Solution Techniques Models Complex models tend to be valid Is the model tractable?

advertisement

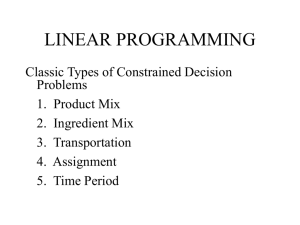

Solution Techniques Models Thousands (or millions) of variables Thousands (or millions) of constraints Complex models tend to be valid Is the model tractable? Solution techniques IE 312 1 Definitions Solution: a set of values for all variables n decision variables: solution n-vector Scalar is a single real number Vector is an array of scalar components IE 312 2 Some Vector Operations Length (norm) of a vector x x = n 2 j x j =1 x1 + y1 M x +y = xn + yn Sum of vectors Dot product ofn vectors x y= j =1 xj y j IE 312 3 Neighborhood/Local Search Find an initial solution Loop: Look at “neighbors” of current solution Select one of those neighbors Decide if to move to selected solution Check stopping criterion IE 312 4 Example: DClub Location Location of a discount department store Three population centers Center 1 has 60,000 people Center 2 has 20,000 people Center 3 has 30,000 people Maximize business Decision variables: coordinates of location IE 312 5 Constraints Must avoid congested centers (within 1/2 mile): x1 (1) 2 + ( x2 3) 2 = (1 / 2) 2 ( x1 1) 2 + ( x2 3) 2 = (1 / 2) 2 ( x1 0) 2 + ( x2 (4)) 2 = (1 / 2) 2 IE 312 6 Objective Function 60 max p( x1 , x2 ) = 2 2 1 + ( x1 + 1) + ( x2 3) 20 + 2 2 1 + ( x1 1) + ( x2 3) 30 + 2 2 + + + 1 ( x1 ) ( x2 3) IE 312 7 Objective Function IE 312 8 Searching 5 4 3 2 1 0 -1 -2 -3 -4 -5 -5 -4 -3 -2 -1 0 IE 312 1 2 3 4 5 9 Improving Search Begin at feasible solution Advance along a search path Ever-improving objective function value Neighborhood: points within small positive distance of current solution Stopping criterion: no improvement IE 312 10 Local Optima Improving search finds a local optimum May not be a global optimum (heuristic solution) Tractability: for some models there is only one local optimum (which hence is global) IE 312 11 Selecting Next Solution Direction-step approach x ( t +1) = x(t ) + l x Step size Search direction Improving direction: objective function better (t ) (t ) + l for x x than x for all value of l that are sufficiently small Feasible direction: not violate constraints IE 312 12 Step Size How far do we move along the selected direction? Usually: Maintain feasibility Improve objective function value Sometimes: Search for optimal value IE 312 13 Detailed Algorithm Initialize: choose initial solution x(0); t=0 If no improving direction x, stop. Find improving feasible direction x (t+1) Choose largest step size lt+1 that remains feasible and improves performance 4 Update 0 1 2 3 x ( t +1) = x + lt +1 x (t ) ( t +1) Let t=t+1 and return to Step 1 IE 312 14 Stopping Search terminates at local optimum If improving direction exists cannot be a local optimum If no improving direction then local optimum Potential problem with unboundedness Can improve performance forever Search does not terminate IE 312 15 Local Optimum 5 4 3 2 1 0 -1 -2 -3 -4 -5 -5 -4 -3 -2 -1 0 IE 312 1 2 3 4 5 16 Improving Search Still a bit abstract ‘Find improving feasible direction’ How? IE 312 17 Smooth Functions Assume objective function is smooth What does this mean? You can find the derivative Smooth Not Smooth IE 312 18 Gradients Function f (x) = f ( x1 , x2 ,..., xn ) The gradient is found from the partial derivatives f (x) = ( f / x1 , f / x2 ,..., f / xn ) Note that the gradient is a vector IE 312 19 Example 60 max p( x1 , x2 ) = 2 2 1 + ( x1 + 1) + ( x2 3) 20 + 2 2 1 + ( x1 1) + ( x2 3) 30 + 2 2 1 + ( x1 ) + ( x2 + 3) IE 312 20 Partial Derivatives p( x1 , x2 ) = x1 60× 1 + ( x 1 +1) + ( x2 3) 2 2 x1 2 2 2 1 + ( x1 +1) + ( x2 3) 120×( x1 +1) = +... 2 2 2 + + + 1 ( x1 1) ( x2 3) [ ] [ +... ] IE 312 21 Plotting Gradients 5 4 3 2 1 0 -1 -2 -3 -4 -5 -5 -4 -3 -2 -1 0 IE 312 1 2 3 4 5 22 Direction of Gradients Gradients are perpendicular to contours of objective function direction most rapid objective value increase Using gradients as direction gives us the steepest descent/ascent (greedy) IE 312 23 Effect of Moving When moving in direction x: The objective function is increased if (Improving direction for maximization) The objective function is decreased if f ( x) x 0 f ( x) x < 0 IE 312 24 Feasible Direction Make sure the direction is feasible Only have to worry about active constraints (tight/binding constraints) No active constrains x2 <= 6 x1<= 9 x1 IE 312 One active constraint Active if equality sign holds! 25 Linear Constraints Direction Dx is feasible if and only if n (iff) a x 0, if a j Dx j b a x 0, if a x = 0, if j =1 n a Dx j b a Dx j =b j =1 n j =1 IE 312 j j 26 Comments The gradient gives us A greedy improving direction Building block for other improving directions (later) Conditions Check if direction is improving (gradient) Check if direction is feasible (linear) IE 312 27 Validity versus Tractability Which models are tractable for improving search? Stops when it encounters a local optimum This is guaranteed to be a global optimum only if it is unique IE 312 28 Unimodal Functions Unimodal functions: Straight line from a point to a better point is always an improving direction IE 312 29 Typical Unimodal Function IE 312 30 Linear Objective Linear objective functions f ( x) = n j =1 cj xj = c x Unimodal for both maximization and minimization IE 312 31 Check First calculate n n j =1 j =1 f (x (1) ) f (x ( 2) ) = c j x (j 2) c j x (j1) n = c j x (j 2) x (j1) j =1 = c (x ( 2) x (1) ) = f (x (1) ) (x ( 2) x (1) ) Then apply our test to Dx = x ( 2) x(1) IE 312 32 Optimality Assume our objective function is unimodal Then every unconstrained local optimum is an unconstrained global optimum Note that none of the constraints can be active (tight) IE 312 33 Convexity Now lets turn to the feasible region A feasible region is convex if any line segment between two points in the region is contained in the region IE 312 34 Line Segments Representing a line (1) x + lx ( 2) x (1) , l [0,1] To prove convexity, we have to show that for any points in the region, all points that can be represented as above are also in the region IE 312 35 Linear Constraints If all constraints are linear then the feasible region is convex Suppose wen have two feasible npoints: (1) a x j j b and j =1 ( 2) a x j j b j =1 How about a point on the line between: x = x(1) + l x( 2) x(1) = (1 l )x(1) + lx( 2) ? IE 312 36 Verify Constraints Hold n n (1) ( 2) (1) ( 2) a ( 1 l ) x + l x = a ( 1 l ) x + a l x j j j j j j j j =1 j =1 n n j =1 j =1 = a j (1 l ) x (j1) + a j lx (j2) n n j =1 j =1 (1 l ) a j x (j1) + l a j x (j2 ) (1 l )b + lb = b IE 312 37 Example x2 x2 6 x1 9 x1 IE 312 38 Tractability (This is the reason we are defining all these term!) The most tractable models for improving search are models with unimodal objective function convex feasible region Here every local optimum is global IE 312 39 Improving Search Algorithm 0 Initialize: choose initial solution x(0); t=0 1 If no improving direction Dx, stop. 2 Find improving feasible direction Dx (t+1) 3 Choose largest step size lt+1 that remains feasible and improves performance 4 Update x ( t +1) = x + lt +1Dx (t ) ( t +1) Let t=t+1 and return to Step 1 IE 312 40 Initial Feasible Solutions Not always trivial to find an initial solution Initial analysis: Thousands of constraints and variables Does a feasible solution exist? If yes, find a feasible solution Two methods Two-phase method Big-M method IE 312 41 Two-Phase Method Phase I Phase II Choose a solution to model and construct a new model by adding artificial variables for each violated constraint Assign values to artificial variables. Perform improving search to minimize sum of artificial variables If terminate at zero then feasible model and continue, otherwise stop Delete artificial components to get feasible solution Start an improving search IE 312 42 Crude Oil Refinery min 20 x1 + 15x2 s.t. 0.3 x1 + 0.4 x2 2.0 (gasoline) 0.4 x1 + 0.2 x2 1.5 (jet fuel) 0.2 x1 + 0.3 x2 0.5 (lubricant s) x1 9 x2 6 x1 , x2 0 IE 312 43 Artificial Variables Select a convenient solution x1 = 0, x2 = 0 Add artificial variables for violated constraints 0.3 x1 + 0.4 x2 + x3 2.0 0.4 x1 + 0.2 x2 + x4 1.5 0.2 x1 + 0.3 x2 + x5 0.5 x1 9 x2 6 x1 , x2 , x3 , x4 , x5 0 IE 312 44 Phase I Model min f ( x1 , x2 , x3 ) = x1 + x2 + x3 s.t. 0.3 x1 + 0.4 x2 + x3 2.0 0.4 x1 + 0.2 x2 + x4 1.5 0.2 x1 + 0.3 x2 + x5 0.5 x1 9 x2 6 x1 , x2 , x3 , x4 , x5 0 IE 312 45 Phase I Initial Solutions As before To assure feasibility (0) 3 x x1( 0) = 0, x2( 0) = 0 = 2, x (0) 3 = 1.5, x ( 0) 4 = 0.5 Thus, the initial solution is x (0) = (0,0,2,1.5,0.5) IE 312 46 Phase I Outcomes We cannot get negative numbers and problem cannot be unbounded Three possibilities Terminate with f =0 Terminate at global optimum with f > 0 Start Phase II with final solution as initial solution Problem is infeasible Terminate at local optimum with f > 0 Cannot say anything IE 312 47 Big-M Method Artificial variables as before Objective function min 20 x1 + 15 x2 + M ( x3 + x2 + x5 ) originalobjective penaltyfor violating constraints Combines Phase I and Phase II search IE 312 48 Terminating Big-M If terminates at local optimum with all artificial variables = 0, then also local optimum for original problem If M is ‘big enough’ at terminates at global optimum with some artificial variables >0, then original problem infeasible Cannot say anything in between IE 312 49 Linear Programming We know what leads to high tractability: We know how to guarantee this Unimodal objective function Convex feasible region Linear objective function Much stronger! Linear constraints When are linear programs valid? IE 312 50 Allocation Models Scarce resource Allocate resources to competing ‘jobs’ Decision variables: Land, capital, time, fuel, etc. How much to allocate to each job Constraints: Limitation on resources Other dynamics IE 312 51 Forest Service Allocation Manage 191 acres of national forest Jobs (Prescriptions): Logging Grazing Wilderness preservation 7 analysis areas This is a simplified version of an actual application (fewer variables/constraints) IE 312 52 Analysis Goals Maximize the net present value (NPV) of the land, such that we produce at least 40 million board feet of timber, we have at least 5 thousand animal unit months of grazing, and we keep wilderness index at least 70. IE 312 53 Data Area Acres Use NPV Timber Grazing Wild si t i,j g i,j w i,j j p i,j 1 75 2 90 3 140 4 60 5 212 6 98 7 113 1 2 3 1 2 3 1 2 3 1 2 3 1 2 3 1 2 3 1 2 3 503 140 203 675 100 45 630 105 40 330 40 295 105 460 120 490 55 180 705 60 400 310 50 0 198 46 0 210 57 0 112 30 0 40 32 0 105 25 0 213 40 0 0.01 0.04 0 0.03 0.06 0 0.04 0.07 0 0.01 0.02 0 0.05 0.08 0 0.02 0.03 0 0.02 0.04 0 IE 312 40 80 95 55 60 65 45 55 60 30 35 90 60 60 70 35 50 75 40 45 95 54 Objective: Maximize NPV xi , j = thousands of acres in area i managed by prescripti on j 7 3 max pi , j xi , j = 503x1,1 + 140 x1, 2 + 203x1,3 + ... i =1 j =1 ... + 705 x7 ,1 + 60 x7 , 2 + 400 x7 ,3 IE 312 55 Constraints All acres in3 an area are allocated x j =1 i, j = s j , i Performance requirements are met 7 3 t i =1 j =1 7 3 g i =1 j =1 x 40,000 (timber) i, j i, j x 5 (grazing) i, j i, j 1 7 3 wi , j xi , j 70 (wildernes s) 788 i =1 j =1 IE 312 56 Blending Models Best mix of ingredients Applications chemicals animal feed metals diets Example: Fagersta AB - Swedish Steel Mill IE 312 57 Steel Mill Charging a furnish Combine 1000 kilogram charge Scrap in inventory Pure blend Blend with right % of chemical elements Iron Other: Carbon, Nickel, Chromium, Molybdenum IE 312 58 Formulation Decision variables How much of each available ingredient to use x j = kilograms of ingredient j included in charge j=1,2,…,7 Four supplies of scrap (1,2,3,4) Three pure materials (5,6,7) IE 312 59 Formulation (cont.) Constraints Correct amount Composition constraints x1 + x2 + x3 + x4 + x5 + x6 + x7 = 1000 Properties of the resulting blend fraction in amount of jth allowed fraction blend j jth ingredient ingredient used or in the blend total IE 312 60 Example Constraints 7 0.008 x1 + 0.0070 x2 + 0.0085 x3 + 0.0040 x4 0.0065 x j j =1 7 0.008 x1 + 0.0070 x2 + 0.0085 x3 + 0.0040 x4 0.0075 x j j =1 7 0.180 x1 + 0.032 x2 + 1.0 x5 0.0030 x j j =1 7 0.180 x1 + 0.032 x2 + 1.0 x5 0.0035 x j j =1 7 0.120 x1 + 0.011x2 + 1.0 x6 0.010 x j j =1 7 0.120 x1 + 0.011x2 + 1.0 x6 0.012 x j j =1 7 0.001x2 + 1.0 x7 0.011 x j j =1 7 0.001x2 + 1.0 x7 0.013 x j j =1 IE 312 61 Other Constraints Availability x1 75 x2 250 Positive Amounts x j 0, j = 1,2,...,7 IE 312 62 Objective Function Minimize Cost min 16 x1 + 10 x2 + 8x3 + 9 x4 + 48x5 + 60 x6 + 53x7 Note that the pure additives are very expensive! IE 312 63 Ration Constraints Bound quotients of linear functions by a constant 7 0.008 x1 + 0.0070 x2 + 0.0085 x3 + 0.0040 x4 0.0065 x j j =1 0.008 x1 + 0.0070 x2 + 0.0085 x3 + 0.0040 x4 0.0065 x1 + x2 + x3 + x4 + x5 + x6 + x7 Not linear! Can often be converted to linear constraints IE 312 64 Linear Programming Models Allocation Blending Operations Planning Shift Scheduling IE 312 65 Operations Planning What to do and when to do it? Tubular Products Division of Babcock and Wilcox New mill Three existing mills Optimal distribution of work? IE 312 66 Problem Data Product Standard 1 .5" thick 2 .5" thin 3 1" thick 4 1" thin 5 2" thick 6 2" thin 7 8" thick 8 8" thin Pressure 1 .5" thick 2 .5" thin 3 1" thick 4 1" thin 5 2" thick 6 2" thin 7 8" thick 8 8" thin Mill 1 Mill 2 Mill 3 Mill 4 Weekly Cost Hours Cost Hours Cost Hours Cost Hours Demand 90 80 104 98 123 113 - 0.8 0.8 0.8 0.8 0.8 0.8 - 75 70 85 79 101 94 160 142 0.7 0.7 0.7 0.7 0.7 0.7 0.9 0.9 70 65 83 80 110 100 156 150 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 63 60 77 74 99 84 140 130 0.6 0.6 0.6 0.6 0.6 0.6 0.6 0.6 100 630 500 980 720 240 75 22 140 124 160 143 202 190 - 1.5 1.5 1.5 1.5 1.5 1.5 - 110 96 133 127 150 141 190 175 0.9 0.9 0.9 0.9 0.9 0.9 1.0 1.0 - - 122 101 138 133 160 140 220 200 1.2 1.2 1.2 1.2 1.2 1.2 1.5 1.5 50 22 353 55 125 35 100 10 IE 312 67 Formulation Decision Variables x p ,m = amount of product p produced at mill m (pounds/we ek) Objective cost of product p 16 min 4 c p =1 m =1 p ,m IE 312 x p ,m 68 Constraints Demand is met 4 x m =1 p ,m Capacity is ok 16 x p =1 d p , p = 1,2,...,16 p ,m bm , m = 1,2,3,4 x p ,m 0, p, m Non-negativity IE 312 69 Canadian Forest Products purchase logs peel logs purchase veneer dry and process press sheets IE 312 sand and trim 70 Study Objectives Stages of Production - More Complex Objective of OR analysis How to operate production facilities Maximize contributed margin Sales - Wood cost Fixed costs: labor, maintenance, etc. Constraints: availability of wood, market for products, capacity of plants IE 312 71 Production Yield Data Available per month Cost per log ($ Canadian) A 1/16" green veneer (ft 2) B 1/16" green veneer (ft 2) C 1/16" green veneer (ft 2) A 1/8" green veneer (ft 2) B 1/8" green veneer (ft 2) C 1/8" green veneer (ft 2) Veneer Yield (ft2) Vendor 1 Vendor 2 Good Fair Good Fair 200 300 100 1000 340 190 490 140 400 200 400 200 700 500 700 500 900 1300 900 1300 200 100 200 100 350 250 350 250 450 650 450 650 IE 312 72 Availability and Costs 1/16" Green Veneer 1/8" Green Veneer A B C A B C Available (ft 2/month) 5000 25000 40000 10000 40000 50000 Cost ($/ft 2) 1.00 0.30 0.10 2.20 0.60 0.20 IE 312 73 Composition of Products 1/4" Plywood Sheets AB AC BC 1/16 A 1/16 B 1/16 B 1/2" Plywood Sheets AB AC BC Front veneer 1/16 A 1/16 B 1/16 B 1/8 C 1/8 C 1/8 C Core veneer 1/8 C 1/8 C 1/8 C 1/8 B 1/8 B 1/8 B 1/8 C 1/8 C 1/8 C Back veneer 1/16 B 1/16 C 1/16 C 1/16 B 1/16 C 1/16 C Market/month 1000 4000 8000 1000 5000 8000 Price $ 45.00 $ 40.00 $ 33.00 $ 75.00 $ 65.00 $ 50.00 Pressing time 0.25 0.25 0.25 0.40 0.40 0.40 IE 312 74 Decision Variables wq , w,t = logs of quality q bought from vendor v and peeled into thickness t xt , g = ft 2 of thickness t , grade g veneer purchased directly yt , g , g ' = sheets of thickness t used as grade g' after processing from grade g zt , g , g ' = sheets of thickness t , front grade g , back grade g' , pressed and sold IE 312 75 Continuous Variables Treat all variables as continuous Continuous models more tractable Is it equally valid? Does one unit back or forth really matter? If no, then ok to use continuous approximation Example: Does $0.01 ever matter? IE 312 76 Objective max - (log cost) - (purchased veneer cost) + (sales income) IE 312 77 Constraints Log availability wG ,1,1/16 + wG ,1,1/ 8 200,... Purchased veneer availability x1/16, A 5000,... Pressing capacity z1/ 4, A, B 1000,... IE 312 78 Balance Constraints Must link log and veneer purchasing Balance constraint assures in-flows equal or exceed out-flows for each stage of production 400wG ,1,1/16 + 200wF ,1,1/16 + 400wG , 2,1/16 + 200wF , 2,1/16 + x1/16, A 35 y1/16, A, A + 35 y1/16, A, B Etc. IE 312 79 Assembly for Two Products Assembly 1 Assembly 2 Part 3 Part 3 Part 4 Assembly 2 Part 3 Part 3 IE 312 Part 4 80 Balance Equations Decision Variable x j = number of j produced Assembly 2 must be at least assembly 1 Must have enough parts x2 x1 x3 2 x1 + 1x2 x4 1x1 + 2 x2 IE 312 81 Shift Scheduling Work fixed Plan resources to do work Shift scheduling/staff planning models How many types of workers/shifts IE 312 82 Ohio National Bank Check processing center All checks must clear by 10 PM Check arrivals: Hour Arrivals Hour Arrivals 11:00 AM 10 5:00 PM 32 12:00 PM 11 6:00 PM 50 1:00 PM 15 7:00 PM 30 2:00 PM 20 8:00 PM 20 3:00 PM 25 9:00 PM 8 4:00 PM 28 IE 312 83 Workers Two types: Full time (8 hour shift, 1 hour lunch) $11 hour + $1 night 150% overtime 1000 checks/hour Part time (4 hour shift) $7 hour 800 check/hour IE 312 84 All Possible Shifts Full Time Shifts 11 12 13 11:00 AM R 12:00 PM R R 1:00 PM R R R 2:00 PM R R R 3:00 PM R R 4:00 PM R R 5:00 PM R R 6:00 PM RN RN RN 7:00 PM RN RN RN 8:00 PM OT RN RN 9:00 PM OT RN Start 11 R R R R - 12 R R R R - Part Time Shifts 13 14 15 16 R R R R R R R R R R R R R RN RN - IE 312 17 R RN RN RN - 18 RN RN RN RN 85 Decision Variables xh = full time workers starting at h = 11,12,13 yh = full time workers w/overtim e starting at h = 11,12 z h = part time workers starting at h = 11,...,18 IE 312 86 Objective Function min 90 x11 + 91x12 + 92 x13 + 18 y11 + 18 y12 + 28 z11 + 28 z12 + 28 z13 + 28 z14 + 29 z15 + 30 z16 + 31z17 + 32 z18 IE 312 87 Constraints No more than 35 operators on duty x11 + z11 35 (11 AM machines) M Overtime limits y11 1 x11 2 1 y12 x12 2 y11 + y12 20 IE 312 88 Covering Constraints Shift provides enough workers (output/wo rker)(numb er on duty) requiremen t shifts 1x11 + 0.8 z11 10 w12 1x11 + 1x12 + 0.8 z11 + 0.8 z12 11 + w12 w13 M IE 312 89 Example Government agency Clerical workers can work 4x 10-hour days/week j = 1 Monday-Wednesday-Thursday-Friday j = 2 Monday-Tuesday-Thursday-Friday j = 3 Monday-Tuesday-Wednesday-Friday Need: Monday - 10 workers Friday 9 workers, and Tuesday - Thursday 7 workers IE 312 90 Formulation Decision variables LP Model x j = number of employees working pattern j min s.t. x1 + x2 + x3 x1 + x2 + x3 10 (cover Monday) x2 + x3 7 (cover Tuesday) x1 + x3 7 (cover Wednesday) x1 + x2 7 (cover Thursday) x1 + x2 + x3 9 (cover Friday) x1 , x2 , x3 0 IE 312 91 Time-Phased Models Static Models One point in time Planning or design stage decisions Dynamic Models Account for decision over time Operational decisions IE 312 92 Institutional Food Services (IFS) Cash Flow Supplies food to restaurants, schools, etc. Cash flow decisions 1 Projected Weekly Amount/Week 2 3 4 5 6 750 $ 1,200 $ 2,100 $ 2,250 $ 180 $ Item Cash sales s t $ 600 $ 330 $ 540 Accounts receivable r t $ 770 $ 1,260 $ 1,400 $ 1,750 $ 2,800 $ 4,900 $ 5,250 $ 420 Accounts payable p t $ 3,200 $ 5,600 $ 6,000 $ 480 $ 880 $ 1,440 $ 1,600 $ 2,000 Expenses e t $ 940 $ 990 $ 350 $ 400 $ 550 $ IE 312 350 $ 7 8 350 $ 410 93 System Dynamics Cash sales and accounts receivable result in immediate income to checking account Accounts payable are due in 3 weeks but get 2% discount if paid immediately Bank $4 million line of credit 0.2% interest/week Must have 20% of borrowed amount in checking Short-term money market with 0.1%/week $20,000 safety balance in checking IE 312 94 Decision Variables Decision Variables g t = amount borrowed in week t ht = amount of debt paid in week t wt = accounts payable delayed until week t + 3 xt = amount invested in money market in week t Define for convenience yt = cumulative line of credit debt in week t zt = cash on hand during week t IE 312 95 Balance Constraints General time-phased models starting impact of starting level in + period t = level in period t decisions period t + 1 Cash flow models cash in net gain in cash in + = period t period t period t + 1 IE 312 96 Net Gain in Each Period Note that we carry both cash and debt Cost Increments Funds borrowed in week t Investment principal from week t-1 Interest on investment in week t-1 Cash sales from week t Accounts receivable for week t Cash Decrements Borrowing paid off in week t Investment in week t Interest on debt in week t-1 Expenses paid in week t Accounts payable paid with discount for week t Accounts payable paid without discount for week t-3 IE 312 97 Balance Constraints Cash balance zt = zt 1 + g t ht + xt 1 xt + 0.001xt 1 0.002 yt 1 + st et + rt 0.98( pt wt ) wt 3 Debt balance yt = yt 1 + g t ht IE 312 98 Linear Programming Model min s.t. 8 8 8 t =1 t =1 t =1 0.002 yt + 0.02 wt 0.001 xt zt = zt 1 + g t ht + xt 1 xt + 0.001xt 1 0.002 yt 1 + st et + rt 0.98( pt wt ) wt 3 yt = yt 1 + g t yt 4000 zt 0.20 yt wt pt zt 20 0 g t , ht , wt , xt , yt , zt IE 312 99 Optimal Solution Decision Variable Borrowing Debt payment Payables delayed Short-term investments Cumulative debt Cumulative cash 1 $ 100.0 $ $ 2,077.6 $ $ 100.0 $ 20.0 2 $ 505.7 $ $ 3,544.5 $ $ 605.7 $ 121.1 Optimal Weekly Amount for Weeks 3 4 5 6 $ 3,394.3 $ $ 442.6 $ $ $ 442.5 $ $ 2,715.3 $ 1,138.5 $ $ $ $ $ $ $ $ 4,000.0 $ 3,557.4 $ 4,000.0 $ 1,284.7 $ 800.0 $ 711.5 $ 800.0 $ 256.9 IE 312 7 8 $ $ 1,284.7 $ $ 2,611.7 $ $ 20.0 $ $ $ $ 1,204.3 $ $ 20.0 100 Time Horizons Fixed time horizon usual case problems with boundaries start with ‘typical’ numbers condition to assure ends ‘reasonably’ Infinite time horizon wrap around (output of last stage input to the first stage) IE 312 101 Example: Balance Constraints Decision variables xq = thousands of snow shovels produced in quarter q iq = thousands of snow shovels held in inventory Demand: 11000, 48000, 64000, 15000 beginning inventory ending + production = demand + inventory 0 + x1 = 11 + i1 i1 + x2 = 48 + i2 i2 + x3 = 64 + i3 i3 + x4 = 15 + i4 IE 312 102 “Typical” Initial Inventory beginning inventory ending + production = demand + inventory 9 + x1 = 11 + i1 i1 + x2 = 48 + i2 i2 + x3 = 64 + i3 i3 + x4 = 15 + i4 IE 312 103 Wrapper (Infinite Horizon) beginning inventory ending + production = demand + inventory i4 + x1 = 11 + i1 i1 + x2 = 48 + i2 i2 + x3 = 64 + i3 i3 + x4 = 15 + i4 IE 312 104