Agriculture Online 08-04-06 With farmland values, the variables are many

advertisement

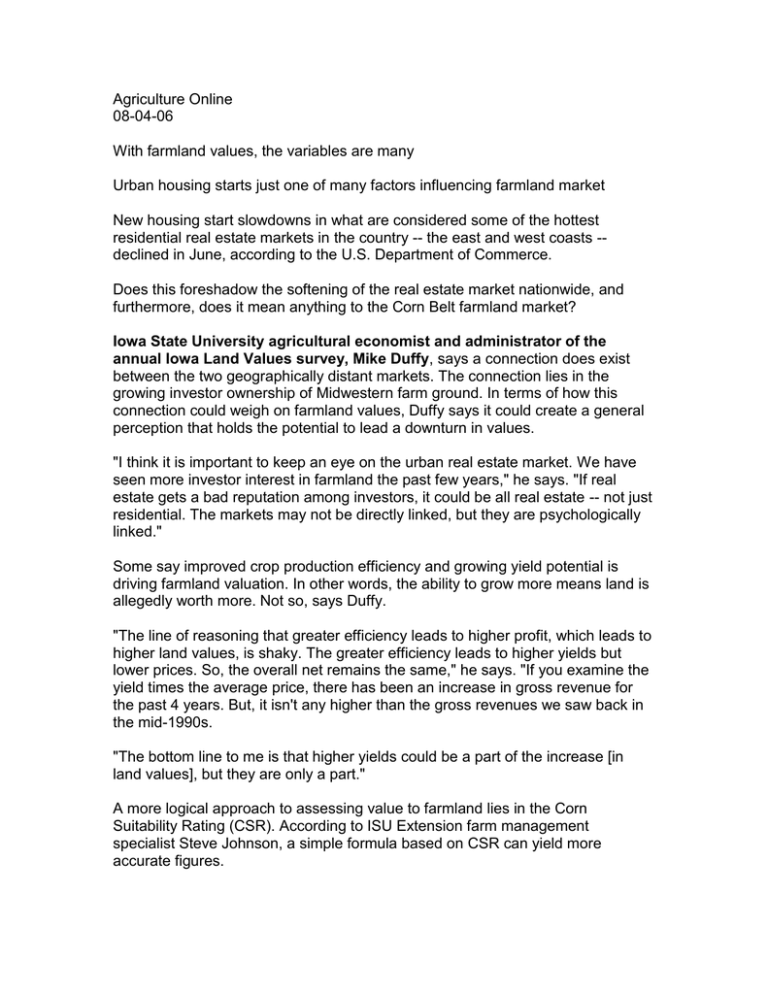

Agriculture Online 08-04-06 With farmland values, the variables are many Urban housing starts just one of many factors influencing farmland market New housing start slowdowns in what are considered some of the hottest residential real estate markets in the country -- the east and west coasts -declined in June, according to the U.S. Department of Commerce. Does this foreshadow the softening of the real estate market nationwide, and furthermore, does it mean anything to the Corn Belt farmland market? Iowa State University agricultural economist and administrator of the annual Iowa Land Values survey, Mike Duffy, says a connection does exist between the two geographically distant markets. The connection lies in the growing investor ownership of Midwestern farm ground. In terms of how this connection could weigh on farmland values, Duffy says it could create a general perception that holds the potential to lead a downturn in values. "I think it is important to keep an eye on the urban real estate market. We have seen more investor interest in farmland the past few years," he says. "If real estate gets a bad reputation among investors, it could be all real estate -- not just residential. The markets may not be directly linked, but they are psychologically linked." Some say improved crop production efficiency and growing yield potential is driving farmland valuation. In other words, the ability to grow more means land is allegedly worth more. Not so, says Duffy. "The line of reasoning that greater efficiency leads to higher profit, which leads to higher land values, is shaky. The greater efficiency leads to higher yields but lower prices. So, the overall net remains the same," he says. "If you examine the yield times the average price, there has been an increase in gross revenue for the past 4 years. But, it isn't any higher than the gross revenues we saw back in the mid-1990s. "The bottom line to me is that higher yields could be a part of the increase [in land values], but they are only a part." A more logical approach to assessing value to farmland lies in the Corn Suitability Rating (CSR). According to ISU Extension farm management specialist Steve Johnson, a simple formula based on CSR can yield more accurate figures. "The use of CSR at around $40 to $45 per tillable acre per CSR index point is much more recognized as an appraisal tool than just a few years ago," Johnson says. Using this formula, farmland with a CSR of 80 would be valued from $3,200 to $3,600 per acre. Still other factors beyond generally softening real estate markets and production efficiency will loom large in the farmland value arena in the near future. "I'm not sure the housing market is as large of a concern as is interest rates (both borrowers and investors," Johnson says. "Two more important factors impacting farmland values and cash rental rates in the next few years are the 2007 farm bill and the impact of biofuels on crop production, crop prices, CRP land, etc." While these factors may swing the pendulum one way or another at different times, Duffy warns it's important not to view them as counteracting one another, instead creating an altogether more volatile marketplace with plenty of variables in the near future. "There are countervailing forces and you need to be aware of the positives and the negatives, but you can't really say one thing cancels another," Duffy says. "Higher interest rates, uncertainty over the government programs, the ethanol boom, non-farming recreational demand and the aging ownership [of farmland] are just a few of the other really major factors."