Neighborhood Level Foreclosures in Durham County: Census Tract Characteristics and Foreclosure

advertisement

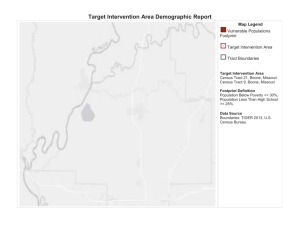

Neighborhood Level Foreclosures in Durham County: Census Tract Characteristics and Foreclosure Report #2 December 2013 UNC Center on Poverty, Work and Opportunity Neighborhood Level Foreclosures in Durham: Report #2 2 Acknowledgments Special thanks to the Office of the Attorney General for the State of North Carolina for making this research possible. Thanks also to Center on Poverty, Work and Opportunity research fellow, Joseph Polich, and research assistants Stephanie Mellini, Kat Gardzalla and David Harper. About the Center The Center on Poverty, Work and Opportunity is a nonpartisan, interdisciplinary research center located in the UNC School of Law. It was founded and designed to study, examine, document, and advocate for proposals, policies and services to mitigate poverty in North Carolina and the nation. Contact information: 323 W. Barbee Chapel Road Campus Box #3382 Chapel Hill, NC 27599-3382 919.445.0196 poverty_center@unc.edu www.law.unc.edu/centers/poverty/ !UNC!Center!on!Poverty,!Work!and!Opportunity! Neighborhood Level Foreclosures in Durham: Report #2 3 Introduction This report is the second in a series analyzing neighborhood-level data obtained from foreclosure files located at the Durham County Clerk of Courts’ office. This data comes from approximately 200 files opened mostly in January and February 2011. The first report gave an overview of foreclosure start locations in Durham County during this time. Using the 2011 American Community Survey 5-Year Estimates, this report will focus on the demographic and socioeconomic characteristics of census tracts with and without foreclosure starts in Durham County. Durham County is currently split into 60 census tracts. Census tracts, which are defined by the U.S. Census Bureau, are geographic subdivisions of a county. Tracts generally contain 1,200 to 8,000 people and can vary widely in spatial size. More sparsely populated areas consist of larger tracts; tracts in areas that are more densely populated, such as city centers, are smaller. Over three-fourths of Durham’s census tracts are represented in our sample (Map 1). As discussed in the first report, a census tract may not appear in our data for a number of reasons. Some contain university campuses and large college student populations (particularly around the universities of Duke and North Carolina Central); others have nonresidential landscape features (commercial areas, large green spaces, the Research Triangle Park) or a preponderance of renters. Random chance may also play a role in which tracts appear in our sample and we will monitor and describe changes as we collect data from more files. !UNC!Center!on!Poverty,!Work!and!Opportunity! Neighborhood Level Foreclosures in Durham: Report #2 Map 1: Location of Foreclosure Starts by Census Tract, Durham County Source:(Foreclosure(Project(data.((Map(made(using(QGIS.( !UNC!Center!on!Poverty,!Work!and!Opportunity! 4 5 Neighborhood Level Foreclosures in Durham: Report #2 Averages for Durham County On average, Durham County’s residents are more racially and ethnically diverse than the state overall (Figure 1). Durham’s residents are more educated, enjoy a lower unemployment rate and are wealthier (Figures 2 and 3). The median home value is higher (Figure 3). Yet compared to the state, Durham’s poverty rate is higher and its homeownership rate lower (Figure 2). Figure 1: Race and Ethnicity 65.7( 70( 60( Percentage( 50( 40( 42.7( 36.9( 30( Durham( 21.2( 20( 12.9( 10( NC( 8.1( 4.4( 2.1( 0( %(African(American( (not(Hispanic)( %(Hispanic( %(Asian((not(Hispanic)( %(White((not(Hispanic)( Source:(2011(ACS(5PYear(EsSmates( (( One of the reasons for this tension in the county’s numbers lies in the relative youth of its residents.i Durham contains a large number of college students, who as a whole have relatively low personal incomes.ii Although the Census Bureau excludes college students who live in dormitories from its poverty calculations, those who live off campus and have incomes below the poverty threshold are included in poverty estimates. One Census Bureau report finds a significant drop in the poverty rate in Durham when off-campus college students are not counted.iii Without obscuring the pockets of deep destitution that exist in the county, a tract-by-tract analysis should differentiate between student and non-student poverty. Similarly, the county’s relatively low homeownership rate may stem in part from higher rates of renting associated with university communities.iv Homeownership rates also increase with age.v The relative youthfulness of Durham’s residents—its median age is one of the lowest in the state—may translate into fewer homebuyers. !UNC!Center!on!Poverty,!Work!and!Opportunity! 6 Neighborhood Level Foreclosures in Durham: Report #2 Figure 2: Education, Unemployment, Poverty and Homeownership Rate 80( 67.8( 70( 55.4( Percentage( 60( 44.4( 50( 40( 26.6( 30( Durham( 17.1( 16.1( 20( 8.1( 10( NC( 9.7( 0( %(25(years(and(up(w/( Unemployment(rate( bachelor's(degree(or( higher( Poverty(rate( Homeownership(rate( Source:(2011(ACS(5PYear(EsSmates( Figure 3: Median Household Income and Home Value $200,000( $178,400( $180,000( $152,700( $160,000( Dollars( $140,000( $120,000( $100,000( Durham( $80,000( $60,000( $50,078( NC( $46,291( $40,000( $20,000( $0( Median(household(income( Median(house(value( Source:(2011(ACS(5PYear(EsSmates(( !UNC!Center!on!Poverty,!Work!and!Opportunity! 7 Neighborhood Level Foreclosures in Durham: Report #2 Averages for Census Tracts with and without Foreclosure Starts In order to get a basic grasp of the characteristics of tracts with and without foreclosure starts, we took the weighted average of a range of demographic and socioeconomic data for each group and compared them to each other and the county average. (Data for all individual tracts can be found in Appendix A.) We first look at tracts without foreclosure starts. In order to facilitate comparisons, Table 1 presents two analyses. The first is a weighted average for all tracts without foreclosure starts.vi The second is a weighted average that excludes tracts containing Duke University.vii It also omits tract 9801 due to its unusually small population and the resulting unreliability of its data.viii Despite the fact that Census Tract 13.01 (located next to NC Central University) exhibits many of the characteristics of a “university” census tract (high percentage of 18 to 24 year-olds, unusually high poverty and unemployment rates, low levels of household income and homeownership), it is included where Duke is not because it also possesses a significant older (and probably non-student) population. Table 1: Average of Census Tracts Without Foreclosure Starts Census&tract& averages& %&African& American& (not& Hispanic)& 24.26( %& Hispanic& %&White& Poverty& (not& rate& Hispanic)& Unemploy= ment&rate& Median& household& income& Home= ownership& rate& Median& home& value& Nonforeclosure( 17.81( 48.46( 19.74( 7.68( $37,978( 37.01( $184,973*( tracts(average((all)( ( Nonforeclosure( 25.08( 19.46( 48.35( 19.67( 7.31( $40,707( 37.05( $184,973*( tracts(average((no( Duke(or(Census( Tract(9801)( ( County(average( 36.9( 12.9( 42.7( 17.1( 8.1( $50,078( 55.4( $178,400( ( *Median(home(value(is(the(same(in(both(analyses(because(values(for(15.01,(15.03(and(9801(are(not(available(from(the(2011(American( Community(Survey(5PYear(Estimates.( %&18=29& years& old& 33.61( 25.66( 21.3( ( Source:(2011(ACS(5PYear(Estimates( Tracts without foreclosure starts present a mixed picture when compared to county averages. They have a smaller percentage of African American residents and a larger percentage of Hispanic and white residents than the county overall. Surprisingly, the average poverty rate for the nonforeclosure tracts is higher than the county average, even without the Duke University tracts. The average unemployment rate under both analyses is slightly lower than the county average. The average median household income, even with the omission of tracts containing Duke, is notably lower than the county average, but the median home value is higher. !UNC!Center!on!Poverty,!Work!and!Opportunity! 8 Neighborhood Level Foreclosures in Durham: Report #2 The comparatively low income and homeownership rates described here may stem from the fact that the percentage of 18 to 29 year olds living in these tracts is higher than the county average and the average median age of tract residents is lower.ix This suggests that one reason these tracts do not appear in our sample is that many of their residents, being young and perhaps just starting their careers, had not yet entered the housing market by 2011. Turning to tracts with foreclosure starts (Table 2), a complementary set of data emerges. Compared to county and nonforeclosure tract averages, foreclosure tracts have a greater portion of African American residents, and a lesser portion of Hispanics and whites. The poverty rate is lower in foreclosure tracts, but unemployment is higher. The average median household income is 30% higher than in nonforeclosure tracts and is higher than the county average. The homeownership rate is higher, perhaps reflecting the increase in age. The median home value is less than in the nonforeclosure tracts. In general, foreclosure tract averages are close to the county averages, a finding that makes sense given that our foreclosure tracts constitute 77% of all census tracts in Durham and 84% of its population.x Table 2: Average of Census Tracts with Foreclosure Starts and Comparison to No Foreclosure Tracts Census&tract&& averages& %&African& American& (not& Hispanic)& 39.28( Foreclosure(tracts( average( ( Nonforeclosure( 25.08( tracts(average((no( Duke(or(Census( Tract(9801)( ( County(average( 36.9( %& Hispanic&& %&White& Poverty& (not& rate& Hispanic)& Unemploy =ment& rate& Median& household& income& Home= ownership& rate& Median& home& value& %&18=29& years& old& 12.02( 41.63( 16.63( 8.18( $52,784( 58.92( $173,509( 18.96( 19.46( 48.35( 19.67( 7.31( $40,707( 37.05( $184,973( 25.66( 12.9( 42.7( 17.1( 8.1( $50,078( 55.4( $178,400( 21.3( Source:(2011(ACS(5PYear(Estimates( When considered as a group, foreclosure tracts do not exhibit obvious symptoms of distress. Indeed, by some standards the residents of the foreclosure tracts appear better off than their nonforeclosure counterparts. These averages demonstrate the tug between multiple variables: resident age, the influence of different types of neighborhoods within a census tract, the pull of outliers on averages and many others. In the next section, we’ll examine high foreclosure tracts to see if they reveal evidence of clearer patterns. !UNC!Center!on!Poverty,!Work!and!Opportunity! 9 Neighborhood Level Foreclosures in Durham: Report #2 Characteristics of Census Tracts Most Burdened by Foreclosure Here we’ll look more closely at census tracts with the highest number and rate of foreclosure starts in order to determine whether they possess distinctive characteristics. Table 3 shows the eleven tracts with the highest number of foreclosure starts (the odd number is a consequence of listing all tracts with five foreclosure starts or more). What is most arresting about this array of tracts is the spectrum they represent: from the low poverty and unemployment and high median household income, homeownership rate and median home value in tract 18.08 to the exceptionally high poverty and unemployment and low median household income, homeownership rate and median home value in tract 17.09. This contrasting diversity of features explains some of the tension that we saw in the averages above. Table 3: Tracts with the Highest Number of Foreclosure Starts Census& tract& #&of&fore= closures& %&African& American&& %& Hispanic&& %& %& Asian&& White&& Poverty& rate& Unemp.& rate& 9.1( Median& household& income& $54,682( Home= ownership& rate& 80.1( Median& home& value& $143,800( 18.07& 18( 51.6( 15.5( 1.4( 28.3( 10.2( 18.06& 12( 42.9( 13.5( 1.4( 41( 15( 7.5( $62,702( 89.7( $155,800( 18.02& 12( 63.6( 21.1( 0.2( 18.01& 10( 55.5( 12.6( 0.4( 13.8( 31( 16.3( $37,448( 61.2( $118,500( 28.1( 15.8( 12.6( $49,556( 83.8( $135,300( 17.09& 9( 72.9( 9.3( 0.2( 11.5( 37( 23.3( $26,138( 22.6( $118,500( 18.08& 8( 33.1( 13.2( 1.0( 45.5( 2.4( 4.5( $81,912( 92.3( $213,900( 17.08& 8( 16.01& 6( 76.2( 2.7( 6.2( 7.1( 15.5( 12.3( $43,981( 58.4( $155,700( 30.7( 3.4( 4.1( 60.9( 8.9( 5.1( $66,779( 90.7( $167,800( 20.26& 5( 64( 13( 3.0( 17( 15.2( 9.3( $39,409( 46.8( $130,100( 20.20& 5( 22.6( 5.9( 10.4( 59.6( 6.8( 2.9( $127,468( 97.5( $322,800( 20.13& 5( 28.8( 6.7( 2.6( 55.9( 7.2( 7( $71,150( 77.2( $166,700( & ( ( ( ( ( ( ( ( ( ( Tract& average& County& average& (P(( 50.1( 11.3( 2.6( 32.6( 15.6( 9.9( $60,111( 72.3( $166,264( (P(( 36.9( 12.9( 4.4( 42.7( 17.1( 8.1( $50,078( 55.4( $178,400( Source:(2011(ACS(5PYear(Estimates( Table 4 ranks the ten tracts with the highest foreclosure start rate. Unlike the mélange of characteristics shown by tracts in Table 3, these tracts tell a consistent story of severe economic distress. They have a much higher proportion of minority residents than we have seen in previous breakdowns. All but one tract have much higher rates of African American residents than the county average (and three have about twice the rate). Although the average of all foreclosure tracts has approximately the same percentage of Hispanic residents as the county average, these tracts have a discernably higher rate. And while Asians on average !UNC!Center!on!Poverty,!Work!and!Opportunity! 10 Neighborhood Level Foreclosures in Durham: Report #2 comprise a miniscule portion of the population of these ten tracts, two tracts (15.02 and 17.08) contain a surprisingly high percentage of Asian residents. Table 4: Tracts with Highest Foreclosure Start Rate Census& Tract& %&African& American& %& Hispanic&& %& Asian& %& White& Poverty& rate& Unemp.& rate& 23& Fore= closure& rate& 36.364%( 15.4( Median& household& income& $16,803( Home=& ownership& rate& 10.9( Median& home& value& $65,500( 63.3( 12.4( 0( 6.2( 65.2( 9& 4.878%( 65.5( 26.8( 0( 4.2( 51.7( 8.2( $23,015( 22.6( $65,000( 15.02& 3.509%( 32.5( 33.4( 13.1( 17.09& 2.169%( 72.9( 9.3( 0.2( 19( 32.7( 12.2( $26,244( 2.8( $114,700( 11.5( 37( 23.3( $26,138( 22.6( $118,500( 13.04& 1.681%( 87.6( 10.3( 0.3( 1.8( 49.2( 21.7( $22,679( 31.3( $104,200( 11& 1.299%( 78.4( 10.8( 0( 9.5( 37.6( 25.1( $18,338( 14.8( $76,100( 10.02& 1.282%( 17.08& 1.043%( 48.4( 38.2( 0( 12.2( 42.1( 9.2( $23,514( 22.2( $85,400( 76.2( 2.7( 6.2( 7.1( 15.5( 12.3( $43,981( 58.4( $155,700( 10.01& 0.984%( 68.5( 24.6( 1.1( 4.4( 44.1( 18.5( $24,000( 32.7( $76,800( 18.02& 0.951%( 63.6( 21.1( 0.2( 13.8( 31( 16.3( $37,448( 61.2( $118,500( & ( ( ( ( ( ( ( ( ( ( 62.5( 20.4( 2.8( 10.8( 36.2( 15.9( $26,216( 30.1( $98,040( 36.9( 12.9( 4.4( 42.7( 17.1( 8.1( $50,078( 55.4( $178,400( Tract& (P(( average&& County& (P(( average& Source:(2011(ACS(5PYear(Estimates( The average poverty and unemployment rates in the high foreclosure rate tracts are about twice the county average, with some individual tracts reaching appalling levels for both measures. Congruent with the high poverty rates, average median household income is about half the county average. All tracts have median household incomes markedly lower than the county average; many have less than half the county average and a few have less than the 2011 federal poverty guidelines for a family of four.xi Perhaps reflecting the low median household incomes in these tracts, the homeownership rates are also low and median home values generally fall far below the county average. Overall, these tracts paint a picture of deeply disadvantaged neighborhoods. In fact, eight of these ten tracts are defined as distressed in a report issued by the UNC Center on Poverty, Work and Opportunity in summer 2013.xii Two charts (Figures 4 and 5) encapsulate the stark differences between averages for the tracts with the highest rate of foreclosure starts on the one hand and averages for all foreclosure tracts and the county on the other. !UNC!Center!on!Poverty,!Work!and!Opportunity! Neighborhood Level Foreclosures in Durham: Report #2 11 Figure 4: Comparison of Key Tract Characteristics, Part 1 70%( 60%( Percentage& 50%( 40%( 30%( County( 20%( All(foreclosure(tracts( 10%( Tracts(w/(highest(foreclosure(rate( 0%( Source:(2011(ACS(5PYear(EsSmates( Figure 5: Comparison of Key Tract Characteristics, Part 2 $200,000( $180,000( $160,000( Dollars& $140,000( $120,000( County( $100,000( All(foreclosure(tracts( $80,000( Tracts(w/(highest(foreclosure(rate( $60,000( $40,000( $20,000( $0( Median(home(value( Median(household(income( Source:(2011(ACS(5PYear(EsSmates( !UNC!Center!on!Poverty,!Work!and!Opportunity! Neighborhood Level Foreclosures in Durham: Report #2 12 Three tracts (18.02, 17.09, 17.08) appear in both tables, meaning in early 2011 they had both a large number of foreclosure starts relative to other tracts and a high foreclosure start rate. The very high rates identified here are deeply worrisome considering that they reflect a mere two months of data. For example, a foreclosure start rate of .951% (the rate for tract 18.02, the lowest in Table 4), if maintained throughout 2011, would affect almost six out of every hundred owner-occupied homes with a mortgage in this tract. Conclusion On average, tracts without foreclosures are whiter and younger than county and foreclosure tract averages. Residents are more likely to be employed (or not looking for work), but are also more likely to be poor and have lower median household incomes. Homeownership rates are lower than county and foreclosure tract averages, but median home values are higher. The averages for tracts with foreclosures parallel county averages fairly closely. Because they encompass a broad variety of neighborhoods, no single pattern or feature stands out. Tracts with a high number of foreclosure starts are, according to some markers, surprisingly untroubled. Median household income and homeownership rates are higher than the average for nonforeclosure tracts and the county; poverty rates are lower. However, averages conceal the fact that individual tract characteristics are all over the place, from the affluence of tract 20.20 to the disturbing signs of economic hardship in 17.09. No such mixed message exists with the high foreclosure rate tracts. These are among some of Durham’s poorest tracts. While foreclosure is harmful to homeowners and communities alike, when it is concentrated in communities that are already economically fragile, its blow can be especially cruel. In the next report, we will examine our data to see how much home value was lost in some of these high foreclosure rate tracts, which lenders were most involved and how many mortgages in our sample show signs of being subprime. !UNC!Center!on!Poverty,!Work!and!Opportunity! Appendix A Table 1: Demographic and Socioeconomic Data for Nonforeclosure Tracts in Durham County Census& tract& Population& %&White& Poverty& (not& rate& Hispanic)& 37.4( 18.9( Unemploy= ment&rate& 3848( %&& %& African& Hispanic& American& 36.8( 24.2( 5.2( Median& household& income& $36,511( Home= ownership& rate& 51.6( Median& home&& value& $130,100( 1.02& 3.01& 2206( 43.3( 8.3( 38.5( 3.02& 3478( 19( 16.6( 59( 14.1( 9.4( $39,648( 36.1( $128,900( 18.6( 3.5( $37,500( 42.3( $229,200( 4.01& 2751( 7.6( 1.8( 85.7( 7.5( 3.7( $66,310( 68.1( $254,500( 4.02& 1917( 7.4( 5.9( 68.1( 15.8( 7.1( $41,466( 20.1( $171,600( 13.01& 1058( 15.01& 2729( 88.4( 2( 1.5( 43.5( 35.4( $13,986( 33.2( $88,300( 17.7( 6.1( 50.6( 85.1( 11( $7,955( 0( N/A( 15.03& 1894( 18.8( 3( 45.4( 0( 14.1( N/A( 0( N/A( 17.05& 4454( 17.6( 21.7( 59.2( 10.8( 9.8( $43,322( 53.8( $146,500( 20.15& 5357( 35( 30.4( 30.8( 22.2( 7.3( $36,923( 20.4( $166,500( 20.16& 5538( 23.5( 40.6( 26.1( 31( 7.1( $33,131( 11.1( $240,000( 20.19& 4644( 11.7( 6.4( 70.6( 10.5( 3.6( $57,151( 50( $276,500( 22& 1743( 26( 10.7( 49.6( 41.8( 11.5( $41,827( 22.5( $202,600( 9801& 73( 0( 0( 100( 0( 51( N/A( 100( N/A( Source:(2011(ACS(5PYear(Estimates( 14 Neighborhood Level Foreclosures in Durham Table 2: Demographic and Socioeconomic Data for Foreclosure Tracts in Durham County Census& Population&& %&African& tract& American& %& Hispanic&& %& White& Poverty& rate& Unemploy= ment&rate& 14.5( Median& household& income& $38,792( Home= Median& ownership& home& rate& value& 61.8( $110,100( 1.01( 2829( 47.9( 20.7( 28.1( 27.6( 2( 2998( 41.3( 10.6( 40.5( 35.1( 9.2( $34,032( 44.9( $191,900( 5( 3027( 57.5( 7.3( 19.2( 47.7( 14( $20,924( 25( $117,400( 6( 4929( 27( 7( 2647( 36.5( 25( 42.5( 21.4( 4( $58,489( 56.7( $219,200( 6.3( 54.9( 17.6( 4.7( $47,705( 55.9( $272,800( 9( 1700( 65.5( 26.8( 4.2( 51.7( 8.2( $23,015( 22.6( $65,000( 10.01( 3392( 68.5( 24.6( 4.4( 44.1( 18.5( $24,000( 32.7( $76,800( 10.02( 5216( 48.4( 38.2( 12.2( 42.1( 9.2( $23,514( 22.2( $85,400( 11( 2185( 78.4( 10.8( 9.5( 37.6( 25.1( $18,338( 14.8( $76,100( 13.03( 3315( 76.7( 3.6( 14.7( 29.4( 11.5( $28,167( 45.7( $89,500( 13.04( 2418( 87.6( 10.3( 1.8( 49.2( 21.7( $22,679( 31.3( $104,200( 14( 2992( 93.6( 5.4( 0.3( 58( 23.5( $15,616( 23.5( $84,200( 15.02( 5918( 32.5( 33.4( 19( 32.7( 12.2( $26,244( 2.8( $114,700( 16.01( 6068( 30.7( 3.4( 60.9( 8.9( 5.1( $66,779( 90.7( $167,800( 16.03( 5987( 14.3( 7.4( 72.1( 2.6( 3.6( $79,152( 96.1( $187,300( 16.04( 6704( 17.5( 1.4( 75.3( 1.9( 5.8( $88,076( 95.3( $220,100( 17.06( 4130( 27.3( 4.5( 57( 16.2( 6.7( $46,250( 45.9( $192,200( 17.07( 7039( 6( 5.7( 79.6( 9.5( 3.4( $70,440( 77.9( $207,700( 17.08( 4271( 76.2( 2.7( 7.1( 15.5( 12.3( $43,981( 58.4( $155,700( 17.09( 6040( 72.9( 9.3( 11.5( 37( 23.3( $26,138( 22.6( $118,500( 17.10( 4035( 42( 17.2( 36( 9.5( 7( $40,034( 53.5( $141,700( 17.11( 4414( 40.2( 29.6( 24( 19.9( 12.4( $32,147( 17.4( $125,300( 18.01( 6357( 55.5( 12.6( 28.1( 15.8( 12.6( $49,556( 83.8( $135,300( 18.02( 7124( 63.6( 21.1( 13.8( 31( 16.3( $37,448( 61.2( $118,500( 18.06( 5313( 42.9( 13.5( 41( 15( 7.5( $62,702( 89.7( $155,800( 18.07( 9283( 51.6( 15.5( 28.3( 10.2( 9.1( $54,682( 80.1( $143,800( 18.08( 4419( 33.1( 13.2( 45.5( 2.4( 4.5( $81,912( 92.3( $213,900( 18.09( 6555( 32.8( 21.6( 32.7( 15.4( 8.5( $50,661( 45.4( $182,000( 19( 2163( 9.9( 4.5( 80.4( 4.8( 4.9( $72,644( 85.3( $199,400( 20.07( 4838( 28.1( 8.2( 59.6( 3.5( 3.5( $72,741( 79.8( $227,300( 20.08( 2943( 2.5( 8.3( 82.9( 0.5( 3.7( $141,196( 92.3( $415,700( 20.09( 4890( 79.5( 17.4( 2.5( 23( 14.7( $43,783( 63.6( $110,000( 20.13( 4470( 28.8( 6.7( 55.9( 7.2( 7( $71,150( 77.2( $166,700( 20.17( 6596( 5.6( 4.3( 79.6( 3.4( 3.8( $80,092( 68.6( $327,900( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( ( !UNC!Center!on!Poverty,!Work!and!Opportunity! 15 Neighborhood Level Foreclosures in Durham Census& Population&( %&African& tract( American( %& Hispanic&( %& White( Poverty& rate( Unemploy= ment&rate( 3.8( Median& household& income( $63,834( Home= ownership& rate( 60.8( Median& home& value( $310,300( 20.18( 7627( 12.9( 4.7( 74.4( 14.5( 20.20( 5401( 22.6( 5.9( 59.6( 20.21( 4208( 30.6( 3.4( 52.7( 6.8( 2.9( $127,468( 97.5( $322,800( 5.7( 6.6( $41,831( 41.1( $227,400( 20.22( 4598( 36.1( 14.2( 43.8( 12.8( 9.5( $48,802( 40.8( $192,100( 20.23( 2890( 25.4( 3( 64.1( 7.1( 5.2( $61,695( 49.2( $231,800( 20.24( 5784( 20.25( 5857( 18.2( 4.8( 65.2( 5.7( 3( $80,866( 78.4( $191,900( 52.4( 10.7( 29.2( 6.1( 6.3( $61,753( 78.6( $173,900( 20.26( 5589( 64.0( 13.0( 17.0( 15.2( 9.3( $39,409( 46.8( $130,100( 20.27( 7557( 40.2( 11.4( 34.6( 17.7( 3.2( $47,620( 33.4( $179,700( 20.28( 5346( 26.4( 12.9( 50.3( 5.7( 8.9( $58,950( 28.5( $202,200( 21( 8744( 24.9( 7( 64.5( 2.6( 5( $85,963( 88.4( $233,800( 23( 1366( 63.3( 12.4( 6.2( 65.2( 15.4( $16,803( 10.9( $65,500( Source:(2011(ACS(5PYear(Estimates( !UNC!Center!on!Poverty,!Work!and!Opportunity! Neighborhood Level Foreclosures in Durham 16 Endnotes The median age of Durham residents is 33.3 years old; the 7th youngest in North Carolina. The six other counties with a younger median age are either university or military strongholds. U.S. Census Bureau, 2011 American Community Survey 5-Year Estimates, Table S0101. i The Census Bureau estimates that over half of students who live off campus (and not with relatives) have personal incomes below the poverty level. Alemayehu Bishaw, Examining the Effect of Off Campus College Students on Poverty Rates (Statistics Branch, Social, Economic and Housing Statistics Division, U.S. Census Bureau, May 1, 2013), 5, www.census.gov/hhes/www/poverty/publications/bishaw.pdf. ii Using 2011 American Community 3-Year Estimates, one Census Bureau report calculated the poverty rate fell by 1.8% for Durham County and 2% for the City of Durham when off-campus college students were omitted. U.S. Census Bureau, Social, Economic and Housing Statistics Division, Poverty Statistics Branch, “Examining the Effect of Off Campus College Students on Poverty Rates,” Bishaw, Appendix Tables 3 and 4, www.census.gov/hhes/www/poverty/publications/bishaw.pdf. iii According to Census 2010, Durham’s homeownership rate is the lowest county rate in the state. Joining it at the bottom are Pitt, Watauga, Cumberland and Onslow Counties, which are also home to large transient populations due to the presence of universities (in Pitt and Watauga) or military bases (in Cumberland and Onslow). See G. Scott Thomas, “National Homeownership Rate is Pegged at 65 Percent,” American City Business Journals, Sept. 28, 2012, http://www.bizjournals.com/bizjournals/on-numbers/scottthomas/2012/09/national-homeownership-rate-is-pegged.html. iv U.S. Census Bureau, “Statistical Abstract of the United States: 2012,” Table 992, Housing Vacancies and Homeownership, http://www.census.gov/prod/2011pubs/12statab/construct.pdf. v Weighted averages are not given for data that the Census Bureau provides only in the form of a median value. As a result, median age, median household income and median home value are simply averages of the numbers for each tract. vi Almost all residents in census tracts 15.01 and 15.03, which include Duke’s east and west campuses, are between 18 and 24 years old (96.6 and 95.4%, respectively). U.S. Census Bureau, 2011 American Community Survey 5-Year Estimates, Table S0101. vii viii 2011 American Community Survey 5-Year Estimates, Table DP05. Median age for residents of all tracts with foreclosure starts is 34.6 years. For all tracts without foreclosure starts, it is 32.7; median age increases slightly to 33.2 when Duke and Census Tract 9801 are excluded. U.S. Census Bureau, 2011 American Community Survey 5-Year Estimates, Table S0101. ix According to the 2011 American Community Survey 5-Year Estimates, the population for all tracts with foreclosure starts is 222,172 and for Durham County is 263,862. 2011 American Community Survey 5-Year Estimates, Table DP05. x The US Department of Health and Human Services classified a family of four as poor in 2011 if their income was below $22,350. xi The Center on Poverty, Work and Opportunities’ 2013 report, Urban Poverty Update for Durham and Mecklenburg Counties, updated a 2005 study by Allen Serkin and Stephen Whitlow, The State of North Carolina’s Urban Distressed Communities. That study used Census 2000 data to identify distressed census tracts in North Carolina using three measures: an unemployment rate greater than 150% of the North xii !UNC!Center!on!Poverty,!Work!and!Opportunity! Neighborhood Level Foreclosures in Durham 17 Carolina average; per capita income less than or equal to 67% of the North Carolina average; and a poverty rate equal to or greater than 150% of the North Carolina average. The Poverty Center’s 2013 report used the same measures but updated results for Durham and Mecklenburg Counties using the 2011 American Community Survey 5-Year Estimates. Alison Templeton, Urban Poverty Update for Durham and Mecklenburg Counties (Chapel Hill, N.C.: UNC Center on Poverty, Work and Opportunity, UNC School of Law, 2013), http://www.law.unc.edu/documents/poverty/publications/finalurbanpovertyreportdurhamandmecklenburg.pdf. !UNC!Center!on!Poverty,!Work!and!Opportunity!