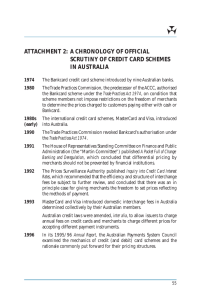

OVERVIEW

advertisement

OVERVIEW The Payments System Board and the Reserve Bank have a clear legislative mandate to promote competition, efficiency and stability in Australia’s payments system and the stability of the systems used to clear and settle transactions in financial instruments. The Government has given the Bank explicit powers under the Payment Systems (Regulation) Act 1998 and the Corporations Act 2001 to carry out these responsibilities, which the Board oversees. The Board’s preferred approach to carrying out its mandate has been to work with industry participants in order to understand the nature of the systems they operate and the business pressures they face. It has complemented this with analysis of the price incentives facing both the providers of payment, clearing and settlement services and their ultimate customers – consumers, businesses and financial market participants – and by comparisons with developments in other countries. This approach has assisted the Board in identifying areas where there is scope to improve efficiency by allowing competitive forces to operate more effectively and to redesign systems to make them safer and more efficient. Where the industry has been receptive, the Bank has worked with participants to explain its analysis and conclusions and to explore with them ways in which reforms might be voluntarily introduced. This is consistent with the co-regulatory approach envisaged by the Government under which the Bank would use its powers when other avenues for reform had been exhausted. Over recent years much of the Board’s focus has been on the retail payments sector. This work stems from recommendations of the Financial 2 System Inquiry (the Wallis Inquiry) that led to the establishment of the Board in 1998 and the Board’s early investigations along the lines described above. The early projects focused on gathering information. The Board’s first major research initiative was on card payment systems in Australia and was undertaken jointly with the Australian Competition and Consumer Commission (ACCC). Data on the costs of these systems in Australia were collected from financial institutions and then analysed and reported in Debit and credit card schemes in Australia, published in October 2000. Similarly, the Board undertook a project looking at the use of direct debits in Australia. More recently, the Bank has launched a new retail payments statistics collection, the first instalment of which was published in 2003. These information-gathering exercises have allowed the Board to form views about the operation of the payments system in Australia and to look at reform proposals to address its concerns. Following the preferred approach, the Board and the Bank have sought to work with industry participants to achieve a more competitive and efficient payments system. As a result of the work on debit card systems, participants in the ATM network and the debit card system are pursuing voluntary reform and the Bank has encouraged and facilitated that process. In the case of ATMs the focus has been on eliminating interchange fees (fees paid between ATM owners and card issuers) which are unrelated to costs, and fees to cardholders which are not transparent at the time of a transaction. They would be replaced by direct charges made clear to cardholders before they withdraw cash. The Board strongly supports this initiative, which will introduce competition into the cash dispensing market. Overseas experience suggests that most cardholders will find ways to pay no fees or only limited fees. While operators of some machines may levy higher charges, there are likely to be ATMs in many locations where they were not previously available. Industry participants have also accepted the Board’s view that there is no justification for the current interchange arrangements for debit cards and they have proposed to the ACCC that they be reduced to zero. The ACCC has not been convinced that such a move would be in the public interest unless there is also liberalisation of access to the debit card system that would increase competition in the provision of services to cardholders and merchants. The ACCC has invited the industry to address both questions simultaneously. The Board encourages the industry to undertake this work, with a view to increasing competition and efficiency in the debit card system. On the other hand, the Bank has had to use its powers to achieve reform of credit card schemes. It became clear in early 2001 that a voluntary approach to dealing with reform of credit card schemes was not feasible and the Board initiated a formal regulatory process under the Payment Systems (Regulation) Act 1998. This culminated in August 2002 when the Board determined standards that abolished the “no surcharge” rule applied by the international credit card schemes and set a cost-based benchmark that is expected to reduce interchange fees in credit card schemes substantially. It also foreshadowed an access regime that provides for non-discriminatory treatment by the card schemes of specialist organisations supervised by the Australian Prudential Regulation Authority that wish to participate in the credit card business. The Board expects that these reforms, which are being introduced over the course of 2003, will improve competition in the Australian payments system, increase efficiency and reduce costs currently borne by merchants and passed on to all consumers in the form of higher prices for goods and services. Shortly after the reforms were announced, MasterCard International and Visa International initiated legal action seeking to have them overturned on procedural and jurisdictional grounds. The case was heard during May and June 2003 and, at the time of writing, the judge was considering his decision. On the safety and stability side, the Board has encouraged the reduction of risk in foreign exchange settlements through the establishment of the Continuous Linked Settlement (CLS) Bank. CLS became operational in September 2002 and by early 2003 most banks active in the Australian dollar foreign exchange market were participating in its settlement arrangements. In May 2003 the Board finalised financial stability standards for central counterparties and securities settlement systems that clear and settle transactions in debt instruments, equities and derivatives. The standards drew on international work in this area and benefited from consultation with financial market participants. They focus on the need for clearing and settlement facilities to control the risks to which they are necessarily exposed in carrying out their roles. The standards apply to facilities operated by the Australian Stock Exchange and the Sydney Futures Exchange. The Board’s assessments of their compliance with the standards will be included in next year’s Annual Report. 17 September 2003 3