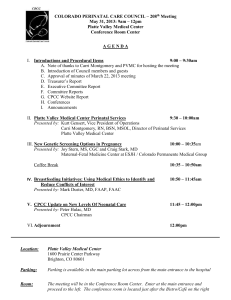

Board of Directors Regular Meeting Thursday, April 28, 2016, 9:00 a.m.

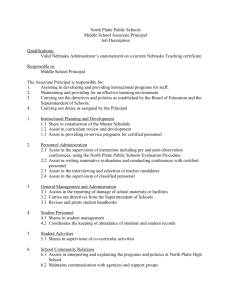

advertisement