Enhancing Productivity through Effective Collaborations:

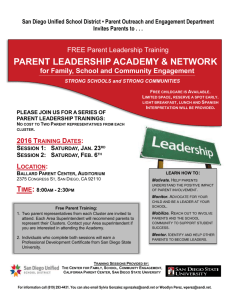

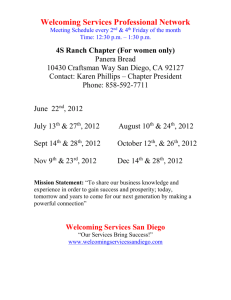

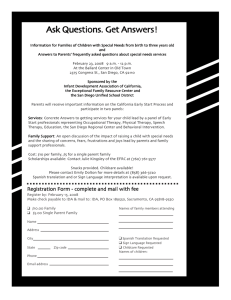

advertisement