Troubled Banks 2011 Financial Institutions Investment Banking FBR Capital Markets & Co. p

advertisement

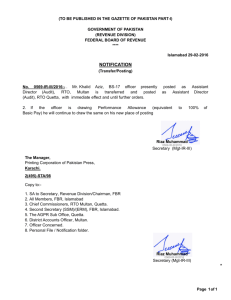

FBR Capital p Markets & Co. Financial Institutions Investment Banking Troubled Banks 2011 April 1, 2011 Strictly Private and Confidential Cautionary y Statement The following document (the “Presentation”) was prepared solely for discussion purposes for the party (“the Company”) to whom FBR Capital Markets & Co. (“FBR”) has provided it and is not to be reprinted or redistributed without the permission of FBR. In preparing this Presentation, we have relied upon information provided by the Company and/or other publicly available information. We have (i) not independently verified any of such information, and (ii) assumed such information is complete and accurate in all material respects. This Presentation may contain statements that are forward-looking statements. Such forward-looking statements are based upon information provided by the Company and/or publicly available information. Actual results may differ from those set forth in the forward-looking statements and are subject to significant risks and uncertainties. These risks and uncertainties could cause the results to differ materially from those set forth in the forward-looking statements. Please note that this Presentation is also based on economic, market and other conditions as in effect on, and the information regarding the business and operations of companies in the Presentation as represented to FBR by the Company and/or public information as of the date hereof, and does not purport to take into consideration any information or events arising subsequent to such date. It should be understood that subsequent developments may affect this Presentation and that we do not have any obligation to update, revise, or reaffirm this Presentation. FBR makes no representation or warranty that there has been no material change in the information provided or reviewed by us in connection herewith. The information contained herein is confidential and has been prepared exclusively for the benefit and use of the Company, Company and may not be used for any other purpose or be discussed, discussed reproduced, reproduced disseminated, quoted or referred to at anytime, in any manner or for any purpose without FBR’s express prior written consent. This Presentation is not for the benefit of, and does not convey any rights or remedies to, any holder of securities of the Company or any other person. This Presentation should not be construed as providing an opinion to the Company and does not constitute a recommendation by FBR to the Company, or security holders of the Company, on the business, the corporate strategy, the valuation, the regulatory environment nor the competitive environment in which the Company or its affiliates operates. Any information included herein concerning valuation of the Company is hypothetical and is based on certain assumptions discussed with management. These assumptions may not be valid, and may also change over time. This presentation should not be construed as a fairness opinion. A fairness opinion would contain additional financial information, models and methodologies. In addition, a fairness opinion is based on the specific terms of a proposed transaction, including many “non-financial” terms and conditions that actually do provide or limit value to the shareholders of the Company. The information contained herein should not be relied upon to determine if any given transaction would be “fair” to the Company. All references to “FBR FBR Capital Markets Markets” refer to FBR Capital Markets Corporation and its subsidiaries as appropriate. appropriate Investment banking, banking sales, sales trading and research services are provided by FBR Capital Markets & Co. (FBRC), and those services in the U.K. and Europe are provided by FBR Capital Markets International, Ltd. (FBRIL). FBRC is a broker-dealer registered with the SEC and is a member of FINRA, the Nasdaq Stock Market and the Securities Investor Protection Corporation. FBRIL, based in the UK, is authorized and regulated by the Financial Services Authority. Asset management services, including managed hedge funds, mutual funds, private equity and venture capital funds, are provided by FBR Capital Markets subsidiaries FBR Investment Management, Inc. (FBRIM) and FBR Fund Advisers, Inc., which are investment advisers registered with the SEC. 1 Failures by State 2008 - PRESENT 0 Bank Failures Per State 1-2 3-4 5-9 ≥10 Total 14 WA 6 OR ME ND MT 15 1 SD ID WY CA 1 NE 10 1 IA 1 CO KS 11 IL 41 8 OH IN 11 KY AZ 10 OK NM 3 8 TX 1 1 AL 4 3 SC 5 57 47 FL Source: FDIC as of March 28, 2011 MA 3 CT NJ 2 6 MD DC GA MS VA WV NC AR LA 1 4 DE 1 TN 2 PA 3 4 1 MO 3 NY MI 6 2 1 NH WI 5 UT 37 MN UPDATE 6 NV VT RI GA FL IL CA MN WA MO MI NV* NV AZ TX KS OR MD UT* WI CO SC OH AL NY NJ PR PA NC NM OK VA AR NE KY IA LA IN ID SD MA WV WY MS Total: 57 47 41 37 15 14 11 11 10 10 8 8 6 6 6 6 5 5 4 4 4 3 3 3 3 3 3 2 2 2 1 1 1 1 1 1 1 1 1 1 349* 2 Problem Banks Problem Banks by State 1-5 0 > 15 6-15 733 banks in the U.S. with Adjusted Texas Ratios(1) above 75% 23 WA 6 4 8 5 OR SD ID WY CA 1 6 29 NE 52 MN 4 CO KS IL IN OH KY TN 2 6 OK NM 9 8 AL TX 5 16 3 VA 11 19 NC GA MS LA 9 SC 21 90 87 AK FL HI PR 2 7 MA CT RI 7 3 NJ DE 2 WV 24 AR 19 13 5 MO AZ 6 PA 27 13 NY 15 66 26 UT MI 24 12 4 NH WI 1 IA 1 VT UPDATE 13 NV ME ND MT MD DC 1 1 12 AK AL AR AZ CA CO CT DC DE FL GA HI IA ID IL IN KS KY LA MA MD ME MI MN MO MS 0 16 8 6 29 26 3 1 1 87 90 1 12 5 66 5 13 9 5 4 12 1 15 52 27 3 MT NC ND NE NH NJ NM NV NY OH OK OR PA PR RI SC SD TN TX UT VA VI VT WA WI WV WY 8 19 4 4 0 7 2 6 7 13 9 6 6 2 0 21 1 24 19 13 11 1 0 23 23 2 1 729 1 Source: SNL Financial Note: Adjusted Texas Ratio excludes government guaranteed delinquent loans. (1) Adjusted Texas Ratio = (Adjusted NPAs + Adjust Loans 90PD) / (Tangible Equity + LLR) 3 Large g Problem Banks Problem Banks by State 0 1-2 ≥6 3-5 65 banks in the U.S. with deposits over $1 Billion and Adjusted Texas Ratios(1) above 75% 3 WA 2 ME ND MT 1 OR MN SD ID VT CA IA NE CO IN KY MO NM 1 1 AL MS 3 2 1 VA 1 SC 1 1 TX 6 AK 1 1 MD DC 2 NC GA AR LA WV 3 TN OK AZ 1 DE 1 1 MA NJ 1 OH 2 CT PA IL 3 KS NY 4 6 4 UT 2 2 UPDATE 1 MI 3 WY NV NH WI FL RI 1 AK AL AR AZ CA CO CT DC DE FL GA HI IA ID IL IN KS KY LA MA MD ME MI MN MO MS 0 2 1 0 2 4 0 0 1 6 1 1 2 0 6 1 0 1 0 0 1 0 4 1 3 1 MT NC ND NE NH NJ NM NV NY OH OK OR PA PR RI SC SD TN TX UT VA VT WA WI WV WY 0 2 0 0 0 1 0 0 2 1 1 2 0 2 0 1 0 3 3 1 1 0 3 3 1 0 65 HI 1 PR Source: SNL Financial Note: Adjusted Texas Ratio excludes government guaranteed delinquent loans. (1) Adjusted Texas Ratio = (Adjusted NPAs + Adjust Loans 90PD) / (Tangible Equity + LLR) 2 4 FDIC Problem Institutions 1990 - 2010 FDIC Problem Institutions 1990-2010 $900 $ 1,500 , 2009 $800 Q1 Total Assets ($ in Billions) Total Assets ($B) Number of Institutions $700 Number of Q3 Q4 Q1 Q2 Q3 1,400 Q4 1,300 $220 $300 $346 $403 $431 $403 $379 $390 305 Institutions Q2 2010 416 552 702 775 829 860 1,200 884 1,100 1,000 $600 900 $500 800 700 $400 600 500 $300 400 $200 300 200 $100 100 $0 0 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 Q1 Q2 Q3 Q4 2010 2010 2010 2010 Q1 Q2 Q3 Q4 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2010 2010 2010 Total Assets $647 $837 $601 $346 $73 ($B) $31 $12 $6 $11 $10 $24 $40 $39 $30 $28 $7 $8 $22 $159 $403 $431 $403 $379 $390 Number of Institutions 193 117 92 84 79 94 114 136 116 80 52 50 76 1,496 1,430 1,066 575 318 252 702 775 829 860 884 Source: FDIC Quarterly Banking Profile 5 Evolution of FDIC Assisted Transactions The FDIC continues to add and modify structures for its resolution process both to facilitate sales and to minimize cost to the DIF FDIC Assisted Transactions with Loss Share ($ in billions) Assumed Assets $40 $20 March 2010 Structured Sale Guaranteed Notes BB&T / BBVA deals First Clawback July 2009 State Bank First Contingent March 2009 IndyMac PE Sale (# of deals) Updated rules on PE involvement Number of Deals $30 April 2010 Modified Loss Share Modified Bid Discount FDIC Financing August 2009 Announcement of white paper on PE FBR Capital Markets Sept 2009 NBH First Blind Pool December 2009 AmTrust Bank First Equity Warrants May 2010 Blue Ridge Holdings First 90/10 Contingent October 2009 Corus Bank May 2009 BankUnited PE Sale 20 18 September 2010 Introduction of 3 tranche loss sharing 16 14 12 10 8 6 $10 4 2 $0 0 Jan-09 Feb-09 Mar-09 Apr-09 May-09Jun-09 Jul-09 Aug-09Sep-09 Oct-09 Nov-09Dec-09 Jan-10 Feb-10 Mar-10 Apr-10 May-10Jun-10 Jul-10 Aug-10Sep-10 Oct-10 Nov-10Dec-10 Jan-11 Feb-11 Mar-11 Jan 2009 – Aug 2009 Loss share Asset transfer First contingent transaction completed by State Bank & Trust Aug 2009 – Dec 2009 Good bank / bad bank Modified bids Linked bids Clawback structure Equity appreciation instrument NBH Holdings completes $1 billion blind pool offering Dec 2009 – Aug 2010 Retention of NPLs for LLCs Blind pools Elimination of 95/5 tranche “Clustering” 50/50 loss share up to stated threshold FDIC asset-based funding North American completes blind pool offering Blue Ridge Holdings completes first 90/10 contingent deal Source: FDIC, FBR Research Sept 2010 3 tranches loss sharing 6 Key y Recent Transactions Commentary Tangible Book Value Transaction Multiples1 Dialogue increasing, small bank MOE’s in particular 3.50x 3.00x “Clean” banks trading around 1.40x tangible book (unadjusted) 3.22x 2.64x 2.94x 2.76x 2.62x 2 50x 2.50x “Broken” banks still at a discount to book Detailed credit analysis heavily highlighted in communication with investors 2.00x 1.50x 1.00x 2.10x 2.18x 2.21x 2.31x 2003 2004 2005 2006 1.40x 1.63x 0.50x 0.00x 2002 Source: SNL Financial. 1. Median of all transactions per year 2. Median of acquisitions listed below Deals > $50mm New Normal All Deals Recent Large Transactions* Acquirer Target IBERIABANK Corp. IBERIABANK Corp. Susquehanna Bancshares Inc. People’s United Financial Comerica Incorporated Hancock Holding Company Berkshire Hills Bancorp Inc. BMO Financial Group Cameron Bancshares, Inc. Omni Bancshares, Inc. Abington Bancorp Inc. Danvers Bancorp, Inc. Sterling Bancshares, Inc. Whitney Holding Company Legacy Bancorp, Inc. Marshall & Isley Corporation Announce Date 3/10/2011 2/21/2011 1/26/2011 1/20/2011 1/16/2011 12/22/2010 12/21/2010 12/17/2010 Deal Value ($M) $134.8 $40.0 $273.8 $488.9 $1,027.8 $1,496.3 $113.0 $4,096.0 Deal Status Pending Pending Pending Pending Pending Pending Pending Pending Price/ LTM Earnings 14.6x NM 33.4x 28.5x NM NM NM NM Price/ Book 1.7x 1.2x 1.2x 1.6x 1.6x 1.1x 1.0x 0.8x Price/ Tangible Book 1.7x 1.2x 1.2x 1.8x 2.3x 1.6x 1.1x 1.0x Core Deposit Premium 11.9% 1.39% NA 13.37% 16.71% 3.91% 1.90% NA Target Assets ($M) $706 $746 $1,247 $2,631 $5,192 $11,517 $972 $51,887 Target Deposits ($M) $575 $653 $900 $1,766 $4,257 $8,866 $695 $38,201 Target Branches 22 15 20 28 60 168 20 390 Target NPAs / Assets 1.34% 8.71% 3.18% 0.71% 3.81% 4.51% 2.26% 4.86% Target TE / TA 10.96% 4.42% 16.99% 10.17% 8.77% 10.78% 10.68% 11.46% Source: SNL Financial * Includes most recent transactions with deal values over $40 million 7 The Shifting g Depository y Landscape M&A Drivers Solid Q4 results, regulatory reforms, and other features are supporting the shift to traditional M&A FDIC assisted deal competition is suppressing returns – Becoming less “attractive” – Three tranche loss share structure – Average size of problem institutions declining FDIC Premiums Regulators are providing troubled institutions more time – Continued investor interest in banks supporting recaps – US Treasury open to restructuring TARP Capital Greater differentiation in the market between the “haves” and the “havenots” Economic Growth Loan Growth Healthy banks demonstrating improving credit, increased earnings, strong capital, and superior valuation Margins Unhealthy banks experiencing credit, capital, and earnings pressure resulting in depressed valuations – Regulators providing more aggressive reviews and required actions C dit Quality Credit Q lit Smaller institutions remain the most vulnerable – Still battling credit issues – Management & board fatigue Compliance & Legal Costs 8 Current Evolution of Bank M&A FDIC - Assisted Increasingly New competitive three tranche loss Chapter 11: Pre-pack + 363 Recapitalizations Private sector alternative Unconventional approach to FDIC-assisted to resolving problem transactions institutions share structure sizeable troubled Opportunistic investor interest 363: SKBHC / AmericanWest deals to expand and fill-in footprint Selected institutions seeking to expand through some shareholder value to sellers Rationale includes ability to enter new markets, gain incremental market share, institutions already seized Unassisted acquisitions Provides Continued Most Pre-Receivership, Distressed Limited cost to US Government Pre-pack to support a recap: Nexity Financial Ability to asses credit risk is critical add new products, and eliminate redundancies Corporation US Treasury and FDIC h have b been supportive ti 9 The Pace of Traditional M&A Activity y Has Picked Up from Low’s of ‘09 Buyer uncertainty, internal focus, and a “wait for the FDIC approach” has slowed M&A. Deals Announced Annually (Since 2001)1 ($ in billions) 101 $13 120 103 100 Transac ction Value $120 78 85 $90 51 $8 $8 $30 $30 $8 $7 2001 2002 $76 $62 $10 $17 2004 2005 2006 Banks $66 24 21 $7 $27 2007 7 $1 $0 2008 2009 $9 $3 $5 $2 2010 40 20 0 2011 YTD Annualized Number of Deals 2010 Quarterly & 2011 YTD Transaction Volume2 $600 35 $500 30 11 22 25 12 20 7 20 $400 10 16 $300 9 12 8 15 23 10 7 16 12 8 18 19 18 13 6 $200 9 10 14 7 12 12 8 2 Average Deal Size ($mm) A 40 5 28 Thrifts Monthly Transactions and 3 Month Rolling Average Deal Size2 15 60 $4 $115 2003 80 $31 75 $60 $0 Number of Deals 99 Numb ber of Deals $150 $100 6 0 $0 Jan-10 Feb-10 Mar-10 Apr-10 May-10 Jun-10 Jul-10 Aug-10 Sep-10 Oct-10 Nov-10Dec-10 Jan-11 Feb-11March11 YTD Unassisted FDIC Assisted 3 Month Rolling Avg Deal Value Source: FDIC; SNL Financial as of March 22, 2011. 1. Includes only transactions with a deal value of at least $40 million. 2. Includes all banks and thrifts transactions announced since 2010; does not include terminated transactions Assisted Unassisted Q1 38 26 Q2 41 53 Q3 39 45 Q4 29 42 2010 147 166 2011 YTD 23 26 2010 2011 YTD T t l Total 170 192 10 Boston 100 Federal Street, 29th Floor Boston, MA 02110 617.757.2900 Dallas 2100 McKinney Avenue, Suite 1940 Dallas, TX 75201 469.341.1200 FBR Capital Markets Corporation Metropolitan Washington, D.C. Headquarters 1001 Nineteenth Street North . Arlington, VA 22209 p 703.312.9500 T . 703.312.9501 F . www.fbrcapitalmarkets.com Houston 600 Travis Street, Suite 6070 Houston, TX 77002 713.343.1000 Irvine (Los Angeles) 18101 Von Karman Ave., Suite 950 Irvine, CA 92612 949.477.3100 NOTE: Not all services are available from all offices. New York 299 Park Avenue, 7th Floor New York, NY 10171 212.457.3300 237 Park Avenue, 19th Floor New York, NY 10017 212 457 3300 212.457.3300 San Francisco 4 Embarcadero Center, Suite 1950 San Francisco, CA 94111 415.248.2900 London, UK FBR Capital Markets International Ltd. 8th Floor Floor, Berkeley Square House Berkeley Square London WIJ 6DB 011.44.20.7409.5300 11