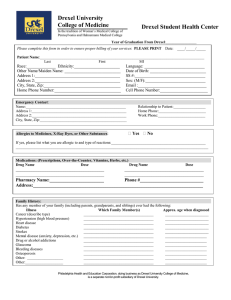

Drexel University and Subsidiaries

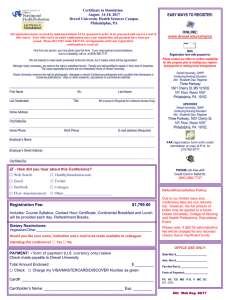

advertisement