Inside Futures, IL 06-26-07 Daily Ag Market Commentary

advertisement

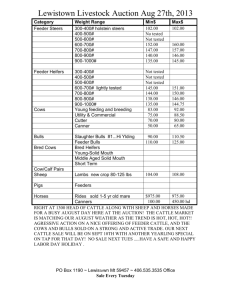

Inside Futures, IL 06-26-07 Daily Ag Market Commentary by Chris Haverkamp of Paragon Investments, Inc. Beef: Live cattle futures were lower at the end of Tuesday's day session. June was down hard as weak cash fundamentals prompted concerns about the futures premium that could attract additional deliveries. Some spreading pressured the other contracts, but for the most part these deferred contracts looked the other way and let June fall. Because of this, the June-August spread has been in a freefall of $3.00 since last Monday. The low-range closes suggest a bearish bias for tomorrow. The bulls seem to have retreated to behind the scenes. Thus, the question is what will happen make them step forward. Some would say that December live cattle need to make a new low below the last swing low of 94.00 before buyers will be interested. Friday's USDA Acreage report could also be trigger. If that report shows more corn acres, then the electronic trade in the cattle complex may offer the first opportunity to trade a bearish corn number by buying feeder and live cattle contracts. By that time, if futures are still down, there is likely to be a lot of shorts wanting to get out as well. In fact, as this idea circulates, there may be enough short covering to support live and cattle futures going into that report. The bears have been in control and there doesn't seem to be much to pry control away from them. However, the numbers show that there should be tighter supplies coming. Looking at a beef price chart, Choice prices are at a level that has been supported no less than four other times. Thus, retailers should view these prices as worth buying; especially since live cattle futures suggest that these will be the lowest prices for this year and next year. I am not ready to declare a bottom yet as delayed marketing's often make for a bearish backlog at this time of year, but it seems close and higher prices from here shouldn't be surprising. Feeder cattle futures were lower, pressured by the lower live cattle futures and the higher grains. Corn on its close retraced to around unchanged, which may attract some buying of feeders. As mentioned above, there is the potential for Friday's Acreage report to be a mover of feeder cattle. The electronic feeder trade is very light so even though it would be more natural to buy feeders on a bearish corn number the liquidity may put more trading into the live cattle electronic trade. Feeder cattle futures are not oversold like live cattle so the incentive and willingness to buy what are historically high feeder prices will continue to amaze me, but that would be the play and it may be hard to find sellers in that environment to make the action very volatile. Buy stops are likely sitting above the 100-day moving average which sits at 109.11 and is rising about 5-6 cents a day. Cash feeder prices were mostly lower for the reports I saw today. The August contract is about even with the feeder index and will need to pay attention to the cash market, but it may be far enough away from expiration yet that the current cash market will be secondary to expectations of what feeder demand will do. Lean hog futures were sharply lower at the end of Tuesday's day session. The bearish mentality was attributed to ideas that the cash market would remain weak after Friday's Hogs and Pigs report shows more expansion than expected. Hog slaughter for today was on par with a year ago, but the week-to-date is still large, up 6.7% from last year. A survey conducted by the University of Missouri and Iowa State University showed that the big players in the hog industry were looking to expand to the tune of 5%. That is much bigger than the mostly steady shown by USDA in the March report and the few guesstimates I have seen for Friday's June report. Very profitable conditions over the last four years make it easy to explain why there should be expansion. But it has been reportedly kept in check by environmental issues, legal battles, high building costs, and at times high feed prices. None of that has really changed and the potential for substantially higher feed prices would seem likely to easily squash any ideas of expansion, especially in the midst of pork exports not being so good of late. The other issue is that Friday's morning Acreage report could prompt action in the hog pit. The mentality of late has been that higher corn prices meant lower pork production (i.e. higher hog prices). Thus, a bearish corn report could prompt renewed sell pressure for those brave enough to trade ahead of the unknown of what is in USDA's afternoon Hog report. Milk futures were sharply lower. The sell pressure was attributed to profit taking as new highs attract top pickers and ideas that the record high prices would curb demand. Cheese, nonfat dry milk, and butter prices were mostly steady today. The buying interest has posted new record highs in open interest for a bulk of this month's trading action. It will be interesting to see if today's lower action indeed came from longs exiting or whether the bears are just getting more confident to place new sell orders as well.