ARCHIVES JUN LIBRARIES

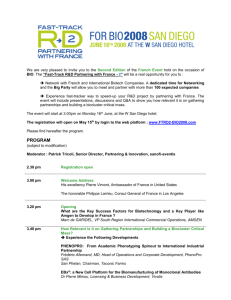

advertisement