Market Segmentation and Pricing of International Assets Cathy(Qiao) Ning April, 2004

advertisement

Market Segmentation and Pricing of

International Assets

Cathy(Qiao) Ning∗

April, 2004

Abstract

This paper investigates how conditional and unconditional forms of an

international multi-factor asset pricing model perform in explaining the

returns available to global investors. The assets considered are portfolios

of equities, bonds and currencies from several of the largest industrial

countries. We find evidence suggesting that international equity markets,

bond markets and currency markets are segmented. Therefore, we price

these assets using separate multi factor models. The factors we consider

are measures related to the level of equity market risk, currency market

risk, term structure risk, and default risk. To compare the performance

across different models, we estimate the Hansen-Jagannathan distances for

each model. Although we are unable to reject our unconditional models

∗ I would like to thank Prof. Stephen Sapp for his sufficient instruction. I also wish to

thank Prof. John Knight for his encouragement and useful suggestions, Prof. Joel Fried for

helpful discussion. Comments from the applied economics workshop also improve the paper.

All the errors are of myself.

1

for pricing equities, we do not find a significant role for our factors in

the unconditional models. Conditional models perform well for pricing

international equities with the term structure playing a significant role.

On the other hand, unconditional models perform well for bonds with

bond returns being explained by the default premium and equity market

risk premium, but conditional models perform poorly for bonds. For

currency returns, both the unconditional and conditional models indicate

that term structure risk and default risk have explanatory power.

1

Introduction

As the economies of the world have become increasingly global in nature, investors are able to invest in assets from around the world. Consequently both

academics and practitioners are interested in understanding how to explain the

returns on the set of international assets available to investors. In this paper, we examine several categories of international assets that are considered

by global investors, namely equities, bonds and currencies from several of the

largest industrial countries.

Trying to understand what factors influence the returns of assets has been the

focus of significant research for at least the past 40 years. The first attempts being related to the different versions of the Capital Asset Pricing Model (CAPM).

Among them, the Sharpe-Lintner-Black Capital Asset Pricing Model (CAPM)

2

is one of the most commonly used models by financial managers to assess the

risk of an investment. According to CAPM, the risk of an investment project is

measured by its correlation with the return on the market portfolio of all assets

in the economy, which is the systematic risk named beta. The expected return

for an asset has a linear relationship with the beta. Unfortunately numerous

empirical tests report that the CAPM does not fit cross-sectional asset pricing

data. For example, Fama and French (1992) find that cross sectional returns

can be explained by two persistent variables: size and book-to-market ratio,

while market beta has no explanation power in cross-sectional returns.

Possible explanations for the poor performance of the CAPM are provided

by some of the main critiques of the CAPM: 1) Roll’s (1977) critique that

market portfolio is unidentifiable. 2) Static CAPM fails to consider the effects

of time-varying investment opportunities in the calculation of an asset’s risk.

3) the Hansen-Richard (1987) critique that CAPM implies a conditional linear

factor model, which does not imply an unconditional model. The CAPM may

be true conditionally but may fail the unconditional testing. Therefore, CAPM

is a theoretical intuitive but not realistic model.

Since CAPM is unsatisfactory performed and not realistic, researchers have

developed many other more flexible and realistic models. Multifactor model

is one of them. In addition to the stock market risk, multifactor models take

into account many other sources of systematic risks that could influence the

asset returns. Besides, conditional multifactor models also solve the problem of

time-varying investment opportunities. And more, the multifactor models have

3

successfully explained the returns of domestic and global assets in the literature.

Many risk factors have been shown significant roles.

The domestic multifactor models tried to explain returns from stocks, bonds

and mutual funds. Chen, Roll and Ross (1996) introduce one of the earliest

popular multifactor models. They find that US stock returns can be explained

by some macro factors such as the term structure, expected and unexpected

inflation, industrial production, and default premium. Fama and French (1992

and 1993) propose the presently most popular multifactor models. They find

that stock returns are priced by firm specific factors such as firm size and bookto-market ratio. Chan, Karceski and Lakonishok (1998) investigate both macro

and firm specific risks factors in pricing stock returns and find a couple of

significant risk factors. Fama and French (1993) also find the explanation power

of multifactor models in bonds. Kryzanowski, Lalancette and To (1997) develop

the multifactor model to explain returns of mutual funds.

International multifactor models also tried to determine which risk factors

can explain global assets. Ferson and Harvey (1994) find that the world market

betas do not provide good explanation of cross-sectional difference of returns.

Multiple beta models provide an improved explanation of international equity

returns. Dumas and Solnik (1995) find both currency risk factors and world

market risk factor are significant in explaining world equity returns and foreign currency deposit returns. However international multifactor models are

relatively less developed than domestic ones.

In this paper, we investigate how multifactor models perform in explaining

4

the returns of the assets that are available to the global investors. Especially we

include foreign currencies as one category of available assets. In the literature of

international CAPM or multifactor models research, whether foreign exchange

risk is priced in the international equity asset returns receives a lot of attention.

See Solnik (1974), Sercu (1980), Stulz (1981). However, foreign exchange itself

is an important asset for investors. How to price it has not receive enough

attention that it deserves. By including currencies as assets, we actually extend

the investment opportunity set of global investors as global investors not only

invest in stocks and bonds, but also foreign currencies.

We examine the sources of the risks exposed by these international assets

and investigate several global economic risk factors including world equity market risk, foreign exchange risk, term structure risk, and default risk. We try

to answer the question as whether different international assets are priced by

the same risk factors. This depends on whether the assumption of market integration is true or not. International models usually assume the integrity of

international capital market although Korajczyck and Viallet (1992) indicate

evidence of market segmentation. We undertake a couple of tests to examine

the assumption of market integration.

We find evidence that international asset markets are actually segmented.

The segmentation in this paper means that different assets can not be priced the

same. Based on this, we analyze the returns of different international assets by

separate multifactor models. For each group of assets, we compare performance

of models with different risk factor specifications using Hansen-Jagannathan

5

(1996) distance measure (here after HJ-distance). Since HJ-distance approach

uses the same weighting matrix for different models, it allows us to compare

different models directly. If the model is correctly specified, the HJ-distance

should be zero.

Finally, in the empirical research of multifactor models, portfolios are usually

formed according to some attributes. However, according to Roll(1977), Lo

and Mackinlay(1990), FF(1996), and Brennan et al (1996), portfolio formation

processes are quite problematic. They find that same model with different

attribute-formed portfolios often lead to different inferences. In our study, we

use single asset such as one equity, bond and foreign currency for each country.

It can be viewed as a natural portfolio formed by the attributes of a country.

This naturally formed portfolio may avoid the problem caused by the artificial

portfolio formation process.

The main results of the paper are as following. The conditional models are

not rejected for equities and the world equity market risk factor can explain

the equity returns in the single factor model. But the significance of this factor

disappears when other risk factors are considered. Conditional models perform

well with the term structure risk factor being the only survived significant risk

factor with the presence of other factors in the explanation of equity returns.

Unconditional models perform well for bonds with significant explanation role

of term structure risk. But conditional models perform very poorly for bonds.

Both unconditional and conditional models indicate that foreign currency returns can be explained by term structure risk and default risk.

6

The paper is organized as follows. Part 2 describes the models and methodology. Part 3 describes and summaries the data.

Results are described and

discussed in Part 4. Part 5 summarizes our conclusions.

2

Models and Methodology

2.1

Unconditional models

According to CAPM, the beta multifactor model with K risk factors and N

assets is :

k

E[Rit ] = λ0 + ΣK

k=1 λk β i

where β ki =

cov(Rit ,Rtk )

V ar(Rtk )

(1)

is the factor loading, k=1,2 ....K

is the number

of factors, and i =1· · ·N is the number of assets. λk is the risk premium of

factor k. Rit is the gross return of asset i at time t. And Rtk is the return

of the kth risk factor at time t. Substitute expression of β ki into (1) and use

cov(Rit , Rtk ) = E[Rit Rtk ] − E[Rit ]E[Rtk ], we get:

E[Rit ] = λ0 + ΣK

k=1 λk

= λ0 + ΣK

k=1 λk

= λ0 + ΣK

k=1

cov(Rit ,Rk

t)

V ar(Rk

t)

E[Rit Rtk ]−E[Rit ]E[Rk

t]

V ar(Rtk )

λk E[Rit Rtk ]

V ar(Rk

t)

− ΣK

k=1

λk E[Rit ]E[Rk

t]

V ar(Rtk )

move all the terms except λ0 into left side of above equation. we get:

7

E[Rit ] − ΣK

k=1

λk E[Rit Rtk ]

V ar(Rtk )

+ ΣK

k=1

λk E[Rit ]E[Rtk ]

V ar(Rtk )

λ E[Rk ]

= λ0

λ Rk

k

k t

K

t

that is E[Rit (1 + ΣK

k=1 V ar(Rk ) − Σk=1 V ar(Rk ) )] = λ0

t

multiply

1

λ0

t

for both side, we get

λ E[Rk ]

λ Rk

k

k t

K

t

E[Rit ( λ10 + ΣK

k=1 λ0 V ar(Rk ) − Σk=1 λ0 V ar(Rk ) )] = 1

t

let δ 0 =

1

λ0

+

1

λ0

t

PK

λk E[Rtk ]

k=1 V ar(Rk

t)

λk

δ k = − λ0 V ar(R

k ) , for k=1...K,

t

then

k

E[Rit (δ 0 + ΣK

k=1 δ k Rt )] = 1N

(2)

for i=1· · ·N.

This is the stochastic discount factor form of multifactor CAPM. Here the

k

discount factor is dδ = δ 0 + ΣK

k=1 δ k Rt .

In the literature, factor models are most often applied to excess returns. Let

rit denote the excess return of asset i at time t. In the case of excess returns,

according to Cochrane (2002) page 256, the discount factor model will be:

k

E[rit (b0 + ΣK

k=1 bk Rt )] = 0

k

Where Rtk are returns of risk factors. As any multiples of (b0 + ΣK

k=1 bk Rt )

will fit the model, there is no way to separately identify b0 and bk ,Therefore,

the model is normalized as:

k

E[rit (1 + ΣK

k=1 bk Rt )] = 0

8

k

Where bk = − C0 V λar(R

k)

t

C0 = 1 +

PK

λk E[Rtk ]

k=1 V ar(Rk

t)

k

Then E[rit (1 + ΣK

k=1 bk Rt )] = E[wt (δ)] is the vector of pricing error, which

should be 0. The naturally convenient approach of estimation of the model

is the General Method of Moment (GMM). To do this, the quadratic form

E[wt (b)]0 G−1 E[wt (b)] is formulated, where G−1 is a positive definite matrix

(weighting matrix). b is chosen to make the pricing errors E[wt (b)] as small as

possible, by minimizing the quadratic form E[wt (b)]0 G−1 E[wt (b)].

It is well known that (V ar(wt (b)))−1 is the statistically optimal weighting

matrix, which produces estimates with lowest asymptotic variance. This is

formally shown by Hansen (1982). This weighting matrix also has the interpretation of paying less attention to pricing errors from assets with high variance of

k

rit (1 + ΣK

k=1 bk ft ). With this optimal weighting matrix, Hansen also shows that

the quadratic form has a χ2 distribution with degree of freedom (N-K), where

N is the number of moments and K is the number of parameters in the model.

We will only use this type of optimal GMM method for the test of the market

integration hypothesis based on stochastic discount factor models. However, it’s

inappropriate to use the optimal GMM approach to compare competing model’s

performance because the weighting matrix keeps changing across different models. We will use HJ-distance approach to compare model performance, which is

examined in the latter part of the paper.

9

2.2

Conditional Models

As the previous studies document that the poor empirical performance of CAPM

maybe because of inadequate allowances for time variation in the conditional

moments of returns. That is it fails to take into account the effects of timevarying investment opportunities. For the discount factor form of the model, the

discount factor dδ should be state dependent, which means it should incorporate

the conditional information. The conditional asset pricing model can be written

as follows:

k

E[(ri,t (1 + ΣK

k=1 bk Rt )|It−1 ] = 0

(3)

where It−1 is the information set at time t − 1 that investors use to price

assets.

By Cochrane (2001), one approach to incorporate conditional information

is to specify and estimate explicit statistical models of conditional distributions

of asset payoffs and discount factor variables. However, by this way, the number

of required parameters can quickly exceed the number of moments. And more

importantly, this explicit approach requires us to assume that investors use the

same conditioning information that we use. This is apparently not true. We

don’t observe all the conditional information as economic agents do. However,

asset price can summarize an enormous amount of information that only individual observes. To avoid assuming that investors only see the variables that we

include in an empirical investigation, we can incorporate conditional information by scaling factors with instruments that are likely to summarize variation

10

in conditional moments. By this way, the conditional model is transformed into

unconditional model. Let Zt−1 be the information variable set that summarizes

the It−1 .Then the moments can be formulated as following:

k

E[ri,t (1 + ΣK

k=1 bk Rt ) ⊗ Zt−1 ] = 0mN

(4)

where Zt−1 = {1, z1, z2 ......zm−1 }t−1 , and m is the number of conditional

variables.

This is actually:

E

[ri,t (1 +

k

ΣK

k=1 bk Rt )]

k

[ri,t (1 + ΣK

k=1 bk Rt )]z1,t−1

···

k

[ri,t (1 + ΣK

k=1 bk Rt )]zm−1,t−1

0N

0

N

=

···

0N

(5)

Which gives m × N moments and estimating K parameters. So there are

(m × N − K)over identifying moments.

let wt = {rit , Zt−1 }, yT = (wT0 , wT0 −1 , · · ·, w10 )0 be a vector containing all the

observations with sample size T. And let

k

[ri,t (1 + ΣK

k=1 bk Rt )]

[r (1 + ΣK b Rk )]z

i,t

1,t−1

k=1 k t

h(b, wt ) =

···

k

[ri,t (1 + ΣK

k=1 bk Rt )]zm,t−1

The sample average value of h(b, wt ) is

g(b, yT ) = (1/T )

PT

t=1

h(b, wt ),

11

(6)

and the GMM objective function is

Q(b) = [g(b, yT )]0 SbT−1 [g(b, yT )]

With the assumption of no serial correlation,

P

δ, wt )][h(b

δ, wt )]0 },

SbT = (1/T ) Tt=1 {[h(b

The standard errors for bbT is:

b 0 = (1/T ) PT

where D

T

t=1

0

b−1 d −1

d

(1/T ){D

T ST DT }

∂h(b,wt )

|b=bb

∂b0

T

In the econometric context, Zt−1 is an instrument vector because it should

be uncorrelated with the error vector. Cochrane (2001) interprets the implications of the conditioning model as to include actively managed portfolios to the

analysis by adding instruments. This is in principle able to capture all of the

model’s predictions. Suppose there is only one conditional variable Zt−1 , the

investor decided on the amount of money to invest in each asset based on Zt−1

at the beginning of each period. Therefore the level of Zt−1 at the beginning

of each period is considered as an investment signal. Hence Zt−1 can be interpreted as time varying investment portion of the risky asset. The payoff (in

excess of risk free rate) of the actively managed portfolios is rt Zt−1 .

2.3

Testing of Market Segmentation

Method 1—othogonality condition test

Testing market segmentation is the same as testing subsets of othogonality conditions. The method we use to test whether a subset of othogonality

12

conditions holds is the one developed in Eichenbaum, Hansen, and Singleton (1988). Following the above notations, the whole pricing error vector is

k

1

rit (1 + ΣK

k=1 bk Rt ) ⊗ Zt−1 = ht . Partition the vector into two subvectors ht and

h2t . Here ht is N dimensional with N assets and parameter vector b0 , while

h1t and h2t are N1 , N2 dimension with N1 , N2 assets and K1 and K2 parameters

b10 , b20 respectively. The null hypothesis is :

if E[ht ] = 0 and E[h1t ] = 0,

then H0 : E[h2t ] = 0

Following the notation in the above section, assume that the matrices S0

b T : T ≥ 1} and

and D0 can be consistently estimated by { SbT : T ≥ 1} and {D

S0 is nonsingular. According to the orthogonality conditions, we partition D0 ,

S0 , S0−1 and gT as:

¯

¯

¯

¯

¯ D1 ¯

¯ 0 ¯

¯

D0 = ¯¯

¯

¯ D2 ¯

¯ 0 ¯

S0−1

¯

¯

¯

¯

= ¯¯

¯

¯

Se011

Se021

¯

¯

12 ¯

e

S0 ¯

¯

¯

22 ¯

e

S0 ¯

Where g1T (b1T ) = (1/T )

¯

¯

¯ S 11

¯ 0

S0 = ¯¯

¯ S 21

¯ 0

PT

t=1

S012

S022

¯

¯

¯

¯

¯

¯

¯

¯

¯

¯

¯ g (b )

¯ 1T 1T

gT = ¯¯

¯ g (b )

¯ 2T 2T

¯

¯

¯

¯

¯

¯

¯

¯

h1t , g2T (b2T ) = (1/T )

In order to implement this test, first,

PT

t=1

h2t

one chooses b0T to minimize the

objective function [gT ]0 SbT−1 [gT ]. Next, the estimator b1T is formed by using

only the first N1 orthogonality conditions that are presumed to hold under the

alternative hypotheses and the weighting matrix (SbT11 )−1 . Using both estimators

to calculate the distance

13

CT = T [gT (b0T )]0 SbT−1 [gT (b0T )] − T [g1T (b1T )]0 (SbT11 )−1 [g1T (b1T )]

(7)

Under null hypothesis, the asymptotic distribution of CT is χ2 with degrees

of freedom [N ∗ m − K − (N1 ∗ m − K1)], where m is the number of instruments.

If CT is statistically significant different from 0, the null hypothesis is rejected. This means that the stochastic discount factors used to price the two

groups of assets perform significantly differently. In the context of market segmentation, this means the market consisting of N2 assets is segmented from the

market consisting of the N1 assets.

Method 2—likelihood ratio test

Another formal test of market segmentation is obtained by comparing the

market prices of pricing risks. If the market is integrated, the prices should be

the same for different financial market. The null hypothesis here is that the

market is integrated, that is:

(1) H0:

beq = bex

(2)

H0:

bbd = bex

(3)

H0:

beq = bbd

where beq , bex , bbd are market pricing vectors for equities, currencies and

bonds respectively. To test these, we can use Wald test, Lagrangian multiplier

test and likelihood ratio test. As Monte Carlo simulations suggest that the

asymptotic distribution of the Wald test is a poorer approximation to its small

14

sample distribution than the other two tests, we use likelihood ratio test for our

case.

The likelihood ratio test statistic is

T = 2 ∗ (L(eb) − L(bb))

(8)

where bb is the unconstrained estimate of b and eb is the constrained estimate

of b such that H0 is true. L is the log likelihood function for the estimation

method used. Under the null hypothesis the test statistic is asymptotically

distributed as a χ2 random variable with r degrees of freedom, where r is the

number of constraints on the null hypothesis. The p-values reported for the

tests are computed from the distribution and are only asymptotically valid.

2.4

Comparison of model performance by HJ-distance

In order to compare the performance of different model, we can not use the optimal weighting matrix to calculate the pricing error because the weighting matrix

changes for different models and parameter values. We fix the weighting matrix

among different models for the same category of the assets. Following Hansen

and Jagannathan (1996), we use second-moment matrix G−1 = E[rt0 rt ]−1 as

weighting matrix for unconditional models, while G−1 = E[(rt ⊗ Zt−1 )0 (rt ⊗

Zt−1 )]−1 as the weighting matrix for the conditional models. The fixed weighting matrix allow us to compare the performance of models by the value of

the quadratic form E[wt (b)]0 G−1 E[wt (b)], whose square root is called HansenJagannathan distance (HJ-distance). Hansen and Jagannathan (1994) showed

that the value of the quadratic form is the squared distance from the candidate

15

stochastic discount factor of the given model to the set of all the discount factors

that price the N assets correctly. With this arbitrarily weighting matrix, the

quadratic form E[wt (b)]0 G−1 E[wt (b)] will asymptotically have a distribution

of weighted sum of χ2. Based on this, the HJ-distance of various models and

p-value of HJ-distance by the method of GMM can be calculated. The smaller

of the HJ-distance indicates better fit of the model.

3

Data and Summary Statistics

3.1

Data Sources and Data Specification

The international market consists of international equity market, currency market and bond market. The assets in these markets will be equities, foreign

currencies and bonds from each country. More specifically, we consider 4 industrialized countries with the largest market capitalization. They are US, United

Kingdom, Germany and Japan. Therefore, there are four equities, three foreign

exchanges and four bonds for the four countries.

All returns for assets are monthly excess returns. For equities, if equity

index for country i at time t is pit , rriskf ree is the one month US dollar risk-free

rate, then the excess return is rit =

ex

defined as: rit

=

pit −pi,t−1

pi,t−1

deposit

pex

)−pex

it (1+rit

i,t−1

pex

i,t−1

− rriskf ree . Currency returns are

− rriskf ree . Where pex

it is the exchange

deposit

rate of country i relative to US dollars at time t. rit

is the deposit rate of

currency i at time t. Bond returns are bond holding returns computed from the

long term government bond yield.

16

Data are from January 1982 to December 1998. The data for equity indices are from Morgan Stanley Capital International (MSCI) and they are all

expressed in US dollars. The bond indices are data stream total all lives government bond indices for each country. These data are from the last day of each

month. The monthly exchange rate data are from the Federal Reserve Board

and Economic Research Federal Reserve Bank of St. Louis (FRED).

In order to see whether the different international assets are priced the same,

we use standard international capital asset models following Dumas and Solnik

(1995). The world market risk factor is defined as world equity index returns.

The world equity index is from the MSCI. If purchasing power parity is violated,

then investing in foreign markets entails exposure to exchange rate risk. The

currency risk factor should be added. We will not break this into separate

factors for each country as Dumas and Solnik (1995) did. As they state that,

the separation of foreign exchange risk “ creates a potential problem since in

reality investors bear exchange risks from other currencies.” Following Ferson

and Harvey (1994), we use the returns on trade-weighted US dollar price of the

currencies of 10 industrialized countries the proxy of the currency risk factor.

The G-10 trade weighted currency index return is understood as the aggregate

measure of currency risk.

The selection of conditioning information is an important step. The instrumental variables should summarize the information that international investors

use to formulate prices. The conditional variables are selected by comparing

with the literature. Harvey (1991) uses following common instruments for world

17

equity market: 1. return of S&P 500 index, 2.dummy variable for January, 3.return difference of 3 month treasure bill and 1 month treasure bill, 4. return

difference of Baa corporate bond and Aaa corporate bond. Instruments in Dumas and Solnik (95) are: 1. constant,2.the excess rate of return on the world

index lagged one month,3. a January dummy,4. the US bond yield, 5.the dividend yield on the US index, 6. the one-month rate of interest on a Eurodollar

deposit. Santis and Gerard (98) use following instruments:1.a constant,2.the

dividend yield on the world equity index in excess of the one-month Eurodollar

rate,3. the change in the US term premium measured by the yield on the tenyear US Treasury note in excess of the one-month Eurodollar rate, 4.the change

in the one-month Eurodollar deposit rate, 5. the US default premium measured

by the yield deference between Moody’s Baa-rated and Aaa-rated bonds.

Dumas and Solnik document that the US bond yield, the US dividend yield,

and the Eurodollar rate are fairly strongly correlated, and all three are somewhat correlated with the lagged world equity return. Plus that the dividend

yield, the bond yield and short-term rate of interest may not be stationary.

Therefore, among these instruments, we only chose lagged world equity return

and Eurodollar rate.

Following the literature and also considering above discussions, we select

following instruments:

1. a constant

2.lagged world equity market return in excess of US risk free rate, denoted

as rmlag.

18

3. the US default premium measured by the yield deference between Moody’s

Baa-rated and Aaa-rated bonds, denoted as rdef.

4. the change in the US term premium measured by the yield on the ten-year

US Treasury note in excess of the US risk free rate, denoted as rtm11 .

5. the one-month rate of interest on a Eurodollar deposit, denoted as euro.

The Eurodollar deposit rate is the 1 month Eurodollar deposit rate bid at

11am London time from data stream. The US risk free rate should be one

month T-bill rate. As one month T-bill rate is not available in our time period,

we use three month T-bill rate from FRED instead. The available data of one

month rate and three month rate are compared and we find that the difference

is very small. All interest rates are divided by 12 to change the annually rate

to monthly rate.

3.2

Risk factor specification

Cochrane (2001) points out that: since we can always take linear combination

of factors to reduce the number of factors, the pure number of pricing factors is

not a meaningful question. However, sometimes, an economic interpretation of

the factors can be lost on taking a linear combination of the factors . He then

argues that clear economic foundation is important for factor models. Carefully

describing the fundamental macroeconomic sources of risk thus provides more

1 We also use GDP weighted risk free rate, default premium, term premium from the major

industrilized countries, the results are not good to interprete. The problem could be the noisy

of this type of weighted data.

19

discipline for empirical work.

In the literature, there are two basic approaches to identify factors. One

is to use statistic techniques to identify optimal risk factors such as Connor

and Korajczyck (1993). The other is to specify a set of macro economic factors

(state variables), for example, Chen, Roll and Ross (1988). We will use the later

approach to identify factors.

By Cochrane (2001), factor pricing models choose for factors according to

the following approximation:

0

0

t)

β uu0 (c(ct−1

) ≈ δ 0 + δ ft

Any variable that is good proxy for aggregate marginal utility growth is an

economically meaningful approximation. Directly speaking, investors are especially concerned about some special states of the economy in which their portfolios do not perform badly. The factor variables should be those of indication

or forecast of these “bad states”.

As consumption and marginal utility are related to the state of the economy, any variables that can measure the state of the economy are good candidate factors. Furthermore, consumption and marginal utility respond to news.

Therefore, any variable that forecasts changes in the investment opportunity set

or asset returns is a candidate factor. Consequently, macro economic factors as

state variables are proposed as pricing factors in the literature.

Following Dumas and Solnik (1995) and Ferson and Harvey (1994), we use

two market risk variables: equity risk factor and currency risk factor. In the

20

literature of multifactor asset pricing models, equally weighted or value weighted

equity market index returns are usually taken as the proxy for the market risk.

According to their argument, when we consider international assets, stock risk

is not the only source of market risk. Relative price change of currencies (foreign

exchanges) is another source of market risk. Therefore, it is necessary to consider

both equity market risk and currency market risk as the proxy of the world

market risk. The computation of these two factors are specified in the above

section.

Another two factors we considered are macroeconomic factors. Macroeconomic factors are systematic forces that can affect the asset prices by changing

the investment opportunities. Chen, Roll and Ross (1986) first investigate the

role of macroeconomic risk factors in the domestic multifactor models, followed

by numerous others. Ferson and Harvey (1994) use macroeconomic factors in

the international asset pricing models.

The first macroeconomic factor we considered is term structure. This factor

has been used by many authors such as Chen, Roll and Ross (1980), Ferson and

Harvey (1994), and Lettau and Ludvigson(2001). They argue that this factor

captures investors expectation of the trend of economy and it will influence

the asset returns by changing the time value of the future cash flows. It can

also forecasts “good” state or “bad” state of the economy. It is defined as the

difference between the yield on the seven-year US Treasury note and 3 month

treasure bill return denoted as rtm2t. We use seven year US treasury note

instead of long term government bond is because business cycle usually takes

21

about five to eight years.

The second macroeconomic factor considered is default risk. Chen, Roll

and Ross (1986) and Ferson and Harvey (1994) used this risk factor because

it has been argued that it captures the change of risk aversion of international

investors. It is also a forecast of “good” state or “bad” state. The increasing

of this premium indicates a ”bad” state. It is approximated by the difference

between Moody’s Baa corporate bond return and the Aaa corporate bond return

denoted as rdeft.

3.3

Data analysis and Summary Statistics

In order to have a basic idea about the behavior of different assets and the data

properties, we give a preliminary data analysis as following.

Figure 1 and Figure 2 give the trends in the international equity market and

bond market. They plot the equity index trend and bond index trend for the

four countries considered. The equity market shows upward trend while there

is no apparent trend for the bond market. Figure 3 and Figure 4 plot foreign

exchange rate against time. Foreign exchange market shows downward trends

indicating appreciation of U.S. dollars during this period. From these figures,

we can visually tell that these assets behave quite differently.

The description statistics are in Table 1. Panel A of the Table 1 gives the

statistics for excess returns of all assets considered. The mean of excess equity

returns are all positive. It’s interesting to see from the table that US equity

22

market has both lowest average return and volatility. This is consistent with

the financial theory of low risk low return. Japanese equity market has relatively

small mean and largest standard deviation. That means Japanese stock market

has relatively low return with highest risk. This unusual phenomenon may be

related to Japanese economic bubble. Other country’s market is consistent with

the financial theory of high return high risk. The autocorrelations of equities

are very small and not significant.

The means of bond index returns are all positive with standard deviations

much lower than those of equity returns, which indicates much more stable of

bond market. All bonds exhibit significant first order autocorrelation. But

the autocorrelations die out one month later. The currency deposit returns

have lower means and higher standard deviations than those of bonds, but

lower standard deviations than those of equities. Currency returns show similar

autocorrelation patterns as that of bonds. The fluctuations of returns in different

international markets can also be seen in figure 5, 6 and 7. The figures show

that there is no trend for the series and the volatilities of series do not change

much with time. By Dicky-Fuller test, all return series are stationary.

Panel B of Table 1 provides the descriptive statistics for risk factors. The

world equity index return has lower standard deviation than that of any country,

which indicates relatively low risk of world stock index return. This data does

not show significant autocorrelations. Similar to the world equity return, world

currency risk premium is lowest among all currency returns. It also shows

significant first order autocorrelation but dies out one month later. Figure 8

23

gives the fluctuation of these two terms. Term structure and default premium

show significant first order autocorrelation but dies out one month later as well.

Dicky-Fuller tests reject the null hypothesis of nonstationary of these series. The

volatilities of the term structure and default premium are much lower than the

world equity market index. Given their small volatilities, it would be hard for

the model to price the term premium and default premium. If they are priced,

that implies that they are really strong factors in predicting returns.

The descriptive statistics for instruments are in Panel C of Table 1. Notice

that lagged term premium, default premium, and excess Eurodollar returns have

much lower standard deviation than lagged world equity risk premium. Among

all instruments, lagged term premium and default premium show significant first

order autocorrelations but the autocorrelations die out one month later again.

Excess Eurodollar returns exhibit significant autocorrelations up to 4 lags. As

the autocorrelations decay very fast, we can judge all series are stationary. The

Dicky-Fuller tests also confirm this judgement. Therefore the assumption of

stationary data for GMM is satisfied.

In order to gauge the instruments predictive ability, various assets’ returns

are regressed on the instruments. The results are provided in Table 2. Though

the R squares are low, but several coefficients are significant. The equity market

risk premium is significant to predict the US, Japanese, and German bond returns. Term premium is significant in predicting most asset returns. Eurodollar

plays significant role in predicting Japanese bond returns and French currency

returns.

24

The correlations between pricing factors are presented in Table 3. Table

3 shows that correlations between factors are small except the correlation between term premium and default premium, which is -0.33421. There may have

some multicollinearity, but the collinearity is not perfect after implementing

multicollinearity diagnose.

4

Main Results

4.1

4.1.1

Test of Market Integration

Linear Regression

In order to have a rough idea about the relationship of assets and international

market risk factors: world equity risk factor (reqwd) and world currency risk factor (rexwd), all single assets (equity returns, bond returns and foreign exchange

returns) are regressed on these factors. The linear model for excess returns ri,t

is

ri,t = β 0 + β reqwd,i, ∗ reqwdt + β rexwd,i ∗ rexwdt

(9)

Where β 0 is the intercept term. The results are in Table 4. All R-squares

for equity and currency assets are very high ranging from 0.33 to 0.95 with

significant role of reqwd and rexwd for most single equities and currencies.

This indicates that world equity market risk premium and world currency risk

premium play significant roles in predicting single equity and currency returns

for different countries. However, the R squares for bonds are very low with only

25

reqwd being significant. The currency risks usually do not affect bond returns.

These also show that bond market is quite different from equity market and

exchange market.

Then, we do regressions for the conditional linear international model:

rt = β 0t + β 1t ∗ reqwdt + β 2t ∗ rexwdt

Following Lettau and Ludvigson (2001)’s arguments, β 0t , β 1t and β 2t are

time varying. That is

β 0t = β 01 + β 02 ⊗ Zt−1

β 1t = β 11 + β 12 ⊗ Zt−1

where

β 2t = β 21 + β 22 ⊗ Zt−1

Zt−1 is the conditional information set. As specified in the data

section, Zt−1 = {1, rmlag, rtm1, rdef }t . The explicit form of the conditional

model in our case is:

rti = β i0 + β i1 ∗ reqwdt + β i2 ∗ rexwdt + β i4 ∗ rmlagt + β i4 ∗ rdeft + β i5 ∗ rtm1t +

β i6 ∗ eurot

+β i7 ∗ reqz1 + β i8 ∗ reqz2 + β i9 ∗ reqz3 + β i10 ∗ reqz4

+β i11 ∗ rexz1 + β i12 ∗ rexz2 + β i13 ∗ rexz3 + β i14 ∗ rexz4

(10)

Where

reqz1 = reqwdt ∗ rmlagt−1 , reqz2 = reqwdt ∗ rdeft−1 , reqz3 = reqwdt ∗

rtm1t−1 , reqz4 = reqwdt ∗ eurot−1

rexz1 = rexwdt ∗ rmlagt−1 , rexz2 = rexwdt ∗ rdeft−1 , rexz3 = rexwdt ∗

rtm1t−1 , rexz4 = rexwdt ∗ eurot−1

rti is the return of asset i. The results are in Table 5. The conditional linear

model increases R squares for all the cases, which implies that conditional model

26

performs better than unconditional ones. It’s interesting that while world equity

risk factor plays an important role in predicting equity returns for different

countries, the currency risk factor is no longer significant in this market. Both

factors are still significant for currency returns as before. This difference implies

that there exists potential difference between international equity market and

exchange market. The term premium plays very significant role in the bond

market. This again shows that bond market is different from the other two

markets.

The formal test of market integration by conditional linear model is presented in Table 6. As linear model is the special case of nonlinear model, we

use likelihood ratio test method described in the methodology part. The null

hypothesis is market integration. That is to test the equality of the coefficients

for different assets. The null hypothesis is rejected for all cases. Therefore,

the linear models indicate that international equity market, bond market and

currency market are segmented.

4.1.2

Stochastic Discount Factor Models

1. Orthogonality Condition Test

We then test the null hypothesis of market integration by the international

stochastic discount factor models with the method of Eichenbaum, Hansen

and Singleton (1988) discussed earlier in 2.3. The international asset pricing

model proposed by Dumas & Solnik (1995) and others includes both a stock

27

market risk factor and a currency risk factor in the model. The inclusion of

currency risk factor is to incorporate the international market risk from the

relative changing of currency prices. The reason to use this model is that the

assets we are examining are international assets. They should expose to both

stock market risk and the foreign exchange risk.

The unconditional version of the model is:

E[rit ∗ (1 + b1 ∗ reqwdt + b2 ∗ rexwdt )] = 0

(11)

The results in Panel A of Table 7 shows that most unconditional models are

rejected. Only the models for equities and bonds are not rejected. But none

of the factors are significant for equities. Only the world equity risk factor is

significant for bonds. Overall, the unconditional models do not perform well for

international assets.

Then we investigate the conditional international models:

E[rit ∗ (1 + b1 ∗ reqwdt + b2 ∗ rexwdt ) ⊗ Zt−1 ] = 0

Where the conditional information variables in Zt−1 are the same as defined

earlier. The explicit form of the model is:

[ri,t ∗ (1 + b1 ∗ reqwdt + b2 ∗ rexwdt )]

[r ∗ (1 + b ∗ reqwd + b ∗ rexwd )] ∗ rmlag

i,t

1

t

2

t

t−1

E

[ri,t ∗ (1 + b1 ∗ reqwdt + b2 ∗ rexwdt )] ∗ rtm1t−1

[r ∗ (1 + b ∗ reqwd + b ∗ rexwd )] ∗ rdef

i,t

1

t

2

t

t−1

[ri,t ∗ (1 + b1 ∗ reqwdt + b2 ∗ rexwdt )] ∗ eurot−1

=

0N

0N

0N

(12)

0N

0N

To simplify notation, we use E[ht ] = 0 to denote above equation system

(12).

28

The results are presented in Table 7 Panel B. The models are not rejected

for most cases, the coefficients for most cases are significant, which shows better

performance of conditional models. This indicates investors do use conditional

information. However, overall, this type of the model does not perform very well

in explaining asset returns we considered except equity returns. The p-value for

the objective function of currency assets is much smaller than that of equity

assets or bond assets. This indicates exchange assets performs quite differently.

The two-factor model fit currency returns data very poorly.

We then test the market integration hypothesis based on the conditional

model. We first assume that different international asset markets are integrated.

That is to assume the integration of the international equity market and the

bond market, integration of equity market with currency market, and the integration of the bond market with the currency market. So the hypothesis test

is:

Assume:

E[ht ] = 0

for the whole asset group of r consisting of the sub asset group

of r1 and r2

E[h1t ] = 0

for the sub asset group of r1

Test H0:

E[h2t ] = 0

for the sub asset group of r2

To check the robustness, we then test the alternative null hypothesis of the

market segmentation. The hypothesis test will be:

Assume:

29

E[ht ] = 0

for the whole asset group of r consisting of the sub asset group

of r1 and r2

E[h1t ] 6= 0

for the sub asset group of r1

Test H0:

E[h2t ] = 0

for the sub asset group of r2

Market integration tests are done for international conditional models. We

use Eichenbaum, Hansen and Singleton (1988)’s method of testing orthogonality

condition to test the null hypothesis of the market integration. The results are

in Panel A of Table 8. Both the null hypothesis of integration of equity market

and bond market and the integration of equity market and currency market are

rejected.

Then we undertake the test of the null hypothesis of the market segmentation. The results are in Panel B of Table 8. We can not reject any null

hypothesis, indicating that the three types of markets are segmented from each

other.

2.Likelihood ratio test

The likelihood ratio test results are presented in Panel C of Table 8. The

model is the same as in (12). The test method is dexcribed in section 2.3. The

null hypotheses of integration of the equity market and the currency market,

and the integration of the equity market and bond market are strongly rejected

with the p-value less than .0001. The null hypothesis of integration of bond

market and currency market is rejected with p value of 0.0002.

Therefore, the hypothesis of integration of the international equity market,

30

bond market and currency market is rejected. This means that we can not price

the three type of assets together. Next, we will price international equities,

bonds, and currency returns with separate multifactor models.

4.2

Pricing of International Assets by multifactor models

We use the multifactor models discussed in the model section to price our international assets. Factors considered are equity market risk factor (reqwd),

foreign exchange risk factor (rexwd), term structure factor (rtm2t) and the default premium factor (rdeft). These factors are discussed and defined in section

3 of the paper. HJ-distance is used to compare the performance of different factor models for each category of the assets. The unconditional and conditional

multifactor models are:

k

E[rit (1 + ΣK

k=1 bk Rt )] = 0

(13)

k

E[ri,t (1 + ΣK

k=1 bk Rt ) ⊗ Zt−1 ] = 0mN

(14)

where bk is the subset of {b1 b2 b3 b4 }, Rtk is the subset of {rexwd rtm2t

rdef t reqwd}t . Zt−1 is the conditional variable set described in section 2, that is

Zt−1 = {1 rmlag rtm1 rdef euro}t−1 . To be more explicitly, the unconditional

models are:

Model 1: E[rit (1 + b1 ∗ rexwdt )] = 0

Model 2: E[rit (1 + b4 ∗ reqwdt )] = 0

Model 3: E[rit (1 + b1 ∗ reqwdt + b4 ∗ reqwdt )] = 0

Model 4: E[rit (1 + b2 ∗ rtm2tt + b3 ∗ rdef tt + b4 ∗ reqwdt )] = 0

31

Model 5: E[rit (1 + b1 ∗ reqwdt + b2 ∗ rtm2tt + b3 ∗ rdef tt )] = 0

Model 6: E[rit (1 + b1 ∗ reqwdt + b2 ∗ rtm2tt + b3 ∗ rdef tt + b4 ∗ reqwdt )] = 0

Model 7: E[rit (1 + b2 ∗ rtm2tt + b3 ∗ rdef tt )] = 0

The correspondent explicit conditional models are:

Model 8: E[rit (1 + b1 ∗ rexwdt ) ⊗ Zt−1 ] = 0mN

Model 9: E[rit (1 + b4 ∗ reqwdt ) ⊗ Zt−1 ] = 0mN

Model 10: E[rit (1 + b1 ∗ reqwdt + b4 ∗ reqwdt ) ⊗ Zt−1 ] = 0mN

Model 11: E[rit (1 + b2 ∗ rtm2tt + b3 ∗ rdef tt + b4 ∗ reqwdt ) ⊗ Zt−1 ] = 0mN

Model 12: E[rit (1 + b1 ∗ reqwdt + b2 ∗ rtm2tt + b3 ∗ rdef tt ) ⊗ Zt−1 ] = 0mN

Model 13: E[rit+1 (1 + b1 ∗ reqwdt + b2 ∗ rtm2tt + b3 ∗ rdef tt + b4 ∗ reqwdt ) ⊗

Zt−1 ] = 0mN

Model 14: E[rit (1 + b2 ∗ rtm2tt + b3 ∗ rdef tt ) ⊗ Zt−1 ] = 0mN

The explicit form of the cross product is the same as in equation (12). For

the unconditional models, the common weighting matrix of the HJ-distances is:

G−1 = E[rt0 rt ]−1 . For the conditional model, the common weighting matrix for

HJ-distance is G−1 = E[(rt ⊗Zt−1 )0 (rt ⊗Zt−1 )]−1 . We examine these models by

their different combination of factors to pin down which factors are significant

in pricing different international assets.

4.2.1

Pricing of Foreign Exchange Rate Returns

We tried the above fourteen models to explain currency returns. Table 9 gives

the results for the unconditional models (model 1-5, model 7). The first 3

models are rejected with HJ-distance significantly different from zero. Model 4

32

and 5 are exactly identified cases with term structure and default premium being

significant factors. The two-factor model 7 has the statistically insignificant HJdistance of 0.6132, this is the smallest among all the competing models. The

p-value of 82.86% indicates that we can’t reject this two-factor model. The

model also indicate that term structure and default premium are significant in

pricing foreign exchange returns.

The comparison of conditional multifactor models are in Table 10. Model

8, 9, and 10 are rejected indicating that either world currency index risk nor

world equity index risk are not enough to price foreign exchange returns. The

next four models are not rejected with the four factor model having the lowest

HJ-distance of 3.7661, which is statistically not significantly different from zero.

Term structure and default premium keep playing significant role in pricing

foreign exchange returns. The world equity market risk also shows significance

in several cases.

Both unconditional and conditional classical and international models do

not work for pricing foreign exchange returns.The term structure risk factor

and default risk factor improve the models’ performance dramatically in both

unconditional case and conditional case. The extremely good performance of

models with term and default premium factors indicates that the cross sectional

exchange rate returns can be priced by these two terms. That is cross sectional

foreign exchange returns are explained by fundamental economic variables. The

sign for the coefficients of term premium and default premium are all negative,

which means the increase of exposure to these risks requires higher compensation

33

for returns.

Another striking result is that even though the equity market risk and currency market risk factor explain a significant portion of the time-series variability of single exchange returns, they have insignificant influence on pricing when

compared with the fundamental economic state variables. Therefore, market

force variables are dominated by economic state variables. Foreign exchange

returns are priced by systematic economic forces such as term risk and default

risk2 .

4.3

Pricing of International Equities

Next, we apply the above seven unconditional and the seven conditional models

to the international equities. Table 11 and Table 12 give the results. From

Table 11, we can not reject any unconditional model. However, none of the

factors are significant except the market equity risk factor in the single factor

model (model 2). The classical single market factor model is not rejected with

the p value of the HJ-distance of 84.8% and the equity market risk factor is

statistically significant. This result is consistent with that was found in Dumas

and Solnik (1995).

Shown in Table 12, the conditional models perform very well for equities.

None of the model is rejected. It looks like that investors do use conditional

2 Note that the term premium and default premium are from US data. The GDP weighted

aggregate world premium and default premium are tried to replace the above two factors.

We find that they are not significant factors. This might because that we are looking at

US investors, the currency returns are more related to US fundamental forces. The world

aggregate variables just add more noise, which lead bad fit of the models.

34

information in making equity investment decision. Both equity market risk

factor and currency market risk factor play significant role in the single factor

model. However, when the macro economics factors are added into the model,

none of the market risk factors showing any significant role. The term structure

factor is persistently significant in all models. Unlike the case of exchange

rate returns, default risk factor does not play any significant role in explaining

equity returns. The finding of the significant role of term structure factor and

powerlessness of market risk factor in explaining of equity returns confirmed

Chen, Ross and Roll’s (1986) result in explaining domestic equity returns. They

argue that the equity market risk factor may be captured by the significant

macro economic factor.

4.4

Pricing of International Bonds

We then fit the unconditional and conditional models (model 1 to model 14) with

international bonds data. Shown in Table 13, the unconditional models perform

ok for bonds. The single currency risk factor model (model 1) is rejected. The

other models are not rejected. The equity market risk factor is significant in the

models without macro economics factors (model 2 and model 3). The default

risk factor is significant in the models that the equity risk factor is not included

(model 5 and model 7). It seems that simultaneously including both market

risk factor and default risk factor will hurt the model fit. This can be seen

from the not significant of any factor in model 4 and model 6. Our findings of

unconditional models for bonds are consistent with those of Fama and French

35

(1993) and Erb, Viskanta and Harvey (1996).

From Table 14, we can see that the conditional models perform poorly for

bond returns. All the models considered are rejected. The HJ-distances are

much bigger than the models for equities and currencies. And they are all significantly different from zero. The poor performance of the conditional models

for bonds seems to indicate that, unlike investing in risky assets, investors do

not update the conditional information when they make decision on investing

in fixed-income assets. This also indictes that bonds are risk free assets that

can not be explained by risky factors.

5

Conclusion

According to capital asset pricing theory, asset pricing models should price any

assets. However, should we price all international assets using the same stochastic discount factor model? In this paper, we examine the performance of

unconditional and conditional models for all international assets. We find that

there exists market segmentation in the international asset market. Given this,

we explain the foreign exchange rate returns, international equity returns and

bond returns with separate multifactor models. Different stochastic discount

factor models are examined and it is found that some fundamental economic

state variables term premium and default premium are significant factors in

pricing cross sectional returns of foreign exchanges. Market risk terms in international models play no significant role in predicting cross sectional return of

36

exchange rate. Unconditional models are not rejected but there is no persisitent

significant factor. Conditional models perform well for pricing international equities with the term structure playing a significant role. On the other hand,

unconditional models perform well for bonds with bond returns being explained

by the default premium and equity market risk premium, but conditional models

perform very poorly for bonds.

37

References:

Bekaert, G. and Hodrick, R.J., 1992, Characterizing predictable components

in excess returns on equity and foreign exchange markets, Journal of Finance

47, 467-51.

Brennan, M.J., Chordia, T. and Subrahmanyam, S., 1998, Alternative factor

specifications, security characteristics, and the cross-section of expected stock

returns, Journal of Financial Economics 49, 345-373.

Brennan, M.J. and Subrahmanyam, A., 1996, Market microstructure and

asset pricing on the compensation for illiquidity in stock returns. Journal of

Financial Economics 41, 341-364.

Chan, Louis K.C., Karceski, J. and Lakonishok, J., June 1998, The risk and

return from factors, Journal of Financial and Quantitative Analysis, Nol. 33,

No. 2.

Chen, N.F., Roll, R.and Ross, S. A., Jul., 1986, Economic forces and the

stock market, Journal of Business, Vol. 59, Issue 3, 393-403.

Cochrane, J.H., 2001, Asset Pricing, Princeton University Press.

Connor, G. and Korajczyk, T., 1993, A Test for the number of factors in an

approximate factor model. Journal of Finance 48, 1263-1291.

Dumas, B. and Solnik, B.,June 1995, The world rice of foreign exchange risk,

The Journal of Finance, Vol 47, No.2.

Eichenbaum, M. S., Hansen, L. P. and Singleton, K. J., Feb. 1988, A Time

Series Analysis of Representative Agent Models of Consumption and Leisure

Choice Under Uncertainty. The Quarterly Journal of Economics, Issue 1.

38

Elton, .E. J., Gruber, M. J. and Blake, C. R., Sep., 1995, Fundamental

economic variables, expected returns, and bond fund performance, The Journal

of Finance, Vol. 50, Issue 4, 1229-1256.

Erb, C. B., Viskanta, T. E. and Harvey, C. T., June 1996, The influence of

political, economic and financial risk on expected fiexed-income returns. Journal

of Fixed Income, Vol 6 No. 1.

Fama, E.F. and French, K.R., 1992, The Cross-Section of expected stock

returns, Journal of Finance 47, 427-465.

Fama, E.F. and French, K.R., 1993a, Differences in the risks and returns of

NYSE and NASDAQ stocks. Financial Analysts Journal 49, 27-41.

Fama, E.F. and French, K.R., 1993b, Common risk factors in the returns on

stocks and bonds. Journal of Financial Economics 33, 3-56.

Fama, E.F. and French, K.R., 1996, Multifactor explanations for asset pricing anomalies. Journal of Finance 51, 55-84.

Ferson, Wayne E. and Harvey, Campbell R., 1994, Sources of risk and expected returns in global equity markets. Journal of Banking & Finance 18,

775-803.

Harvey, C.R., March 1991, The world price of covariance risk, The Journal

of Finance, Vol. XLVI, No.1.

Hansen, Lars Peter, 1982, Large sample properties of generalized method of

moments estimators, Econometrica 50, 1029-1054

Hansen, Lars Peter, and Ravi Jagannathan, 1994, Assessing specification

errors in stochastic discount factor models, Technical working paper No. 153,

39

NBER.

Hansen, L and Richard, S., 1987, The role of conditioning information in

deducing testable restrictions implied by dynamic asset pricing models”, Econometrica 55, pp. 587-613.

Jagannathan, R.,Wang, Z.Y., Mar.1996, The conditional CAPM and the

cross-section of expected returns, Journal of Finance, Volume 51, Issue1, 3-53

Korajczyck, R.A., and C.J. Viallet, 1992, Equity risk premia and the pricing

of foreign exchange risk, Journal of International Economics, 199-220.

Kryzanowski, L., Lalancette, S. and To, M.C., Jun.1997, Performance attribution using an APT with prespecified macrofactors and time-varying risk

premium and betas, The Journal of Financial and Quantitative Analysis, Vol.

32, Issue 2 , 205-224.

Lettau, M. and Ludvigson, S., Dec., 2001, Resurrecting the CCAPM: A

Cross-Sectional Test When Risk Premia Are Time -Varying, Journal of Political

Economy, Number 6, Vol. 109..

Lo, A.W., MacKinlay, A.C., 1990, Data-snooping biases in tests of financial

asset pricing models. Review of Financial Studies 3, 431-468.

Roll. R., 1977, A critique of the Asset Pricing Theory’s tests: on past and

potential testability of theory, Journal Financial Economics 4, 129-176.

Santis,Giorgio De and Gerard, Bruno, 1998, How big is the premium for

currency risk, Journal of Financial Economics 49, 375-412.

Sercu, P., 1980, A generalization of the international asset pricing model,

Finance 91-135.

40

Solnik, B., 1974, An equilibrium model of the international capital market,

Journal of Economic Theory 8, 500-524.

Stulz, R. M., 1981, A model of international asset pricing, Journal of Financial Economics 9, 383-406.

41

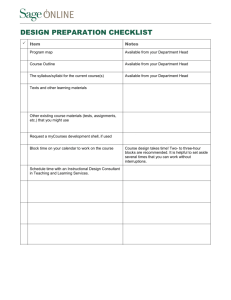

Table 1

Summary Statistics

Requs, requk, reqgm and reqjp are excess equity index returns from U.S, United Kindom,

German and Japan. Rbdus, rbduk, rbdgm, and rbdjp are excess bond returns calculated from

long term government yields from these countries. Rexuk, rexgm, and rexjp are excess

exchange returns of British pound, German deutsche mark, Japanese yen (defined by the

currency one month deposit return compounded with variation of exchange rates). Reqwd is

the excess world equity index return. Rexwd is the G-10 trade weighted exchange index

return excess of risk free rate. Rmlag is the lagged term of reqwd. Rdef is the lagged

default premium defined as the difference of US Baa corporate bond returns and Aaa

corporate bond returns. Rtm1 is the lagged term premium defined by the difference between

ten year t-bill note return and three month t-bill return. Euro is the lagged one month

Eurodollar rate in excess of risk free rate. Rdeft is the default premium defined as the

difference between Baa corporate bond returns and Aaa corporate bond returns. Rtm2t is

the term premium defined as seven year Treasury bill return in excess of 3 month t-bill

rate. The ρi’s are autocorrelations lagged by i.

________________________________________________________

Nomber of Observations=202 (March 1982-December 1998)

_____________________________________________

Panel A: Excess Returns of Assets

variable

mean

0.0059705

0.0072959

0.0081282

0.0062159

Standard

deviation

0.04192

0.05537

0.06027

0.07055

requs

requk

reqgm

reqjp

ρ1

-.04665

-.05567

-.01547

0.07594

ρ2

-.00311

-.06790

0.04505

-.08691

ρ3

-.08244

-.04553

0.04073

0.06008

ρ4

-.14500

0.00292

0.08924

0.07157

ρ12

-.01722

-.08662

-.01936

0.01323

ρ24

0.12170

0.07093

0.01880

0.04844

rbdus

rbduk

rbdgm

rbdjp

0.0048974

0.0058049

0.0026792

0.0011409

0.02042

0.01904

0.01542

0.02375

0.39383*

0.28837*

0.35552*

0.14799*

0.01632

0.02746

0.06628

0.08736

0.01809

-.12576

0.06983

-.06910

0.01529

-.07233

0.01771

-.11418

-.07637

-.00114

-.02681

0.08223

0.02455

0.05091

-.09177

-.02379

rexuk

rexgm

rexjp

0.0035409

-0.0018599

-0.0047444

0.02729

0.02744

0.02944

0.32381*

0.30744*

0.33443*

-.05892

0.01475

0.02186

0.04698

0.07514

0.03880

0.01969

0.03425

-.04972

0.06728

0.06359

0.02298

-.02008

-.08093

-.02392

42

Panel B: Risk Factors

variable

mean

Standard

deviation

ρ1

ρ2

ρ3

ρ4

ρ12

ρ24

reqwd

0.0061388

0.04063

0.01196

-.03524

-.05235

-.04655

0.01047

0.14834

rexwd

-0.0057908

0.02239

0.31905*

0.00624

0.07467

0.01404

0.06217

-.07850

rtm2t

0.004897

0.02042

0.39383*

0.01632

0.01809

0.01529

-.07637

0.02455

rdeft

0.00097

0.00558

0.29563*

-.04098

0.04080

-.02898

-.04828

0.01577

Panel C: Instruments

variable

mean

rmlag

rtm1

rdef

euro

0.0004196

0.0048692

0.0010109

0.0004516

Standard

deviation

0.04118

0.02041

0.005566

0.000421

ρ1

0.02978

0.39876*

0.23704*

0.69591*

43

ρ2

-.03445

0.01401

-.06836

0.61132*

ρ3

-.03519

0.01424

-.10724

0.59173*

ρ4

-.02019

0.01284

-.01471

0.45857*

ρ12

0.00944

-.07751

-.10823

0.26146

ρ24

0.15097

0.02523

0.03125

0.22608

Table 2

Excess Returns Regressed on the Instruments

Regression: ri = a0 +a1*rmlag+a2*rdef+a3*rtm1+a3*euro

Where ri is an element of { requs requk reqgm reqjp rbdus

rbduk rbdgm rbdjp rexuk rexgm rexjp}

rmlag

rdef

rtm1

euro

Constant

Observations

R-squared

(1)

requs

-0.098

(1.32)

-0.108

(0.19)

0.426

(2.68)**

3.409

(0.48)

0.003

(0.56)

202

0.05

(2)

requk

-0.062

(0.62)

-0.373

(0.50)

0.349

(1.64)

-0.851

(0.09)

0.006

(1.07)

202

0.02

(3)

reqgm

-0.073

(0.68)

-1.304

(1.62)

0.438

(1.92)

-12.747

(1.26)

0.013

(2.05)*

202

0.05

(4)

reqjp

0.048

(0.39)

0.129

(0.14)

0.789

(2.98)**

5.891

(0.50)

-0.000

(0.06)

202

0.06

(5)

rbdus

-0.098

(2.94)**

-0.124

(0.49)

0.436

(6.14)**

1.697

(0.54)

0.002

(1.09)

202

0.20

Absolute value of t statistics in parentheses

* significant at 5%; ** significant at 1%

rmlag

rdef

rtm1

euro

Constant

Observations

R-squared

(7)

rbdgm

-0.045

(1.76)

-0.345

(1.77)

0.260

(4.73)**

-4.008

(1.63)

0.004

(2.32)*

202

0.15

(8)

rbdjp

-0.131

(3.19)**

0.329

(1.06)

0.304

(3.46)**

-7.828

(2.01)*

0.003

(1.19)

202

0.09

(9)

rexuk

0.011

(0.23)

0.498

(1.35)

-0.019

(0.18)

8.128

(1.75)

-0.001

(0.19)

202

0.02

(10)

rexgm

0.098

(2.01)*

0.232

(0.63)

-0.207

(1.99)*

4.451

(0.96)

-0.003

(1.07)

202

0.04

(11)

rexjp

-0.011

(0.22)

-0.270

(0.68)

-0.292

(2.61)**

5.585

(1.12)

-0.006

(1.78)

202

0.04

Absolute value of t statistics in parentheses

* significant at 5%; ** significant at 1%

44

(6)

rbduk

-0.043

(1.27)

-0.330

(1.29)

0.142

(1.96)

0.146

(0.05)

0.005

(2.67)**

202

0.04

Table 3

Correlation Coefficients of risk factors

Reqwd is the excess world equity index return. Rexwd is the G-10 trade weighted exchange

index return in excess of risk free rate. Rdeft is the default premium defined as the

difference between Baa corporate bond returns and Aaa corporate bond returns. Rtm2t is

the term premium defined as seven year Treasury bill return in excess of 3 month t-bill

rate.

reqwd

rexwd

rtm2t

rdeft

____________________________________________________________________

reqwd

1.00000

-0.21699

0.28674

-0.15635

rexwd

-0.21699

1.00000

-0.21343

0.22029

rtm2t

0.28674

-0.21343

1.00000

-0.33421

rdeft

-0.08536

0.08109

-0.33421

1.00000

________________________________________________________________________

Table 4

Regression of Each Single Asset on International Risk

Factors (Unconditional Model)

Regression: rit = β0 +βreqwd*reqwd+ βrexwd *rexwd

Where rit is the excess asset returns, and reqwd and rexwd are

international market risk factors.

reqwd

rexwd

Constant

R-squared

(1)

requs

0.848

(18.99)**

0.322

(3.97)**

0.003

(1.43)

0.64

(2)

requk

1.003

(15.98)**

-0.313

(2.75)**

-0.001

(0.26)

0.60

(3)

reqgm

0.819

(9.26)**

-0.178

(1.11)

0.002

(0.57)

0.33

(4)

reqjp

1.220

(14.36)**

-0.382

(2.48)*

-0.003

(1.00)

0.55

(5)

rbdus

0.132

(3.81)**

-0.116

(1.85)

0.003

(2.40)*

0.10

(6)

rbduk

0.146

(4.50)**

0.007

(0.12)

0.005

(3.73)**

0.10

Absolute value of t statistics in parentheses

* significant at 5%; ** significant at 1%

(7)

rbdgm

0.105

(3.95)**

0.009

(8)

rbdjp

0.100

(2.41)*

-0.134

(9)

rexuk

-0.020

(0.67)

0.942

(10)

rexgm

0.029

(2.68)**

1.207

(11)

rexjp

-0.109

(3.02)**

0.895

(0.19)

(1.78)

(16.99)**

(62.15)**

Const.

0.002

-0.000

0.009

0.005

(13.66)*

*

0.001

R-sqrd

(1.92)

0.07

(0.14)

0.05

(7.27)**

0.61

(11.27)**

0.95

(0.75)

0.53

reqwd

rexwd

Absolute value of t statistics in parentheses

* significant at 5%; ** significant at 1%

45

Table 5

OLS Regression of Each Asset on International Risk Factors

and Instrument Scaled Factors (Conditional)

Model: rit = β0 +βreqwd*reqwd+ βrexwd *rexwd + βrmlag*rmlag +βrdef *rdef

+βrtm1*rtm1 + βeuro*euro+βreqz1 *reqz1+βreqz2 *reqz2+βreqz3 *reqz3+βreqz4

*reqz4+βrexz1 *rexz1+βrexz2 *rexz2+βrexz3 *rexz3+βrexz4 *rexz4

Where

reqz1=reqwd*rmlag, reqz2=reqwd*rdef, reqz3=reqwd*rtm1, reqz4=reqwd*euro

rexz1=rexwd*rmlag, rexz2=rexwd*rdef, rexz3=rexwd*rtm1, rexz4=rexwd*euro

rit is the asset return from {requs, requk, reqgm reqjp rbdus rbduk

rbdgm rbdjp rexuk rexgm rexjp}t

reqwd

rexwd

rmlag

rdef

rtm1

euro

reqz1

reqz2

reqz3

reqz4

rexz1

rexz2

rexz3

rexz4

Constant(β0)

Observation

s

R-squared

(1)

requs

0.744

(10.73)**

0.217

(1.68)

-0.066

(1.25)

0.051

(0.15)

-0.005

(0.04)

0.333

(0.07)

0.842

(0.72)

-18.281

(1.53)

-4.199

(1.69)

239.320

(2.27)*

-0.332

(0.19)

13.105

(0.83)

-2.521

(0.50)

215.727

(1.08)

0.003

(0.90)

202

(2)

requk

0.943

(9.85)**

-0.068

(0.38)

-0.045

(0.62)

-0.171

(0.36)

-0.180

(1.18)

3.149

(0.51)

-0.485

(0.30)

18.524

(1.12)

-8.005

(2.33)*

123.169

(0.84)

-2.156

(0.88)

12.631

(0.58)

-9.494

(1.36)

-488.434

(1.77)

0.001

(0.22)

202

(3)

reqgm

0.896

(6.51)**

-0.060

(0.23)

-0.149

(1.43)

-1.162

(1.69)

0.146

(0.67)

-11.923

(1.34)

-1.793

(0.78)

29.715

(1.26)

-0.116

(0.02)

-228.710

(1.09)

-6.839

(1.94)

33.209

(1.06)

4.843

(0.48)

-359.477

(0.91)

0.010

(1.73)

202

(4)

reqjp

1.345

(10.16)**

-0.378

(1.54)

0.149

(1.48)

0.142

(0.22)

0.017

(0.08)

3.275

(0.38)

-0.005

(0.00)

22.592

(0.99)

11.602

(2.45)*

-290.958

(1.44)

1.750

(0.52)

-7.333

(0.24)

3.288

(0.34)

43.451

(0.11)

-0.007

(1.33)

202

(5)

rbdus

0.110

(2.18)*

-0.222

(2.37)*

-0.070

(1.84)

-0.132

(0.52)

0.357

(4.45)**

1.345

(0.41)

0.210

(0.25)

-5.695

(0.66)

1.395

(0.77)

-19.059

(0.25)

0.792

(0.61)

-8.506

(0.74)

2.754

(0.75)

274.664

(1.89)

0.001

(0.58)

202

(6)

rbduk

0.198

(3.91)**

0.000

(0.00)

-0.016

(0.42)

-0.391

(1.54)

0.096

(1.19)

0.335

(0.10)

0.803

(0.95)

-5.709

(0.66)

-0.782

(0.43)

-103.710

(1.35)

1.696

(1.31)

-11.555

(1.00)

2.582

(0.70)

17.790

(0.12)

0.005

(2.47)*

202

0.67

0.64

0.37

0.58

0.27

0.15

Absolute value of t statistics in parentheses

* significant at 5%; ** significant at 1%

46

reqwd

rexwd

rmlag

rdef

rtm1

euro

reqz1

reqz2

reqz3

reqz4

rexz1

rexz2

rexz3

rexz4

Constant

Observations

R-squared

(7)

rbdgm

0.086

(2.19)*

0.141

(1.94)

-0.035

(1.19)

-0.375

(1.92)

0.246

(3.95)**

-4.103

(1.63)

1.141

(1.74)

0.077

(0.01)

-1.265

(0.90)

-3.544

(0.06)

1.313

(1.31)

0.677

(0.08)

1.803

(0.63)

-232.546

(2.06)*

0.004

(2.48)*

202

0.23

(8)

rbdjp

0.068

(1.09)

-0.071

(0.61)

-0.114

(2.41)*

0.468

(1.49)

0.204

(2.04)*

-9.840

(2.44)*

-2.155

(2.05)*

-1.621

(0.15)

5.225

(2.33)*

-10.304

(0.11)

-0.555

(0.35)

1.982

(0.14)

1.758

(0.39)

-54.364

(0.30)

0.002

(0.89)

202

0.17

(9)

rexuk

-0.057

(1.21)

1.091

(12.47)**

-0.073

(2.04)*

0.385

(1.63)

0.205

(2.73)**

2.957

(0.97)

-0.115

(0.15)

-3.657

(0.45)

-0.870

(0.52)

20.615

(0.29)

-1.679

(1.39)

0.640

(0.06)

3.113

(0.91)