Electronic Journal of Differential Equations, Vol. 2014 (2014), No. 178,... ISSN: 1072-6691. URL: or

advertisement

Electronic Journal of Differential Equations, Vol. 2014 (2014), No. 178, pp. 1–16.

ISSN: 1072-6691. URL: http://ejde.math.txstate.edu or http://ejde.math.unt.edu

ftp ejde.math.txstate.edu

EXISTENCE AND UNIQUENESS OF M-SOLUTIONS FOR

BACKWARD STOCHASTIC VOLTERRA INTEGRAL

EQUATIONS

WENXUE LI, RUIHUA WU, KE WANG

Abstract. In this article, we study general backward stochastic Volterra integral equations (BSVIEs). Combining the contractive-mapping principle, stepby-step iteration method and mathematical induction, we establish the existence and uniqueness theorem of M-solution for the BSVIEs. This theorem

could be applied directly to many models, for example, using the result to

a kind of financial models provides a new and easy method to discuss the

existence of dynamic risk measure.

1. Introduction

Backward stochastic differential equations (BSDEs) and backward stochastic

Volterra integral equation (BSVIE) are applied widely in finance and stochastic

control etc.[3, 6, 7]. The theoretical foundation of BSDEs have been established by

Pardoux and Peng[5]. The development of BSDEs greatly promoted the evolution

of economics and finance. For example, economists Diffie and Epstein introduced

BSDEs into economics in 1992, and stochastic analyst El Karoai et al [2] discovered the important role of BSDEs in finance. In 2006, Yong [8] introduce the

BSVIEs, in which play a major role in considering the properties of forward stochastic Volterra integral equations, which describe the stochastic optimal control

problem with memories, and in the proof of stochastic Pontryagin maximum principle [7] etc.. Besides, in [9], a class of dynamic convex and coherent risk measures

are identified as a component of the adapted M-solutions to certain BSVIEs.

In this article, we consider general backward stochastic Volterra integral equation

(BSVIE)

Z T

Y (t) = F (t, Y (t)) +

g(t, s, Y (s), Y (t), Z(t, s), Z(s, t)) ds

t

(1.1)

Z T

−

h(t, s, Y (s), Y (t), Z(t, s)) dW (s),

t ∈ [0, T ].

t

2000 Mathematics Subject Classification. 45D05, 60H17, 34A12, 60H20.

Key words and phrases. Backward stochastic Volterra integral equations; existence;

uniqueness; dynamic risk measure.

c

2014

Texas State University - San Marcos.

Submitted August 2, 2013. Published August 21, 2014.

1

2

W. LI, R. WU, K. WANG

EJDE-2014/178

A class of important BSVIEs (1.1) is the the following

Z T

Z T

Y (t) = ξ +

g(s, Y (s), Z(s)) ds +

Z(s) dW (s),

t

t ∈ [0, T ].

(1.2)

t

Yong [8] introduced another form of BSVIE (1.1):

Z T Z

Y (t) = φ(t) −

g t, s, Y (s), Z(t, s), Z(s, t) ds −

t

T

Z(t, s) dW (s),

t ∈ [0, T ],

t

(1.3)

and gave the following definition of adapted solution.

Definition 1.1. Any pair of stochastic processes (Y (·), Z(·, ·)) ∈ H1 [S, T ] (defined

as (3.1)) satisfying (1.3) is called an adapted solution of (1.3).

Also, the conditions of the existence and uniqueness of the adapted solution to

(1.3) are given. However, it is difficult to consider the uniqueness of the adapted

solution to (1.3) under Definition 1.1. For example, for the BSVIE

Z T Z T

Y (t) =

g t, s, Y (s), Z(t, s) ds −

Z(t, s) dW (s), t ∈ [0, T ],

(1.4)

t

t

in which g satisfies the conditions of existence and uniqueness theorem, suppose

(Y (·), Z(·, ·)) is the uniqueness adapted solution of (1.4). But it is easy to check

that (Ŷ (·), Ẑ(·, ·)) satisfies

Ŷ (t) = Y (t),

t ∈ [0, T ],

Ẑ(t, s) = Z(t, s),

(t, s) ∈ [0, T ] × [t, T ],

Ẑ(t, s) = ς(t, s),

(t, s) ∈ [0, T ] × [0, t],

is also an adapted solution of (1.4) for any ς(·) ∈ L2F (0, T ; R). It is contradictive.

The purpose of this article is to discuss the existence and uniqueness of adapted

M-solutions (defined later), rather than the adapted solution to (1.1) in Definition 1.1. We give some sufficient conditions for the existence and uniqueness of

M-solution to (1.1), by combining contractive-mapping principle, step-by-step iteration method and mathematical induction. These results could be applied directly

to many models, such as those described as BSVIEs, in which a component of the

M-solution of BSVIEs has a close relation with the dynamic risk measure. By applying the main result to the financial models, it provides a new and easy method

to discuss the existence of dynamic risk measure.

2. Motivation and main results

2.1. Experimental motivation. In this article, we use (1.1) to describe a class of

economic problems as certain portfolio, such as European option, some current cash

flows, mutual funds etc. Here, Y (t) denotes the price of merchandize, F (t, Y (t))

stands for the total wealth of certain portfolio and g is referred to as the generator

of (1.1). Since the component Y (t) of the M-solution to (1.1) has a close relationship with the dynamic risk measure, it is significant to consider the existence and

uniqueness of the M-solution. Here the dynamic risk measure is defined as follows:

Definition 2.1 ([9]). A map ρ : L2FT (0, T ) → L2F (0, T ) is called a dynamic risk

measure if the following conditions hold:

EJDE-2014/178

EXISTENCE AND UNIQUENESS

3

1. For any ψ(·), ψ̄(·) ∈ L2FT (0, T ), if ψ(·) = ψ̄(·), a.s. s ∈ [t, T ], for some

t ∈ [0, T ), then

ρ(t, ψ(·)) = ρ(t, ψ̄(·)),

L2FT (0, T ),

2. For any ψ(·), ψ̄(·) ∈

t ∈ [0, T ), then

a.s..

if ψ(·) ≤ ψ̄(·), a.s. s ∈ [t, T ], for some

ρ(t, ψ(·)) ≥ ρ(t, ψ̄(·)),

a.s. s ∈ [t, T ].

In fact, the model is on the basis of some classical financial models. El Karoui et

al [2] described the problem of European option pricing by applying BSDE (1.2). In

this case, ξ represents square-integrable contingent claim and Y (t) represents the

price of European option. For their model, if there exists unique solution, then the

map ρ : ξ → Y (t) defined by (1.2) is a dynamic risk measure. Yong [9], extended

(1.2) into (1.3). There φ(t) represents the total wealth of certain portfolio. The

author gave dynamic risk measure ρ(t, φ(t)) = Y (t) for (1.3).

2.2. Model assumptions and novelty. Now we give some assumptions for (1.1)

such that it has unique solution.

(H1) Let g : ∆c × Rm × Rm × Rm×d × Rm×d × Ω → Rm be B(∆c × Rm × Rm ×

Rm×d × Rm×d ) ⊗ FT -measurable, and for all (t, ζ, η, ξ, ς) ∈ [0, T ] × Rm ×

Rm × Rm×d × Rm×d , g(t, ·, ζ, η, ξ, ς) is F-adapted and satisfies

Z T Z T

2

E

|g(t, s, 0, 0, 0, 0)| ds dt < ∞,

(2.1)

0

t

¯ ς, ς¯ ∈ Rm×d

and for all (t, s) ∈ ∆ , ζ, ζ̄, η, η̄ ∈ Rm , ξ, ξ,

c

¯ ς¯))|

|g(t, s, ζ, η, ξ, ς) − g(t, s, ζ̄, η̄, ξ,

¯ + Lς (t, s)|ς − ς¯| a.s.,

≤ Lζ (t, s)|ζ − ζ̄| + Lη (t, s)|η − η̄| + Lξ (t, s)|ξ − ξ|

(2.2)

where for some ε > 0, Lζ (t, s), Lη (t, s), Lξ (t, s), Lς (t, s) : ∆c → R satisfy

Z Th

i

sup

Lζ (t, s)2+ε + Lη (t, s)2+ε + Lξ (t, s)2+ε + Lς (t, s)2+ε ds = A < ∞,

t∈[0,T ]

t

and

sup

t∈[0,T ]

T

Z

2

Lη (t, s) ds = K <

0

1

,

8C 2

(2.3)

in which C is the same as the one in (3.5).

(H2) Let F : R1 × Rm × Ω → Rm be B(R1 × Rm ) ⊗ FT -measurable, and

Z T

E

|F (t, 0)| dt < ∞.

(2.4)

0

Moreover,

|F (t, ς) − F (t, ς¯))| ≤ Lς (t)|ς − ς¯|,

t ∈ R, ς, ς¯ ∈ Rm a.s.,

sup |Lς (t)|2 ≤ D,

t∈[0,T ]

2CL D < 1.

hold. Here CL is determined by (3.11).

(2.5)

4

W. LI, R. WU, K. WANG

EJDE-2014/178

(H3) Let h : ∆c ×Rm ×Rm ×Rm×d ×Ω → Rm×d be B(∆c ×Rm ×Rm ×Rm×d )⊗FT measurable, and for all (t, ζ, η, ξ) ∈ [0, T ] × Rm × Rm × Rm×d , h(t, ·, ζ, η, ξ)

is F-adapted and has the following relations:

¯ − (ξ − ξ)|

¯ 2 ≤ Lζ |ζ − ζ̄|2 + Lη |η − η̄|2 + Lξ |ξ − ξ|

¯ 2,

|h(t, s, ζ, η, ξ) − h(t, s, ζ̄, η̄, ξ)

∀(t, s) ∈ ∆c , ζ, ζ̄, η, η̄ ∈ Rm , ξ, ξ¯ ∈ Rm×d , a.s.,

Z TZ T

|h(t, s, 0, 0, 0)|2 ds dt < ∞,

E

0

nt

o

max 4CF Lξ , CF (Lζ + Lη )T < 1,

(2.6)

where CF is determined by (3.21).

It is easy to verify that conditions (H1)–(H3) will degenerate into (H) in [10] as

(1.1) equal to (1.3). In the rest of the subsection, we will show the novelty in this

paper from the following points: theory and application.

(1) It is noted that (1.2) can not show the rule of the total wealth changing with

the time; and both (1.2) and (1.3) cannot build up the relation between the total

wealth with the price of merchandise. To get rid of the two defects, we reconstruct

the model as BSVIE (1.1).

In [2] (or [9]), by building the relation between ξ and Y (t), (or φ(t) and Y (t)),

the dynamic risk measure for (1.2) (or (1.3)) is found. However, model (1.1) gives

directly the explicit relation of ϕ(t) and F (t, Y (t)), i. e. ϕ(t) = F (t, Y (t)). Hence,

if F (t, ·) has well properties, we could arrive a dynamic risk measure F −1 : ϕ(t) →

Y (t). Sequently, in order to study the properties of the dynamic risk measure, such

as dynamic convex or coherent risk measures, it only needs to restrict the F (t, ·)

further. Then applying the main results to this model, it is convenient to find the

dynamic risk measure. (2) It is well-known that step-by-step iteration method and

fixed point theorem are important method to prove the existence and uniqueness of

solution to equations [1, 4, 5, 8, 10]. But sometimes, for the equations having complicated forms, it is hard to derive the existence and uniqueness theorem, by using

only method of them. However, in this paper we combine step-by-step iteration

method, fixed point theorem, mathematic induction and Martingale representation

theorem to provide a proof of the existence and uniqueness of M-solution to (1.1).

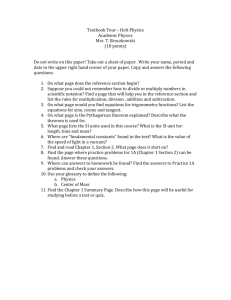

For different domain of definition of Z(·, ·), we use different method as in Figure 1.

2.3. Main results. Firstly, we introduce the definition of M-solution, and then

give the main results of the paper: existence and uniqueness theorem of M-solution

to BSVIE (1.1). The proof of it is left in the next section.

Definition 2.2. A pair (Y (·), Z(·, ·)) ∈ H1 [S, T ] is called an adapted M-solution

of BSVIE (1.1) on [S, T ], if (Y (·), Z(·, ·)) satisfies (1.1) in the usual Itôs sense for

almost all t ∈ [S, T ] and, in addition, the following holds:

Z

t

Y (t) = E(Y (t)|FS ) +

Z(t, s) dW (s),

S

a.e. t ∈ [S, T ].

EJDE-2014/178

EXISTENCE AND UNIQUENESS

5

↑

T

Step-by-step

iteration method

Fixed point

theorem

Mathematical

induction

Martingale

representation

theorem

S

S

T

→

t

Figure 1. Diagram of methods used in different domains of definition of Z(·, ·) to prove the main result

Theorem 2.3. Let (H1)–(H3) hold, then (1.1) admits a unique adapted M-solution

(Y (·), Z(·, ·)), and the following estimate holds:

k(Y (·), Z(·, ·))k2H2 [R,T ]

Z

nZ T

≤ Ch E

|F (t, 0)|2 dt +

Z

T

Z

R

T

+

R

T

R

Z

T

2

|g(t, s, 0, 0, 0, 0)| ds dt

t

o

|h(t, s, 0, 0, 0)|2 ds dt ,

(2.7)

R ∈ [0, T ].

t

Furthermore, if ḡ, F̄ , h̄ satisfy (H1)–(H3), respectively, and (Ȳ (·), Z̄(·, ·)) is the Msolution, in which (g, F, h) is replaced by (ḡ, F̄ , h̄). Then

Z TZ T

hZ T

i

2

E

|Y (t) − Ȳ (t)| dt +

|Z(t, s) − Z̄(t, s)|2 ds dt

R

R

≤ Ch E

nZ

R

T

|F (t, Y (t)) − F̄ (t, Y (t))|2 dt

R

Z

T

+

Z

R

T

|g(t, s, Y (s), Y (t), Z(t, s), Z(t, s))

(2.8)

t

2

− ḡ(t, s, Y (s), Y (t), Z(t, s), Z(t, s))| ds dt

Z TZ T

o

+

|h(t, s, Y (s), Y (t), Z(t, s)) − h̄(t, s, Y (s), Y (t), Z(t, s))|2 ds dt ,

R

t

for R ∈ [0, T ].

3. Proof of the main theorem

Before proving Theorem 2.3, we show some useful notion from [10], and some

lemmas. Let

n

LpFS (Ω; Lq (0, T )) = φ : (0, T ) × Ω → Rm : φ(·) is B([0, T ]) ⊗ FS -measurable,

o

Z T

pq

<∞ .

E

|φ(t)|q dt

0

6

W. LI, R. WU, K. WANG

EJDE-2014/178

n

o

LpF (Ω; Lq (0, T )) = φ(·) ∈ Lp (Ω; Lq (0, T )) : φ(·) is F-adapted .

For any p, q ≥ 1, let Lq (0, T ; LpF (Ω; L2 (0, T ))) be the set of all processes Z : [0, T ]2 ×

Ω → Rm×d , such that for almost all t ∈ [0, T ], Z(t, ·) ∈ LpF (Ω; L2 (0, T )), there is

Z T n Z T

p/2 oq/p

E

|Z(t, s)|2 ds

dt < ∞.

0

0

For convenience, denote

∆[R, S] = {(t, s) ∈ [R, S]2 : R ≤ s ≤ t ≤ S},

∆c [R, S] = {(t, s) ∈ [R, S]2 : R ≤ t < s ≤ S},

and for any 0 ≤ R ≤ S ≤ T ,

Hp [R, S] = LpF (Ω; Lp (0, T )) × Lp (0, T ; LpF (Ω; L2 (0, T ))).

(3.1)

If we define

n Z

ky(·), z(·, ·)kH2 [R,S] ≡ E

S

|y(t)|2 dt +

R

Z

S

Z

R

S

|z(t, s)|2 ds dt

o1/2

.

R

Then k · kH2 [R,S] could define a metric on H2 [R, S] and the space is complete under

this metric, clearly.

For any R, S ∈ [0, T ), consider the stochastic integral equation

Z T

Z T

λ(t, r) = ψ(t) +

k(t, s, µ(t, s)) ds −

µ(t, s) dW (s),

(3.2)

r

r

for r ∈ [R, T ] and t ∈ [S, T ], where k : [S, T ] × [R, T ] × Rm×d × Ω → Rm is given.

(λ(t, ·), µ(t, ·)) is F-adapted for any t ∈ [R, T ]. Introduce the following assumption

for k:

(H0) Let R, S ∈ [0, T ), and k : [S, T ] × [R, T ] × Rm×d × Ω → Rm be B([S, T ] ×

[R, T ] × Rm×d ) ⊗ FT -measurable such that k(t, ·, z) is F-progressively measurable for (t, z) ∈ [S, T ] × Rm×d , and

Z T

p

E

|k(t, s, 0)| ds < ∞, a.e. t ∈ [S, T ],

(3.3)

R

for some p > 1. Moreover, the following holds:

|k(t, s, z) − k(t, s, z̄)| ≤ Lz (t, s)|z − z̄|, (t, s) ∈ [S, T ] × [R, T ], z, z̄ ∈ Rm×d , a.s,

where Lz : [S, T ] × [R, T ] → [0, ∞) is a deterministic function, such that

for some ε > 0,

Z T

sup

Lz (t, s)2+ε ds < ∞.

t∈[S,T ]

R

Let r = S ∈ [R, T ) be fixed. Define

ψ S (t) = λ(t, S), Z(t, s) = µ(t, s),

t ∈ [R, S], s ∈ [S, T ].

Then (3.2) is rewritten as stochastic Fredholm integral equations (SFIEs):

Z T

Z T

ψ S (t) = ψ(t) +

k(t, s, Z(t, s)) ds −

Z(t, s) dW (s), t ∈ [S, T ].

r

(3.4)

r

We call (ψ S (·), Z(·, ·)) ∈ LpFS (R, S) × Lp (R, S; L2F (S, T )) as an adapted solution of

(3.4), if it satisfies (3.4) in the sense of Itô.

EJDE-2014/178

EXISTENCE AND UNIQUENESS

7

Lemma 3.1 ([10]). Let (H0) hold. Then for any ψ(·) ∈ LpFT (R, S), (3.4) admits a

unique adapted solution (ψ S (·), Z(·, ·)) ∈ LpFS (R, S) × Lp (R, S; L2F (S, T )), and the

following estimate holds:

n

Z T

p/2 o

n

Z T

p o

E |ψ S (t)|p +

|Z(t, s)|2 ds

≤ CE |ψ(t)|p +

|k(t, s, 0)| ds

, (3.5)

S

S

m×d

for t ∈ [R, S]. If k̄ : [R, S] × [S, T ] × R

× Ω → Rm satisfies (H0), ψ̄(·) ∈

p

p

S

LFT (R, S), and (ψ̄ (·), Z̄(·, ·)) ∈ LFS (R, S) × Lp (R, S; L2F (S, T )) is the unique

adapted solution of (3.4) in which (k, ψ) is replaced by (k̄, ψ̄), then

n

Z T

p/2 o

E |ψ S (t) − ψ¯S (t)|p +

|Z(t, s) − Z̄(t, s)|2 ds

S

(3.6)

n

Z T

o

p

≤ CE |ψ(t) − ψ̄(t)|p +

|k(t, s, Z(t, s)) − k̄(t, s, Z(t, s))| ds

,

S

for t ∈ [R, S].

Let S = R, and define

t ∈ [S, T ],

Y (t) = λ(t, t),

Z(t, s) = µ(t, s),

(t, s) ∈ ∆c [S, T ].

Then (3.2) can be rewritten as

Z T

Z

Y (t) = ψ(t) +

k(t, s, Z(t, s)) ds −

t

T

Z(t, s) dW (s),

t ∈ [S, T ].

(3.7)

t

Lemma 3.2 ([10]). Let (H0) hold. Then for any ψ(·) ∈ LpFT (R, S), (3.7) admits

a unique adapted M-solution (Y (·), Z(·, ·)) ∈ Hp [S, T ], and the following estimate

holds:

n

Z T

p/2 o

n

Z T

p o

E |Y (t)|p +

|Z(t, s)|2 ds

≤ CE |ψ(t)|p +

|k(t, s, 0)| ds

, (3.8)

S

t

m×d

m

for t ∈ [S, T ]. If k̄ : [R, S] × [S, T ] × R

× Ω → R also satisfies (H0), ψ̄(·) ∈

LpFT (S, T ), and (Ȳ (·), Z̄(·, ·)) ∈ Hp [S, T ] is the unique adapted M-solution of BSVIE

(3.7) in which (k, ψ) is replaced by (k̄, ψ̄), then

n

Z T

p/2 o

p

E |Y (t) − Ȳ (t)| +

|Z(t, s) − Z̄(t, s)|2 ds

S

(3.9)

n

Z T

o

p

≤ CE |ψ(t) − ψ̄(t)|p +

|k(t, s, Z(t, s)) − k̄(t, s, Z(t, s))| ds

,

t

for t ∈ [S, T ].

The proof of Theorem 2.3 is split into three steps, in which we find solutions for

the three BSVIE’s: (3.10), (3.20), and (1.1).

3.1. Existence and uniqueness of M-solution for the BSVIE.

Z T

Z T

Y (t) = ψ(t) +

g(t, s, Y (s), Y (t), Z(t, s), Z(s, t)) ds −

Z(t, s) dW (s), (3.10)

t

for t ∈ [0, T ].

t

8

W. LI, R. WU, K. WANG

EJDE-2014/178

Theorem 3.3. Let (H1) hold. Then for any ψ(·) ∈ L2FT (0, T ), (3.10) admits

a unique adapted M-solution (Y (·), Z(·, ·)) ∈ H2 [0, T ]. Moreover, the following

estimate holds:

k(Y (·), Z(·, ·))k2H2 [R,T ]

Z

nZ T

≡E

|Y (t)|2 dt +

R

≤ CL E

T

Z

R

nZ

T

|ψ(t)|2 dt +

Z

T

o

|Z(t, s)|2 ds dt

R

T Z T

R

R

(3.11)

2 o

|g(t, s, 0, 0, 0, 0)| ds dt ,

R ∈ [0, T ].

t

If ḡ also satisfies (H1), ψ̄(·) ∈ L2FT (0, T ), and (Ȳ (·), Z̄(·, ·)) ∈ H2 [0, T ] is the

adapted M-solution of (3.10) in which (g, ψ) is replaced by (ḡ, ψ̄), then

Z TZ T

nZ T

o

E

|Y (t) − Ȳ (t)|2 dt +

|Z(t, s) − Z̄(t, s)|2 ds dt

R

R

≤ CL E

R

T

nZ

|ψ(t) − ψ̄(t)|2 dt +

Z

R

T

Z

R

T

|g(t, s, Y (s), Y (t), Z(t, s), Z(s, t))

t

2 o

− ḡ(t, s, Y (s), Y (t), Z(t, s), Z(s, t))| ds dt ,

R ∈ [0, T ].

(3.12)

Proof. We split the proof into three steps.

Step 1: Let M2 [S, T ] be a subspace of H2 [S, T ], and for any (y(·), z(·, ·)) ∈

M2 [S, T ] satisfies

Z t

y(t) = E(y(t)|FS ) +

z(t, s) dW (s), a.e. t ∈ [S, T ], a.s.,

(3.13)

S

and define

n Z

ky(·), z(·, ·)kM2 [S,T ] ≡ E

T

S

2

|y(t)|2 dt +

Z

T

S

Z

T

o1/2

|z(t, s)|2 ds dt

.

t

2

Clearly, M [S, T ] is a nontrivial closed subspace of H [S, T ].

For any ψ(·) ∈ L2FT (S, T ), (y(·), z(·, ·)) ∈ M2 [S, T ], consider the BSVIE:

Z T

Z T

Y (t) = ψ(t)+

g(t, s, y(s), y(t), Z(t, s), z(s, t)) ds−

Z(t, s) dW (s), t ∈ [S, T ].

t

t

Applying Lemma 3.2, this BSVIE admits a unique adapted M-solution (Y (·), Z(·, ·))

in H2 [S, T ]. On the other hand, (Y (·), Z(·, ·)) salsifies (3.13), hence (Y (·), Z(·, ·)) ∈

M2 [S, T ].

Define map Λ : M2 [S, T ] → M2 [S, T ] by

Λ(y(·), z(·, ·)) = (Y (·), Z(·, ·)).

(3.14)

If (ȳ(·), z̄(·, ·)) ∈ M2 [S, T ], and Λ(ȳ(·), z̄(·, ·)) = (Ȳ (·), Z̄(·, ·)), then by (3.9) we

obtain

Z T

h

i

E |Y (t) − Ȳ (t)|2 +

|Z(t, s) − Z̄(t, s)|2 ds

S

≤ CE

hZ

t

T

i2

|g(t, s, y(s), y(t), Z(t, s), z(s, t)) − ḡ(t, s, ȳ(s), ȳ(t), Z(t, s), z̄(s, t))| ds

EJDE-2014/178

≤ CE

T

hZ

EXISTENCE AND UNIQUENESS

9

Lζ (t, s)|y(s) − ȳ(s)| + Lη (t, s)|y(t) − ȳ(t)| + Lς (t, s)|z(s, t)

t

i2

− z̄(s, t)| ds

≤ 9CA

2

2+ε

(T − t)

i

− z̄(s, t)|2 ds .

ε

2+ε

E

hZ

T

|y(s) − ȳ(s)|2 + |y(t) − ȳ(t)|2 + |z(s, t)

t

Consequently, we obtain that

kΛ(y(·), z(·, ·)) − Λ(ȳ(·), z̄(·, ·))k2M2 [S,T ]

Z TZ T

i

hZ T

|Z(t, s) − Z̄(t, s)|2 ds dt

≡E

|Y (t) − Ȳ (t)|2 dt +

t

S

S

2

ε

≤ 9CA 2+ε (T − t) 2+ε max{1, 2(T − S)}E

nZ

T

|y(t) − ȳ(t)|2 dt

S

Z

T

Z

T

2

|z(s, t) − z̄(s, t)| ds dt

+

S

o

t

ε

≤ C3 (T − S) 2+ε k(y(·), z(·, ·)) − (ȳ(·), z̄(·, ·))k2M2 [S,T ] ,

2

where C3 = 9CA 2+ε max{1, 2(T − S)}. So Λ : M2 [S, T ] → M2 [S, T ] is contracting,

if T − S is sufficiently small. Then there exists a unique fixed point in M2 [S, T ].

Hence (3.10) admits a unique adapted M-solution (Y (·), Z(·, ·)) ∈ M2 [S, T ].

Now (3.8) yields

Z T

h

i

E |Y (t)|2 +

|Z(t, s)|2 ds

t

T

n

Z

2

≤ CE |ψ(t)| +

2 o

|g(t, s, Y (s), Y (t), 0, Z(s, t))| ds

t

n

Z

2

≤ 4CE |ψ(t)| +

T

2

|g(t, s, 0, 0, 0, 0)| ds

t

+

Z

T

Z

Lζ (t, s)2 ds

T

Z

Lς (t, s)2 ds

t

+

Z

T

Z

|Y (s)|2 ds +

t

t

T

Z

Lη (t, s)2 ds

t

T

T

|Y (t)|2 ds

t

o

|Z(s, t)|2 ds .

t

(3.15)

Consequently,

k(Y (·), Z(·, ·))k2H2 [S,T ]

Z

hZ T

≡E

|Y (t)|2 dt +

S

≤ 4CE

T

Z

S

nZ

T

Z

2

S

T

|ψ(t)| dt +

S

+ 2(T − S)

ε +1

2+ε

A

2

2+ε

Z

S

T

S

T

i

|Z(t, s)|2 ds dt

Z

T

2

|g(t, s, 0, 0, 0, 0)| ds dt

t

|Y (s)|2 ds

10

W. LI, R. WU, K. WANG

+ (T − S)

ε

2+ε

2

T

Z

T

Z

A 2+ε

EJDE-2014/178

o

|Z(s, t)|2 ds dt .

S

S

ε

2+ε

If T − S is so small that 4C(T − S)

A max{2(T − S), 1} < 1/2, then (3.11) holds

with CL = 8C.

Next, let us talk about the stability estimate. Let (Y (·), Z(·, ·)) and (Ȳ (·), Z̄(·, ·))

be adapted M-solutions of (3.10) corresponding to (g, ψ) and (ḡ, ψ̄), respectively.

Denote

Ŷ (t) = Y (t) − Ȳ (t),

Ẑ(t, s) = Z(t, s) − Z̄(t, s),

ψ̂(t) = ψ(t) − ψ̄(t)

ĝ(t, s) = g(t, s, Y (s), Y (t), Z(t, s), Z(s, t)) − ḡ(t, s, Y (s), Y (t), Z(t, s), Z(s, t)).

Then by Hadamard formula, we obtain

Z Th

Ŷ (t) = ψ̂(t) +

α1 (t, s)Ŷ (s) + α2 (t, s)Ŷ (t)

t

+

d

X

Z

i

(βi (t, s)Ẑi (t, s) + β̄i (t, s)Ẑi (s, t)) + ĝ(t, s) ds −

T

Ẑ(t, s) dW (s).

t

i=1

Applying (3.11), we have the stability estimate (3.12) holds with CL = 8C.

In this step we determine the unique solution (Y (t), Z(t, s)) to (3.10) for t, s ∈

[S, T ].

Step 2: Since E[Y (t)|FS ] ∈ L2 (S, T ; L2FS (Ω)), by the Martingale Representation

Theorem we could find a unique Z(·, ·) ∈ L2 (S, T ; L2FS (2S − T, S)) such that

Z S

E[Y (t)|FS ] = E[Y (t)|F2S−T ] +

Z(t, s) dW (s), t ∈ [S, T ].

(3.16)

2S−T

By (3.16) we conclude that

Z S

E

|Z(t, s)|2 ds = E|Y (t)|2 − |EY (t)|2 ,

t ∈ [S, T ].

2S−T

Furthermore,

Z

E

T

Z

S

Z

S

|Z(t, s)|2 ds dt

2S−T

T

|Y (t)|2 dt

≤E

S

≤ 8CE

nZ

T

|ψ(t)|2 dt +

S

Z

T

Z

S

T

2 o

|g(t, s, 0, 0, 0, 0)| ds dt .

t

In this step we determine the unique solution (Y (t), Z(t, s)) of (3.10) for t ∈

[S, T ], s ∈ [2S − T, S].

Step 3: Denote

Y1 (t) = Y (t),

t ∈ [2S − T, S],

Z11 (t, s) = Z(t, s), t ∈ [2S − T, S] × [S, T ],

Y2 (t) = Y (t),

t ∈ [S, T ],

Z12 (t, s) = Z(t, s), t ∈ [S, T ] × [S, T ],

Z21 (t, s) = Z(t, s), t ∈ [2S − T, S] × [2S − T, S],

Z22 (t, s) = Z(t, s), t ∈ [S, T ] × [2S − T, S].

EJDE-2014/178

EXISTENCE AND UNIQUENESS

11

(0)

Set Y1 (t) = 0, and for n = 1, 2, · · · , define the Picard iterations:

Z T

(n−1)

g(t, s, Y2 (s), Y1

ψnS (t) = ψ(t) +

(t), Z11 (t, s), Z22 (s, t)) ds

S

Z

T

−

Z11 (t, s) dW (s),

S

(n)

Y1 (t)

ψnS (t)

=

S

Z

+

(3.17)

(n)

(n)

(n)

(n)

g(t, s, Y1 (s), Y1 (t), Z21 (t, s), Z21 (s, t)) ds

t

S

Z

−

(n)

Z21 (t, s) dW (s),

t

(n)

(n)

for t ∈ [2S − T, S]. Obviously, (Y1 (t), Z21 (t, s)) ∈ M2 [2S − T, S]. Moreover, by

stability estimate (3.12) we can obtain

Z S Z S

hZ S

i

(n)

(n−1)

n−1

n

2

E

|Y1 (t) − Y1 (t)| dt +

|Z21 (t, s) − Z21 (t, s)|2 ds dt

2S−T

≤ 8CE

2S−T

nZ

S

2S−T

o

S

|ψnS (t) − ψn−1

(t)|2 dt .

2S−T

By (2.3) and (3.6), it is not difficult to see that

Z T

h

i

n−1

S

S

2

n

E |ψn (t) − ψn−1 (t)| +

|Z11

(t, s) − Z11

(t, s)|2 ds

S

≤ CKE|Y1n−1 (t) − Y1n−2 (t)|2 ,

and

Z

S

S

|ψnS (t) − ψ̄n−1

(t)|2 dt ≤ 8C 2 KE

8CE

2S−T

|Y1n−1 (t) − Y1n−2 (t)|2 dt.

2S−T

Consequently,

Z

hZ S

n−1

n

2

E

|Y1 (t) − Y1 (t)| dt +

2S−T

S

Z

S

(n)

(n−1)

|Z21 (t, s) − Z21

2S−T

≤ 8C 2 KE

S

Z

(t, s)|2 ds dt

i

2S−T

S

Z

|Y1n−1 (t) − Y1n−2 (t)|2 dt

2S−T

2

n−1

≤ · · · ≤ (8C K)

Z

S

E

|Y11 (t) − Y10 (t)|2 dt.

2S−T

(n)

(n)

By (2.3) it is easy to see that 8C 2 K < 1, then we obtain (Y1 (·), Z21 (·, ·)) and

(n)

(ψnS (·), Z11 (·, ·)) are Cauchy sequences on M2 [2S − T, S] and LpFT (S, T ) × Lp (2S −

T, S; L2F (S, T )), respectively. If n → ∞ in (3.17), we could obtain the unique

adapted M-solution (Y (t), Z(t, s)) of (3.10) for t ∈ [2S − T, S], s ∈ [2S − T, T ].

Now, we give the estimate of solution for (t, s) ∈ [2S − T, S] × [2S − T, T ]. Since

Z S Z S

hZ S

i

E

|Y1 (t)|2 dt +

|Z21 (t, s)|2 ds dt

2S−T

≤ 8CE

2S−T

nZ

S

2S−T

|ψ S (t)|2 dt +

2S−T

S

Z

2S−T

Z

t

S

2 o

|g(t, s, 0, 0, 0, 0)| ds dt ,

12

W. LI, R. WU, K. WANG

EJDE-2014/178

and

T

Z

h

E |ψ S (t)|2 +

i

|Z11 (t, s)|2 ds

S

n

Z

2

≤ CE |ψ(t)| +

T

2 o

|g(t, s, Y2 (s), Y1 (t), 0, Z22 (t, s))| ds

S

T

n

Z

≤ CE |ψ(t)|2 + 4

2 o

|g(t, s, 0, 0, 0, 0)| ds

S

+ 4C(T − S)

ε

2+ε

2

A 2+ε E

T

hZ

|Y2 (s)|2 ds

S

Z

T

i

ε

2

|Z22 (s, t)|2 ds + 4C(T − S) 2+ε +1 A 2+ε E|Y1 (t)|2 .

+

S

2

2ε

2+ε

So, if 32(T − S) A 2+ε C 2 max{1, T − S} < 21 , we have

Z S Z T

hZ S

i

E

|ψ S (t)|2 dt +

|Z11 (t, s)|2 ds dt

2S−T

2S−T

≤ (8C + 3)E

S

T

nZ

|ψ(t)|2 dt +

Z

2S−T

T

T

Z

2S−T

2 o

|g(t, s, 0, 0, 0, 0)| ds dt ,

(3.18)

t

and

E

hZ

S

Z

2

S

S

Z

|Z21 (t, s)|2 ds dt

|Y1 (t)| dt +

2S−T

2S−T

≤ (8C + 4)E

2S−T

T

nZ

i

Z

2

T

|ψ(t)| dt +

2S−T

T

Z

2S−T

2 o

|g(t, s, 0, 0, 0, 0)| ds dt .

(3.19)

t

Combining (3.18) and (3.19), we show that

Z T Z T

nZ T

o

E

|Y (t)|2 dt +

|Z(t, s)|2 ds dt

2S−T

2S−T

≤ (8C + 4)E

nZ

2S−T

T

Z

|ψ(t)|2 dt +

2S−T

T

Z

2S−T

T

2 o

|g(t, s, 0, 0, 0, 0)| ds dt

t

Similar to Step 1, stability estimate (3.12) holds for t ∈ [2S − T, T ]. Then we can

use induction method to finish the theorem.

3.2. Existence and uniqueness of M-solution for the BSVIE.

Z T

Y (t) = F (t, Y (t)) +

g(t, s, Y (s), Y (t), Z(t, s), Z(s, t)) ds

t

Z

−

(3.20)

T

Z(t, s) dW (s), t ∈ [0, T ].

t

Theorem 3.4. If (H1) and (H2) hold for (3.20). Then there admits unique adapted

M-solution (Y (·), Z(·, ·)) ∈ H2 [0, T ], and the following estimate holds:

k(Y (·), Z(·, ·))k2H2 [R,T ]

Z

nZ T

2

≤ CF E

|F (t, 0)| dt +

R

T

R

Z

T

2 o

|g(t, s, 0, 0, 0, 0)| ds dt , R ∈ [0, T ],

t

(3.21)

EJDE-2014/178

EXISTENCE AND UNIQUENESS

13

2CL

where CF = 1−2C

. Furthermore, if ḡ also satisfies (H1), F̄ satisfies (H2), and

LD

(Ȳ (·), Z̄(·, ·)) ∈ H2 [0, T ] is the adapted M-solution of (3.20), in which (g, F ) is

replaced by (ḡ, F̄ ). Then

Z TZ T

i

hZ T

|Z(t, s) − Z̄(t, s)|2 ds dt

E

|Y (t) − Ȳ (t)|2 dt +

R

R

R

≤ CF E

T

nZ

|F (t, Y (t)) − F̄ (t, Y (t))|2 dt

(3.22)

R

T

Z

T

Z

+

R

|g(t, s, Y (s), Y (t), Z(t, s), Z(t, s))

t

2 o

− ḡ(t, s, Y (s), Y (t), Z(t, s), Z(t, s))| ds dt , R ∈ [0, T ].

Proof. Let Y (0) (t) = 0. Since F (t, Y (0) (t)) ∈ L2FT (0, T ), then for n = 1, 2, · · · we

can define the Picard iterations:

Z T

(n)

(n−1)

Y (t) = F (t, Y

(t)) +

g(t, s, Y (n) (s), Y (n) (t), Z (n) (t, s), Z (n) (s, t)) ds

t

T

Z

Z (n) (t, s) dW (s),

−

t ∈ [0, T ].

t

(3.23)

In view of (3.12), we have that

Z

hZ T

(n)

n−1

2

E

|Y (t) − Y

(t)| dt +

0

T

0

Z

≤ CL DE

T

Z

|Z n (t, s) − Z n−1 (t, s)|2 ds dt

i

0

T

|Y1n−1 (t) − Y1n−2 (t)|2 dt ≤ · · ·

0

T

Z

≤ (CL D)n−1 E

|Y11 (t) − Y10 (t)|2 dt.

0

By (2.5) we are sure that (Y (n) (·), Z (n) (·, ·)) is a Cauchy sequence on M2 [0, T ]. Let

n → ∞ in (3.23) we could obtain the unique solution of (3.20). From (3.11), we

have

Z TZ T

hZ T

i

2

E

|Y (t)| dt +

|Z(t, s)|2 ds dt

0

0

0

T

n Z

≤ CL E 2

Z

2

|F (t, 0)| dt + 2D

0

Z

+

0

T

Z

T

|Y (t)|2 dt

(3.24)

0

T

2 o

|g(t, s, 0, 0, 0, 0)| ds dt .

t

So from (2.5) and (3.24) we conclude that

Z TZ T

hZ T

i

E

|Y (t)|2 dt +

|Z(t, s)|2 ds dt

0

≤ CF E

0

nZ

0

0

T

|F (t, 0)|2 dt +

Z

0

T

Z

T

2 o

|g(t, s, 0, 0, 0, 0)| ds dt ,

t

2CL

. Similar to Step 1 of Theorem 3.3, the stability estimate

where CF = 1−2C

LD

holds. The proof is complete.

14

W. LI, R. WU, K. WANG

EJDE-2014/178

3.3. Existence and uniqueness of M-solution for (1.1).

Proof. Let (Y (0) (t), Z (0) (t, s)) = (0, 0), then for n = 1, 2, · · · we can have the Picard

iterations:

Z Th

n

n−1

Y (t) = F (t, Y

(t)) −

h(t, s, Y (n−1) (s), Y (n−1) (t), Z (n−1) (t, s))

t

i

− Z (n−1) (t, s) dW (s)

Z T

(3.25)

+

g(t, s, Y n (s), Y n (t), Z n (t, s), Z n (s, t)) ds

t

T

Z

Z n (t, s) dW (s),

−

t ∈ [0, T ].

t

By (3.22) and Itô’s isometry, we have

Z

hZ T

(n)

(n−1)

2

E

|Y (t) − Y

(t)| dt +

0

T

0

T

nZ

T

Z

|Z (n) (t, s) − Z (n−1) (t, s)|2 ds dt

i

0

T

Z

|h(t, s, Y (n−1) (s), Y (n−1) (t), Z (n−1) (t, s)) − Z (n−1) (t, s)

o

− [h(t, s, Y (n−2) (s), Y (n−2) (t), Z (n−2) (t, s)) − Z (n−2) (t, s)]|2 ds dt

Z TZ T

≤ CF Lξ E

|Z (n−1) (t, s) − Z (n−2) (t, s)|2 ds dt

≤ CF E

0

t

0

0

T

Z

(Y (n−1) (s) − Y (n−2) (s)) ds.

+ CF (Lζ + Lη )T E

0

(3.26)

By (2.6), we see that max{CF Lζ , CF (Lζ + Lη )T } = M < 1, and then

Z TZ T

hZ T

i

(n)

(n−1)

2

E

|Y (t) − Y

(t)| dt +

|Z (n) (t, s) − Z (n−1) (t, s)|2 ds dt

0

0

≤ ME

0

T

hZ

|Y (n−1) (t) − Y (n−2) (t)|2 dt

0

T

Z

T

Z

+

0

≤M

i

|Z (n−1) (t, s) − Z (n−2) (t, s)|2 ds dt ≤ · · ·

0

n−1

E

T

hZ

|Y

(1)

(t) − Y

(0)

2

Z

Z

(t)| dt +

0

0

(n)

T

T

|Z (1) (t, s) − Z (0) (t, s)|2 ds dt

i

0

holds. So we obtain (Y (·), Z (·, ·)) is a Cauchy sequence on M2 [0, T ]. Let

n → ∞ in (3.25) we obtain the unique adapted M-solution of (1.1). From (3.21),

we have

Z TZ T

hZ T

i

|Z(t, s)|2 ds dt

E

|Y (t)|2 dt +

0

0

≤ CF E

T

nZ

+

0

T

0

Z

|F (t, 0) −

0

Z

(n)

T

h

i

h(t, s, 0, 0, Z(t, s)) − Z(t, s) dW (s)|2 dt

t

Z

t

T

2 o

|g(t, s, 0, 0, 0, 0)| ds dt

EJDE-2014/178

≤ CF E

EXISTENCE AND UNIQUENESS

T

nZ

Z

|F (t, 0)|2 dt + 4Lξ

0

T

Z

Z

T

T

Z

|Z(t, s)|2 ds dt

0

0

T

T

Z

2

|h(t, s, 0, 0, 0)| ds dt +

+4

Z

0

t

0

15

T

2 o

|g(t, s, 0, 0, 0, 0)| ds dt .

t

So

E

T

hZ

2

Z

T

Z

T

|Y (t)| dt +

0

0

≤ Ch E

Z

nZ

+

0

0

T

0

T Z T

i

|Z(t, s)|2 ds dt

|F (t, 0)|2 dt +

Z

T

Z

0

T

2

|g(t, s, 0, 0, 0, 0)| ds dt

(3.27)

t

o

|h(t, s, 0, 0, 0)|2 ds dt

t

4CF

where Ch = 1−4L

. Similar to Step 1 of Theorem 3.3, applying the Hadamard

ξ CF

formula it is not difficult to see that (2.8) holds.

Acknowledgements. This research was supported by the NNSF of China (Nos.

11301112, 11171081 and 11171056), by the NNSF of Shandong Province (No.

ZR2013AQ003), by China Postdoctoral Science Foundation funded project (Nos.

2013M541352, 2014T70313), by HIT.IBRSEM.A.2014014 and by the Key Project

of Science and Technology of Weihai (No.2013DXGJ04).

References

[1] K. Bahlali; Backward stochastic differential equations with locally Lipschitz coefficient, C. R.

A. S, Paris, serie I. 333 (2001) 481-486.

[2] N. El Karoui, S. Peng, M. C. Quenez; Backward stochastic differential equations in finance,

Mathematical Finance. 7 (1997) 1-71.

[3] Y. Hu, J. Ma; Nonlinear Feynman-Kac formula and discrete-functional-type BSDEs with

continuous coefficients, Stochastic Process Appl. 112 (2004) 23-51.

[4] X. Mao; Adapted solution of backward stochastic differential equation with non-Lipschitz

coefficients, Stochastic Process Appl. 58 (1995) 281-292.

[5] E. Pardoux, S. Peng; Adapted solution of backward stochastic equations, Systems Control

lett. 14 (1990) 55-61.

[6] J. Yong; Completeness of security markets and solvability of linear backward stochastic differential equations, J. Math. Anal. Appl. 319 (2006) 333-356.

[7] J. Yong, X. Zhou; Stochastic Controls: Hamiltonian System and HJB Equations, Springer,

New York (1999).

[8] J. Yong; Backward stochastic Volterra integral equations and some related problems, Stochastic Process Appl. 116 (2006) 779-795.

[9] J. Yong; Continuous-time dunamic risk measures by backward stochastic Volterra integral

equations, Applicable Analysis. 86 (2007) 1429-1442.

[10] J. Yong; Well-Posedness and regularity of backward stochastic Volterra integral equations,

Probability Theory and Related Fields, 142 (2008) 21-77.

Wenxue Li

Department of Mathematics, Harbin Institute of Technology (Weihai), Weihai 264209,

China

E-mail address: wenxuetg@hitwh.edu.cn, Phone +86 0631 5687035, fax +86 0631 5687572

Ruihua Wu

Department of Mathematics, Harbin Institute of Technology (Weihai), Weihai 264209,

China

E-mail address: wu ruihua@hotmail.com

16

W. LI, R. WU, K. WANG

EJDE-2014/178

Ke Wang

Department of Mathematics, Harbin Institute of Technology (Weihai), Weihai 264209,

China

E-mail address: wangke@hitwh.edu.cn