Statistics 451 Examination 1 Name Spring 2015

advertisement

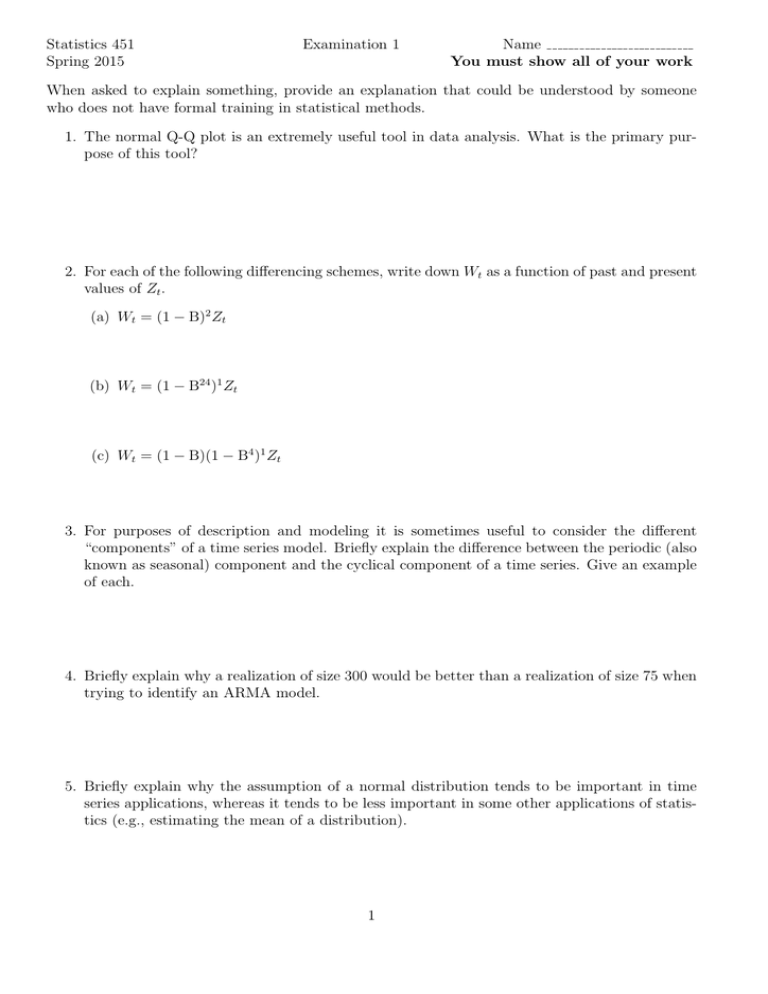

Statistics 451 Spring 2015 Examination 1 Name You must show all of your work When asked to explain something, provide an explanation that could be understood by someone who does not have formal training in statistical methods. 1. The normal Q-Q plot is an extremely useful tool in data analysis. What is the primary purpose of this tool? 2. For each of the following differencing schemes, write down Wt as a function of past and present values of Zt . (a) Wt = (1 − B)2 Zt (b) Wt = (1 − B24 )1 Zt (c) Wt = (1 − B)(1 − B4 )1 Zt 3. For purposes of description and modeling it is sometimes useful to consider the different “components” of a time series model. Briefly explain the difference between the periodic (also known as seasonal) component and the cyclical component of a time series. Give an example of each. 4. Briefly explain why a realization of size 300 would be better than a realization of size 75 when trying to identify an ARMA model. 5. Briefly explain why the assumption of a normal distribution tends to be important in time series applications, whereas it tends to be less important in some other applications of statistics (e.g., estimating the mean of a distribution). 1 6. Consider the following MA time series model Zt = θ0 + (1 − θ1 B1 )at , at ∼ nid(0, σa2 ). (a) Derive an expression for the mean of Zt . (b) Derive an expression for the variance of Zt . (c) Derive expressions for ρ1 , ρ2 , and ρ3 , the autocorrelation between observations separated by one, two, and three time periods. (d) Give expressions, as simple as possible, for computing the first three lags of the PACF function for this MA model. (e) Find the root(s) of the model-defining polynomial. (f) For what values of θ1 is the model for Zt invertible? Why? (g) Is the model for Zt weakly stationary or not? Why or why not? 2 7. The following figure shows monthly data on the number of armed robberies in Boston from January 1966 to October 1975. 300 100 200 Number 400 500 Number of Armed Robberies in Boston 1966 1967 1968 1969 1970 1971 1972 1973 1974 1975 1976 Time The following models were fit to the data Model 1: Yt = β0 + β1 Time + at Model 2: Yt = β0 + β1 Time + β2 Aug + β3 Dec + · · · + β12 Sep + at at ∼ nid(0, σa2 ) where Yt is the number of robberies, Time is been defined as (1966.00, 1966.08333, . . . , 1975.75) and Aug is 1 in August and 0 otherwise, Dec is 1 in month December and 0 otherwise,. . . , Sep is 1 in month September and 0 otherwise (there is no dummy variable for April in this model). The results of the regression fit using ordinary least squares for Model 1 showed βb0 = −82887, βb1 = 42.15, σ ba = 44.39 (116 degrees of freedom) and for Model 2, βb0 = −82561, βb1 = 41.98, βb2 = 57.41, . . . βb12 = 35.11, σ ba = 41.47 (105 degrees of freedom). (a) What is the practical interpretation of the parameter β1 in Model 1? (That is, how would you explain the meaning to someone who did not know much statistics, using the appropriate units of the coefficient?) (b) What is the practical interpretation of the parameter β2 in Model 2? 3 (c) What is the practical interpretation of the parameter σa in Model 1? (d) Explain why there really is no “practical” interpretation for β0 in these models, for this application. (e) Compare the results from fitting Models 1 and 2, assuming that at ∼ nid(0, σa2 ). Is there evidence of a seasonal effect in the data? (f) The following figure shows the ACF of the residuals from Model 1. -0.2 0.0 0.2 ACF 0.4 0.6 0.8 1.0 Series : residuals(boston.robberies.fit1) 0 5 10 Lag 15 20 What does this plot tell us about our model assumptions? (g) How would the value of βb1 change if Time had, instead, been defined as (1, 2, 3, . . . , 118). 4