PART TWO: APPLICATION—COMMUNITY INTEGRATION AND IMMIGRANT DAY LABORERS IN NORTH CAROLINA

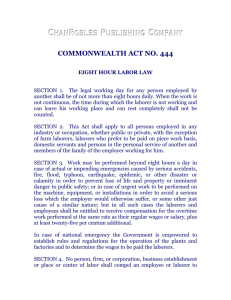

advertisement