, Kyklos, 47,

53-65, 1994.

Mattoo, Aaditya and Harsha V. Singh. “Eco-Labelling, the Environment and International

Trade”, in Zarrilli, Simonetta, Veena Jha and René Vossenaar (eds), Eco-Labelling and

International Trade, Macmillan Press, U.K., 1997.

Markusen, J.R., International Externalities and Optimal tax Structures, Journal of

International Economics, 5, 15-29, 1975

Nielson, Chantal and Kym Anderson, “GMO’s, Trade Policy and Welfare in Rich and

Poor Countries”, CEIS Policy Discussion Paper, 0021, May 2000.

25

OECD, “Eco-Labelling: Actual Effects of Selected Programmes”, OCDE GD(97)105,

Paris, 1997.

Olson, M. “The Logic of Collective Action”, Harvard University Press, Cambridge MA,

1965.

Ranné Omar. “More Leeway for Unilateral Trade Measures? The Report of The Appellate

Body in the Shrimp-Turtle Case”, Intereconomics: Review of International Trade and

Development, March/April, 72-83, 1999.

Samuelson, P.A., “The pure theory of public expenditure, Review of Economics and

Statistics, 36, 387-89, 1954.

Silberberg E., “A Revision of Comparative Statics Methodology in Economics, or How to

do Economics on the Back of a Envelope”, Journal of Economic Theory, 7, 1, 159-172,

1974.

Shams, Rasul. “Eco-labelling and Environmental Policy Efforts in Developing Countries”,

Intereconomics: Review of International Trade and Development, May/June, 143-149,

1995.

Simula, Markkuu. “Timber Certification Initiatives and their Implications for Developng

Countries”, in Zarrilli, Simonetta, Veena Jha and René Vossenaar (eds), Eco-Labelling

and International Trade, Macmillan Press, U.K., 1997.

Swallow, Stephen K. and Roger A. Sedjo, “Eco-Labelling Consequences in General

Equilibrium: A Graphical Assessment”, Land Economics, 76, 1, 28-36, 2000.

26

The Economist, “Turtle Wars” October 3, 22-24, 1998.

The Economist, “GM Food and Trade: More Trouble Ahead”, July 3, 2003.

Vossenaar, René, “Eco-labelling and International Trade: The Main Issues”, in Zarrilli,

Simonetta, Veena Jha and René Vossenaar (eds), Eco-Labelling and International Trade,

Macmillan Press, U.K., 1997.

Vives, X. “Small income effects: A Marshallian theory of consumer surplus and downward

sloping demand”, Review of Economic Studies, 54 87-103, 1987.

World Trade Organisation, Eco-labelling: Overview of Current Work in Various

International Fora, WT/CTE/W/45, 15 April, 1997.

World Trade Organisation, United States – Import Prohibition of Certain Shrimp and

Shrimp Products, Report of the Appellate Body, WT/DS58/AB/R, 1998(a).

World Trade Organisation, Trade and Environment News Bulletin, TE/023 14 May,

1998(b).

Appendix

Proof of Proposition 2

For this proof I use the first order condition,

u i 1 (ciR , R − ciR − C −Ri ) − u i 2 (ciR , R − ciR − C −Ri ) − piR = 0

27

(3.)

This is an implicit function of ciR . A necessary condition for an interior equilibrium is that

this implicit function satisfies − 1 < ∂ciR / ∂C −Ri < 0 . Differentiating (3.), but holding price

constant, gives

u i 11 dciR − u12 (dciR + dC −Ri ) − u i 21 dciR + u 22 (dciR + dC −Ri ) = 0

(8.)

rearranging gives

∂ciR

− (u 22 − u12 )

=

R

∂C − i (u11 + u 22 − u12 − u 21 )

Since u 22 − u12 < u11 + u 22 − u12 − u 21 this implies − 1 < ∂ciR / ∂C −Ri < 0 .

(9.)

g

Proof of Proposition 3.

For some consumer i, the first order for ciS is

u i 1 (ciR + c iS , R − ciR − C −Ri ) − piS = 0

(5.)

Differentiating, but holding piS constant, and solving for dciS gives

u i 11 (dc iR + dciS ) − u i 12 (dciR + dC −Ri ) = 0

dciS = (u i 12 / u i 11 )(dciR + dC −Ri ) − dciR

(10.)

Next recall that combining (5.) and (6.) gives

u i 2 (ciR + ciS , R − ciR − C −Ri ) = p iS − p iR

28

(7.)

Differentiating (7.) gives

u i 21 (dciR + dciS ) − u i 22 (dciR + dC −Ri ) = 0

(11.)

Using (10.) to substitute out dciS gives

u i 21 (dciR + u i 21 ((u i 21 / u i 11 )(dciR + dC −Ri ) − dciR ) − u i 22 (dciR + dC −Ri ) = 0

(12.)

Simplifying

((u i 21 ) 2 / u i 11 − u i 22 )(dciR + dC −Ri ) = 0

(13.)

The second order condition for a maximum is u i 11u i 22 − (u i 21 ) 2 > 0 . Hence since

u i 11 < 0 , it follows that ((u i 21 ) 2 / u i 11 − u i 22 ) > 0 . Thus, whenever (5.) and (6.) hold with

equality dciR + dC −Ri = 0 , or equivalently, ∂ciR / ∂C −Ri = − 1 .

g

Proof of Proposition 4.

Proposition 3 shows that for any consumer who is in an interior equilibrium, the reaction

function has a slope of negative one. Given this, Proposition 4 follows from the fact that

each consumer only derives utility from the total aggregate level of the resource. To see

this consider the following Lemma.

Lemma 1: Consider any reaction function than can be written xi = f ( ∑ x − i ) , where ∑ x − i

is the sum of all other consumer’s actions. Suppose, further, that for some agent j,

x j = A − ∑ x − j , where A is a constant. That is, one agent has a response function that has

29

a slope of negative one. Then in an equilibrium where x j > 0 , the equilibrium value of xi

is independent of x k for all i and k, where k ≠ i . Hence dxi / dx k = 0 for all k ≠ i .

Proof of Lemma 1: The proof follows from the definition of a Nash equilibrium in pure

strategies. First we write the reaction function of an arbitrary agent i as

f (∑ x − i ) ≡ f (∑ x − i − j + x j ) . The term ∑ x − i −

j

refers to the sum of all actions except those

of agents i and j ≠ i . Given that x j = A − ∑ x − j , a necessary condition for a Nash

equilibrium is that xi solves xi = f (∑ x − i − j + A − ∑ x − j ) = g ( x j ) . Hence in equilibrium, the

value of xi is independent of the actions of all other agents except j, for all i.

g

Proposition 4 follows directly from Lemma 1. First note that any consumer i for whom

ciR > 0 and C −Ri ≠ 0 , is in an interior equilibrium. Thus, if there is exist at least one

marginal consumer, j such that c Rj > 0 and c Sj > 0 , then every other consumer i, for

whom ciR > 0 , where i ≠ j , is in an interior equilibrium. That is, all consumers who

consume R–type goods are in an interior equilibrium. Lemma 1 shows that the actions of

these consumers only affect the demand of the marginal consumer. From Proposition 3,

however, the marginal consumer will respond by increasing or reducing c Rj to offset this

exogenous change, since that agent’s reaction function has a slope of negative one.

Therefore the aggregate level of environmental damage is independent of the demand for

R–type goods by all other consumers who are in an interior equilibrium.

30

g

Proof of Proposition 5.

Suppose equation (5.) is not binding. Then we have u i 1 (ciR + ciS , R − C −Ri − ciR ) < piS and

ciS = 0 . That is, the marginal utility of consumption of S–type goods is less than its price.

It can be shown, however, that u i 1 (ciR , R − C −Ri − ciR ) is increasing for points on the

reaction function, qi (C −Ri , piS , piR ) , with lower values of ciR and higher values of C −Ri .

Hence, for lower values of ciR , eventually either (5.) becomes binding and ciS > 0 , or

ciS = 0 everywhere for this consumer. Denote the point where (5.) becomes binding as

ciR . Then ciS = 0 for all ciR ≥ ciR . Further at the point ciR , since (5.) is binding, marginal

utility of consumption is constant u i 1 (ciR + ciS , R − C −Ri − ciR ) = p iS . Therefore ciS > 0 for

all ciR < ciR .

It remains therefore only to prove the assertion that marginal utility of consumption

u i 1 (ciR , R − C −Ri − ciR ) increases as we move down the reaction function qi (C −Ri , piS , piR )

with lower values of ciR . Note that this does not follow directly from the fact that

u i 11 < 0 , since along the reaction function C −Ri is not constant.

First differentiate u i 1 (ciR , R − C −Ri − ciR ) with respect to C −Ri , to obtain

u i 11 (dc iR / dC −Ri ) − u i 12 − u i 12 (dciR / dC −Ri )

(14.)

It is necessary to show that this expression is positive. From the proof of Proposition 2 we

have

31

− (u i 22 − u i 12 )

dc iR

=

R

dC − i u i 11 + u i 22 − u i 12 − u i 21

Substituting this into (14.) and simplifying gives

u i 11u i 22 − u i 12

u i 11 + u i 22 − 2u i 12

2

−

(15.)

The denominator of this expression is negative and further, since u i 11 u i 22 − (u i 12 ) 2 > 0 ,

g

the expression is positive as required.

Proof of Proposition 7

Although it has been shown that perfect eco-labels can reduce the level of environmental

damage, it remains to demonstrate that the equilibrium is socially inefficient. To see this I

consider the optimal consumption allocation of a planner, whose objective function is

W = ∑ u i (ciS + ciR , R − C R )

(16.)

i

The planner maximises this subject to a set of resource constraints. Since perfect

competition has been assumed, firms set price equal to marginal cost the planning problem

can be written as equivalent to maximising

∑ u (c

i

S

i

+ ciR , R − C R ) +

i

∑ (y

i

32

i

− p iR ciR − piS ciS )

(17.)

with respect to ciS and ciR , for all i. The assumption that the prices may differ across

countries is retained for ease of comparison. Moreover this may reflect transport costs

across countries. The first order conditions for an interior equilibrium are

u i 1 (ciS + ciR , R − C R ) − p iS = 0

u i 1 (ciS + ciR , R − C R ) −

∑

u i 2 (ciS + c iR , R − C R ) − p iR = 0

(18.)

(19.)

i

The first condition (18.) is consistent with the market solution (5.). Equation (19.)

however is a version of Samuelson’s condition for the optimal provision of a public good

and differs from the market solution given by (6.). The two conditions coincide only if

m = 1, or if p S − p R = 0 . For m > 1,

∑u

i2

(c iS + ciR , R − C R ) must be smaller in the

i

planner’s solution compared to the market solution, when all consumers consume some S–

type goods. Thus the average value of u i 2 (ciS + ciR , R − C R ) must be lower in the planners

solution.

Thus, if d (u i 2 (ciS + ciR , R − C R )) < 0 , implies dC R < 0 , then the planning solution must

have a lower level of total environmental damage, C R .Evaluating the expression

d (u i 2 (ciS + ciR , R − C R )) gives u i 21 (dciS + dc iR ) − u i 22 dC R < 0 . Further, differentiating (5.)

gives dciR + dciS = (u i 12 / u i 11 )dC R . Substituting to eliminate the term dciR + dciS gives

((u i 21 ) 2 / u i 11 ) − u i 22 )dC R < 0 . Hence dC R < 0 if ((u i 21 ) 2 / u i 11 ) − u i 22 ) > 0 . This is

33

satisfied since, from the second order conditions, u i 22 u i 11 − (u i 21 ) 2 > 0 Since u i 11 < 0 ,

dividing both sides by u i 11 gives ((u i 21 ) 2 / u i 11 ) − u i 22 ) > 0 , as required.

g

Proof of Proposition 8

Consider an equilibrium where C −Ri = λi . Consumer i will be in region (ii) and, from the

definition of λi , will choose ciR = 0 , so C −Ri = λi = C R . The first order condition (5.)

becomes

u i 1 (ciS , R − C −Ri ) = p iS

(20.)

The left hand side is strictly decreasing in ciS and so this defines a unique maximum value

of ciS . Denote this ciS = f ( R − C −Ri , piS ) . Then (7.) becomes

u 2 ( f ( R − C −Ri , piR ), R − C −Ri ) = piS − piR

(21.)

This defines a unique level of C iR = C R and, therefore also, a unique value of λi . Thus, if

(21.) holds for some consumer type λk = λi , it cannot also hold for another type. Hence

only one consumer type can be in an interior equilibrium.

g

Income Effects

In this appendix I consider the implications of a more general specification of the utility

function than the quasi-linear form, (1.). Specifically suppose that consumer i maximises

34

φi ( xi , ciR , ciS , R, C R ) = u i (c iR + ciS , R − C −Ri − ciR , xi )

(22.)

subject to y i = piS ciS + piR ciR + x i . Using this budget constraint to substitute for ciR , and

recalling that C R = C −Ri + ciR , we have

C R = C −Ri + y i / piR − ( piS / piR )ciS − xi / p iR .

(23.)

From this it can be seen that for any exogenous shock dC −Ri , there is some value dy * that

could induce no change in C R and hence leave total utility unchanged. Note that this

implies that dC −Ri = dciS = − dciR . The income compensation required satisfies

dC R = dC −Ri + dy * / piR − ( piS / piR )dc iS = 0

(24.)

Substiuting dC −Ri = dc iS and solving gives dC −Ri (1 − p iS / p iR ) = − dy * / piR and hence

dC −Ri ( piS − piR ) = dy *

(25.)

Thus if income increases by exactly this amount, the consumer’s utility remains the same.

Consequently an exogenous change in damage levels, dC −Ri has the same effect on total

damage, C R , as a decrease in exogenous income ∂y * /( piS − piR ) . Hence

∂C R / ∂C −Ri = − ( piS − piR ) ∂C R / ∂y *

35

(26.)

Next consider the consumer’s reaction function. This can be written as a function of all the

exogenous variables,

qi (C −Ri , piS , p iR , y ) . Hence total resource consumption is

C iR = C −Ri + qi (C −Ri , p iS , piR , y ) . Differentiating this to evaluate (26.) gives

∂ciR / ∂C −Ri = − 1 − ( piS − piR ) ∂ciR / ∂y *

(27.)

This is a Slutsky-type decomposition of the reaction function, showing the compensated

substitution effect, -1, and the income effect of a change in C −Ri . In the main text, the

quasi–linear preferences give ∂ciR / ∂y * = 0 , so that ∂ciR / ∂C −Ri = − 1 . If the environmental

resource is normal and the R–type commodity is inferior, so that ∂ciR / ∂y * < 1 , the slope

of reaction function will be between 0 and –1. Nevertheless, it can be seen that as long as

∂ciR / ∂y * , is small, then the slope will be approximately –1, and the analysis in the text

therefore provides an appropriate and useful simplification.

36

Figure 1

ciR

a

ciR

(i)

b

(ii)

(iii)

λi − ciR

37

λi

g

C −Ri

Figure 2

c aR

λb

λa

a

e

e'

b'

b

38

λa

λb

cbR