Des Moines Register 10-06-07 Credit-card deal appropriate, beneficial to ISU, alumni group

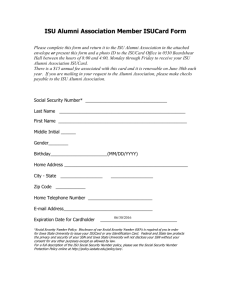

advertisement

Des Moines Register 10-06-07 Credit-card deal appropriate, beneficial to ISU, alumni group Jeff Johnson As president of the Iowa State University Alumni Association, I'd like to provide some context and facts about our association's credit-card program, the subject of recent Register articles. First, the primary audiences for the credit-card program are ISU alumni and fans, not our students. Iowa State's alumni association has had an affinity credit-card program for 19 years. Of our 28,000 card holders, 14,000 have active accounts. Only 284 of those accounts belong to ISU students. The royalties from student accounts amount to less than $3,000 - or about half of 1 percent of the approximately $500,000 the alumni association receives each year. That funding helps to support student and alumni outreach programs, leadership opportunities, university projects and scholarships. It also allows the ISU alumni association to be self-sufficient. I am proud that only 6 percent of the association's operating revenue comes from the university, yet we provide a high level of support back to the university, its students and alumni. According to a 2004 Nellie Mae study, more than 83 percent of undergraduate students nationally carry at least one credit card. More than 92 percent of sophomores nationally have at least one card. The average balance on those cards is $2,347. At Iowa State, just 1 percent of students hold an active ISU alumni association credit card. Those students carry a balance that's less than half the national average. And they carry a card that isn't subject to risk-based repricing, which means their interest rates won't balloon if a payment is late. Our affinity partner, Bank of America, also encourages cardholders to use educational resources such as www.smartcredittips.com or www.makingitcount.com. We believe the agreement in place between Iowa State University, its alumni association and Bank of America is appropriate and mutually beneficial. The concept of an affinity credit card helps to extend our mission, which is to engage the talents and resources of ISU alumni, students and friends in the life, work and aspiration of Iowa State. Regardless of any credit-card relationship, student directory information (including name, address and phone number) is public under Iowa law. Unless the student requests otherwise, ISU is legally required to make the information available to any organization or individual requesting it. Any number of commercial organizations can, and do, purchase that information at cost. The issue is not about sheltering students from credit cards. They are adults, and they will, can and do carry credit cards. The issue is about learning how to use credit responsibly. It's an issue that should be addressed more frequently everywhere, in school and at home. We have programs in place at Iowa State to help counsel students and improve their financial well-being. For example, Iowa State's Financial Counseling Clinic is an excellent free resource for all ISU students. Certified financial counselors are available to educate students (and other community members) about personal finance, wise use of credit, overcoming indebtedness and developing strategies to achieve financial goals. We will continue to pursue ways to improve the quality of credit education offered on campus. But please, don't ask our bright students and future leaders to bury their heads in the sand when it comes to making their own financial decisions. They deserve more credit than that. JEFF JOHNSON is president of the Iowa State University Alumni Association.