Fort Dodge Messenger, IA 01-27-08 Soybeans looking good in Brazil

advertisement

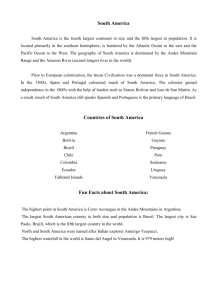

Fort Dodge Messenger, IA 01-27-08 Soybeans looking good in Brazil Crop expected to impact U.S. grain prices By KRISTIN DANLEY-GREINER, Messenger correspondent AMES — If Brazil and Argentina’s soybean production estimates pan out, it could have a definite impact on the anticipated upside potential for soybean prices. Bob Wisner, grain economist at Iowa State University, said the U.S. Department of Agriculture projects Brazil’s crop to be an estimated 2 percent larger than last year, as well as a 5 percent increase coming out of Argentina. “Crop conditions are reported to be very good at this time, although some areas of Argentina are getting slightly dry,”î Wisner said. “Some private forecasters are raising their Brazil estimates a little above those of the USDA.î” Potentially negative factors that could impact these two regions’ crops would be too much or too little rain. “But so far, that hasn’t been a serious concern,î” Wisner said. “Too much rain could interfere with spraying for Asian rust.î” Phil Corzine, general manager of South American Soy, said that the soybean crop in nearly all major growing areas of Brazil are doing great.î “Rains have came pretty much when needed, and hot sunny days are rarely in short supply there in Brazil. On the basis of looks alone — a person might be tempted to predict a record soybean crop for Brazil,”î Corzine said. “Even though the crop is looking great, what we don’t know is how many farmers cut back on their use of fertilizer and lime and other inputs, due to the low prices that have been plaguing the country. A strong real drove domestic soybean prices to rock bottom levels — less than half of what we saw just a couple of years ago. Most of Brazil’s soy is exported and sold on the world market in dollars. “When those dollars area taken back to Brazil, the strong real translates into less reals per bushel. So, we know that a lot of farmers there in Brazil cut their crop budgets either to have a chance of producing a profitable crop with lower prices, or simply due to the fact that they were already in debt so far that banks, input suppliers or grain buyers wouldn’t loan them enough money to plant using a full set of inputs,î” Corzine continued. “Brazil’s soils aren’t like ours here in Illinois and Iowa, as they need lots of fertilizer and lime, so cuts in those products will surely lower the maximum achievable yields, even with the great weather we have been experiencing.î” But if Brazil or Argentina reaps bigger crops as anticipated, it likely will negatively impact the markets for the U.S. “It may temper the upside potential in soybean prices some in late winter and spring,î” Wisner said. Darrel Good, ag economist with the University of Illinois, said prospects are for a record harvest in Brazil, even with a slight reduction in acreage. With imperfect weather conditions and soybean rust to battle, there are no indications of significant problems there, he added. “Large crops there, along with an increase in production in Argentina, will partially offset the anticipated reduction in acreage in the U.S. in 2007. Additional increases can be expected in South America in 2008,”î Good said Corzine said the Brazilian government believes that farmers there actually planted 7 percent fewer soybeans this year than last year, due to poor prices. The government also believes that even with fewer acres, higher yields will increase by 2.7 percent from the previous crop to 54.874 million metric tons. In any case, it’s likely that Brazil’s good crop news will be drowned outî by the upcoming spring corn and soybean acreage situation in the U.S., Corzine said.