KIRKWOOD COMMUNITY COLLEGE FOUNDATION FINANCIAL STATEMENTS

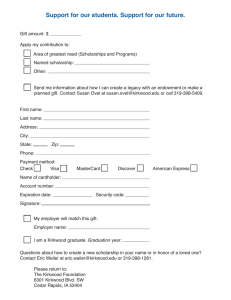

advertisement

KIRKWOOD COMMUNITY COLLEGE FOUNDATION FINANCIAL STATEMENTS YEARS ENDED JUNE 30, 2015 AND 2014 KIRKWOOD COMMUNITY COLLEGE FOUNDATION TABLE OF CONTENTS YEARS ENDED JUNE 30, 2015 AND 2014 INDEPENDENT AUDITORS' REPORT 1 FINANCIAL STATEMENTS STATEMENTS OF FINANCIAL POSITION 3 STATEMENTS OF ACTIVITIES 4 STATEMENTS OF CASH FLOWS 5 NOTES TO FINANCIAL STATEMENTS 6 CliftonLarsonAllen LLP CLAconnect.com INDEPENDENT AUDITORS' REPORT Audit Committee Kirkwood Community College Foundation Cedar Rapids, Iowa We have audited the accompanying financial statements of Kirkwood Community College Foundation (Foundation), a component unit of Kirkwood Community College, which comprise the statement of financial position as of June 30, 2015, and the related statements of activities and cash flows for the year then ended, and the related notes to the financial statements. Management’s Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error. Auditors’ Responsibility Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditors’ judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. An independent member of Nexia International (1) Audit Committee Kirkwood Community College Foundation Opinion In our opinion, the 2015 financial statements referred to above present fairly, in all material respects, the financial position of the Foundation as of June 30, 2015, and the results of its operations and its cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America. Other Matters The financial statements of Kirkwood Community College Foundation as of June 30, 2014, were audited by other auditors whose report dated October 28, 2014, expressed an unmodified opinion on those statements. As discussed in Note 10 to the financial statements, the Foundation has adjusted its 2014 financial statements to retrospectively apply the change in accounting for a beneficial interest in a trust agreement and reclassification of pledges receivable as temporarily restricted net assets. The other auditors reported on the financial statements before the retrospective adjustment. As part of our audit of the 2015 financial statements, we also audited the adjustments to the 2014 financial statements to retrospectively apply the change in accounting as described in Note 10. In our opinion, such adjustments are appropriate and have been properly applied. We were not engaged to audit, review, or apply any procedures to Kirkwood Community College Foundation’s 2014 financial statements other than with respect to the adjustments and, accordingly, we do not express an opinion or any other form of assurance on the 2014 financial statements as a whole. a CliftonLarsonAllen LLP Cedar Rapids, Iowa October 19, 2015 (2) KIRKWOOD COMMUNITY COLLEGE FOUNDATION STATEMENTS OF FINANCIAL POSITION JUNE 30, 2015 AND 2014 2015 2014 ASSETS CURRENT ASSETS Cash Pledges, at Net Present Value, Less Allowance for Doubtful Pledges Total Current Assets $ $ 511,013 406,205 1,074,202 382,064 893,077 311,523 29,047,084 254,029 405,087 30,017,723 624,891 29,125,720 238,188 416,014 30,404,813 $ 31,091,925 $ 31,297,890 $ $ INVESTMENTS AND LONG-TERM ASSETS Pledges, at Net Present Value, Less Allowance for Doubtful Pledges Investments Cash Value of Life Insurance Beneficial Interests Total Investment and Long-Term Assets Total Assets 667,997 LIABILITIES AND NET ASSETS CURRENT LIABILITIES Accounts Payable Due to Kirkwood Community College Due to Kirkwood Facilities Foundation Due to KCCK-Radio Current Portion of Annuities Payable Total Current Liabilities ANNUITIES PAYABLE, LESS CURRENT PORTION ABOVE Total Liabilities 16,616 160,822 640,406 555,942 32,700 1,406,486 20,617 109,606 634,761 515,478 32,700 1,313,162 112,700 1,519,186 121,200 1,434,362 1,848,159 1,822,152 24,807,765 28,478,076 1,887,313 1,611,424 24,971,301 28,470,038 Temporarily Restricted 1,094,663 1,393,490 Total Net Assets 29,572,739 29,863,528 $ 31,091,925 $ 31,297,890 NET ASSETS Unrestricted Unrestricted, Board Designated for Endowment Unrestricted, Donor Advised for Endowment Total Unrestricted Total Liabilities and Net Assets See accompanying Notes to Financial Statements. (3) KIRKWOOD COMMUNITY COLLEGE FOUNDATION STATEMENTS OF ACTIVITIES YEARS ENDED JUNE 30, 2015 AND 2014 2015 SUPPORT AND REVENUES Contributions, Pledges and Cash, Net Contributions, In-Kind Contributions from Kirkwood Community College Contributions to Donor Advised for Endowment Investment Income, Net Actuarial Adjustment to Annuities Payable Other, Primarily Special Event Fundraisers Release from Temporarily Restricted Total Unrestricted Support and Revenues $ EXPENSES Program Expenses: Distributions to Kirkwood Community College for: Scholarships Capital Projects Other, Primarily Instructional Department Support Other Scholarships Total Program Expenses 2014 859,007 115,877 1,841,466 517,640 213,328 (23,764) 8,394 406,857 3,938,805 $ 738,820 135,812 1,722,640 758,000 3,853,156 (25,108) 6,023 453,120 7,642,463 2,532,899 107,521 326,876 32,067 2,999,363 2,413,993 66,573 527,917 31,296 3,039,779 Fundraising Expenses: Annual Campaign Expenses Planned Giving Expenses Total Fundraising Expenses 58,823 47,363 106,186 95,890 47,314 143,204 Management and General Expenses: Payroll Professional Contract Services Memberships Meetings Other, Primarily Operating Expenses Total Management and General Expenses 479,911 159,641 6,621 1,938 177,107 825,218 459,394 115,173 7,114 1,881 189,033 772,595 3,930,767 3,955,578 8,038 3,686,885 Total Expenses CHANGE IN UNRESTRICTED NET ASSETS SUPPORT AND REVENUES - TEMPORARILY RESTRICTED Contributions, Pledges and Cash, Net Release from Restriction Total Temporarily Restricted Support and Revenues 108,030 (406,857) (298,827) CHANGE IN NET ASSETS (290,789) 24,599 (453,120) (428,521) 3,258,364 Net Assets - Beginning as Previously Reported - 26,208,765 Prior Period Adjustment (See Note 10) - 396,399 29,863,528 26,605,164 Net Assets - Beginning as Restated NET ASSETS - ENDING $ See accompanying Notes to Financial Statements. (4) 29,572,739 $ 29,863,528 KIRKWOOD COMMUNITY COLLEGE FOUNDATION STATEMENTS OF CASH FLOWS YEARS ENDED JUNE 30, 2015 AND 2014 2015 CASH FLOWS FROM OPERATING ACTIVITIES Change in Net Assets Adjustments to Reconcile Change in Net Assets to Net Cash Provided by Operating Activities: Net (Appreciation) Depreciation in Fair Value of Investments Addition (Reduction) of Allowance for Uncollectible Pledges Actuarial Adjustment to Annuities Payable Change in Beneficial Interests Contributed Stock Changes in Assets and Liabilities: Pledge Receivable Accounts Payable Due to Related Entities Net Cash Provided by Operating Activities $ (290,789) 2014 $ 3,258,364 248,575 1,000 23,764 817 (21,262) (3,475,524) (3,000) 25,108 (3,361) - 309,489 (4,001) 97,325 364,918 421,657 (2,178) 439,611 660,677 CASH FLOWS FROM INVESTING ACTIVITIES Proceeds from Sales of Investments Purchases of Investments Distributions from Beneficial Interests Cash Value of Life Insurance Net Cash Used in Investing Activities 14,818,571 (14,988,510) 10,110 (15,841) (175,670) 10,236,633 (10,930,679) 10,357 (22,216) (705,905) CASH FLOWS FROM FINANCING ACTIVITIES Payments on Annuities (32,264) (32,708) INCREASE (DECREASE) IN CASH 156,984 (77,936) Cash - Beginning 511,013 588,949 CASH - ENDING $ See accompanying Notes to Financial Statements. (5) 667,997 $ 511,013 KIRKWOOD COMMUNITY COLLEGE FOUNDATION NOTES TO FINANCIAL STATEMENTS JUNE 30, 2015 AND 2014 NOTE 1 NATURE OF ACTIVITIES AND SIGNIFICANT ACCOUNTING POLICIES Nature of Activities Kirkwood Community College Foundation (Foundation) is a not-for-profit organization formed in 1969 for the purpose of maintaining, developing and extending its facilities and services for the benefit of Kirkwood Community College (College), a separate entity. The Foundation is organized and operates exclusively for charitable, scientific and educational purposes to provide broader educational service opportunities to the College's students, staff, faculty and residents of the geographic area it serves. The Foundation is considered a discretely presented component unit of the College, and therefore, included in the College's government-wide financial statements. Significant Accounting Policies Basis of Presentation: The Foundation classifies its net assets for accounting and reporting purposes into three net asset categories according to externally (donor) imposed restrictions. As such, the financial statements are presented on the basis of unrestricted, temporarily restricted and permanently restricted net assets. The Foundation may designate portions of its unrestricted net assets as board-designated for various purposes. The three classes are based on the presence or absence of donor-imposed restrictions. Temporarily restricted net assets include net assets restricted by donors to a specific time period or purpose. Permanently restricted net assets are restricted by donors to be maintained in perpetuity. The donor agreements used by the Foundation and the Foundation's bylaws contain a variance power provision, which results in the Foundation having the unilateral power to override a donor's instruction without approval of the donor. Therefore, all contributions received and net assets are reported as unrestricted. Accounting Estimates: The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses, gains, losses and other changes in net assets during the reporting period. Actual results could differ from those estimates. Cash: The Foundation excludes money market accounts held for long-term investment in its definition of cash and cash equivalents. Recognition of Contributions: Contributions, including unconditional promises to give, are recognized as revenues in the period received. Conditional promises to give are not recognized until they become unconditional, that is when the conditions on which they depend are substantially met. Contributions to be received after one year are discounted at an appropriate discount rate commensurate with the risks involved. Amortization of discount is recorded as additional contribution revenue. An allowance for uncollectible contributions receivable is provided based upon management's judgment including such factors as prior collection history, type of contribution and nature of fund raising activity. Pledges written off totaled $14,287 and $16,098 for the years ended June 30, 2015 and 2014, respectively. (6) KIRKWOOD COMMUNITY COLLEGE FOUNDATION NOTES TO FINANCIAL STATEMENTS JUNE 30, 2015 AND 2014 NOTE 1 NATURE OF ACTIVITIES AND SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) Significant Accounting Policies (Continued) Investments: Investments are recorded at fair value, the price that would be received to sell the investment in an orderly transaction at the statement of financial position date, except for money markets which are recorded at cost. Realized and unrealized gains and losses on investment transactions, which are determined by the specific-identification method, are included in investment income. Interest and dividends are recognized as revenue when earned. Endowed investment assets are pooled on a market value basis, with each individual fund receiving a share of the total pool's investment activity for the month based on the balance of the endowment on the first day of that month. Beneficial Interests: Board designated endowment funds are held by a local community foundation. The transactions are deemed reciprocal and, therefore, the values of the funds are recognized as assets. The Foundation is also a 40% beneficiary of a charitable education trust holding land primarily. Contributed Services and In-Kind Contributions: Non-monetary assets, art objects, equipment and various services contributed to the College through the Foundation for the direct benefit of a College department are recorded at fair value at the date of the contribution and recorded as in-kind revenue and other program expenses. Fair value is primarily determined based on appraised values from third-party appraisers or comparable items. The donors receive recognition from the Foundation for such contributions. These items are transferred to the College upon receipt. The in-kind contributions for the years ended June 30, 2015 and 2014 include several small donations with individual market values no greater than $30,000, respectively. Contributed services that enhance nonfinancial assets and that require specialized skills and are provided by individuals with those specialized skills are included in the contributions from the College and a corresponding expense (see Note 5). Annuities Payable: The Foundation has received gifts from various individuals under annuity agreements (life income agreements). Annuities payable to beneficiaries are reportable as a liability at the present value of the estimated future payments to be distributed over the beneficiaries' lives. The Foundation recalculates the present value of these payments through the use of discount rates and Internal Revenue Service (IRS) life expectancy tables. The present value of these payments is included in the financial statements using discount rates ranging from 6.6% to 11.1%. The annuities payable will be paid from investment earnings. Functional Expenses: The costs of providing contributions and other activities have been summarized on a functional basis in the statement of activities. Directly identifiable expenses are charged to programs and supporting services. Management and general expenses include those expenses that are not directly identifiable with any other specific function, but provide overall support and direction of the Foundation. Fundraising expenses include those expenses that are directly identifiable to the solicitation of contributions. (7) KIRKWOOD COMMUNITY COLLEGE FOUNDATION NOTES TO FINANCIAL STATEMENTS JUNE 30, 2015 AND 2014 NOTE 1 NATURE OF ACTIVITIES AND SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) Significant Accounting Policies (Continued) Income Tax Status: The IRS has recognized the Foundation as exempt from federal income tax under Section 501(c)(3) of the Internal Revenue Code. The Foundation follows the accounting guidance for accounting for uncertainty in income taxes. The Foundation is subject to federal and state income taxes to the extent it has unrelated business income. In accordance with the guidance for uncertainty in income taxes, management has evaluated their material tax positions and determined that there are no income tax effects with respect to its financial statements. Reclassifications: Certain amounts included in prior year financial statements have been reclassified with no effect on change in net assets or net assets to conform to the current presentation. Subsequent Events: Management has evaluated subsequent events through October 19, 2015, the date the financial statements were available for issuance. Through this date, there were no subsequent events requiring disclosure. NOTE 2 PLEDGES Pledges as of June 30 consist of the following: Endowed Pledges Nonendowed Pledges Other Pledges Gross Pledges Less: Discount to Present Value* Less: Allowance for Uncollectible Pledges Net Pledges $ $ Amounts Due in: Less than One Year One to Five Years Thereafter $ $ 2015 77,500 618,953 45,275 741,728 (18,000) (6,000) 717,728 406,205 295,452 40,071 741,728 $ $ $ $ 2014 134,200 895,229 9,526 1,038,955 (27,000) (5,000) 1,006,955 382,106 596,795 60,054 1,038,955 * Discount to adjust to present value of future cash flows using a discount rate ranging from 1.2% to 2.2%. (8) KIRKWOOD COMMUNITY COLLEGE FOUNDATION NOTES TO FINANCIAL STATEMENTS JUNE 30, 2015 AND 2014 NOTE 3 FAIR VALUE MEASUREMENTS AND INVESTMENTS Investments as of June 30 are as follows: 2015 $ 252,927 7,981,554 20,812,603 $ 29,047,084 Money Market Fixed Income, Mutual Funds Equity, Mutual Funds 2014 $ 222,967 9,735,579 19,167,174 $ 29,125,720 The Fair Value Measurements and Disclosures Topic of the FASB Accounting Standards Codification defines fair value, establishes a framework for measuring fair value and requires disclosure of fair value measurements. The fair value hierarchy set forth in the Topic is as follows: Level 1 – Quoted prices (unadjusted) for identical assets or liabilities in active markets that the Foundation has the ability to access as of the measurement date. Level 2 – Significant other observable inputs other than Level 1 prices such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data. Level 3 – Significant unobservable inputs that reflect a reporting entity's own assumptions about the assumptions that market participants would use in pricing an asset or liability. A description of the valuation methodologies used for assets and liabilities measured at fair value, as well as the general classification of such instruments pursuant to the valuation hierarchy, is set forth below: Investments: Investments that have a fair value based on quoted market prices in an active market for identical securities are classified as Level 1. Beneficial Interest in Assets Held by Community Foundation: Valued at the Foundation’s pro-rata share of the community foundation’s investment pool. The unobservable inputs are the underlying assets at the community foundation and follow their investment policy. Beneficial Interest in Assets Held by Educational Trust: Valued at the Foundation’s prorata share of the trust’s assets. The unobservable inputs are the value of the land. (9) KIRKWOOD COMMUNITY COLLEGE FOUNDATION NOTES TO FINANCIAL STATEMENTS JUNE 30, 2015 AND 2014 NOTE 3 FAIR VALUE MEASUREMENTS AND INVESTMENTS (CONTINUED) There have been no changes in valuation methodologies during the years ended June 30, 2015 and 2014. The following tables summarize assets measured at fair value on a recurring basis, by level classification, as of June 30: 2015 Investments: Equities: Large Cap Value Large Cap Global Mid Cap Value International Real Assets Fixed Income: Intermediate Term Short Term Fair Value Level 1 $ 7,878,632 3,145,332 1,438,399 5,301,879 1,389,874 $ 7,878,632 3,145,332 1,438,399 5,301,879 1,389,874 7,341,013 640,541 27,135,670 7,341,013 640,541 27,135,670 - - 28,152 - - 28,152 376,935 - - 376,935 $ 27,540,757 $ 27,135,670 Fair Value Level 1 $ 8,158,817 2,678,174 1,478,327 5,398,776 1,472,385 $ 8,158,817 2,678,174 1,478,327 5,398,776 1,472,385 7,786,476 476,718 27,449,673 7,786,476 476,718 27,449,673 - - 29,479 - - 29,479 386,535 - - 386,535 $ 27,865,687 $ 27,449,673 Beneficial Interest in Assets Held by Community Foundation Beneficial Interest in Assets Held by Educational Trust Total Assets Level 2 $ $ Level 3 - - $ - $ 405,087 2014 Investments: Equities: Large Cap Value Large Cap Global Mid Cap Value International Real Assets Fixed Income: Intermediate Term Short Term Beneficial Interest in Assets Held by Community Foundation Beneficial Interest in Assets Held by Educational Trust Total Assets (10) Level 2 $ $ Level 3 - - $ - $ 416,014 KIRKWOOD COMMUNITY COLLEGE FOUNDATION NOTES TO FINANCIAL STATEMENTS JUNE 30, 2015 AND 2014 NOTE 3 FAIR VALUE MEASUREMENTS AND INVESTMENTS (CONTINUED) The tables above do not include money market investments of $252,927 and $222,967 as of June 30, 2015 and 2014, respectively, which are valued at cost. There were no transfers between Levels 1 and 2 of the fair value hierarchy during the years ended June 30, 2015 and 2014. The following table presents additional information about assets as of June 30 measured at fair value on a recurring basis for which the Foundation has utilized Level 3 inputs to determine fair value: Balance, Beginning Distributions Change in Beneficial Interests Balance, Ending $ $ 2015 416,014 (10,110) (817) 405,087 $ $ 2014 423,010 (10,357) 3,361 416,014 The following table sets forth additional disclosure of the Foundation's investments whose fair value is estimated using NAV per share (or its equivalent) as of June 30, 2015 and 2014: Fair Value Private Equity Fund, U.S. Small Cap Equity Fund (a) 2015 2014 $ 1,658,487 $ 1,453,080 Unfunded Commitment $ - Redemption Frequency Redemption Notice Period Daily Same Day (a) This fund invests in marketable equity securities that are all exchange traded in the United States of America (USA). These funds can be redeemed at NAV per share based on the fair value of the fund's securities and other assets, less liabilities at the close of business on any day the New York Stock Exchange is open. The fair value of this investment has been estimated using the NAV per share on the investments provided by the fund manager. The investments of the Foundation are exposed to various risk such as interest rate, market and credit due to the level of risk associated with such investments and the level of uncertainty related to changes in the value of such investments, it is at least reasonable possible that changes in risks in the near term could materially affect investment balances and the amounts reported in the financial statements. Investment income for the years ended June 30 is summarized as follows: Interest and Dividends, Net of Fees Net Realized Gains Net Unrealized Gains Change in Cash Surrender Value of Life Insurance, Net $ $ (11) 2015 461,426 333,422 (581,996) 476 213,328 $ $ 2014 371,065 1,134,489 2,341,035 6,567 3,853,156 KIRKWOOD COMMUNITY COLLEGE FOUNDATION NOTES TO FINANCIAL STATEMENTS JUNE 30, 2015 AND 2014 NOTE 4 NATURE AND AMOUNT OF TEMPORARY RESTRICTED NET ASSETS Temporarily restricted net assets are available for the following purposes as of June 30: Scholarships Other Programs $ $ NOTE 5 2015 1,051,388 43,275 1,094,663 $ $ 2014 1,383,964 9,526 1,393,490 RELATED PARTY TRANSACTIONS The Foundation provides services for the benefit of the College. In return, the College has provided the Foundation with certain staff, facilities and insurance coverage for its operations without charge. The Foundation has recorded revenue included in contributions from the College and expenses included in payroll and fundraising expenses totaling $939,065 and $917,719 for the years ended June 30, 2015 and 2014, respectively. In addition, the College has provided payroll and benefits of $93,286 and $92,152 for certain employees that do not meet the criteria for recognition as contributed services because their position does not require specialized skills. Also, during the years ended June 30, 2015 and 2014, the Foundation contributed to the College for facilities additions and equipment, scholarships and various amounts for programs conducted by the College totaling $3,215,039 and $3,173,016, including scholarships of $2,532,899 and $2,413,993 and in-kind contributions of $115,877 and $135,812, respectively. The Foundation received contributions of $902,401 and $800,903 from the College during the years ended June 30, 2015 and 2014, respectively. The Foundation acts as an agent for Kirkwood Facilities Foundation by providing pooled investments, which had a balance of $640,406 and $634,761 as of June 30, 2015 and 2014, and for KCCK-FM Radio, a department of the College, by providing tracking of contributions raised by KCCK-Radio and pooled investments, which had a balance of $555,942 and $515,478 as of June 30, 2015 and 2014, respectively. Of the pledges outstanding, approximately $22,959 and $34,303 is due from related parties of the Foundation, primarily from the Board of Directors, as of June 30, 2015 and 2014, respectively. NOTE 6 EMPLOYEE BENEFIT PLANS Employees of the Foundation are participants in various employee benefit programs of which the College pays on their behalf. The expense for the defined contribution retirement plan totaled $38,932 and $37,269 for the years ended June 30, 2015 and 2014, respectively. (12) KIRKWOOD COMMUNITY COLLEGE FOUNDATION NOTES TO FINANCIAL STATEMENTS JUNE 30, 2015 AND 2014 NOTE 7 ENDOWMENTS The Foundation's endowment is pooled amongst all investments, which are established for a variety of purposes. Its endowment includes only funds designated as endowment by the Board of Directors. The Foundation has a policy within the endowment gift agreements that provides for a variance power. This power gives the Foundation the power to use the funds if necessary at their discretion. Because of this, all of the endowments are reported as unrestricted in the statements of activities and financial position. Interpretation of relevant law: The Board of Directors of the Foundation interprets Uniform Prudent Management of Institutional Funds Act (UPMIFA) to require consideration of the following factors, if relevant, in making a determination to appropriate or accumulate donor-advised endowment funds: The duration and preservation of the endowment fund The purpose of the institutional and the endowment fund General economic conditions The possible effect of inflation or deflation The expected total return from income and the appreciation of investments The investment policy of the institution Other resources of the institution The state of Iowa, as well as the Foundation, follows the Uniform Prudent Management of Institutional Funds Act (UPMIFA) regarding the Foundation's ability to spend the net appreciation in the value of donor advised endowments funds. UPMIFA authorizes institutions to appropriate for expenditure income as well as the net appreciation, realized and unrealized, in the fair value of the assets of the endowment fund over the historic dollar value of the fund, as is prudent. The Foundation has implemented a spending policy goal of up to 5% of a three-year (12quarter) rolling average of the market value of each endowment fund. Spendable amounts from endowed funds will be calculated as soon as is practical after March 31 to allow scholarship budgeting for the following academic year. Once the scholarship budget is approved by the Foundation's executive committee, the spendable amount will be considered to be available for scholarship awards through June 30 of the following year. Changes in endowment, not total, net assets for the years ended June 30 is as follows: Endowment Net Assets, Beginning Investment Return: Interest Income Net Appreciation/(Depreciation) Total Investment Return Contributions Appropriations for Expenditures Endowment Net Assets, Ending (13) 2015 $ 26,716,925 2014 $ 23,078,888 436,646 (235,695) 200,951 523,489 (888,948) $ 26,552,417 349,207 3,302,092 3,651,299 767,864 (781,126) $ 26,716,925 KIRKWOOD COMMUNITY COLLEGE FOUNDATION NOTES TO FINANCIAL STATEMENTS JUNE 30, 2015 AND 2014 NOTE 8 CONCENTRATION OF CREDIT RISK The Foundation maintains cash balances that exceed the maximum amount insured by the Federal Deposit Insurance Corporation. At June 30, 2015, the Foundation had $654,145 of cash deposited in one bank. Management believes the credit risk related to the uninsured balance is minimal. NOTE 9 AMOUNTS HELD ON THEIR BEHALF The Foundation receives money from a local community foundation for the change in investments designated to the Foundation and held by the local community foundation on their behalf, with variance power. Because the local community foundation holds variance power over the funds, these investments are not recorded by the Foundation; rather the amount of funds received is recorded as revenue when received. The amount of investments held on the Foundation's behalf as of June 30, 2015 and 2014 was $1,073,674 and $1,070,271, respectively. NOTE 10 PRIOR PERIOD ADJUSTMENT The financial statements for the year ended June 30, 2014 have been restated to correct an error in reporting a beneficial interest in a trust agreement and reclassifying pledges receivable from unrestricted net assets to temporarily restricted net assets. The effect of the beneficial interest in a trust agreement restatement as of July 1, 2013 was to increase long-term assets and temporarily restricted net assets by $396,399. This adjustment caused a decrease to change in net assets by $9,864 as of June 30, 2014. The effect of reclassifying pledges receivable as temporarily restricted net assets as of July 1, 2013 was a decrease to unrestricted net assets and an increase to temporarily restricted net assets of $1,006,955. This reclassification had no impact on the change in total net assets as of June 30, 2014. (14)