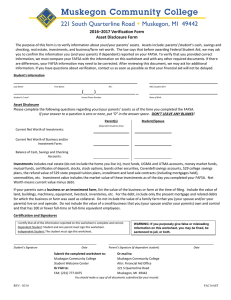

2015–2016 Verification Form Asset Disclosure Form

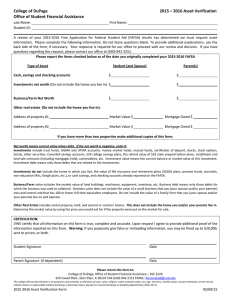

advertisement

2015–2016 Verification Form Asset Disclosure Form The purpose of this form is to verify information about your/your parents’ assets. Assets include: parents’/student’s cash, savings and checking, real estate, investments, and business/farm net worth. The law says that before awarding Federal Student Aid, we may ask you to confirm the information you (and your parents if dependent) reported on your FAFSA. To verify that you provided correct information, we must compare your FAFSA with the information on this worksheet and with any other required documents. If there are differences, your FAFSA information may need to be corrected. After reviewing this document, we may ask for additional information. If you have questions about verification, contact us as soon as possible so that your financial aid will not be delayed. Student’s Information _______________________________________________ __________________________ Last Name MCC Student ID # First Name M.I. __________________________(____)_______________ _ __________________________ Student’s E-mail Date of Birth Home Phone Number Asset Disclosure Please complete the following questions regarding your/your parents’ assets as of the time you completed the FAFSA. If your answer to a question is zero or none, put “0” in the answer space. DON’T LEAVE ANY BLANKS! Parent(s) Student/Spouse (Dependent Students Only) Current Net Worth of Investments: Current Net Worth of Business and/or Investment Farm: Balance of Cash, Savings and Checking Accounts: Investments includes real estate (do not include the home you live in), trust funds, UGMA and UTMA accounts, money market funds, mutual funds, certificates of deposit, stocks, stock options, bonds other securities, Coverdell savings accounts, 529 college savings plans, the refund value of 529 state prepaid tuition plans, installment and land sale contracts (including mortgages held), commodities, etc. Investment value includes the market value of these investments as of the day you completed your FAFSA. Net Worth means current value minus debt. If your parents own a business or an investment farm, list the value of the business or farm at the time of filing. Include the value of land, buildings, machinery, equipment, livestock, inventories, etc. For the debt, include only the present mortgage and related debts for which the business or farm was used as collateral. Do not include the value of a family farm that you (your spouse and/or your parents) live on and operate. Do not include the value of a small business that you (your spouse and/or your parents) own and control and that has 100 or fewer full-time or full-time equivalent employees. Certification and Signatures I certify that all of the information reported on this worksheet is complete and correct. Dependent Student: Student and one parent must sign this worksheet. Independent Student: The student must sign this worksheet. WARNING: If you purposely give false or misleading information on this worksheet, you may be fined, be sentenced to jail, or both. _________________________________________________ ______________________________________________________________ Student’s Signature Parent’s Signature (if dependent student) Date Submit the completed worksheet to: Muskegon Community College Student Welcome Center Or FAX to: FAX: (231) 777-0475 Date Or mail to: Muskegon Community College Attn: Financial Aid Office 221 S Quarterline Road Muskegon, MI 49442 You should make a copy of all documents submitted for your records REV: 03/15 FAC15AST