Impact of Globalisation on Accountancy Education Research Publication 2002

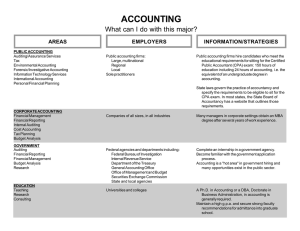

advertisement