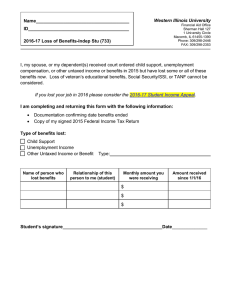

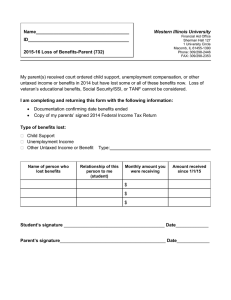

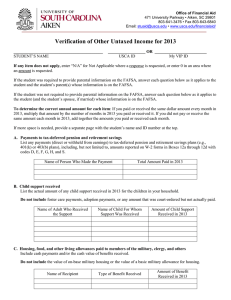

2016–2017 Verification Form Other Untaxed Income

advertisement

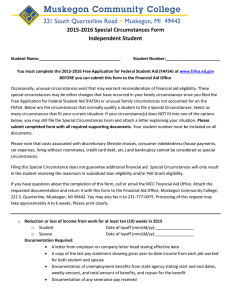

2016–2017 Verification Form Other Untaxed Income _______________________________________________ _____________________________________ Last Name First Name M.I. MCC Student ID # ______________________________________________(______)_______________________________ Student’s E-mail __________________________ Home Phone Number __________________________ Date of Birth You reported unusually low income on the FAFSA. Please complete the following questions regarding untaxed income as of the time you completed the FAFSA. If you were required to provide parental information on the FAFSA, answer each question as it applies to you and your parent(s). If not, answer each question as it applies to you (and spouse, if married). If your answer to a question is zero or not applicable, put “0” or “N/A” in the answer space. Failure to report adequate income to demonstrate support will result in denial of your request for financial aid at MCC. Don’t leave any blanks! STUDENT PARENT I) 2015 UNTAXED INCOME RESOURCES: List Annual Amounts (& Spouse if married) (If dependent) List any payments (direct or withheld from earnings) to tax-deferred pension and retirement savings plans (e.g., 401(k) or 403(b) plans), including, but not limited to, amounts reported on W-2 $ $ forms in Boxes 12a through 12d with codes D, E, F, G, H, and S. List the actual amount of any child support received in 2015 for the children in your household. Do $ $ not include Foster Care or adoption payments. Housing, food, and other living allowances paid to members of the military, clergy, and others. $ $ Include cash payments and/or the cash value of benefits received. List the total amount of veterans non-education benefits received in 2015. Include Disability, Death Pension, Dependency and Indemnity Compensation (DIC), and/or VA Educational Work-Study $ $ allowances. List the amount of other untaxed income not reported and not excluded elsewhere on this form. Include untaxed income such as workers’ compensation, disability, Black Lung Benefits, untaxed portions of health savings accounts from IRS Form 1040 Line 25, Railroad Retirement Benefits, etc. $ $ Do not include untaxed Social Security benefits, Supplemental Security Income (SSI), Workforce Investment Act (WIA) educational benefits. List any money received or paid on the student’s behalf (e.g., payment of student’s bills) and not reported elsewhere on this form. Enter the total amount of cash support the student received in $ $ 2015. Include support from a parent whose information was not reported on the student’s 2016– 2017 FAFSA, but do not include support from a parent whose information was reported. Source Amount per Month Amount per Month II) Additional Support Explanation: List Monthly Amount Example: SSI $0 $ 1,500 Complete this section only if you (and spouse, if married) and parent(s) (if dependent) total taxed and untaxed annual income reported is less than 70% of the poverty guidelines*. Please explain how you/your parents met monthly expenses (like low income housing, SNAP benefits, cash aid, Welfare benefits, Social Security benefits, VA Education benefits, etc.). Continue on the back of this form if more space is needed. *http://aspe.hhs.gov/poverty/15poverty.cfm#guidelines Certification and Signatures I certify that all of the information reported on this worksheet is complete and correct. Dependent Student: Student and one parent must sign this worksheet. Independent Student: The student must sign this worksheet. ___________________________________________________ Student’s Signature Date WARNING: If you purposely give false or misleading information on this worksheet, you may be fined, be sentenced to jail, or both. ___________________________________________________________ Parent’s Signature (if dependent student) Date Submit the completed worksheet to: Or mail to: Muskegon Community College Muskegon Community College Student Welcome Center Attn: Financial Aid Office Or FAX to: 221 S Quarterline Road FAX: (231) 777-0475 Muskegon, MI 49442 You should make a copy of all documents submitted for your records REV: 02/16 FAC16OUI