Summer 2004 Stat

advertisement

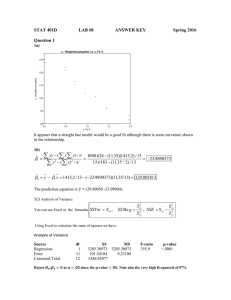

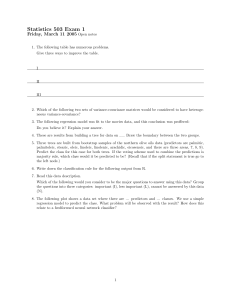

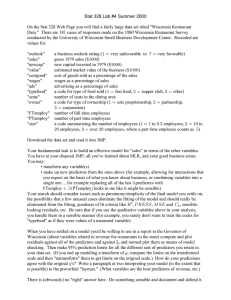

Summer 2004 Stat 328 Exam II Prof. Vardeman This exam concerns the analysis of some data taken from Data Analysis Using Regression Models: The Business Perspective by Frees. They come originally from a study by Schmit and Roth reported in the paper “Cost Effectiveness of Risk Management Practices” published in The Journal of Risk and Insurance. 73 risk managers of large companies (from a larger number originally sent questionnaires) returned questionnaires giving information about the risk management practices of their organizations. The response variable of basic interest is firmcost , the total property and casualty premiums and uninsured losses expressed as a percentage of total company assets. Some preliminary analysis suggested that for modeling purposes, a more convenient version of the response variable is costlog = log10 ( firmcost ) and our discussion will use this variable. (Note that “undoing” the logarithm transform, firmcost = 10costlog .) Potential explanatory variables are both “financial” and “attitudinal.” Financial predictor variables available for analysis are assume = per occurence retention amount as a percentage of total assets cap = a 0-1 dummy variable indicating whether the company owns a captive insurance company sizelog = the logarithm of firm total assets indcost = a measure of the firm's industry risk Attitudinal predictor variables available for analysis are central = a measure of the centralization of decisions about how much risk to retain soph = a measure of the technical sophistication (the importance of analytical tools like regression) in comapny risk mangement Further, for modeling purposes, we will also consider the predictor variable 2 indcost -squared = ( indcost ) There is a logical “gotcha” in the analysis of data like these that come from a survey with a low response rate. That is the very real possibility that “non-responders” are unlike “responsders” and researchers try to assess the degree to which this is the case (and one can only take any analysis as relevant to “responders” and “similar” subjects). We’ll ignore the issue for the purposes of this exam and suppose that data used here are representative of all large US firms. Accompanying this exam are a data table and JMP reports from various analyses of the survey data. Use them as you choose the best single answer to each of the following 25 multiple choice questions. After you have finished this exam, transfer your answers to the answer sheet and turn in the answer sheet, this exam, and the JMP reports, all with your name written plainly on them. 1 There is evidence on the JMP reports of multicollinearity among the basic predictors (for the time being, ignore indcost -squared ). 1. a) b) c) d) e) From the evidence available to you, which two predictors seem most strongly related? assume, cap assume, sizelog assume, indcost sizelog , cap central , soph 2. a) b) c) d) From the evidence available to you, large (as measured by sizelog ) firms seem to assume/retain relatively low risk and have low sophistication scores. assume/retain relatively high risk and have low sophistication scores. assume/retain relatively low risk and have high sophistication scores. assume/retain relatively high risk and have high sophistication scores. sizelog seems to be the best single predictor of the response variable costlog . Until further notice consider a simple linear regression analysis of y = costlog as a function of x = sizelog . 3. a) b) c) d) e) What do you estimate to be the standard deviation of costlog for a fixed value of sizelog ? .050 .170 .405 .413 .423 4. What are 95% confidence limits for the increase in mean costlog that accompany a 1 unit increase in company sizelog ? a) 3.68 ± 3.68 b) 3.68 ± .85 c) −.35 ± .35 d) −.35 ± .10 ( e) ( 3.68 + ( −.35 ) ⋅1) ± 2.00 SE µˆ ) 5. Is there clear evidence that mean costlog changes with sizelog ? a) Yes. The p -value for testing H 0 :β1 = 0 in the SLR model is less than .05. b) No. The p -value for testing H 0 :β1 = 0 in the SLR model is less than .05. c) Yes. The p -value for testing H 0 :β1 = 0 in the SLR model is more than .05. d) No. The p -value for testing H 0 :β1 = 0 in the SLR model is more than .05. 2 6. What are 95% confidence limits for the mean costlog for companies with sizelog = 10 ? a) ( −.68,1.02 ) b) c) d) e) ( −.02,.36 ) (.04,1.70 ) (.77,.98) .17 ± 2.00 (.413) 7. For a certain value of sizelog , SE µˆ = .07 (used for making confidence limits for µ y|x ). The corresponding value of SE yˆ (used for making prediction limits for ynew , a new value of costlog at that value of sizelog ) is closest to a) .07 b) .17 c) .42 d) .48 e) 1.00 8. For a certain value of sizelog and confidence level, prediction limits for an additional value of costlog are .87 ± .70 . Corresponding prediction limits for firmcost = 10logcost a) are 10.17 and 101.57 , i.e. 1.48 and 37.15 b) are 10.87 − 10.70 and 10.87 + 10.70 , i.e. 2.40 and 12.43 c) can not be determined from the given information d) None of a) through c) are correct. 9. Suppose that an additional survey form was returned incomplete, but carrying the information that firmcost = 10 so that costlog = 1 and that you must estimate the company’s value of sizelog . What is an estimate based on the least squares line? a) 5.6 b) 6.6 c) 7.6 d) 8.6 e) 9.6 10. Case number 15 stands out on the plot of costlog versus sizelog . As a matter of fact, JMP calculations not represented in the reports available to you show that the case has a “hat” value that is not particularly large, but has the biggest “Cook’s D” in the data set for this simple linear regression analysis. This reflects the facts that for firm number 15 a) sizelog is extreme, and the residual is large b) sizelog is moderate, and the residual is large c) sizelog is extreme, and the residual is moderate d) sizelog is moderate, and the residual is moderate 3 In the search for a good model for costlog , Vardeman ran the “All Possible Models” routine in JMP. Below are some summary values for “best” (largest R 2 ) models of each “size” (number of predictors). Number of Predictors Predictors sizelog , indcost , ( indcost ) , R2 s = RMSE p Cp .5841 .3605 8 8.00 10.54 8.45 .5841 .3578 7 6.00 10.17 8.45 .5826 .3558 6 4.24 10.00 8.48 PRESS SSE 2 7 central , assume, soph, cap sizelog , indcost , ( indcost ) , 2 6 central , assume, soph sizelog , indcost , ( indcost ) , 2 5 central , assume sizelog , indcost , ( indcost ) , 2 .5750 .3563 5 3.42 10.16 8.63 3 central 2 sizelog , indcost , ( indcost ) .5655 .3577 4 2.90 10.01 8.83 2 1 sizelog , indcost sizelog .5150 .4052 .3752 .4125 3 2 8.80 23.96 4 10.98 9.85 12.83 12.08 Use the information in this table to answer the next 3 questions. 11. The “best” value of s in the table corresponds to the model with how many predictors? a) 2 predictors b) 3 predictors c) 4 predictors d) 5 predictors e) 6 predictors 12. Generally speaking, the values of PRESS in the table are a) encouraging because they are not too different from the corresponding values of SSE b) discouraging because they are not too different from the corresponding values of SSE c) encouraging because they are all larger than the corresponding numbers of predictors d) discouraging because they are all larger than the corresponding numbers of predictors 13. The values of C p in the table suggest that a) b) c) d) e) any of the models could be used to effectively describe costlog at least 2 predictors should be used in modeling costlog at least 3 predictors should be used in modeling costlog at least 4 predictors should be used in modeling costlog at least 5 predictors should be used in modeling costlog JMP MLR reports for the models indicated above with 2,3,4, and 7 predictors are available to you. Use them in answering the following questions about multiple linear regression analyses of the data. 4 14. In the model with 3 predictors ( sizelog , indcost , ( indcost ) ) I am interested in testing 2 H 0 :β sizelog = βindcost = β indcost 2 = 0 . An F value for this overall model utility test is ( a) b) c) d) e) ) 8.03 15.13 29.94 48.37 58.16 15. After accounting for the 3 predictors ( sizelog , indcost , ( indcost ) ), does the 4th ( central ) provide 2 statistically detectable additional explanatory power regarding the response ( costlog )? a) Yes. The p -value for testing H 0 :β central = 0 in the 4-predictor model is less than .1. b) No. The p -value for testing H 0 :β central = 0 in the 4-predictor model is less than .1. c) Yes. The p -value for testing H 0 :β central = 0 in the 4-predictor model is larger than .1. d) No. The p -value for testing H 0 :β central = 0 in the 4-predictor model is larger than .1. e) Not enough information is given to find a relevant p -value . 16. There is an F statistic useful for comparing the 3-predictor model to the 7-predictor model. Degrees of freedom for that statistic are a) 3 and 7 b) 4 and 65 c) 3 and 65 d) 4 and 69 e) 3 and 69 17. The numerator sum of squares for the F statistic referred to in question 16 is a) 11.87 b) 11.49 c) .38 d) .18 e) not computable based on the information provided on the JMP reports provided here 18. There is an F statistic for testing H 0 :β sizelog = βindcost = β indcost 2 = 0 in the 7-predictor model. The ( ) numerator sum of squares for that statistic is a) 11.87 b) 11.49 c) .38 d) .18 e) not computable based on the information provided on the JMP reports provided here Henceforth suppose that one has settled on the model with 3 predictors ( sizelog , indcost , ( indcost ) ). 2 The rest of the questions in this exam refer to analyses based on this model. 5 19. In the model with the 3 predictors ( sizelog , indcost , ( indcost ) ), what do you estimate to be the 2 standard deviation of costlog for any fixed combination of sizelog and indcost (and therefore ( indcost ) a) b) c) d) e) 2 )? .044 .358 .550 .566 .700 20. The lower and upper 2.5% points of the χ 2 distribution with 69 degrees of freedom are respectively 47.92 and 93.86. 95% confidence limits for the standard deviation referred to in question 19 can then be obtained by multiplying the answer to 19 by a) 47.92 and 93.86 1 1 b) and 93.86 47.92 69 69 and c) 93.86 47.92 69 69 d) and 93.86 47.92 e) None of a)-d) is correct 21. According to 95% confidence limits based on the model with 3 predictors, if one increases 2 sizelog by .1 unit while holding indcost (and therefore ( indcost ) ) constant, average costlog should increase by how much? a) −.034 ± .009 b) −.034 ± .034 c) −.34 ± .09 d) −.34 ± .34 e) 2.76 − .034 + 2.72 indcost − 1.56 ( indcost ) ± 2.00 ( SE µˆ ) 2 22. According to the fitted 3-predictor model, two firms with the same sizelog but respective indcost values of .1 and .5 have predicted costlog values that differ by approximately a) .4(2.72) = 1.09 b) 2.72(.4) − 1.56(.4) 2 = .84 c) ( 2.72 (.5) − 1.56 (.5) ) − ( 2.72 (.1) − 1.56 (.1) ) = .71 2 2 d) None of a)-c) are correct, as the answer depends on the value of sizelog On the next page is a part of the JMP data table with some columns added based on the fitting of the 3predictor model. You may use it in addition to the JMP reports in answering the last few questions. 6 23. 95% prediction limits for the value of costlog for a company not represented in the data set that has sizelog = 9.55 and indcost = .32 are a) .27 ± 2.00(.07) b) .27 ± 2.00 (.36 ) c) .27 ± 2.00 (.36 ) 74 / 73 d) .27 ± 2.00 (.43) e) .27 ± 2.00 (.36 ) + (.07 ) 2 2 24. Company 16 has the largest value of “h COSTLOG” in the part of the data table shown above (and indeed in the whole table). In retrospect, this is sensible because a) because case 16 has a large residual b) because case 16 has a small residual c) because case 16 has a large predicted value d) because case 16 has a very small value of sizelog and a very large value of indcost 25. Case 15 has the largest residual in the part of the data table shown above. (In fact, no other residual for the entire data set is larger in magnitude than .78.) If that case were to be dropped from the data set and the 3-predictor model refit, one would expect a) R 2 to decrease and s to decrease b) R 2 to increase and s to decrease c) R 2 to decrease and s to increase d) R 2 to increase and s to increase 7 328 Final 04 Data Rows FIRMCOST COSTLOG ASSUME CAP SIZELOG INDCOST INDCOST-SQUARED CENTRAL SOPH 3.29 9.31 4.07 6.94 5.35 28.86 2.79 15 3.89 4.07 4.34 4.33 5.29 7.9 97.55 65 8.51 4.31 12.45 2.55 8.18 11.29 1.25 11.92 0.65 3.15 19.38 3.75 13.33 4.58 13.96 0.28 6.08 0.94 2.97 4.11 1.22 6.29 6.12 3.51 2.16 0.36 7.83 5.09 0.2 8.85 0.76 5.71 17.53 14 2.06 0.93 10 5.82 9.13 9 12.61 2.15 22.22 12.71 15.97 4.32 8.49 5.25 18.33 21.72 0.4 3.7 15 18 29.12 79.3 13.57 0.5171959 0.96894968 0.60959441 0.84135947 0.72835378 1.46029633 0.4456042 1.17609126 0.5899496 0.60959441 0.63748973 0.6364879 0.72345567 0.89762709 1.98922727 1.81291336 0.92992956 0.63447727 1.09516935 0.40654018 0.9127533 1.05269394 0.09691001 1.07627626 -0.1870866 0.49831055 1.28735377 0.57403127 1.12483015 0.66086548 1.14488542 -0.552842 0.78390358 -0.0268721 0.47275645 0.61384182 0.08635983 0.79865065 0.78675142 0.54530712 0.33445375 -0.4436975 0.89376176 0.70671778 -0.69897 0.94694327 -0.1191864 0.75663611 1.24378192 1.14612804 0.31386722 -0.0315171 1 0.76492298 0.96047078 0.95424251 1.10071509 0.33243846 1.34674405 1.10414555 1.20330492 0.63548375 0.92890769 0.7201593 1.26316246 1.33685982 -0.39794 0.56820172 1.17609126 1.25527251 1.46419137 1.89927319 1.13257985 0.29 0.89 1.67 1.21 0.28 14.86 0.85 1.47 3.47 5.86 0.39 2.08 1.14 0.24 0.18 1.27 0.23 0.5 1.02 0.44 3.86 2.98 0.01 1.68 0.09 0.21 0.34 3.28 0.83 0.44 0.02 0 0.5 0.01 0.17 0.17 0.5 0.01 0.05 0.33 0.9 0.07 1.67 0.5 0.07 1.35 0.02 1.53 0.13 0.63 0.33 0.79 0.71 0.29 2.5 2.03 61.82 0.13 0.42 3.42 0.79 1.9 0.29 6.46 0.29 0.92 0 0.43 2.92 2.3 0.79 0.51 37.14 1 0 0 0 0 1 0 0 0 0 0 1 0 0 1 1 0 0 0 0 0 0 0 0 0 1 1 0 0 1 1 0 1 1 0 1 1 0 1 0 1 0 0 0 1 0 0 0 0 0 1 1 0 1 0 0 1 0 0 0 0 0 0 1 0 0 1 1 0 1 0 0 1 9.55 8.04 7.9 8.1 7.74 8.16 9.47 8.13 7.5 8.55 8.08 8.01 7.59 8.52 9.31 6.68 8.39 8.86 8.3 10.12 7 7.65 8.52 6.29 8.7 8.59 7.38 8.07 8.01 8.48 8.49 9.86 7.6 8.16 7.45 8.41 10.6 9.04 8.26 9.15 8.96 9.95 8.01 7 10.27 8.27 10.02 8.16 7.31 8.99 9.1 9.55 8.16 8.55 8.29 7.6 7.42 9.01 7.5 7.09 8.95 8.58 8.58 8.29 8.7 7.5 10.36 8.17 7.5 9.21 7.96 5.27 7.24 0.32 0.33 0.34 0.34 0.09 0.42 0.41 0.32 0.53 1.22 0.26 0.34 0.42 0.33 0.62 1.22 0.63 0.42 0.32 0.34 0.42 0.34 0.41 0.34 0.1 0.5 0.33 0.33 0.53 0.34 0.5 0.1 0.33 0.33 0.1 0.33 0.34 0.86 0.33 0.32 0.34 0.34 0.26 0.33 0.1 0.33 0.5 0.26 0.86 0.33 0.33 0.34 0.5 0.5 0.32 0.5 0.62 0.32 0.33 0.32 0.62 0.32 0.32 0.42 0.86 0.41 0.41 0.34 0.34 0.86 0.33 0.32 0.86 0.1024 0.1089 0.1156 0.1156 0.0081 0.1764 0.1681 0.1024 0.2809 1.4884 0.0676 0.1156 0.1764 0.1089 0.3844 1.4884 0.3969 0.1764 0.1024 0.1156 0.1764 0.1156 0.1681 0.1156 0.01 0.25 0.1089 0.1089 0.2809 0.1156 0.25 0.01 0.1089 0.1089 0.01 0.1089 0.1156 0.7396 0.1089 0.1024 0.1156 0.1156 0.0676 0.1089 0.01 0.1089 0.25 0.0676 0.7396 0.1089 0.1089 0.1156 0.25 0.25 0.1024 0.25 0.3844 0.1024 0.1089 0.1024 0.3844 0.1024 0.1024 0.1764 0.7396 0.1681 0.1681 0.1156 0.1156 0.7396 0.1089 0.1024 0.7396 1 2 2 1 3 3 1 1 2 1 5 4 3 2 2 2 2 1 1 1 3 1 5 1 2 2 1 2 2 3 3 1 3 1 3 4 1 2 4 1 2 4 2 4 1 1 3 3 1 4 1 2 1 2 5 4 1 4 1 2 3 3 1 1 1 4 5 1 1 3 1 4 3 25 24 15 16 18 25 11 22 18 27 26 11 20 22 17 26 23 19 11 17 30 24 24 25 23 19 27 23 18 18 29 5 22 18 25 25 13 20 23 27 19 22 25 26 25 24 19 24 18 23 24 28 27 9 31 24 24 23 18 27 28 27 15 11 25 18 21 17 14 18 19 23 20 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 Multivariate Correlations COSTLOG 1.0000 0.1645 -0.0881 -0.6366 0.3946 -0.0544 0.1441 COSTLOG ASSUME CAP SIZELOG INDCOST CENTRAL SOPH ASSUME 0.1645 1.0000 0.2310 -0.2092 0.2493 -0.0681 0.0618 CAP -0.0881 0.2310 1.0000 0.1962 0.1225 -0.0038 -0.0866 SIZELOG -0.6366 -0.2092 0.1962 1.0000 -0.1022 -0.0798 -0.2089 INDCOST 0.3946 0.2493 0.1225 -0.1022 1.0000 -0.0849 0.0927 CENTRAL -0.0544 -0.0681 -0.0038 -0.0798 -0.0849 1.0000 0.2826 SOPH 0.1441 0.0618 -0.0866 -0.2089 0.0927 0.2826 1.0000 Bivariate Fit of COSTLOG By SIZELOG 2.5 2 COSTLOG 1.5 1 0.5 0 -0.5 -1 4 5 6 7 8 9 10 11 12 SIZELOG Linear Fit Linear Fit COSTLOG = 3.6813956 - 0.3509918 SIZELOG Summary of Fit RSquare RSquare Adj Root Mean Square Error Mean of Response Observations (or Sum Wgts) 0.405227 0.39685 0.412531 0.756961 73 Analysis of Variance Source Model Error C. Total DF 1 71 72 Sum of Squares 8.232268 12.082913 20.315181 Mean Square 8.23227 0.17018 F Ratio 48.3734 Prob > F <.0001 Parameter Estimates Term Intercept SIZELOG Estimate 3.6813956 -0.350992 Std Error 0.423237 0.050465 t Ratio 8.70 -6.96 Prob>|t| <.0001 <.0001 1 Response COSTLOG Whole Model Actual by Predicted Plot COSTLOG Actual 2 1.5 1 0.5 0 -0.5 -0.5 .0 .5 1.0 1.5 2.0 COSTLOG Predicted P<.0001 RSq=0.52 RMSE=0.3752 Summary of Fit RSquare RSquare Adj Root Mean Square Error Mean of Response Observations (or Sum Wgts) 0.515 0.501143 0.375174 0.756961 73 Analysis of Variance Source Model Error C. Total DF 2 70 72 Sum of Squares 10.462318 9.852863 20.315181 Mean Square 5.23116 0.14076 F Ratio 37.1649 Prob > F <.0001 Parameter Estimates Term Intercept SIZELOG INDCOST Estimate 3.1827934 -0.332229 0.8181391 Std Error 0.40478 0.046137 0.205543 t Ratio 7.86 -7.20 3.98 Prob>|t| <.0001 <.0001 0.0002 Effect Tests Source SIZELOG INDCOST Nparm 1 1 DF 1 1 Sum of Squares 7.2986719 2.2300505 F Ratio 51.8537 15.8435 Prob > F <.0001 0.0002 Residual by Predicted Plot COSTLOG Residual 1.5 1.0 0.5 0.0 -0.5 -1.0 -0.5 .0 .5 1.0 1.5 2.0 COSTLOG Predicted 2 Response COSTLOG Whole Model Actual by Predicted Plot COSTLOG Actual 2 1.5 1 0.5 0 -0.5 -0.5 .0 .5 1.0 1.5 2.0 COSTLOG Predicted P<.0001 RSq=0.57 RMSE=0.3577 Summary of Fit RSquare RSquare Adj Root Mean Square Error Mean of Response Observations (or Sum Wgts) 0.565539 0.54665 0.357652 0.756961 73 Analysis of Variance Source Model Error C. Total DF 3 69 72 Sum of Squares 11.489035 8.826146 20.315181 Mean Square 3.82968 0.12792 F Ratio 29.9392 Prob > F <.0001 Parameter Estimates Term Intercept SIZELOG INDCOST INDCOST-SQUARED Estimate 2.758867 -0.335531 2.7202067 -1.55693 Std Error 0.413872 0.043998 0.699379 0.549547 t Ratio 6.67 -7.63 3.89 -2.83 Prob>|t| <.0001 <.0001 0.0002 0.0060 Effect Tests Source SIZELOG INDCOST INDCOST-SQUARED Nparm 1 1 1 DF 1 1 1 Sum of Squares 7.4392512 1.9350882 1.0267169 F Ratio 58.1577 15.1279 8.0265 Prob > F <.0001 0.0002 0.0060 Residual by Predicted Plot COSTLOG Residual 1.5 1.0 0.5 0.0 -0.5 -1.0 -0.5 .0 .5 1.0 1.5 2.0 COSTLOG Predicted 3 Response COSTLOG Whole Model Actual by Predicted Plot COSTLOG Actual 2 1.5 1 0.5 0 -0.5 -0.5 .0 .5 1.0 1.5 2.0 COSTLOG Predicted P<.0001 RSq=0.58 RMSE=0.3563 Summary of Fit RSquare RSquare Adj Root Mean Square Error Mean of Response Observations (or Sum Wgts) 0.575048 0.550051 0.356308 0.756961 73 Analysis of Variance Source Model Error C. Total DF 4 68 72 Sum of Squares 11.682210 8.632971 20.315181 Mean Square 2.92055 0.12696 F Ratio 23.0045 Prob > F <.0001 Parameter Estimates Term Intercept SIZELOG INDCOST INDCOST-SQUARED CENTRAL Estimate 2.8845308 -0.340543 2.7794187 -1.624071 -0.041764 Std Error 0.424716 0.04402 0.698402 0.55018 0.033858 t Ratio 6.79 -7.74 3.98 -2.95 -1.23 Prob>|t| <.0001 <.0001 0.0002 0.0043 0.2216 Effect Tests Source SIZELOG INDCOST INDCOST-SQUARED CENTRAL Nparm 1 1 1 1 DF 1 1 1 1 Sum of Squares 7.5978749 2.0107054 1.1062449 0.1931749 F Ratio 59.8468 15.8379 8.7136 1.5216 Prob > F <.0001 0.0002 0.0043 0.2216 Residual by Predicted Plot COSTLOG Residual 1.5 1.0 0.5 0.0 -0.5 -1.0 -0.5 .0 .5 1.0 1.5 2.0 COSTLOG Predicted 4 Response COSTLOG Whole Model Actual by Predicted Plot COSTLOG Actual 2 1.5 1 0.5 0 -0.5 -0.5 .0 .5 1.0 1.5 2.0 COSTLOG Predicted P<.0001 RSq=0.58 RMSE=0.3605 Summary of Fit RSquare RSquare Adj Root Mean Square Error Mean of Response Observations (or Sum Wgts) 0.584112 0.539325 0.36053 0.756961 73 Analysis of Variance Source Model Error C. Total DF 7 65 72 Sum of Squares 11.866351 8.448830 20.315181 Mean Square 1.69519 0.12998 F Ratio 13.0418 Prob > F <.0001 Parameter Estimates Term Intercept SIZELOG INDCOST INDCOST-SQUARED CENTRAL ASSUME SOPH CAP Estimate 2.8298768 -0.347015 2.9689726 -1.745744 -0.050031 -0.005957 0.004215 0.0022153 Std Error 0.498185 0.047654 0.725151 0.566816 0.036039 0.005556 0.00865 0.095313 t Ratio 5.68 -7.28 4.09 -3.08 -1.39 -1.07 0.49 0.02 Prob>|t| <.0001 <.0001 0.0001 0.0030 0.1698 0.2876 0.6277 0.9815 Effect Tests Source SIZELOG INDCOST INDCOST-SQUARED CENTRAL ASSUME SOPH CAP Nparm 1 1 1 1 1 1 1 DF 1 1 1 1 1 1 1 Sum of Squares 6.8924962 2.1789051 1.2329913 0.2504999 0.1494455 0.0308669 0.0000702 F Ratio 53.0265 16.7631 9.4859 1.9272 1.1497 0.2375 0.0005 Prob > F <.0001 0.0001 0.0030 0.1698 0.2876 0.6277 0.9815 Residual by Predicted Plot COSTLOG Residual 1.5 1.0 0.5 0.0 -0.5 -1.0 -0.5 .0 .5 1.0 1.5 2.0 COSTLOG Predicted 5