Financial Crisis Engineering Financial Safety:

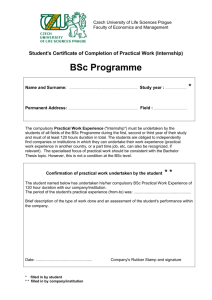

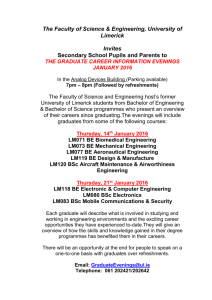

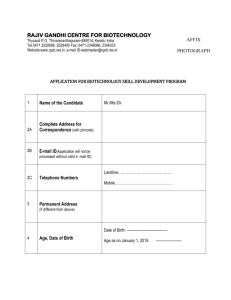

advertisement