Evaluating ADR in ATO Disputes Executive Summary

advertisement

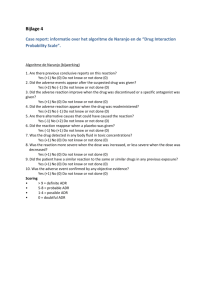

Evaluating ADR in ATO Disputes Executive Summary Evaluating ADR in ATO Disputes – Executive Summary 1. Introduction The ‘Evaluating Alternative Dispute Resolution (ADR)’ Report considers a total of 118 taxation and superannuation disputes that were referred to conciliation, mediation or evaluation processes that took place between 1 July 2013 and 30 June 2014. The Report details findings made by the Australian Centre for Justice Innovation (ACJI) based at Monash University which was engaged by the Australian Taxation Office (ATO) to design and implement a mechanism for independently evaluating the ATO’s use of ADR in taxation disputes. The Report considers the effectiveness, cost, perceptions and approaches used in the ADR processes that were noted on the ATO ADR Register.1 Some ADR processes are not noted on the Register. For example where conferencing takes place at the Administrative Appeals Tribunal (AAT) this is not recorded as ADR on the ATO Register (conferencing involves facilitation and case management and, where parties are represented, usually only the representatives attend). These processes are also important as they lead to the finalisation of most taxation and superannuation disputes that are commenced at the AAT. “It was a good outcome for both parties. It could have been resolved earlier if there had been an earlier mediation conference with both parties being brought together.” Those involved in the more intensive ADR in each dispute (parties, representatives, ADR practitioners and experts) were surveyed about their experiences and 340 people involved in the 118 disputes responded to survey requests. In addition to the surveying, deidentified data about each dispute was collated by the ATO and has provided valuable baseline data that has been considered in the project. The Report contains detailed findings and this Executive Summary has been prepared to assist in understanding and communicating the main outcomes of that work. The Project involved a project design stage (including ethics approval and survey creation), a surveying stage (concluded in September 2014) as well as regular incremental quarterly reporting about findings. An important objective of the Project was to evaluate and consider user experiences to help understand how ADR processes can be used more effectively and to more generally evaluate the use This updated version of the Executive Summary (23 February 2015) includes some minor clarifications to the data reported under ‘Saving Cost and Time’ (pp. 11–12). These clarifications do not represent a material change to the findings. 1 Evaluating ADR in ATO Disputes – Executive Summary 3 of ADR in disputes involving the ATO. The project was also oriented towards assisting the ATO to evaluate ADR use into the future. The base data about the 118 disputes was used to obtain more information about the processes used, the characteristics of each dispute and the timing and other features of the ADR processes. This data was then combined with the survey data (340 survey responses) to explore key evaluation criteria and test hypotheses. The Final Report in this project provides details about this analysis and will be available on the Monash University ACJI website at http://www.law.monash.edu.au/centres/acji/ from early December 2014. “The success of this process was primarily due to face-to-face contact.” Throughout this Executive Summary, quotes from those involved in the ADR processes have been noted as they highlight a number of user perspectives. Evaluating ADR in ATO Disputes – Executive Summary 4 2. About the ADR used Type of ADR Process Most of the ADR processes that were examined took place in the Administrative Appeals Tribunal (AAT) with a smaller proportion of ADR work being conducted at the Federal Court of Australia or by private ADR practitioners. Some AAT processes were not explored. For example, where a conference took place at the AAT, this was not noted as an ADR event on the ATO Register and conferencing was therefore not evaluated. In the sample: 72 percent of disputes involved conciliation 20 percent involved mediation 8 percent involved evaluation. Type of Dispute There was some data about the disputes and dispute complexity. The base data suggested that three-quarters of the disputes that progressed to ADR were assessed as being of low (23%) medium (52%) or high (25%) complexity. Dispute complexity can impact on the ADR timing and this is discussed below. Base data was compared and tracked in respect of other indicators. For example, complexity was used to consider how processes were used. The least complex matters tended to be referred to conciliation (89% of sample of least complex cases were referred to conciliation) at the AAT and the most complex were more likely to be referred to mediation (40% of sample) or neutral evaluation (10% of sample). The disputes included taxpayers from all States of Australia. The sample was roughly comparable to Australian Bureau of Statistics profile statistics. Data about disputant location was also used to confirm that the dispute pool was representative. The taxpayer size was also tracked and categorised. 49% of the sample involved micro business 28% involved individuals 13% involved small business 9% involved large business. Evaluating ADR in ATO Disputes – Executive Summary 5 Timing of ADR Most disputes in the sample (92 per cent) involved disputes that had already commenced in the AAT or the Federal Court. There was a small percentage of disputes where no court or tribunal processes had commenced (8 per cent). Where proceedings had already commenced, survey respondents were asked why they did not use ADR before starting proceedings and the responses varied according to survey groups. Taxpayers tended to indicate that their lawyers advised them to commence proceedings and lawyers tended to respond that either the ‘other side took too long’ or ‘would not negotiate.’ An important issue considered in the Report is whether the ADR processes that were evaluated could be conducted at an earlier time in the dispute. There were two measures of time taken in respect of each dispute. First, the time taken from the date the objection was lodged to the date of the ADR event and second the date that any proceedings were commenced in the Federal Court or the AAT. ADR occurred reasonably late in the life cycle of most of the disputes. Many disputes were ‘old’ by the time the ADR event took place and more than one third were more than 2 years old. Most cases would have experienced case management at the AAT or Federal Court before the ADR event. At the AAT tax cases are often referred to conferencing (where the majority of tax disputes are finalised) before referral to more intensive forms of ADR. Timeliness was also considered in the context of case complexity. It is clear that less complex cases were referred to the ADR process much earlier than more complex cases. Number of days Timeliness (date objection lodged to date ADR conducted) by case complexity 800 700 600 500 400 300 200 100 0 762 597 479 476 Low 530 Medium Case complexity Average (days) 699 High Median (days) Evaluating ADR in ATO Disputes – Executive Summary 6 3. Key Findings The Report considered the effectiveness of ADR, the cost and timing of ADR and whether the ADR processes were considered to be fair. Effectiveness The qualitative and quantitative data suggests that the intensive forms of ADR are effective in about 70 per cent of disputes in either fully resolving the dispute, partly resolving the dispute or enabling facts or issues to be clarified. The outcome data reflects that more than 40 per cent of matters resolved completely in the ADR process and at least 25 per cent appear to resolve following the ADR process. This is an important finding as many of the disputes would have already passed through a conferencing process at the AAT where settlement had not been achieved (most matters that proceed through conferencing are resolved although a number of matters may have more than one conference). It was clear that in many instances the settlement of the dispute occurred after the intensive ADR process took place and prior to surveying (surveying took place up to three months following the ADR session). The ATO base data that captures information up to the timing of the ADR event does not reflect this significant cohort (however, the survey data did). This means that the ‘settlement rate’ is higher than the ATO base data suggested. The data suggests that micro-enterprise disputes are most likely to resolve at the ADR stage. In addition, they are more likely to be resolved more quickly (referral to ADR is more likely at an earlier time). Large complex business disputes were also more likely to resolve at the ADR event although they will usually not be referred to conciliation, mediation or evaluation until a year after proceedings have commenced in the AAT or Federal Court. It was also noted that outcomes varied by State according to the base data. Evaluating ADR in ATO Disputes – Executive Summary 7 ADR outcome by disputant location (state/territory) 80% 70% 60% 50% 40% 30% 20% 10% 0% 70% 62% 59% 41% 38% “[A] lack of preparation on the other side, they had to go away and get more information (about a taxpayer and their representatives).” 22% 0% 0% Resolved NSW (n=39) 7% Partially resolved VIC (n=34) No result QLD (n=27) The reasons for the different settlement rates may include later ADR referral in some states as well as other factors including practitioner behaviours. Practitioner behaviour can refer to legal and other experts who may not engage in the same way with ADR in different States and may also refer to ADR practitioner approaches. A larger sample would indicate what factors may be more relevant however given the State differences in the sample it is suggested that it may be useful to have focus group or internal ATO interviews as well as liaison with the AAT to explore the reasons for these differences. Another measure of effectiveness is whether the ADR process reduced complexity or narrowed issues. The ATO base data suggests that ADR plays an important role in clarifying facts (which may have longer-term impacts and reduce litigation and other costs). In about half of the ADR cases, ADR was seen as important in clarifying issues, which suggests that the ADR process may assist to narrow issues in dispute where the matter does not resolve and may result in later settlement or reduce the issues that proceed to litigation. In terms of process effectiveness and possible improvements, a number of factors were considered. First, this issue was considered from the perspective of fairness. Second, resolution rates were considered. The research shows that there were high levels of satisfaction with the processes. However, in some disputes, there were issues with the level of preparation undertaken by taxpayers, representatives or the ATO and this may have impacted on effectiveness. It is also the case that, when considering comments made, it is important to understand that at times the comments can reflect the reality that the survey respondent did not achieve the outcome they wanted. Evaluating ADR in ATO Disputes – Executive Summary “The problem in this case is that the applicant talks about evidence but doesn’t produce any. The ADR process seemed to make it clearer to him that he must provide evidence not just say what happened. Would have been useful if he had provided evidence beforehand but reality is that he was not going to do so.” “While the process as a whole was not successful due to lack of engagement by the other party some useful information was obtained which will enable the matter to progress closer to resolution.” “All substantive issues except for one were resolved in the process.” 8 Some of the comments regarding preparation are relevant as lower levels of preparation may have impacted on perceptions of process as well as outcomes. Some comments suggested that a lack of preparation meant that resolution was less likely or did not take place. Many of the comments concerned the taxpayer’s lack of preparation rather than that of the ATO, although there were some negative comments about ATO preparation. In the majority of matters the preparation undertaken was regarded as adequate and helpful. However, there were a sufficient number of comments to suggest that more attention needs to be paid to preparation in respect of intensive ADR events. There were several suggestions that the success of the process was influenced by direct face-to-face contact with the parties who have authority to settle. Some survey respondents suggested that there should be more guidelines for selecting appropriate cases for ADR however most comments related to the behaviour of those involved in ADR. In this regard it is notable that the AAT published Guidelines in December 2013 in relation to ADR and the requirement to engage in ‘good faith.’ However, more may need to be done at the Tribunal, Court and ATO levels to ensure that guidelines are supported. The characteristics of the taxpayer may also be important and it may be more likely that a lack of preparation leads to lower prospects of settlement and that this is a factor with small and medium sized business disputants. In such circumstances, it may be more useful for the ADR process to take place earlier, involve intake sessions and ensure that clearer preparation guidelines are available and understood. Was the process fair? In the course of the telephone interviews and online surveying of those in the sample group, the survey respondents were asked a number of questions relating to how they perceived the role of the ATO and whether they considered that the ADR process took place in a fair manner. Perceptions about what is a fair process can also be shaped by previous experience in dispute resolution, and whether they had past experience with the ATO and in dispute resolution. In this research this factor was considered and appeared to have little impact although in freeform comments some considered that the ATO adopted a more proactive and positive approach to the settlement of disputes via ADR and that this was ‘fairer.’ The material also shows that in relation to this survey group there is a strong link between the time taken to deal with a dispute and perceptions of fairness. That is, if the dispute took a long time to be dealt with, people were less likely to think it was fair. Evaluating ADR in ATO Disputes – Executive Summary 9 Overall, 95 per cent of those surveyed agreed or strongly agreed that the process was fair. This finding is regarded as very high in the context of past studies. Fairness perceptions are often linked to participation perceptions – that is, processes can sometimes be viewed as more fair if people can participate or give voice to their concerns. There can be variations among cohorts in terms of perceptions about the extent to which it is considered that a process is fair or the extent to which participation was supported. For example, representatives may consider that they could participate in an ADR process, but taxpayers may think that they could not. There may also be a correlation between these perceptions and the demographic characteristics of disputants; for example, small business disputants may consider that direct disputant participation in the dispute resolution process is very important while big business disputants may consider this to be less important (and may be more comfortable to have lawyers participate more). On the whole, the perceptions of ‘participation’ were very positive, with more than 90 per cent of survey participants agreeing that they could participate in the ADR. However, some survey respondents made comments about the perceived willingness of the other side to genuinely and fully participate in the process. A small number of negative comments were made by both the ATO and taxpayers about participation and these were mainly linked to behaviours within the ADR process. That is, on a few occasions, the ATO was critical of the taxpayer (or their representatives) or the taxpayer or their representative was concerned about ATO or representative behaviour. Some comments about participation may be relevant, although they can be taken out of context and need to be considered against the background of the very positive responses overall. A few survey respondents, for example, commented on the attitude of representatives in the ADR session (rather than the ADR practitioner) and this may be an issue in some ADR processes. A number of survey respondents indicated that they wanted to participate more (around 18 % of tax officers and 18% of taxpayer representatives and 44% of the taxpayer group). “Conceptually I think ADR is a fairer way to resolve disputes when an independent umpire/facilitator is involved. This was not the case in the most recent ADR I was involved with as the ATO resisted ADR, came with a barrister and a very legalistic approach (putting the taxpayer to proof) …” “As a general rule this type of process is usually the better option, but both parties need to attend in good faith. In this instance this was not the case. In my experience this is not common though.” Some specific factors that can influence perceptions of fairness and participation include: The formality of the process. If the process is perceived to be ‘too formal’ it may be that some participants do not consider that they can participate adequately. Some survey respondents considered that the process was ‘too formal.’ Most thought that the formality was ‘about right.’ Evaluating ADR in ATO Disputes – Executive Summary 10 The way in which roles are explained in the ADR process. If lawyers roles are explained in the context of advice and support (rather than advocacy) parties may perceive that they have been included more in the discussion and it may be less likely that exchanges are dominated by representatives. Who speaks after the ADR practitioner introduction? Parties or their representatives. If parties speak first they may be more likely to consider that their participation was important and supported. The extent to which there is an exploration, discussion and clarification of issues may influence participation perceptions. If parties quickly break to a private session they may not consider that they have had an adequate opportunity to speak with those in the process. The extent to which parties can make settlement proposals to one another. If shuttle negotiation processes are used, parties may consider that participation in the agreement and negotiation stages of the ADR process have been reduced. Perceptions of impartiality were recorded and considered. In general, the survey responses show very positive results in terms of impartiality perceptions, with more than 90 per cent of survey respondents considering that both sides were treated ‘equally’. This finding is higher than in some comparable studies. Saving Cost and Time On the basis of the data presented, overall the survey respondents (ATO, Taxpayer and representatives) indicated that the intensive ADR process resulted in significant cost savings. Many survey respondents did not report on costs incurred or saved in the survey and as a result the findings must be expressed with some caution. However, for many who were surveyed the median value of costs saved by successful resolution equated to around $70,000 per matter. Lower cost savings were linked to attendance at the AAT or the Federal Court (where significant cost variation is to be expected). Significantly, a feature of the costs expenditure involved costs for external non-lawyer professionals. The average cost estimates made by ATO Legal Service Branch and external representatives (n=56) was more than $55,000 in respect of valuers, accountants or expert fees. For taxpayers, the sample size was reduced; however, for some the expenditure in this category was considerable. It may be that an earlier clarification of issues could reduce these costs. Evaluating ADR in ATO Disputes – Executive Summary 11 Based on previous work, in the sample many matters progressing to ADR were ‘old’ matters where disputes were longstanding. The median length of time from objection to the ADR process taking place was 607 days. The date of objection was taken as a referable date from the ATO and it is probable that many disputes had arisen before objection and were therefore even ‘older’ when the ADR event took place. Clearly, costs are increased as the age of the dispute increases. Some comments made by survey respondents included that an ADR process may be more beneficial at an earlier stage. These comments and views about earlier ADR referral were also supported by statements made by legal representatives in response to whether there was anything that the ATO could have done to make their contact easier, including “..a personal meeting during the objection process.” Evaluating ADR in ATO Disputes – Executive Summary “(ATO staff) ADR needs to be incorporated in case management earlier on. End of audit or stage of objection. This would get a better understanding earlier.” 12 4.Conclusion The resolution or settlement rates in respect of the ATO sample of disputes that went to ADR from 30 June 2013 – 1 July 2014 are consistent with past studies on conciliation (although at the lower end – mediation settlement rates often cluster above 60 per cent at The resolution or settlement rates in respect of the ATO sample of disputes that went to ADR from 30 June 2013 – 1 July 2014 are consistent with past studies on conciliation (although at the lower end – mediation settlement rates often cluster above 60 per cent at the ADR event stage) and the perceptions of those involved in the ADR processes were generally very positive. Most people thought the processes were fair and if a settlement did not occur at the intensive ADR session that the ADR event had an impact on finalisation of the dispute within a short time frame. The earlier that the intensive ADR process was used, the more positive the perceptions seem to be; however this factor needs to linked to case complexity and cost of dispute factors. “When used correctly, ADR (conciliations / mediations) is a way of articulating each party’s relative strengths and weaknesses when it comes to a dispute. It can then be used to narrow which issues there are scope to move on.” There is also evidence to suggest that the ADR processes were perceived to be cost and time-effective. ADR appears to be more effective for some types of taxpayers than others. In this regard, large businesses and micro business taxpayers were more likely to resolve disputes at an ADR event. It may be that more preparation and intake processes could support some taxpayers. The research also showed that there was a perception among some survey respondents that, in order for an ADR process to be beneficial, everyone has to ‘come to the table with an open mind’ and it was suggested that in some circumstances participants had not engaged in good faith or appropriately. It was also noted that there should be clear guidelines as to when ADR is appropriate as it may not be appropriate for all cases. In the context of future research in this area it is noted that an important part of the project was to develop a methodology and set of tools that could be used by the ATO to conduct sampling work into the future. It is noted that there are some benefits in conducting this work outside the ATO (external researchers are seen as independent, comply with ethical approvals and therefore able to adequately separate confidential information and survey responses from data bases and other operational inputs). However, if work is to be conducted by the ATO, it is suggested that surveying could take place for a three month period (perhaps annually) to determine and track differences with the findings in this Evaluating ADR in ATO Disputes – Executive Summary 13 study. Such an approach particularly conducted in collaboration with key agencies such as the AAT would support the improvement and future development of ADR in taxation disputes. In addition, there is some useful follow up work that could be considered. Issues in respect of the timing of ADR and perceptions of fairness could be usefully explored in focus groups. Focus group input could inform the ATO about specific improvement opportunities as well as informing those who work with ADR about the outcomes of this research. For example, internal facilitation is being trialed by the ATO and the impact of this work could be further considered. In addition, an evaluation and better tracking of AAT conferencing processes in collaboration with the AAT could highlight how referral to intensive ADR could take place earlier and whether there are additional opportunities to improve ADR across this sector. The Research Team thanks all those who responded to survey requests and contributed to the research project. We particularly thank the ATO who supported the research in a collaborative and transparent manner. Evaluating ADR in ATO Disputes – Executive Summary 14