On Business Cycle Asymmetries in ‘G5’ Countries

advertisement

On Business Cycle Asymmetries in ‘G5’ Countries

Khurshid M. Kiani

Department of Economics, 302-D Waters Hall, Kansas State University

Manhattan Kansas, 66506-4001, USA

Tel: +1-785-532-4581; Fax: +1-785-532-6919; E-mail: mkkiani@ksu.edu

Prasad V. Bidarkota*

Department of Economics, 245 Waters Hall, Kansas State University

Manhattan Kansas, 66506-4001, USA

Tel: +1-785-532-4578; Fax: +1-785-532-6919; E-mail: pbidarko@ksu.edu

May 29, 2002

Word count: Main text – 4,658

*

Corresponding author.

Abstract

We investigate whether business cycle dynamics in five industrialized countries are

characterized by asymmetries in conditional mean. We provide evidence on this issue

using a variety of time series models. Our approach is fully parametric. Our testing

strategy is robust to any conditional heteroskedasticity, outliers, and / or long memory

that may be present.

Our results indicate fairly strong evidence of nonlinearities in the conditional mean

dynamics of the GDP growth rates for Canada, Japan, and the US. For France and the

UK, the conditional mean dynamics appear to be largely linear.

Our study shows that while the existence of conditional heteroskedasticity and long

memory does not have much affect on testing for linearity in the conditional mean,

accounting for outliers does reduce the evidence against linearity.

Key phrases: business cycles; asymmetries; nonlinearities; conditional

heteroskedasticity; long memory; outliers; real GDP; stable distributions

JEL codes:

B22, B23, C32, E32

2

1

Introduction

The possible existence of asymmetries in economic fluctuations is being tested

extensively using aggregate macroeconomic data. While studies such as Neftci (1984),

Brunner (1992, 1997), Beaudry and Koop (1993), Potter (1995), and Ramsey and

Rothman (1996) conclude that there are significant asymmetries, others (Falk (1986),

Sichel (1989), DeLong and Summers (1986), and Diebold and Rudebusch (1990)) have

either failed to confirm these findings or have found only weak evidence supporting

them.

Detecting any nonlinearities that may be present in business cycles is important for

several reasons. Nonlinearities imply that the effects of expansionary and contractionary

monetary policy shocks on output are not symmetric. Any nonlinearities would invalidate

measures of the persistence of monetary policy and other shocks on GNP that are based

on linear models, including those derived from vector autoregressions (VARs).

Nonlinearities would necessitate that in order to validate theories of business cycles, such

as the real business cycle (RBC) theories, one would need to go beyond merely matching

the first and second moments of data with the moments implied by the theories in

question.

Granger (1995) recommends testing for linearity using heteroskedasticity-robust tests.

French and Sichel (1993) and Brunner (1992, 1997) show the existence of conditional

heteroskedasticity in real GNP data. Scheinkman and LeBaron (1989) report a weakening

3

of evidence against linearity after accounting for conditional heteroskedasticity in this

series.

There is a growing perception that the evidence of nonlinearity reported in several studies

so far may be due to the presence of outliers. Tsay (1988) demonstrates that linearity

could be rejected by the presence of outliers. Blanchard and Watson (1986) demonstrate

the existence of outliers in GNP data. Balke and Fomby (1994) and Scheinkman and

LeBaron (1989) report weakened evidence against linearity in US real GNP data once

outliers are taken into account.

Several macroeconomic time series data have been characterized as fractionally

integrated processes in a number of studies (Sowell, 1992b). While investigating the

possible existence of asymmetries in economic fluctuations it is important to use time

series models that describe both the long and short run properties of the data accurately.

Most of the studies on business cycles test for asymmetries without taking into account

conditional heteroskedasticity, outliers, and / or long memory. An exception is Bidarkota

(2000). This study finds robust evidence of non-linearities in the conditional mean

dynamics of the chain-weighted quarterly US GNP growth rates.

The present study seeks to extend the analysis in Bidarkota (2000) to an examination of

several developed countries. There are compelling reasons why such an extension is a

worthwhile undertaking. For instance, it is of interest to know whether business cycles in

4

different countries are all alike. If they are, then this provides a serious challenge to

macroeconomic theorists to develop theories of business cycles that can explain

fluctuations in economic activity in different countries without relying on country

specific institutional features. Documenting business cycle characteristics in different

countries is a first step in this task.

Also, in understanding spillover and contagion effects in international business cycles,

macroeconometricians traditionally rely on linear vector autoregressions (VARs). These

are convenient, simple to work with, well understood, and widely used in the literature.

However, there are some new studies that attempt to build nonlinear multivariate models

for studying business cycle linkages across countries (Anderson and Vahid (1998),

Anderson and Ramsey (2002)). Since multivariate nonlinear modeling is complex, it is

important that we document compelling evidence against linearity in international data

first before venturing to build these more complicated models.

This study is organized as follows. Section 2 outlines the various empirical models that

are used in our investigations. Section 3 discusses some important issues related to the

estimation of the models. Section 4 provides details on the data sources and some useful

summary statistics on the raw data. Section 5 reports detailed empirical results on

specification search and parameter estimates. Statistical tests for asymmetries and other

hypotheses of interest are reported in detail in Section 6. Important conclusions that can

be drawn from the results in the study are summarized in Section 7.

5

2

Non-Linear Time Series Models

In this study we use three classes of models to detect the possible presence of

asymmetries in real output series for the countries under investigation. These are termed

CDR-Augmented, CDR-Switching, and SETAR-Switching models. Within each of these

three classes of models, we entertain four different versions of the models. Model 1

incorporates stable distributions, conditional heteroskedasticity, and fractional

differencing. Imposing no fractional differencing (i.e., only integer differencing) on

Model 1 yields Model 2. Imposing homoskedasticity on Model 2 gives Model 3. Finally,

restricting the errors in Model 3 to come from Gaussian distributions gives Model 4.

Model 1 is the most general and it nests all other Models 2 through 4.

Each of the three classes of models listed above is described in detail in the following

three sub-sections.

2.1

CDR Augmented Models

Beaudry and Koop (1993) estimated a standard autoregressive moving average (ARMA)

model, augmented with an ad hoc nonlinear term for capturing asymmetries. This

nonlinear term labeled the current depth of a recession measures the gap between the

current level of output and the economy’s historical maximum level.

Bidarkota (1999, 2000) extended this model by incorporating stable distributions,

conditional heteroskedasticity, and long memory. In this study here we use this model.

In this class of models the most general model (Model 1) can be described as follows:

6

Φ ( L)(1 − L)d ( ∆y t − µ ) = [ Ω( L) − 1]CDR t + ε t

ε t | I t − 1 ~ z tc t ,

(1a)

z t ~ i.i.d.Sα ( 0,1)

c αt = b1 + b2 c αt −1 + b3 | ε t −1 |α

(1b)

Here, ∆y t ≡ 100 * ∆(ln GDPt ) is the growth rate of GDP, its unconditional mean is µ, d is

the differencing parameter that takes on real values, Ω (.) and Φ (.) are polynomials of

orders r and p respectively in the lag operator L , with Ω (0) = Φ ( 0) = 1 . The term

CDR t is the current depth of recession that permits recessions to be less or more

persistent than expansions depending on the parameter estimates. It is defined as

CDR t = max{y t − j } j≥0 − y t .

A random variable X is said to have a symmetric stable distribution Sα (δ,c) if its log

characteristic function can be expressed as ln E exp( iXt ) = i δt − | ct | α . δ ∈ [−∞ , ∞ ] is the

location parameter that shifts the distribution either to the left or the right along the real

line, c ∈ [0, ∞ ] is the scale parameter that expands or contracts the distribution about δ ,

and α ∈ [0,2] is the characteristic exponent governing tail behavior. Smaller values of

this exponent indicate thicker tails. When α = 2 we obtain the normal distribution.

Equation 1b shows the evolution of the scales of the conditional distribution. When we

set α to 2 in the model, we obtain a normal GARCH (1,1) process for the conditional

variance in the volatility specification. Our Model 1b is analogous to the power ARCH

model introduced by Ding, Granger, and Engle (1993), with the exception that in the

7

latter specification the distribution of z t does not depend on the characteristic exponent

α. Dependence on α emerges here naturally because we are allowing for disturbances to

be drawn from the stable family. Liu and Brorsen (1995) also modeled volatility of the

daily foreign currency returns using stable errors. Similarly, McCulloch (1985) fitted a

GARCH-stable model to bond returns using absolute values instead of α powers.

When d = 0 we get a unit root in y t , but with d = −1 we end up with y t being integrated

of order zero I (0). ARFIMA models with long memory are defined in terms of the rate of

decay of their autocovariances, so the extension of these models to infinite variance

stable shocks is not immediate. Kokoszka and Taqqu (1995) contributed significantly to

the theory of fractionally differenced ARMA models with infinite-variance stable

innovations.

According to Brockwell and Davis (1991), a stationary casual and invertible solution to

an ARFIMA model with Gaussian errors requires that | d |< 0.5 . Kokoszka and Taqqu

(1995) showed that the existence of a unique casual MA (∞) representation to an

ARFIMA model with stable shocks requires α (d − 1) < −1 . This implies then that d be

positive when α > 1 . Moreover, for the ARFIMA model to be a solution to an AR (∞)

process requires that α > 1 and | d |< (1 − 1 / α) . In order to force our estimated models to

possess casual and invertible representations, we restrict α and d in Equation 1 to satisfy

these constraints.

8

Although we have an ad hoc non-linear CDR t term within an otherwise standard AR

framework with fractional differencing, this model is simple and parsimonious. When

Ω (L) = 1 , Equation 1a reduces to an autoregressive (AR) model with non-integer

differencing. Since it nests AR models, we can use the standard t-statistic or the

likelihood ratio (LR) statistic to test the statistical significance of the non-linear term

governing the conditional mean dynamics.1 With Ω (L) ≡ 1 + ω1L + ω2 L2 + ... + ωr Lr , when

the autoregressive lag order p is 0 and r is 1, ω1 = 0 yields a random walk with drift.

However, a positive ω1 implies that negative shocks are less persistent whereas a

negative ω1 implies that positive shocks are less persistent.

The existence of asymmetries essentially means that either the innovations are

asymmetric but the impulse transmission mechanism is linear, or that the innovations are

symmetric but the impulse transmission mechanism is nonlinear, or that the innovations

are asymmetric and the impulse transmission mechanism is nonlinear. However, it would

be hard to disentangle the asymmetric innovations from the nonlinear propagation

mechanism, if they both exist in a data series.

Although asymmetric α -stable distributions exist and are well defined, to determine

whether asymmetries in the conditional mean dynamics of the real GDP growth rates are

1

However, the asymptotic distribution of the t-test for the significance of the non-linear

CDR t term in the model given by Equation (1a) is non standard (Hess and Iwata, 1997),

both when the dependent variable is non-stationary [i.e. integrated of order one I(1)], and

when it is stationary [I(0)].

9

caused by asymmetric impulses being propagated linearly or symmetric impulses being

propagated nonlinearly or asymmetric impulses being propagated nonlinearly is beyond

the scope of this study. Here, we are merely investigating whether asymmetries exist in

the conditional mean regardless of how they can best be characterized.

2.2

CDR-Switching Models

Autoregressive models with time varying parameters (Tucci, 1995), threshold

autoregressive models (TAR), regime-switching models (Hamilton, 1989), and many

other nonlinear models have been used to capture asymmetries. TAR models (Tong and

Lim, 1980) are piecewise linear autoregressions. They are not only capable of

approximating a general nonlinear time series model of the form y t = f ( y t −1 ) + ε t and

capturing jump phenomenon, but they also admit limit cycles. Tsay (1988) introduces a

procedure for building and testing TAR models.

Beaudry and Koop (1993) also estimated a switching autoregressive moving average

model with the switch governed by a restriction defined in term of the current depth of

recession CDR t . In this section we use this switching model as modified by Bidarkota

(2000).

The most general model estimated within this class of models is as follows:

In Regime 1:

(1− φ1L − φ2L2 )(1− L)d (∆yt − µ1) = εt

(2a)

10

ε t | I t − 1 ~ z tc t ,

z t ~ i.i.d.Sα ( 0,1)

c αt = b1 + b2 c αt −1 + b3 | ε t −1 |α

(2b)

In Regime 2:

(1 − φ3L − φ4L2 )(1 − L)d (∆yt − µ2 ) = εt

ε t | I t−1 ~ z t γc t ,

(2c)

z t ~ i.i.d.Sα ( 0,1)

c αt = b1 + b 2ctα−1 + b3 | ε t−1 / γ |α

(2d)

When CDR t −1 = 0 , we get regime 1 and when CDR t −1 > 0 we obtain regime 2. The

unconditional mean of the process and the AR coefficients in the two regimes are

different. The parameter γ in regime 2 shows that the model has different scales in the

two regimes as well.

2.3

SETAR-Switching Models

This is identical to the CDR-Switching model, except for what governs switching

between the regimes. When a switch is governed by restrictions that are defined in terms

of the observed series y t , these models are called self-exciting threshold autoregressive

(SETAR) models. Potter (1995) estimated this type of model with a single restriction for

the log real GNP. The restriction is defined in terms of whether, ∆y t− d > r , where yt is

log real GNP, d is the delay and r is the threshold parameter.

11

The most general model estimated within this class of models is as follows:

In Regime 1:

(1− φ1L − φ2L2 )(1− L)d (∆yt − µ1) = εt

ε t | I t −1 ~ zt ct

z ~ iid

(3a)

Sα (0,1)

c αt = b1 + b2 c αt −1 + b3 | ε t −1 |α

(3b)

In Regime 2:

(1 − φ3L − φ4L2 )(1 − L)d (∆yt − µ2 ) = εt

ε t | It −1 ~ zt γct

z ~ iid

(3c)

Sα (0,1)

c αt = b1 + b 2ctα−1 + b3 | ε t−1 / γ |α

(3d)

When ∆y t −2 > 0 , we get regime 1 and when ∆y t −2 ≤ 0 , we get regime 2.

3

Estimation Issues

As mentioned earlier, Beaudry and Koop (1993) simply included an additive nonlinear

term in a standard autoregressive moving average (ARMA) model to capture

asymmetries in business cycles with the assumption that the shocks are normally

distributed. Although addition of a nonlinear term in a standard autoregressive moving

average framework is ad hoc, it does not impose any estimation problems. Bidarkota

12

(1999, 2000) used this model without any moving average terms but with errors having a

more general stable distribution, conditional heteroskedasticity, and long memory.

As in Bidarkota (1999, 2000), we do not consider any moving average (MA) terms in the

specification of the model. Maximum likelihood estimation of mixed ARMA models

with stable errors poses a challenge, although the Whittle estimator (Mikosch et al, 1995)

and minimum dispersion estimators (Brockwell and Davis, 1991) have been used in this

context.

We restrict ourselves to symmetric stable distributions here for a technical reason. We

use the computational algorithm due to McCulloch (1996) to obtain stable densities for

maximum likelihood estimation of our models. This algorithm works only when errors

are symmetric. However, Nolan (undated) has developed computational routines for

maximum likelihood estimation of models with stable distributions.

For the estimation of ARFIMA models the exact full information maximum likelihood

(ML) method of Sowell (1992a) may be adopted if the errors are iid normal. But for the

more complicated non-normal conditionally heteroskedastic models here, we use the

conditional sum of squares (CSS) estimator.

Baillie et al (1996) also used the conditional sum of squares (CSS) method, originally

proposed in the context of AFRIMA models by Hosking (1984), to estimate their

ARFIMA-GARCH models, with normal and Student-t errors. The CSS procedure is

equivalent to the full information MLE asymptotically. Baillie et al (1996) discussed

13

some properties of the CSS estimator in the context of ARFIMA models, particularly

with respect to its bias. They noted that not only does the CSS estimator do well when

they compared with it Sowell’s (1992a) exact MLE but also that it is computationally

feasible for more complex models.

Essentially we fit an ARMA model to the series (1 − L) d ( ∆y t − µ) that is obtained by

expanding the differencing operator (1 − L)d with the binomial expansion, and truncating

the infinite series at the first available observation. The CSS estimator is discussed for

ARMA models in Box and Jenkins (1976).

4

Preliminary Data Analysis

4.1

Data Sources

We obtained quarterly GDP data from the International Financial Statistics (IFS) CDROM (September 2001) for Canada, France, Japan, the United Kingdom (UK), and the

United States of America (USA).2 The dataset spans the period from 1957:1 to 2000:4 for

all countries except France for which the data begins in 1970:1. Table 1.1 provides

2

Initially, we tried working with all the G7 countries that include, in addition to the

above five countries, Germany and Italy. However, Germany poses a unique problem on

account of its reunification. It’s GDP increased by 35.43 percent in 1991:1. Data for Italy

showed an inexplicable spike of 87.5 percent annualized quarterly growth rate in 1970:1.

Consequently we decided to exclude these two countries from our analysis.

14

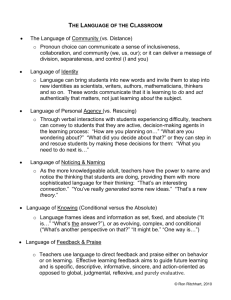

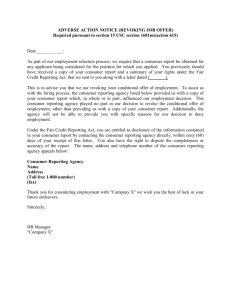

further details on the dataset used for each country. Figure 1 plots the logarithmic GDP

series and Figure 2 plots the annualized quarterly growth rates.

4.2

Summary Statistics

Table 1.2 provides some useful statistics on the raw data and Table 1.3 summarizes

preliminary statistical inferences for some interesting hypotheses. The average annualized

quarterly GDP growth rates range from 2.44 to 8.84 percent, with the average growth

rates for all countries being significantly positive. UK has the lowest and Japan has the

highest growth rate. The quarterly (annualized) standard deviations range from 2.40 for

France to 7.80 for Japan.

Skewness measures range from –0.54 for France to 0.64 for Japan, being statistically

significant for all countries except Canada. Excess kurtosis measures range from 0.14 for

Canada to 2.85 for the UK, with significant fat tails found in UK, US, and Japan

(marginal). The Jarque-Bera test rejects normality for all countries except Canada. These

preliminary results are subject to some qualification because the tests are based on the

assumption that the growth rates are iid. As will be evident later, this assumption is not

appropriate.

The Augmented Dicky Fuller (ADF) test indicates unit roots in levels (with constant and

time trend) for all countries but not in growth rates (with constant only). The only

15

exception is Japan for which the test fails to reject unit roots in growth rates with a

constant term only but does reject with constant and time trend.

Goldfeld-Quandt test fails to reject homoskedasticity in all countries and the Lagrange

Multiplier (LM) test detects autoregressive conditional heteroskedasticity (ARCH) only

in Japan.

5

Empirical Results

5.1

Specification Search

An extensive specification search for each country was conducted for the four versions

(Model 1 through Model 4) of each of the three classes of models described in section 2.

For the CDR-Augmented class of models, the specification search was done over all

parameterizations with lag orders for the autoregressive and CDR t terms of three or less

for parsimony. For the two classes of switching models, namely the CDR-Switching and

SETAR-Switching models, the search was done with the autoregressive lag polynomials

in the two regimes restricted to be of orders (3,3), (2,2), (1,1), or (0,0).

The best parameterizations for each version within each class of models are selected for

each country by the minimum Schwarz Bayesian criterion. The chosen parameterizations

are reported in Tables 2.1, 2.2, and 2.3 for CDR-Augmented, CDR-Switching, and

SETAR-Switching models, respectively. The table also reports the number of parameters

16

in the models, the maximized log-likelihood values, and the values of the Akaike

information (AIC) and Schwarz Bayesian (SBC) criteria, respectively.

Since the AIC is well known to yield relatively over parameterized specifications of

models in general, we choose the versions selected by the minimum SBC criterion in

what follows. These selected versions of the models are reported in Table 2.4.

5.2

Parameter Estimates

Tables 3.1, 3.2, and 3.3 contain parameter estimates for the best parameterizations of the

most general versions (Model 1) within each of the three classes of models, namely, the

CDR-Augmented, CDR-Switching, and SETAR-Switching models. The estimates are

presented for all countries analyzed in this study.

In Table 3.1 the estimates of the unconditional mean µ range from –0.028 percent per

quarter for Japan to 0.905 percent per quarter for Canada. The value of the characteristic

exponent α ranges from virtually 2 for Canada and Japan to a low of 1.734 for the UK.

This is understandable given that fat tails were found in Table 1.2 to be most prominent

in the UK and absent in Canada. The volatility persistence parameter b 2 is estimated to

be between 0.827 for the US to 0.936 for Canada. The ARCH parameter b 3 takes values

from 0.026 for Canada to 0.055 for the UK. The sum of the GARCH parameter estimates

b 2 + b 3 takes values of 0.962 for Canada to a low of 0.877 for the US. The fractional

17

differencing parameter d is estimated to be between -0.464 for the US and 0.499 for

Japan.

The estimates of the autoregressive (AR) parameters range from 0.784 for the US to a

low of –0.389 for Japan. The best models selected within this class of models for Canada

and the UK have no AR terms.

In Table 3.2, the parameter estimates of the unconditional mean in regime 1 µ1 are close

to the values of µ reported in Table 3.1 for the CDR-Augmented model, except for

Japan. The estimates of the unconditional mean in regime 2 µ 2 vary between –2.65 for

Japan to 2.76 for the US. For all countries, excepting Japan, regime 1 is associated with

lower mean growth rates than regime 2. For Japan, this is reversed. The estimates of the

characteristic exponent α are very similar to those reported in Table 3.1. The estimates

of the volatility persistence parameter b 2 are uniformly higher and the estimates of the

ARCH parameter b 3 are uniformly lower in this case than the values of the

corresponding parameters reported earlier in Table 3.1.

For all countries excepting Japan, the scale ratio γ in regime 2 is estimated to be

between 0.914 (for the US) and 0.961 (for France). For Japan, this parameter is estimated

to be 1.08. Given that for all countries (excepting Japan) regime 1 is associated with

lower growth rates, this means that for all countries including Japan lower mean GDP

growth rate regimes are associated with relatively higher volatility.

18

Only Japan has AR terms (of first order only) appearing in the best parameterization

within this class of models. The estimates of the AR parameters in both regimes are

negative.

For the SETAR switching model estimates reported in Table 3.3, no single regime is

necessarily associated uniformly across all countries with lower growth rates.

Furthermore, the parameter estimates also suggest that low mean growth rate regimes are

no longer necessarily associated with relatively higher volatility. All other parameter

estimates, however, are generally similar to the values reported earlier for the CDRAugmented and CDR-Switching models.

6

Hypotheses Tests

We performed four types of hypotheses tests on the estimated models. The first is a test

for normality. The second is a test for homoskedasticity. The third tests for the possible

presence of long memory. The last is a test for linearity in the conditional mean. The

following sub-section describes the various tests and sub-section 6.2 provides empirical

results on the hypotheses tests.

6.1 Description of Various Tests

6.1.1

Test for Normality

19

We performed a normality test based on the value of α . If α equals 2, normality results.

If the value of a is less than 2, then the model is non-normal stable. This test compares

the likelihood ratio (LR) statistic for two models with identical parameterizations.

Since the null hypothesis for this test lies on the boundary of admissible values for α , the

LR test statistic does not have the usual χ 2 distribution asymptotically. Therefore, the

test here is based on small sample critical values generated by Monte Carlo simulations

reported in McCulloch (1997, Table 4, panel b).

6.1.2

Test for Homoskedasticity

The second test is a test for homoskedasticity. Under the null of homoskedasticity, the

GARCH parameters b 2 = b 3 = 0 . The test is based on the likelihood ratio test statistic.

Since b1 and c0 end up being trivial transformations of one another under the null

hypothesis, it is not clear whether the LR test statistic asymptotically has 2 or 3 degrees

of freedom. We base our statistical inference on critical values derived conservatively

from the χ32 distribution.

6.1.3

Test for Long Memory

The null hypothesis is d = 0 implying that the logarithm of GDP has a unit root. The

alternative of d ≠ 0 implies that the logarithm of GDP is described as a fractionally

differenced series. Depending on the estimates of d that are obtained, the logarithm of

GDP could be a stationary or a non-stationary series, with or without long memory. See

Baillie (1996) for an extensive survey on fractionally differenced processes. The test is

20

once again based on the likelihood ratio. Model 1 is the unrestricted model and Model 2

is the restricted model with d restricted to zero. The test statistic is distributed as the χ12

since we have only one restriction here.

6.1.4

Test for Linearity in Conditional Mean

The last is a test for linearity in the conditional mean. While the three tests above are

performed alternatively using the various versions within all the three classes of models,

the test for linearity in the conditional mean is done using different versions of the

models within only the two classes of switching models. This is because the minimum

SBC criterion ends up selecting among the four different versions of the CDRAugmented class of models a version and a parameterization that does not include the

additive CDR term for any of the countries except France (see Tables 2.4 and 2.1).

Footnote 1 reports some added difficulty in testing for the significance of the CDR term

with a standard t-test or an LR test.

Depending on the versions of the two classes of switching models used, we end up testing

for linearity successively using homoskedastic Gaussian models, homoskedastic stable

models, GARCH stable models, and long memory GARCH stable models. Under the null

hypothesis of linearity in conditional mean, the unconditional means in the two regimes

µ 1 and µ2 are equal, the scale ratio γ is equal to one, and the corresponding

autoregressive coefficients in the two regimes, if present in the specific parameterizations

of the model versions used in the test, are equal. If the null hypothesis is not rejected then

21

we only have one regime (linear conditional mean dynamics). If not, then we have two

distinct regimes describing the GDP growth rates.

6.2 Empirical Results on Hypotheses Tests

Hypotheses tests for normality, homoskedasticity, long memory, and linearity in

conditional mean were performed as elaborated in the earlier sub-section. The empirical

results of the various hypotheses tests listed above are reported in Tables 4.1, 4.2, and

4.3, respectively, for the CDR-Augmented, CDR-Switching and SETAR Switching

models. All tests are based on the likelihood ratio (LR) test statistic. For each of the three

tables, a different test is reported in the various rows of the first column. For each such

test, the numbers in the five rows in the other columns for that test are the LR test

statistics for the five countries arranged alphabetically in ascending order. P-values are

reported in parentheses. All statistical inferences are drawn at the five percent

significance level.

6.2.1

Results on Normality

The test for normality easily rejects for the UK and the US. The evidence is somewhat

weaker for France and Japan. For Canada, however, the test fails to reject normality

overwhelmingly. The test results are largely unchanged when we account for conditional

heteroskedasticity and long memory.

6.2.2

Results on Homoskedasticity

22

From the three tables, it is clear that when we test for homoskedasticity using Model 2,

all countries except France show strong evidence against homoskedasticity. France

strongly fails to reject homoskedasticity. The statistical inferences remain unchanged

when we go from 5 to 10 percent significance level. Also, there are no changes in the

inferences when we do the tests after accounting for long memory with Model 1.

6.2.3

Results on Long Memory

The test for d = 0 strongly rejects in all countries with all three classes of models except

for the UK with SETAR Switching models. The statistical inferences are the same at the

5 and 10 percent significance level. However, it is important to note that Sowell’s

(1992b) Monte Carlo simulations suggest that the true small sample p-values may be

higher than the asymptotic χ12 p-values. Typically, GDP data tend to be largely

uninformative about the nature of their long run properties and it is generally hard to rule

out trend stationarity, unit roots, as well as fractional differencing from these data series.

6.2.4

Results on Linearity in Conditional Mean

Canada, Japan, and the US show fairly strong evidence against linearity in the conditional

mean dynamics of the GDP growth rates. Accounting for conditional heteroskedasticity

and long memory seems to be relatively unimportant when testing for linearity. However,

accounting for outliers decreases the evidence against linearity. Statistical inferences are

not affected much when we change the significance level of the test from 10 to 5 percent.

6.3 Discussion of Results on Hypotheses Tests

23

Our results on nonlinearity in the conditional mean for the US are in line with Bidarkota

(2000). This shows that the evidence against linearity in mean for the US is robust to

changes in the sample period.

Koop and Potter (2001) investigate whether nonlinearities could arise from structural

instability. Blanchard and Simon (2001) show a slowdown in the variance of US

economic activity suggesting a possible structural change in the early 1980s. We do not

account for this possibility in this study.

Diebold and Inoue (2001) demonstrate that spurious evidence of long memory may be

found in a series that undergoes occasional structural change. This is analogous to the

spurious evidence of unit roots in a series with occasional breaks (Perron, 1989). Our

results on long memory are subject to this caveat.

7

Conclusions

We used three classes of models, namely, the CDR-Augmented models, CDR-Switching

models, and SETAR-Switching models for testing asymmetries in the conditional mean

dynamics of GDP data in five industrialized countries. Our approach is fully parametric.

Our time series models account for the possibility of conditional heteroskedasticity,

outliers, and long memory in the data series.

24

Our results indicate fairly strong evidence of nonlinearities in the conditional mean

dynamics of the GDP growth rates for Canada, Japan, and the US. For France and the

UK, the conditional mean dynamics seem to be largely linear.

Our study shows that the Switching models capture non-linearity better than the CDRAugmented models. Accounting for conditional heteroskedasticity and long memory is

relatively unimportant when testing for linearity. However, accounting for outliers

decreases the evidence against linearity.

Our results also indicate that the GDP series for all countries excepting France reject

homoskedasticity. Long memory appears to be pervasive. While normality is strongly

rejected for the US and the UK, the evidence is somewhat weaker for France and Japan,

and overwhelmingly in favor of normality for Canada.

25

Table 1.1: Data Description

Canada

France

Japan

UK

USA

Quarterly

Real GDP

Quarterly

Real GDP

Quarterly

Nominal GDP

Quarterly

Real GDP

Quarterly

Real GDP

Sample Period

1957:12000:4

1970:12000:4

1957:12000:4

1957:12000:4

1957:12000:4

Sample Length

176

124

176

176

176

Data Series

Notes on Table 1.1

1. We obtained the quarterly seasonally adjusted GDP data for all countries from the

September 2001 edition of the International Financial Statistics (IFS) CD-ROM.

2. We used nominal GDP for Japan because seasonally adjusted data was only available

for the nominal series and not for the real series on the IFS CD-ROM.

26

Table 1.2: Summary Statistics

Canada

France

Japan

UK

USA

0.91

0.63

2.21

0.61

0.83

(p-value for mean = 0)

(0.00)

(0.00)

(0.00)

(0.00)

(0.00)

Standard Deviation

0.97

0.60

1.95

1.05

0.95

Skewness

0.17

-0.54

0.64

0.36

-0.44

(0.49)

(0.01)

(0.00)

(0.03)

(0.01)

0.14

0.48

0.57

2.85

1.26

(0.32)

(0.14)

(0.06)

(0.00)

(0.00)

0.21

7.16

14.15

62.8

17.16

(0.89)

(0.03)

(0.00)

(0.00)

(0.00)

Levels (constant + trend)

-2.24

-2.25

-1.83

-1.39

0.14

First Differences (constant only)

-4.59

-3.99

-1.80

-4.64

-4.83

Orders of Significant

Autocorrelations (at 5% level)

Orders of Significant

Partial Autocorrelations

(at 5% level)

Goldfeld-Quandt Test

1-3

1,2

3

1,2

1,11

1,2

3,8,16,31

1,2

24.81

20.1

36.21

14.72

13.67

(p-value for homoskedasticity)

(1.00)

(1.00)

(0.99)

(1.00)

(1.00)

0.01

0.00

24.51

0.01

0.03

(0.91)

(0.95)

(0.00)

(0.91)

(0.85)

Mean

(p-value for skewness = 0)

Excess Kurtosis

(p-value for excess kurtosis = 0)

Jarque-Bera Test

(p-value for normality)

ADF Test for Unit Roots

LM Test for ARCH

(p-value for no ARCH effects)

1-10, 12,

13, 16

1-5,8,9

27

Notes on Table 1.2

1.

All statistics reported are for quarterly growth rates defined as 100∆ log y t ,

except the ADF test in levels for which the test statistics are for log levels

log y t .

2.

P-values for statistics pertaining to skewness, excess kurtosis, Jarque-Bera,

Goldfeld-Quandt, and the LM test for ARCH are reported in parentheses

below the test statistics.

3.

Optimal lag order for the ADF tests is chosen using the minimum SBC

criterion. Asymptotic critical values at the 10% significance level for the

model with constant, and with constant and time trend, are -2.57 and -3.13,

respectively.

4.

Optimal lag order for the LM test is chosen using the minimum SBC criterion.

28

Table 1.3: Summary of Statistical Inferences

Canada

France

Japan

UK

USA

Nonzero Mean

Y

Y

Y

Y

Y

Skewness

N

N

Y

Y

N

Fat Tails

N

N

N

Y

Y

Non-Normality

N

Y

Y

Y

Y

Levels (constant +

trend)

First Differences

(constant only)

Y

Y

Y

Y

Y

N

N

Y

N

N

Homoskedasticity

Y

Y

Y

Y

Y

ARCH Effects

N

N

Y

N

N

Unit Roots

29

Notes on Table 1.3

1.

Y indicates presence of, and N indicates absence of, the characteristic listed in

the first column of the corresponding row. For example, N for USA in the second

row indicates absence of skewness. These inferences are based on the statistics

and p-values reported in Table 1.2.

3.

All statistical inferences are done assuming a 5 percent level of significance.

30

TABLE 2.1: Specification Search - CDR-Augmented Models

Model 4

Model 3

Model 2

Model 1

(1,0)

(2,1)

(3,0)

(0,0)

(1,0)

(1,0)

(2,1)

(3,0)

(0,0)

(1,1)

(1,0)

(2,1)

(3,0)

(1,0)

(1,0)

(0,0)

(2,0)

(1,0)

(0,0)

(1,0)

3

5

5

2

3

4

6

6

3

5

7

9

9

7

7

7

9

8

7

8

Log likelihood

-231.10

-106.31

-308.26

-252.12

-224.23

-231.07

-105.28

-301.97

-240.44

-218.70

-219.01

-105.28

-281.87

-219.84

-209.63

-219.30

-107.27

-282.45

-219.73

-207.33

AIC

468.21

222.62

626.52

508.24

454.46

470.14

222.57

615.93

486.87

447.39

452.01

228.56

581.74

453.68

433.26

452.60

232.55

580.90

453.45

430.66

SBC

477.65

236.52

642.23

514.54

463.90

482.73

239.24

634.78

496.32

463.13

474.04

253.65

610.02

475.71

455.29

474.63

257.63

606.04

475.48

455.84

Model

parameterization

selected by minimum

SBC criterion

Number of parameters

31

Notes on Table 2.1

1. For each item listed in the first column, the five rows in the subsequent columns

for that item denote the corresponding statistics for the five countries Canada,

France, Japan, UK, and USA in that order.

2. The most general model is Model 1. We get Model 2 by imposing d = 0 .

Imposing homoskedasticity on Model 2, we get Model 3. Setting α = 2 in Model

3 yields Model 4.

32

TABLE 2.2: Specification Search – CDR-Switching Models

Model 4

Model 3

Model 2

Model 1

(1,1)

(2,2)

(2,2)

(0,0)

(1,1)

(1,1)

(1,1)

(3,3)

(0,0)

(1,1)

(1,1)

(1,1)

(3,3)

(0,0)

(1,1)

(0,0)

(0,0)

(1,1)

(0,0)

(0,0)

6

8

8

4

6

7

7

11

5

7

10

10

14

8

10

9

9

11

9

9

Log likelihood

-227.18

-108.92

-306.92

-249.50

-213.74

-226.95

-112.54

-295.19

-238.63

-210.32

-211.11

-112.30

-269.70

-218.04

-202.42

-212.22

-108.83

-274.89

-216.05

-201.03

AIC

466.35

233.85

629.83

507.00

439.48

467.90

239.07

612.38

487.26

434.64

442.21

244.61

567.4

452.08

424.84

442.44

235.67

571.79

450.09

420.06

SBC

485.20

256.08

654.92

519.57

458.33

489.89

258.53

646.87

502.97

456.63

473.63

272.40

611.30

477.21

456.25

470.72

260.68

606.28

478.37

448.34

Model

parameterization

selected by minimum

SBC criterion

Number of parameters

Notes on Table 2.2

1. As in Table 2.1.

33

TABLE 2.3: Specification Search – SETAR-Switching Models

Model 4

Model 3

Model 2

Model 1

(0,0)

(2,2)

(3,3)

(3,3)

(1,1)

(0,0)

(1,1)

(3,3)

(2,2)

(0,0)

(0,0)

(1,1)

(3,3)

(0,0)

--

(0,0)

(0,0)

(1,1)

(0,0)

(1,1)

4

8

10

10

6

5

7

11

9

5

8

10

14

8

--

9

9

11

9

11

Log likelihood

-231.08

-107.20

-303.93

-243.15

-214.09

-231.08

-110.97

-297.60

-235.93

-219.47

-228.60

-110.86

-273.23

-217.57

--

-217.49

-109.46

-275.13

-216.37

-199.64

AIC

470.17

230.38

627.86

506.30

440.19

472.17

235.95

617.20

489.85

448.94

473.20

241.71

574.45

451.14

--

452.98

236.92

572.27

450.75

421.28

SBC

482.20

252.62

659.22

537.71

459.04

487.88

255.40

651.69

518.12

464.65

498.33

269.51

618.35

476.27

--

481.25

261.93

606.76

479.02

455.83

Model

Parameterization

selected by minimum

SBC criterion

Number of parameters

Notes on Table 2.3

1. As in Table 2.1.

2. The symbol “--“ denotes missing numbers because the numerical algorithm for

maximization of the log likelihood function failed to converge.

34

TABLE 2.4: Model Selection

Canada

France

Japan

UK

USA

Minimum AIC

M2

M3

M1

M1

M1

Minimum SBC

M2

M4

M1

M1

M2

Minimum AIC

M1

M4

M2

M1

M1

Minimum SBC

M1

M4

M1

M2

M1

Minimum AIC

M1

M3

M2

M1

M1

Minimum SBC

M1

M4

M1

M2

M1

CDR-Augmented

CDR-Switching

SETAR-Switching

35

Notes on Table 2.4

1. For each country and within each class of models, the best versions among all

Models 1 through 4 (M1 to M4) are selected and reported in the table.

2. Model selection is done alternatively by two different criteria – the minimum

Akaike information criterion (AIC) and the Schwarz Bayesian criterion (SBC).

3. AIC = T ln( RSS) + 2n , where n in the number of estimated parameters and T is

the number of usable observations.

4. SBC = T ln( RSS ) + n ln( T) , where n in the number of estimated parameters and T

is the number of usable observations.

36

Table 3.1: Parameter Estimates - CDR-Augmented Models

Canada

(0,0)

France

(2,0)

Japan

(1,0)

UK

(0,0)

USA

(1,0)

0.905

(0.253)

0.652

(0.092)

-0.028

(1.029)

0.675

(0.099)

0.825

(0.028)

d

0.266

(0.058)

-0.379

(0.233)

0.499

(0.000)

0.145

(0.064)

-0.464

(0.209)

α

1.999

(0.000)

1.931

(0.074)

1.999

(0.000)

1.734

(0.109)

1.867

(0.095)

c0

1.016

(0.200)

0.319

(0.218)

2.313

(0.879)

1.102

(0.427)

1.252

(0.594)

b1

0.000

(0.000)

0.010

(0.017)

0.018

(0.009)

0.002

(0.004)

0.017

(0.015)

b2

0.936

(0.039)

0.856

(0.171)

0.889

(0.031)

0.861

(0.049)

0.827

(0.084)

b3

0.026

(0.020)

0.041

(0.051)

0.038

(0.017)

0.055

(0.024)

0.050

(0.029)

φ1

0.614

(0.236)

-0.389

0.063

φ2

0.285

(0.149)

-107.20

-282.15

Model

Parameterization

µ

Log Likelihood

-219.30

0.784

(0.163)

-219.93

-207.33

37

Notes on Table 3.1

1.

Parameter estimates are reported for the best model specification for version 1

within the class of CDR-Augmented models as determined by the minimum SBC

criterion.

2.

The most general CDR-Augmented model (Model 1) can be written as:

Φ ( L)(1 − L)d (∆y t − µ ) = [Ω ( L) − 1]CDR t + ε t

(1a)

ε t | I t−1 ~ z t c t , z t ~ i.i.d.Sα ( 0,1)

c αt = b1 + b2 c αt −1 + b3 | ε t −1 |α

(1b)

38

Table 3.2: Parameter Estimates - CDR-Switching Models

Canada

(0,0)

France

(0,0)

Japan

(1,1)

UK

(0,0)

USA

(0,0)

µ1

0.906

(0.280)

0.560

(0.255)

0.299

(1.072)

0.721

(0.130)

0.702

(0.314)

µ2

1.631

(0.746)

1.205

(0.599)

-2.653

(3.424)

0.830

(0.259)

2.760

(0.977)

d

0.279

(0.062)

0.281

(0.088)

0.499

(0.000)

0.157

(0.069)

0.292

(0.070)

α

1.999

(0.000)

1.941

(0.141)

1.999

(0.000)

1.781

(0.126)

1.908

(0.089)

c0

0.914

(0.103)

0.473

0.140

2.020

(0.461)

1.178

(0.402)

0.996

(0.337)

b1

0.000

(0.000)

2.1e-11

(0.000)

0.007

(0.005)

4.6e-9

(0.004)

1.4e-7

(0.006)

b2

1.014

(0.010)

1.014

(0.044)

0.965

(0.009)

0.930

(0.055)

0.963

(0.047)

b3

0.000

(0.000)

1.03e-11

(0.022)

0.000

(0.000)

0.049

(0.025)

0.032

(0.019)

Model

Parameterization

φ1

-0.355

(0.070)

-0.703

(0.209)

φ3

γ

Log Likelihood

0.943

(0.020)

0.961

(0.060)

1.080

(0.039)

0.938

(0.029)

0.914

(0.043)

-212.22

-108.83

-274.89

-216.04

-201.03

39

Notes on Table 3.2

1.

Parameter estimates are reported for the best model specification for version 1

within the class of CDR-Switching models as determined by the minimum SBC

criterion.

2

The most general CDR-Switching model (Model 1) can be written as follows.

In Regime 1 when CDR t −1 = 0 :

(1− φ1L − φ2L2 )(1− L)d (∆yt − µ1) = εt ,

ε t | I t − 1 ~ z tc t ,

(2a)

z t ~ i.i.d.Sα ( 0,1)

c αt = b1 + b 2ctα−1 + b3 | ε t −1 |α

(2b)

In Regime 2 when CDR t −1 > 0 :

(1 − φ3L − φ4L2 )(1 − L)d (∆y t − µ2 ) = ε t ,

ε t | I t−1 ~ z t γc t ,

(2c)

z t ~ i.i.d.Sα ( 0,1)

c αt = b1 + b 2ctα−1 + b3 | ε t−1 / γ |α

(2d)

40

Table 3.3: Parameter Estimates - SETAR-Switching Models

Parameters

Model

Parameterization

Canada

(0,0)

France

(0,0)

Japan

(1,1)

UK

(0,0)

USA

(1,1)

µ1

0.966

(0.247)

0.811

(0.207)

-0.233

(1.034)

0.743

(0.106)

0.830

(0.023)

µ2

1.201

(0.704)

0.281

(0.404)

5.872

(6.079)

0.503

(0.283)

0.685

(0.035)

d

0.254

(0.066)

0.228

(0.079)

0.499

(0.000)

0.125

(0.066)

-0.473

(0.000)

α

1.999

(0.000)

1.960

(0.140)

1.999

(0.000)

1.772

(0.122)

1.897

(0.086)

c0

1.160

(0.353)

0.419

(0.132)

1.554

(0.347)

1.052

(0.385)

0.895

(0.278)

b1

0.000

(0.000)

7.4e-86

(0.000)

0.005

(0.005)

3.1e-9

(0.027)

0.000

(0.000)

b2

0.910

(0.051)

1.040

(0.057)

0.970

(0.009)

0.916

(0.056)

0.964

(0.021)

b3

0.051

(0.037)

2.7e-9

(0.019)

0.000

(0.000)

0.053

(0.027)

0.022

(0.012)

φ1

-0.398

(-0.067)

-0.254

(0.444)

φ3

γ

Log Likelihood

0.940

(0.085)

-217.49

0.888

(0.082)

-109.46

1.161

(0.063)

-275.97

0.769

(0.060)

0.486

(0.158)

0.913

(0.066)

-216.37

0.929

(0.064)

-199.64

41

Notes on Table 3.3

1. Parameter estimates are reported for the best model specification for version 1

within the class of SETAR-Switching models as determined by the minimum

SBC criterion.

2. The most general SETAR-Switching model (Model 1) can be written as follows.

In Regime 1 when ∆y t − 2 > 0 :

(1− φ1L − φ2L2 )(1− L)d (∆yt − µ1) = εt ,

ε t | I t − 1 ~ z tc t ,

(3a)

z t ~ i.i.d.Sα ( 0,1)

c αt = b1 + b 2ctα−1 + b3 | ε t −1 |α

(3b)

In Regime 2 when ∆y t − 2 ≤ 0 :

(1−φ3 L −φ4L2 )(1− L)d (∆yt −µ2 ) = ε t ,

ε t | I t−1 ~ z t γc t ,

(3c)

z t ~ i.i.d.Sα ( 0,1)

c αt = b1 + b 2ctα−1 + b3 | ε t−1 / γ |α

(3d)

42

TABLE 4.1: Hypotheses Tests – CDR-Augmented Models

Model 4

LR ( α = 2 )

LR (no GARCH)

LR ( d = 0 )

Model 3

Model 2

Model 1

0.06

2.06

12.58

23.36

8.26

0.00

0.54

6.72

20.34

4.96

0.00

0.00

16.28

18.62

4.38

24.3 (0.00)

0.02 (0.99)

40.20 (0.00)

41.16 (0.00)

83.74 (0.00)

21.16 (0.00)

1.32 (0.72)

35.78 (0.00)

41.24 (0.00)

15.96 (0.00)

17.88 (0.00)

34.10 (0.00)

55.66 (0.00)

17.22 (0.00)

4.60 (0.03)

43

Notes on Table 4.1

1.

The table presents likelihood ratio (LR) test statistics and their associated p-values

in parentheses.

2.

For each item reported in column 1, row one in column 2 and subsequent columns

for that item presents statistics for Canada, row two for France, row three for

Japan, row four for the UK, and row five for the USA.

3.

LR ( α = 2 ) is a test for normality. The distribution of the test statistic in this

instance is not standard χ 2 because the null hypothesis is on the admissible

boundary of α . However, critical values at the 10% and 5% significance level are

available through Monte Carlo simulations from McCulloch (1997, Table 4, panel

b). These are 0.243 and 1.120, respectively.

4.

LR (no GARCH) is a test for homoskedasticity. The null hypothesis is

b 2 = b3 = 0 . Under this null, b1 and c0 are trivial transformation of one another.

As such, it is not clear whether the LR statistic has asymptotic χ 2 distribution

with two or three degrees of freedom. We report conservative χ 23 p-values in

parentheses.

5.

LR ( d = 0 ) is a test for the absence of long memory.

44

TABLE 4.2: Hypotheses Tests - CDR-Switching Models

Model 4

LR ( α = 2 )

Model 3

Model 2

Model 1

0.46

0.16

15.44

21.74

6.84

4.12

2.56

0.78

58.18

4.80

0.00

5.22

0.00

22.52

11.44

31.68 (0.00)

0.48 (0.92)

50.98 (0.00)

40.66 (0.00)

15.80 (0.00)

12.66 (0.01)

0.00 (1.00)

55.72 (0.00)

44.92 (0.00)

--

LR (no GARCH)

LR ( d = 0 )

LR (one regime)

22.42 (0.00)

19.84 (0.00)

35.68 (0.00)

36.32 (0.00)

19.07 (0.00)

5.86 (0.00)

2.15 (0.14))

16.36 (0.00)

2.72 (0.26)

7.5 (0.06)

6.22 (0.10)

1.30 (0.72)

13.56 (0.00)

0.98 (0.61)

11.30 (0.01)

13.12 (0.00)

1.46 (0.69)

24.34 (0.00)

4.46 (0.11)

0.00 (1.00)

10.68 (0.00)

0.10 (0.95)

14.20 (0.00)

4.16 (0.00)

13.44 (0.00)

45

Notes on Table 4.2

1. The table presents likelihood ratio (LR) test statistics and their associated p-values

in parentheses.

2. For each item reported in column 1, row one in column 2 and subsequent columns

for that item presents statistics for Canada, row two for France, row three for

Japan, row four for the UK, and row five for the USA.

3. LR (one regime) is a test for linear conditional mean dynamics. The null

hypothesis is µ1 = µ2 , γ = 1, and the corresponding autoregressive coefficients in

the two regimes are equal.

4. See notes 3-5 in Table 4.1.

5. The symbol “--“ denotes missing numbers because the numerical algorithm for

maximization of the log likelihood function failed to converge.

46

TABLE 4.3: Hypotheses Tests – SETAR-Switching Models

Model 4

LR ( α = 2 )

Model 3

Model 2

Model 1

0.00

2.80

12.66

14.44

2.98

0.00

0.00

0.38

13.76

--

0.00

4.74

0.00

46.20

12.12

11.50 (0.17)

0.22 (0.97)

48.74 (0.00)

40.20 (0.00)

--

18.74 (0.00)

0.00 (1.00)

75.82 (0.00)

41.26 (0.00)

--

LR (no GARCH)

LR ( d = 0 )

LR (one regime)

22.22 (0.00)

12.96 (0.00)

56.38 (0.00)

2.40 (0.12)

-7.74 (0.01)

5.58 (0.23)

3.54 (0.62)

9.00 (0.00)

6.80 (0.08)

7.76 (0.02)

4.46 (0.22)

2.96 (0.71)

4.74 (0.32)

9.92 (0.01)

1.28 (0.53)

4.34 (0.23)

17.28 (0.00)

5.46 (0.14)

--

0.14 (0.93)

1.06 (0.59)

46.54 (0.00)

3.52 (0.32)

14.58 (0.00)

47

Notes on Table 4.3

1. The table presents likelihood ratio (LR) test statistics and their associated p-values

in parentheses.

2. For each item reported in column 1, row one in column 2 and subsequent columns

for that item presents statistics for Canada, row two for France, row three for

Japan, row four for the UK, and row five for the USA.

3. LR (one regime) is a test for linear conditional mean dynamics. The null

hypothesis is µ1 = µ 2 , γ = 1 , and the corresponding autoregressive coefficients in

the two regimes are equal.

4. See notes 3-5 in Table 4.1.

5. The symbol “--“ denotes missing numbers because the numerical algorithm for

maximization of the log likelihood function failed to converge.

48

8

References

Anderson, H.M. and F. Vahid (1998). “Testing Multiple Equation Systems for Common

Nonlinear Components.” Journal of Econometrics, 84: 1-36.

Anderson, H.M. and J.B. Ramsey (2002). “U.S. and Canadian Industrial Production

Indices as Coupled Oscillators.” Journal of Economic Dynamics and Control, 26: 33-67.

Baillie, R.T. (1996). “Long Memory Processes and Fractional Investigation in

Econometrics.“ Journal of Econometrics (Annals), 73(1): 5-59.

Baillie, R.T., C.F. Chung, and M.A. Tieslau (1996). “Analyzing Inflation by the

Fractionally Integrated ARFIMA-GARCH Model.” Journal of Applied Econometrics,

11(1): 23-40.

Balke, N.S. and T.B. Fomby (1994). “Large Shocks, Small Shocks and Economic

Fluctuations: Outliers in Macroeconomic Time Series.” Journal of Applied Econometrics,

9(2): 181-200.

Beaudry, P. and G. Koop (1993). “Do Recessions Permanently Change Output”? Journal

of Monetary Economics, 31:149-163.

Bidarkota, P.V. (1999). “Sectoral Investigation of Asymmetries in the Conditional Mean

Dynamics of the Real US GDP.” Studies in Nonlinear Dynamics and Econometrics, 3(4):

191-200.

Bidarkota, P.V. (2000). “Asymmetries in the Conditional Mean Dynamics of Real GNP:

Robust Evidence.” The Review of Economics and Statistics, 82(1): 153-157.

Blanchard, O.J. and J. Simon (2001). “The Long and Large Decline in U.S. Output

Volatility.” Brookings Papers on Economic Activity, 1: 135-174.

Blanchard, O.J. and M.W. Watson (1986). “Are Business Cycles All Alike?” In R.J.

Gordon (Ed.), The American Business Cycle: Continuity and Change. Chicago, IL:

University of Chicago Press, 123-179.

Box, G.E.P. and G.M. Jenkins (1976). Time Series Analysis, Forecasting and Control,

San Francisco, CA: Holden-Day.

Brannas, K. and J.G. De Gooijer (1994) “Autoregressive-Asymmetric Moving Average

Models for Business Cycle Data.” Journal of Forecasting, 13: 529-544.

Brockwell, P.J. and R.A. Davis (1991). Time Series: Theory and Methods, SpringerVerlag, New York.

49

Brunner, A.D. (1992). “Conditional Asymmetries in Real GNP: A Semi-nonparametric

Approach.” Journal of Business & Economics Statistics, 10(1): 65-72.

Brunner, A.D. (1997). “On the Dynamic Properties of Asymmetric Models of Real

GNP.” The Review of Economics and Statistics, 79: 321-326.

DeLong, J.B. and L.H. Summers (1986). “Are Business Cycles Symmetrical?” In R.J.

Gordon (Ed.), The American Business Cycle: Continuity and Change. Chicago, IL:

University of Chicago Press, 166-179.

Diebold, F.X. and A. Inoue (2001). "Long Memory and Regime Switching." Journal of

Econometrics , 105, 131-159.

Diebold, F.X. and G.D. Rudebusch. (1990). “A Nonparametric Investigation of Duration

Dependence in the American Business Cycle.” Journal of Political Economy, 98: 596616.

Ding, Z., C.W.J. Granger, and R.F. Engle (1993). “A Long Memory Property of Stock

Market Returns and a New Model.” Journal of Empirical Finance, 1:83-106.

Elwood, S.K. (1998). “Is the Persistence of Shocks to Output Asymmetric?” Journal of

Monetary Economics, 41: 411-426.

Falk, B. (1986). “Further Evidence on the Asymmetric Behavior of Economic Time

Series Over the Business Cycle.” Journal of Political Economy, 94(5): 1096-1109.

French, M.W. and D.E. Sichel (1993). “Cyclical Patterns in the Variance of Economic

Activity.” Journal of Business and Economic Statistics, 11(1): 113-119.

Granger, C.W.J. (1995). “Modelling Nonlinear Relationships Between ExtendedMemory Variables.” Econometrica, 63(2): 265-279.

Hamilton J.D. (1989). “A New Approach to the Economic Analysis of Nonstationary

Time Series and the Business Cycle.” Econometrica, 57(2): 357-384.

Hess, G.D. and S. Iwata (1997). “Asymmetric Persistence in GDP? A Deeper Look at

Depth.” Journal of Monetary Economics, 40: 535-554.

Hosking, J.R.M. (1984). “Modeling Persistence in Hydrological Time Series Using

Fractional Differencing.” Water Resources Research, 20(12): 1898-1908.

Kokoszka, P.S. and M.S. Taqqu (1995). “Fractional ARIMA with Stable Innovations.”

Stochastic Processes and their Applications, 60: 19-47.

Li, W.K. and A.I. McLeod (1986). “Fractional Time Series Modeling.” Biometrika,

73(1): 217-221.

50

Liu, S.M. and B.W. Brorsen (1995). “Maximum Likelihood Estimation of a GARCHStable Model.” Journal of Applied Econometrics, 10(3): 273-285.

McCulloch, J.H. (1985). “Interest-Risk-Sensitive Deposit Insurance Premia: Stable ACH

Estimates.” Journal of Banking and Finance, 9: 137-156.

McCulloch, J.H. (1997). ”Measuring Tail Thickness in Order to Estimate the Stable

Index a: A Critique.” Journal of Business and Economic Statistics, 15(1): 74-81.

Mikosch, T., T. Gadrich, C. Kluppelberg, and R.J. Adler (1995). “Parameter Estimation

for ARMA Models with Infinite Variance Innovations,” Annals of Statistics, 23(1): 305326.

Neftci, S.N. (1984). “Are Economic Time Series Asymmetric Over the Business Cycle?”

Journal of Political Economy, 92(2): 307-328.

Nolan, J.P. (undated). Program for maximum likelihood estimation of parameters for

general (non-symmetric) stable distributions, mle.ps at

http://www.cas.american.edu/~jpnolan.

Perron, P. (1989). “The Great Crash, the Oil Price Shock and the Unit Root Hypothesis.”

Econometrica, 57: 1361-1401.

Potter, S.M. (1995). “ A Non-Linear Approach to U.S. GNP.” Journal of Applied

Econometrics, 10: 109-125.

Koop, G. and S.M. Potter (2001). “Are Apparent Findings of Nonlinearity Due to

Structural Instability in Economic Time Series?” Econometrics Journal, 4: 37-55.

Ramsey, J.B. and P. Rothman (1996). “Time Irreversibility and Business Cycle

Asymmetry.” Journal of Money Credit and Banking, 28: 1-21.

Scheinkman, J.A. and B. LeBaron (1989). “Non-Linear Dynamics and GNP Data.” In

W.A. Barnett et al. (Eds.), Economic Complexity: Chaos, Sunspots, Bubbles, and Noninearity, Cambridge: Cambridge University Press, 213-227.

Sichel, D.E. (1989). “Are Business Cycles Asymmetric? A Correction.” Journal of

Political Economy, 97(5): 1255-1260.

Sowell, F. (1992a). “Maximum Likelihood Estimation of Stationary Univariate

Fractionally Integrated Time Series Models.” Journal of Econometrics, 53: 165-188.

Sowell, F. (1992b). “ Modeling Long-Run Behavior With the Fractional ARIMA

Model.” Journal of Monetary Economics, 29: 277-302.

51

Tong, H. and K.S. Lim (1980). “Threshold Autoregression, Limit Cycles and Cyclical

Data.” Journal of the Royal Statistical Society (Series B), 42(3): 245-292.

Tsay, R.S. (1988). “Nonlinear Time Series Analysis of Blowfly Population.” Journal of

Time Series Analysis, 9(3): 247-263.

Tucci, M.P. (1995). “Time Varying Parameters: A Critical Introduction.” Structural

Change and Economic Dynamics, 6: 237-260.

52

Figure 1 Plot of Logrithmic Real GDP over Time

Canada

France

5

5

4.5

4.5

4

4

3.5

3

1950

1975

2000

2025

3.5

1970

1980

1990

Japan

2000

2010

UK

14

5

13

4.5

12

11

4

10

9

1950

1975

2000

2025

2000

2025

USA

9.5

9

8.5

8

7.5

1950

1975

3.5

1950

1975

2000

2025

Figure 2

Plot of Real GDP Growth Rates Over Time

Canada

France

0.04

0.02

0.01

0.02

0

0

-0.01

-0.02

1950

1960

1970

1980

1990

2000

2010

-0.02

1970

1975

1980

Japan

1985

1990

1995

2000

2005

UK

0.15

0.06

0.04

0.1

0.02

0.05

0

0

-0.05

1950

-0.02

1960

1970

1980

1990

2000

2010

1990

2000

2010

-0.04

1950

1960

1970

1980

1990

2000

2010

USA

0.04

0.02

0

-0.02

-0.04

1950

1960

1970

1980

54