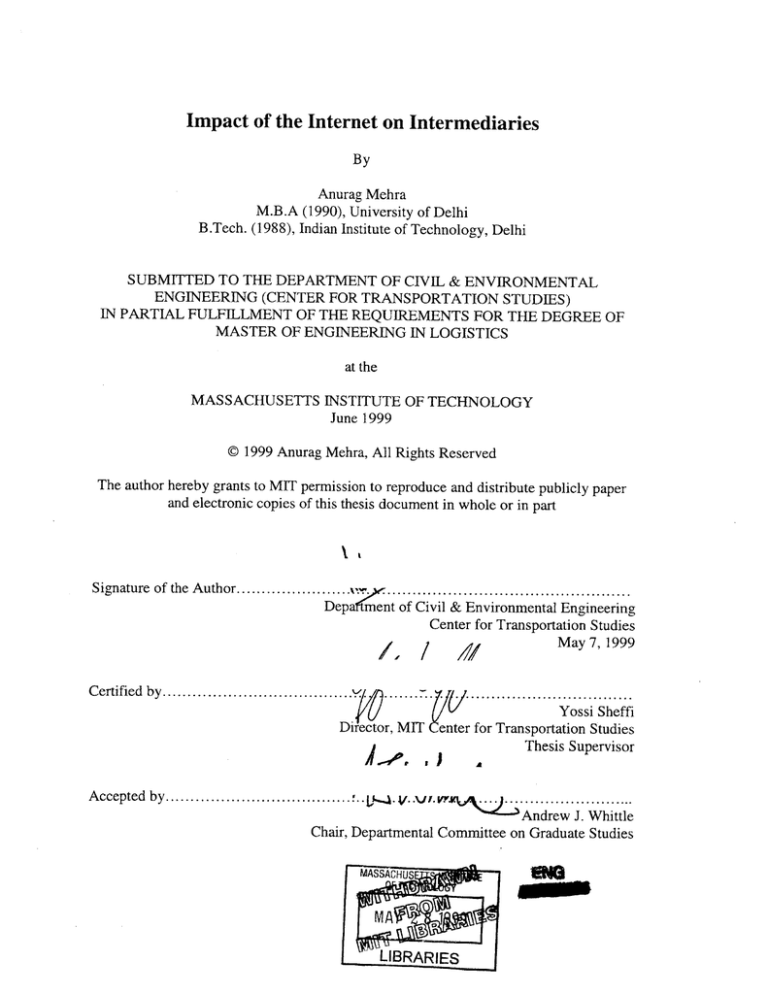

Impact of the Internet on Intermediaries

By

Anurag Mehra

M.B.A (1990), University of Delhi

B.Tech. (1988), Indian Institute of Technology, Delhi

SUBMITTED TO THE DEPARTMENT OF CIVIL & ENVIRONMENTAL

ENGINEERING (CENTER FOR TRANSPORTATION STUDIES)

IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF

MASTER OF ENGINEERING IN LOGISTICS

at the

MASSACHUSETTS INSTITUTE OF TECHNOLOGY

June 1999

@ 1999 Anurag Mehra, All Rights Reserved

The author hereby grants to MIT permission to reproduce and distribute publicly paper

and electronic copies of this thesis document in whole or in part

Signature of the Author .......................

Uv.................................................

Depa ment of Civil & Environmental Engineering

Center for Transportation Studies

May 7, 1999

C ertified by .......................................

....... . .

.................................

Yossi Sheffi

Director, MIT enter for Transportation Studies

Thesis Supervisor

Accepted by .....................................

Whittle

Chair, Departmental Committee on Graduate Studies

MASSACHUS

Impact of the Internet on Intermediaries

by

Anurag Mehra

Submitted to the Department of Civil & Environmental Engineering

In partial fulfillment of the requirements for the Degree of

Master of Engineering in Logistics

Abstract

The exponential growth of the Internet has led to the growing debate about

"disintermediation, i.e. the elimination of intermediaries from markets. Many believe that

traditional intermediaries will soon become extinct because the Internet allows producers

to sell directly to consumers in a more cost-effective way. The debate on

disintermediation in the literature has so far focussed only on "elimination" of

intermediaries, which assumes that all the functions performed by intermediaries can be

disintermediated by the Internet. A deeper analysis of the raison d'etre of intermediaries

suggests that "elimination" of intermediaries is an extremely unlikely scenario. Broadly

speaking, intermediaries perform three functions in a marketing channel: information &

transaction function, logistics function and trust function. Clearly, the Internet can impact

only the information and transaction function, while the logistics and trust issues still

need to be addressed.

This thesis explores the issue of disintermediation from a different perspective: how the

Internet will lead to reorganization of intermediary functions and what kind of

disintermediation scenarios may emerge. It assumes that the allocation of different

functions among various entities in a channel (manufacturers, intermediaries and

consumers) will depend on who can perform the function more efficiently in the long run.

Based on this premise, the thesis explores various disintermediation scenarios and their

applicability to different industries in relation to the consumer needs and buying

behavior.

The thesis develops a framework in terms of a decision flowchart that can be used to

evaluate the possibility of different disintermediation scenarios for specific products/

industries. The framework fulfills the twin objectives of integrating the different

approaches on distribution channels found in the literature and providing a starting point

for further research on industry-wise impact of the Internet on channel structure.

Thesis supervisor: Yossi Sheffi

Title: Director, MIT Center for Transportation Studies

3

To my parents,

my wife Ekta and our newly born son Anirudh

4

Acknowledgements

I would like to thank Prof. Yossi Sheffi for his guidance, encouragement and thoughtful

criticism during the entire duration of my thesis work. Our 'weekly meetings', without

which it may have been impossible to finish this thesis in this short duration of time,

tremendously helped me in focussing on the key issues of this thesis. I am also grateful to

Mr. Jonathan Byrnes for his constructive feedback on the first draft of this thesis.

5

Table of Contents

1

IN TR O D U C TION :...............................................................................................................................

2

CON TEX T A N D LITERA TU RE R EV IEW :...................................................................................

6

11

.......

11

2.1

COST OF INTERM EDIATION:..........................................................................................

2.2

D IRECT CHANNELS: .......................................................................................................................

12

2.3

INDIRECT CHANNELS: ............................................................................-.......................................

15

2.3.1

Role of intermediaries: .......................................................................................................

15

2.3.2

Channel Structure:...................................................................................

...... 17

................

IM PACT OF THE INTERNET: .........................................................................................................

27

3

RESEA R CH HY PO TH ESIS:............................................................................................................

32

4

RESTRUCTURING OF INTERMEDIARY FUNCTIONS: ..........................................................

36

2.4

5

6

INFORM ATION INTERM EDIARIES ...................................................................................

4.2

LOGISTICS INTERMEDIARIES .........................................................................................

. .........

39

4.3

V ALUE-ADDED INTERMEDIARIES .................................................................................

..........

40

DEVELOPING AN INTEGRATED FRAMEWORK: ...................................................................

42

5.1

KEY FACTORS AFFECTING DISTRIBUTION CHANNEL STRUCTURE ...................................................

43

5.2

IMPACT OF THE INTERNET & 3PL SERVICES: .................................................................................

48

5.3

CONSUMER BUYING BEHAVIOR ...................................................................................................

50

5.4

D ECISION FLOW CHART ...........................................................................-

-....... ---.--........

--....... 54

EX PLO RA TO RY A N A LY SIS:.....................................................................................................

59

6.1

(D IS)INTERM EDIATION SCENARIOS: ............................................................................................

59

6.2

CASE STUDIES:..........................................................................................--.-.............................

75

6.2.1

Books: ...................................................................................................................................

75

6.2.2

Computers:............................................................................................................................

79

6.3

LIM ITATIONS OF EXPLORATORY ANALYSIS:...................................................................................

CON C LU SIO N :..................................................................................................................................

7

8

36

4.1

.-.......

-... ---...................................

7.1

THESIS FINDINGS: .............................................................-

7.2

FUTURE RESEARCH: .....................................................................................

REFER EN C ES:.................................................................................................-----......-

--.

-.. --......................

84

85

85

86

88

--. . --............

6

1 Introduction:

Rapid technological progress in information and communication technologies along with

their widespread diffusion have led to speculation about "frictionless" economies in

which transaction costs are nearly zero, barriers to entry disappear, and markets clear

instantly. Some think that electronic commerce, with producers selling directly to

consumers over computer networks such as the Internet, will eliminate existing

intermediaries ("disintermediation") and drastically reduce transaction costs (OECD,

1998).

Transaction costs:

The work done by Ronald H. Coase in introducing the concept of transaction costs in

understanding why firms exist in the form and size that they are, is perhaps more relevant

now than ever. In his article "The Nature of the Firm" (published in 1937, for which he

received the Nobel Prize in Economics in 1991), he addressed the following basic

question (Coase, 1992):

"Why do firms exist, if the pricing mechanism (Adam Smith's 'invisible hand') can

do all the coordination necessary for markets to work?"

Coase found that the answer lies in transaction costs. He realized that there were costs

involved in using the price mechanism: costs related to negotiations, contracts,

inspections, dispute settlements etc. It was the avoidance of the costs of carrying out

transactions through the market that could explain the existence of firms in which

allocation of factors came about by administrative decisions rather than price mechanism.

Hence, Coase argued that a firm would grow in size up to a point when the cost of

internal coordination exceeds the cost of market transactions. Similarly, a firm would

outsource an activity or a function if the transaction cost were lower than internal

coordination cost.

7

The role of intermediaries in a market can be explained in terms of reduction in

transaction costs. For a firm trying to sell directly to its customers, the cost of

communication, distribution and servicing may be quite large if the customers are

geographically spread out and buy in small quantities. Intermediaries reduce this cost by

providing aggregation and dis-aggregation services. The explosive growth of the Internet

has now provided manufacturers/ sellers a low cost access to consumers. So the following

question arises:

"Why should intermediaries exist, when the Internet allows

(by reducing

transaction costs) sellers and buyers to transact directly through the pricing

mechanism?

The growing phenomenon of online auctions is evidence of the disintermediation

possibility. So is the online success of organizations like Amazon.com and Dell. A

potentially larger impact involves the displacement of intermediaries whose basic

function is to convey information that is asymmetrically possessed, for example by travel

agents, insurance agents, stockbrokers, real estate agents, etc. There is evidence of

decline in commissions of stock traders by as much as 57% and of travel agents by 43%

(OECD, 1998). Similarly, for products that can be digitized (e.g. software, music &

video), traditional intermediaries will face much greater prospects of disintermediation

than other industries. For instance, software distributor Egghead (www.egghead.com)

closed over eighty traditional outlets to become the first retailer to make the transition to

Internet-only retail model (BusinessWire, 1998).

However, there is evidence to the contrary too. Bailey and Bakos (1997) explored

thirteen case studies of firms participating in electronic commerce and found that new

roles arise for electronic intermediaries that seem to outweigh any trends toward

disintermediation. A quick look at the top ten shopping sites on the Internet gives some

interesting insight. According to Media Metrix (www.mediametrix.com), an Internet and

8

Digital Media measurement company, the top ten shopping sites (as of Feb, 1999) with

visitors ranging from 2-12 million per month are:

1. www.bluemountainarts.com

2. www.aol.com

3. www.amazon.com

4. www.eBay.com

5. www.cnet.com

6. www.barnesandnoble.com

7. www.cdnow.com

8. www.columbiahouse.com

9. www.musicblvd.com

10. www.valupage.com

Interestingly, none of these sites belong to a manufacturer. Amazon.com's success is

often quoted as evidence of the growing disintermediation phenomenon. However, the

reality is just the opposite. Amazon.com is just another intermediary, albeit not of the

traditional kind. This confusion arises because people generally fail to make a distinction

between the following two questions:

1. Is a product suitablefor online sales (i.e. will the consumers buy over the Net)?

2. Is a product suitablefor direct (manufacturerto consumer) online sales?

Clearly, books are very well suited for online sales, but it does not imply that publishers

will start selling directly to consumers. In the case of Amazon, it is like a wholesaler

selling directly to the consumers on the Net, and therefore disintermediating the retailers.

Research areas:

Since electronic commerce is still at a very early stage in its development, much of the

thinking in this area is based on speculation or anecdotal evidence. As with the advent of

9

any new technology that may be widely diffused, there are overly optimistic and

pessimistic predictions, which are generally inaccurate (mail order has not displaced

traditional retail trade and the VCR has not displaced teachers). To correctly understand

the impact of electronic commerce on markets and economies, research is required in

every aspect of e-commerce. Some of the research areas identified by OECD (1998) are:

1. A statistical methodology and apparatus for measuring electronic commerce should

be developed.

2. The economy-wide and sector-specific impact of e-commerce on productivity should

be assessed, and the notion that this application may lead to a sustained higher level

of economic efficiency should be explored.

3. Monitoring of the restructuring of intermediary functions is needed.

4. Sectoral studies on a variety of consumer and business products should be undertaken

to measure the impact and identify factors that encourage and inhibit price

competition, including the use of intelligent agents. The impact of the structure of

price setting and of the frequency of price changes on markets and on measurement

also requires study.

5. The electronic marketplace needs to be continuously monitored. Case studies should

address the sectoral and market specificity of organizational impacts. Ongoing

assessment of potential new barriers to market entry is also needed.

Focus of the thesis:

This thesis addresses the third issue identified above, i.e. the impact of electronic

commerce on the structure and form of intermediaries and analysis of sectoral differences

in "disintermediation".

10

In order to assess the impact of Internet on intermediaries in a specific industry, it is

important to analyze the following:

1. From manufacturer's perspective, the cost tradeoffs involved in going direct vs. going

via intermediaries.

2. The raison d'8tre of intermediaries in that industry, i.e. what economic value is added

by the intermediaries. Value addition may be in non-monetary forms like riskmitigation.

3. Consumer needs, expectations and buying behavior.

This research being exploratory in nature, does not go into industry-specific cost

structures. The other issues related to the role of intermediaries and the relevance of

consumer buying behavior to channel structure are discussed in greater detail.

Specifically, this research aims to answer the following questions:

1)

What are the product/ market characteristics and other variables that have an

impact on the structure of distribution channels and existence of intermediaries?

2)

What is the impact of the Internet on these variables and therefore on channel

structure for different industries?

3)

If disintermediation is a possibility, what kind of disintermediation may occur?

Will wholesalers be impacted more or retailers? Will traditional intermediaries

transform into cyber-intermediaries?

11

2 Context and Literature Review:

This chapter examines the role of intermediaries and their raison d'etre in distribution

channels. Section 2.1 describes the cost added by intermediaries to explain why

disintermediation is such a big issue in e-commerce. Section 2.2 examines why direct

search markets have remained a small niche so far and how the Internet is changing the

tradeoffs in direct vs. intermediated markets. Section 2.3 describes the role of

intermediaries and various theories of distribution channel structure found in the

literature. Section 2.4 examines the disruptive power of the Internet and why it may lead

to disintermediation.

2.1 Cost of intermediation:

In the chain of activity between the final producer and the final consumer, intermediaries

generally perform three services - transportation, wholesaling, and retailing. In most

OECD countries, intermediaries typically add about 33 per cent to the final price of

goods. In the United States, for all personal consumer expenditures (PCE) (goods and

services), intermediaries add about 15.6 percent to the final price, of which 0.6 per cent

represents transportation, 3.8 percent wholesale costs, and 11.2 percent retail costs

(OECD, 1998). In some cases, the cost added by intermediaries may be as high as 62% as

illustrated for high-quality shirts market (Benjamin and Wigand, 1995):

12

A. Thie Variants of Altemate Value Added :i1aum

Cost per

Percent

Retailer

Consumer*

$52.72

0%

Wholesaler

Retailer

Consumer*

$41.34

28%

Wholesaler

Retailer

Consumer*

$20.45

62%

1.

Producer

Wholesaler

2.

Producer

3.

Producer

----

>

B. Growth in Value Added ard Selling Price

Producer

Wholesaler

Retailer

Value Added

$20.45

$11.36

$20,91

Selling Price

$20.45

$31.81

$52.72

Consumer*

$52.72

* Consumer transaction costs are not consid ered.

The above example illustrates how disintermediation (of retailer, wholesaler or any other

intermediary between the producer and the consumer) can save substantial costs for

manufacturers and (ultimately) consumers. It is not surprising therefore that some forms

of direct channels exist in the economy.

2.2 Direct channels:

Not all markets require intermediaries to function. Garbade (1982) classifies marketbased coordination into four categories:

1. Direct-search markets (where buyers and sellers seek out one another).

2. Brokered markets (where brokers assume the search function).

3. Dealer markets (where dealers hold inventory against which they buy or sell).

4. Auction markets (where buyers and sellers meet to bid for goods on sale).

Except for the first category of markets, all other types of markets depend on

intermediaries to facilitate market transactions. Direct search markets have traditionally

been limited in their appeal due to the high cost of searching buyers or sellers, even

though there may be some savings in distribution costs. Generally, there is a tradeoff

13

between high search costs of direct channel and high distribution costs of indirect

channel:

Direct channel

High search

costs

Indirect channel

High distribution

costs

Data from the 1992 Census of Retail Trade shows that non-store retailers (SIC code 596)

accounted for 51 billion dollar of sales, which is only about 2.7% of the total retail sales

($1.9 trillion). Out of this, catalog and mail-order houses accounted for 34 billion dollars

of sales. According to the Direct Marketing Association (www.the-dma.org), consumer

catalogue sales in 1998 was about $53 billion (out of total catalog sales of about $87

billion, and total retail sales of $2.7 trillion), generated by an estimated 12 billion

catalogues mailed to consumers, at a cost of about 70 cents each (New York Times,

1998). With such high costs, it is not surprising that catalog marketing has remained a

small segment of total retail market. However, this picture is now dramatically changing

because the marginal cost of reaching customers directly on the Internet is negligible

compared to the mail-order catalog:

Internet

Direct channel

High search

costs

Indirect channel

High distribution

costs

The Internet, as a direct marketing channel not only has many similarities with mail-order

catalog business but also has the potential to combine the best of catalog and TV-based

shopping, while adding unique advantages like interactivity (Goldman Sachs, 1997).

14

Companies can, in fact, do things with web that may have been impossible in catalogues

due

to

production

costs

and

space

limitations.

For

example,

Crutchfield

(www.crutchfield.com) has a vehicle selection chart where shoppers type the year, make,

model, and body type of their vehicle into the interactive Vehicle Selector, and the site

automatically customizes all subsequent pages to feature only components that will work

in that car. The Internet also allows catalogers to tailor pricing on a daily basis in

response to consumer demand, making them less vulnerable to excess inventory and

markdown concerns. Hence, the Internet has taken catalog business to a much higher

level of sophistication that can be exploited by savvy marketers to increase their revenues

and profitability. The importance of catalog sales in retailers e-commerce strategy is

evident in the tender offer (source: Bear Stearns Equity Research, 1998) made by

Federated Department Stores (owners of brand names like Macy's and Bloomingdale's)

for 100% of Fingerhut (2 "dlargest cataloger in U.S.) shares for a deal valued at $1.7

billion.

W.A.Dean & Associates, a catalogue industry consulting company estimates that more

than half of the consumer cataloguers currently have e-commerce sites (New York times,

1998). Catalog Age (www.catalogagemag.com) ranking of the top 100 US catalog

companies also gives an indication of how these two businesses are merging. The

revenue of 10 computer-only catalogers ($27 billion) accounts for more than 45% of total

catalog sales ($60 billion) in 1997. Leading the pack in computer-only catalogers are of

course Dell ($11.9 billion) and Gateway ($6.3 billion), who earn a substantial portion of

their revenues through Internet sales.

So it appears that the Internet holds a lot of promise for direct marketers like catalogers,

but its impact on traditional channels of distribution is not so clear. As discussed earlier,

there is mixed evidence of disintermediation and reintermediation, depending on the

changing role of the intermediaries.

15

2.3 Indirect channels:

2.3.1

Role of intermediaries:

Several roles of intermediaries have been identified in the literature. Malone, Yates and

Benjamin (1989) identify the following reasons for existence of intermediaries:

1. Aggregate buyers' demand or sellers' products.

2. Build trust between buyers and sellers.

3. Facilitate the market by reducing transaction costs.

4. Match buyers and sellers.

All the functions mentioned above have one common objective: improving the efficiency

and efficacy of the channel. Sarkar, Butler & Steinfield (1998) suggest a broader list of

functions performed by intermediaries, dividing them into two categories:

1. Services to consumers:

Search and Evaluation. Retail intermediaries design the type of the search and

evaluation services that will be offered to consumers by choosing the product mix and

focus. A consumer choosing a specialty store over a department store implicitly chooses

between two alternative search and evaluation criteria.

Needs Assessment and Product Matching. In many cases it is not reasonable to assume

that individual consumers possess the knowledge needed to assess their needs reliably

and identify the products which will efficiently meet those needs. Therefore,

intermediaries can provide a valuable service by helping customers determine their needs.

16

Customer Risk Management. Consumers do not always have perfect information, and

hence they may purchase products that do not meet their needs. Consequently, in any

retail transaction the consumer faces a certain amount of risk. By providing consumers

with the option to return faulty products

or providing

additional warranties,

intermediaries reduce the consumers' exposure to the risk associated with producer or

communication error.

Product Distribution. Many intermediaries play an important role in the production,

packaging, and distribution of goods. Distribution service firms, such as Federal Express,

are a prime example of how information technology has begun to make it economical to

independently provide services that historically have been provided by integrated retail

intermediaries.

2. Services to producers:

In addition to providing services for consumers, intermediaries also provide a variety of

services for producers. In choosing marketing channels, producers choose the bundle of

services provided by the intermediaries involved. Several functions of intermediaries

purchased by producers are briefly highlighted below.

Product Information Dissemination. Intermediaries provide service to producers by

informing consumers about the existence and characteristics of products. In some cases,

such as traditional retail intermediaries, these information services are tightly tied to other

services, such as distribution, and in other cases the information services and distribution

may be provided by independent intermediaries.

Purchase Influence. Ultimately producers are not interested only in providing

information for consumers; they are interested in selling products. Thus, in addition to

information services, producers also value services related to influencing consumer

purchase choices. Intermediaries can influence consumers' purchasing behavior by

strategic product placement, explicit advice from sales agents etc.

17

Provision of Customer Information. Intermediaries also provide valuable information

about customers to producers, that is used by producers to evaluate new products and

plan production of existing products.

Producer Risk Management. Like consumers, producers face risks when engaging in

commercial transactions. Intermediaries provide services that enable producers to manage

their exposure to such risks as inventory risks, consumer fraud and risk associated with

consumer and producer error.

Transaction Economies of Scale. As with production of goods, transaction services (e.g.

order aggregation) provided by intermediaries are subject to economies of scale, which

are often achieved through the use of IT. Also economies of scale in transportation allow

intermediaries to reduce the total cost of distribution for the channel.

Integration of Consumer and Producer Needs. Intermediaries must deal with problems

that arise when consumer needs conflict with the needs of producers. In a competitive

environment an intermediary must provide a bundle of services that balances the needs of

consumers and producers and is acceptable to both. For example, a producer may wish to

inform consumers about the existence of a good while consumers may not wish to receive

it & would rather have it filtered out as part of the product search and evaluation process.

2.3.2 Channel Structure:

A channel of distribution can be considered to comprise a set of institutions which

performs all the activities (or functions) utilized to move a product and its title from

production to consumption (Bucklin, 1966). A typical distribution channel may look like

the following:

Manufacturer

Intermediary 1

Intermediary2

Consumer

18

Where, intermediaryl may be a wholesaler/ distributor and intermediary2 may be a

retailer. Hence, a channel may be defined in terms of the following three variables related

to the intermediaries:

1. Levels of intermediaries (number of echelons in the channel).

2. Number of intermediaries in each level.

3. Exclusivity of intermediaries (eg. geographic coverage).

A normative channel is generally defined in the literature as a set of institutions which, in

the long run, and under conditions of competition and low barriers to entry, constitutes

the channel for a product. The purpose of defining such a channel is to understand the

basic forces that control channel structure and to develop a benchmark against which real

world channel structures may be meaningfully compared.

The real world channel may be different from the normative channel because of two

reasons. First, many barriers prevent the realization of the full effect of competitive

forces, and second, the normative channel is a long run concept- an equilibrium that may

never be realized because of continuous technological and social changes. The Internet

has, in no small measure, contributed to the dizzying pace of change that firms face

today. Hence, in today's environment, the concept of normative channels may be a purely

theoretical construct, but still worthy of study for the insights it can provide on what the

future may hold for distribution channels.

Most of the marketing literature on distribution channels focuses on normative channels.

Four different approaches have appeared in the literature in development of theory of

distribution channel structure (Frazier, 1987):

1. Bucklin (1966): theory of distribution channel structure.

2. Mallen (1973): functional spin-off approach.

3. Williamson (1979): transaction cost approach.

4. Anderson & Weitz (1983): scale economies approach.

19

Bucklin (1966) relates the structure of distribution channels with the functions performed

by all the organization entities involved in the channel flows, including the consumer. He

identifies five categories of activities/ functions:

1. Communication function: consisting of all activities that serve to transmit to

prospective buyers or sellers information concerning offers to buy or sell and the

acceptance of these offers.

2. Ownership function: concerned with activities that surround the holding of title to

goods.

3. Inventory function: includes all activities that physically control the product at a

given location, not including the capital or risk charges incurred by storage, that being

part of the ownership function.

4. Transit function: includes all activities that physically transport goods between

locations.

5. Production function: consists of all activities that create the product or commodity.

The way Bucklin relates these functions to the channel structure is as follows:

Consumer

Demand for

channel outputs

Channel

Outputs

Functional

structure

Channel

structure

The channel outputs are defined in terms of three variables:

1) market concentration

2) delivery time

3) Lot size

Market concentration concerns the size distribution of customers a firm faces as well as

their geographic density. The more concentrated a market, the more feasible is a "direct"

channel because costs of serving such a market would be lower by direct or shorter

20

channel. Similarly, the more customer service required by the customers (in terms of

faster delivery times and smaller lot sizes), the less desirable is a "direct" channel.

Direct channel

Indirect channel

Cost

Services

Direct

Indirect

The cost of providing increasing level of services to consumers generally increases more

rapidly for direct channels than for indirect channels. On the other hand, at low level of

service, indirect channels are likely to be costlier than direct channels because of the

fixed costs associated with the intermediary functions. Hence, there generally exists a

breakeven point below which direct channels are more efficient and above which indirect

channels.

So the basic construct of Bucklin's theory of distribution channel structure is that

consumers determine the desired channel output, which in turn determines the division of

functions among various organizational entities (including the consumer) and therefore

eventually the channel structure based on the long-run efficiency of different channel

types. Alderson (1957) supports this argument by contending that the efficiency of

vertical market structures is improved by the performance of two functions by

intermediaries: matching and sorting.

Based on the above theory, Bucklin, Ramaswamy & Majumdar (1996) propose the

following hypotheses:

21

1. In markets where end-users buy in small quantities, indirect channels are more likely

to prevail.

2. In markets where goods must travel great distances to reach the end-user, indirect

channels are more likely to prevail.

3.

Under market conditions characterized by end-users who purchase frequently,

indirect channels are more likely to prevail.

4. Under market conditions characterized by manufacturers who produce narrow

assortments, indirect channels are more likely to prevail.

5. In markets where product customization is critical to end users, direct channel

structures are more likely to prevail.

6. In markets characterizedby intense product or technological activity, direct channels

are more likely to prevail.

7. In markets characterized by rapid technological change, direct channels are more

likely to prevail.

8. In markets characterizedby higher customer concentration, direct channels are more

likely to prevail.

It is interesting to note the relevance of hypothesis no. 6-8 to the computer industry and

how these have been successfully leveraged by Dell (www.dell.com) for its direct model.

A more detailed discussion of Dell's model is covered in Section 6.2.

Bucklin also developed a framework in which the generic classification of goods given

by Copeland (1923) is related to the distribution channel structure (Bucklin, 1963). It

suggests that for convenience goods (e.g. groceries), an indirect channel is more suited,

while for shopping goods (e.g. consumer electronics), a direct channel may be more

desirable. This conclusion can be derived from the theory described above, since for

shopping goods, consumers are probably willing to wait to get exactly what they want,

while for convenience goods, consumers require higher service (faster gratification) and

are therefore better off picking the goods from the nearest retail outlet rather than wait.

22

Catalog marketers have traditionally used this classification to sell goods that consumers

want and are willing to wait for. The only problem with catalog marketing has been the

fact that the communication between the sellers and the buyers is essentially a one-way

process, i.e. from the sellers to the buyers. Although catalog sellers rely on extensive

market research to determine the type of goods desired by the consumers, and consumers

also have a choice of selection and ordering, broadly speaking catalog marketing has

remained a uni-directional marketing process. However with the ubiquity of the Tnternet,

this is bound to change. Consumers can now be expected to have a greater say in the

selling process in terms of determining the goods they want in the first place. In

electronic marketplaces, intermediaries such as www.priceline.com allow buyers to

specify product and price requirements and make corresponding offers to participating

sellers, reversing the traditional transactional flow of retail/ catalog markets.

Bruce Mallen's (1973) approach is based on the assumption that functions (e.g. delivery,

warehousing, selling) will align in the channel based on who (manufacturer, wholesaler,

retailer etc.) can do them most efficiently. For example, if a manufacturer finds that the

stocking function can be done at much lower cost by a retailer, it will spin-off the

function to an independent retailer.

Williamson (1979) developed what is commonly referred to as the "transaction cost

analysis" approach. It is the application of the work done by Ronald H. Coase on

transaction costs to the institutional framework of distribution channels. According to this

approach, firms and consumers try to reduce their transaction costs as much as possible.

In this process, intermediaries will be created if there is an opportunity to reduce the

transaction costs between sellers and buyers. A key concept in this approach is "asset

specificity" which refers to the uniqueness of the assets needed to facilitate product and

title flows in the channel. To keep transaction costs low, firms would be better off going

direct if the asset specificity were high, especially when high uncertainty exists in the

environment. Indirect channels with high asset specificity under conditions of high

uncertainty will have high transaction costs, in part because of possible opportunistic

23

behavior of the channel members in possession of the specific assets, and in part because

contingent contract are difficult to develop under conditions of high uncertainty.

Transaction cost theory is an often-employed framework in the context of channel

structure since it focuses on a firm's choice between internalized, vertically integrated

structures, and the use of external market agents for carrying out activities that constitute

its value chain. In the context of channel decisions, it can be used to articulate the

decision process whereby firms either "make or buy" an intermediary function; that is,

whether the firm decides to internalize the channel activity (or sub-activities) within its

organizational boundaries, or whether it chooses to rely on the market.

A fourth approach, developed by Anderson and Weitz (1983) and generally referred to as

"scale economies" approach, predicts that small manufacturers with limited product line

are better off using indirect channels since independent intermediaries can accumulate the

products of other manufacturers and therefore incur lower selling costs. Internet has,

however, drastically changed the rules of the game for small players. Small

manufacturers are no longer inhibited by geographical constraints and potentially have

access to the entire global market (subject to the reach of the Internet).

Not much effort has been made in the past to integrate these different approaches or to

develop a common framework. Frazier (1987) while identifying this as an important

research need, integrates the framework of Bucklin (1966) and Williamson (1979) as

follows:

Asset specificity = Low

Low M.C

High CSR

Low M.C

Asset specificity = High

Low capital

availability

Indirect

High capital

availability

Indirect

Low capital

availability

Indirect

High capital

availability

Combo

Indirect

Combo

Combo

Direct

Indirect

Direct

Combo

Direct

Combo

Direct

Combo

Direct

Low CSR

High M.C

High CSR

High M.C

Low CSR

24

Where, M.C = Market concentration, CSR = Customer service requirements, Combo =

Mix of direct and indirect channels.

The above table highlights the importance of integrating these different approaches. For

instance, it shows that high asset specificity does not always imply direct channels,

especially if market concentration is low and service requirements of customers are high.

Similarly, high market concentration or low service requirements alone are not sufficient

conditions for direct channels.

Besides these four qualitative frameworks, there have been some attempts do develop

quantitative models of distribution channels. Balderston (1958) explains the existence of

intermediaries by a single variable: contact and communication costs. He contends that

every intermediary that cooperates but does not compete, reduces by its presence the total

cost of contact and communication in the system. For instance, if m = number of

producing firms, n = number of buyers and r = number of intermediaries (say retailers),

the number of contacts made in a direct channel will be = m x n; while in an indirect

channel it will be = r (m + n). Intermediaries will be drawn into the system (i.e. r will

increase) so long as the total contact and communication cost in the channel reduces,

allowing them to earn profits. In equilibrium, the number of intermediaries will therefore

be equal to:

Number of intermediaries (r)

=

(m x n)/(m + n)

This, of course, is a highly simplistic view, but can be extended to cover all types of

transaction costs, besides cost of contact and communication. Hence retailers, for

example, reduce the search, negotiation and contracting costs between manufacturers and

consumers by providing a physical market place with assortment of goods produced by

different manufacturers. Although, it only explains the existence of middlemen in one

level, the logic can be extended further to explain the existence of wholesalers between

the manufacturers and retailers.

25

Baligh and Richartz (1967) developed the Balderston model further to estimate the

number of levels of intermediaries, besides the number of intermediaries at each level,

and the effect of the following variables on the these numbers:

i)

cost of information transfer

ii)

fixed cost associated with entry of middlemen

iii)

market segmentation and product differentiation.

According to their model, the number of intermediaries in equilibrium (as given by

Balderston) will be reduced if any of the above factors increase. For example, in a

segmented market, all buyers do not contact all sellers. Hence the total cost in a direct

channel will be relatively lower, thereby reducing the number of intermediaries possible

in equilibrium. Similarly, the higher the fixed cost of entry for an intermediary, the lower

would be their number in equilibrium.

Huff (1981) uses central place theory to estimate the size, spacing and number of

distribution centers (retailer locations) required to provide goods and services to a

dispersed population. The basic premise of his model is that the price of a particular good

to a consumer includes not only the retail selling price, but also the travel costs incurred

in going to the retail location. If 'm' represents the distance from a consumer's residence

to a retail store, and 't' represents the cost for consumer per unit distance, then the total

price paid by the consumer = p + mt, where 'p' is the selling price.

Price

Price

p + mt -----

p + mt -------

~~-----

Distac

I

m

Distance

P------Quan

IQuantity

q

q'

26

The retailer's demand will be a function of the total price for consumers (actual demand q

will be less than q', which is the demand retailers would face if there were no travel costs

for consumers). The market area of a retail store, given a selling price, can then be

represented by a circle with radius proportional to the demand for the store. The more the

number of retailers in an unsaturated market, lower will be the cost for consumers.

However, if the market is fully covered by existing retailers, additional retail locations

will encroach upon each other's market areas, making the size of the circles smaller.

The following table summarizes the various approaches described above and reviews

them in the context of the changed scenario of e-commerce:

Approach

Key hypothesis

Implications for e-commerce

The higher the market

concentration, the better the

viability of direct channel

Geographic market concentration

not much relevant in terms of

transactions, because of the ubiquity

of the Internet. In terms of logistics,

developed by

Bucklin (1966)

it is still important.

The more the service required by

consumers (smaller lot sizes,

faster delivery), the lesser the

viability of direct channel.

Bucklin (1966)

/Copeland

(1923)

Indirect channels are more suited

for convenience goods & direct

channels for shopping goods.

Bruce Mallen

(1973)

Marketing functions will align in

the channel based on who can do

them more efficiently.

Intermediaries will exist if they

reduce transaction costs.

Williamson

(1979) / Coase

(1992; 1937)

Anderson &

Weitz (1983)

Still relevant. However, the network

created by parcel companies like

UPS and FedEx has increased the

feasibility of direct channel even for

smaller lot sizes and faster delivery.

Still relevant. However, the Internet

is bridging the gap by making

comparison-shopping convenient

and inexpensive.

"Core competency" argument still

relevant.

Small manufacturers are better

off using indirect channel to take

advantage of economies of

Transaction cost of direct marketing

reduced drastically by the Internet.

May result in disintermediation of

traditional intermediaries and/or

creation of new types of

intermediaries.

Small manufacturers may find

Internet sales more viable than the

indirect channel because of global

aggregation.

reach of Internet.

27

Balderston

(1958)

Intermediaries exist because they

reduce contact and

communication costs.

Baligh &

Richartz (1967)

The higher the market

segmentation, product

differentiation and fixed cost of

entry, the lower the number of

The Internet may wipe out

intermediaries that exist only for this

reason, by providing a low cost

many-to-many communication

medium.

The Internet has drastically lowered

the fixed cost of entry for

information intermediaries. Hence it

will fuel growth of information

intermediaries.

intermediaries.

Retailers' demand is a function

of total price to consumers,

which is a sum of selling price

and travel cost to retail outlet.

Quite relevant. Direct corollary of

this theory is that the demand of

retailers will reduce because relative

inconvenience cost for retail has

increased with the availability of

convenient online shopping.

Huff (1981)

2.4 Impact of the Internet:

Downes & Mui (1998) describe the Internet as a "killer app", i.e. a product or service that

"winds up displacing unrelated older offerings, destroying and re-creating industries far

from their immediate use, and throwing into disarray the complex relationships between

business partners, competitors, customers, and regulators of markets."

The impact of the Internet on the channels of distribution has however been addressed

only sparsely in the literature, since the Internet phenomenon itself is quite new. Malone,

Yates and Benjamin (1989) were among the first to link transaction cost theory to

electronic communication, illustrating how electronic markets can lower the cost of

transactions and influence the formation of markets. In their view, electronic networks

encourage vertical de-integration of firms by lowering the cost of "buying" compared to

"making" in-house.

In the context of channel decisions, transaction cost theory can be applied in two ways.

Proponents of the threatened intermediaries hypothesis argue that a ubiquitous network

(such as the Internet), by extending into consumers' homes, lowers the transaction costs

28

producers incur when marketing directly to end consumers. However, the same

transaction cost theory can be used to argue that producers will outsource intermediary

functions, resulting in greater reliance on intermediaries.

Sarkar, Butler & Steinfield (1998) resolve this paradox by arguing that four different

possibilities exist depending on changes in relative transaction costs:

After Internet:

Before Internet:

T2

Intermediary

Intermediary

Producer

Producer

Consumer

T3*

Ti *

Consumer

In the pre-Internet scenario, intermediaries existed if TI was greater than T2 + T3.

Similarly, in the post-Internet scenario, intermediaries will exist if T1* > T2* + T3*. The

impact of the Internet on intermediaries can therefore be evaluated for four different

scenarios:

Before Internet

T1* < T2* + T3*

T1<T2+T3

T1>T2+T3

Internet supplements

Threatened

direct market

intermediaries

Cybermediaries

Internet supplements

W-

T1* > T2* + T3*

intermediaries

Threatened intermediaries scenario is only one of the four possibilities, happening if

Internet flips the relative transaction costs in favor of direct transactions. In other cases,

Internet could be supporting existing markets or creating new intermediaries (called

cybermediaries).

29

Balasubramanian (1998) analyzes the competition between direct channels like catalog

and the Internet, and conventional retail channels, using a circular spatial market model.

He establishes a mathematical relationship between the relative cost advantages of direct

channels vs. retail channels, and the equilibrium market share that can be established by a

direct marketer. His model uses a concept similar to the one introduced by Huff, in terms

of the travel cost for consumers being a major component in arriving at the retailer's

market share. Based on this model, he derives the following hypotheses:

1. If consumers have complete knowledge of product availability and prices in all

channels, the direct marketer acts as a competitive wedge between retail stores. Each

retailer competes against the remotely located direct marketer, rather than against

neighboring retailers.

2. Direct marketers will participate in a market if consumers' travel cost (including

opportunity cost of time spent on retail shopping and implicit cost of convenience) is

high and the disutility of buying direct (not so quick gratification, no physical

inspection before buying, product returns difficult etc.) is low.

3.

Under the assumptions of the model, direct marketer can get a maximum two-third

share of the market even if the disutility of buying directfor consumers is zero.

Not much empirical research has been done on estimating the sectoral impact of the

Internet on distribution channels. Reliable economy-wide statistics on Internet commerce

is itself difficult to find. A recent report entitled "The Emerging Digital Economy" (US

Department of Commerce, 1998) analyzes the importance of electronic commerce and

information technologies to the economy as a whole and to individual sectors of the

economy. Some important highlights are:

" The Internet's pace of adoption has eclipsed all technologies that preceded it. To

reach the 50 million users mark, radio took 38 years, TV 13 years, PCs 16 years, and

the Internet took just 4 years.

" Computing power has been doubling every 18 months for the past 30 years. At the

same time, average price of a transistor has fallen by six orders of magnitude.

30

e

Traffic on the Internet has been doubling every 100 days.

" In 1994, 3 million people used the Internet. In 1998, 100 million people were using

the Internet. Some experts believe that by 2005, one billion people may be connected

to the Internet.

" Analysts predict that business-to-business commerce over the Internet will grow to

$300 billion by 2002, still however representing just 3% of the total GDP.

"

Digital delivery of news and information saves

about

30-40

f tV

h toLtl cos oCL

newspaper or magazine.

" Cost of electronic ticket purchased by a consumer on the Internet is 1/8th the cost of a

ticket sold by a travel agent.

" It costs about a penny to conduct banking transaction over the Internet, while it takes

more than a dollar if handled by a teller at a branch bank.

" By a conservative estimate, Internet retailing is expected to reach $7 billion by 2000.

A recent study sponsored by National Retail Federation (E&Y, 1998) highlights some

important facets of Internet commerce. Some key observations from the study are quoted

below:

e

Today's online retailers expect the Net to account for a steadily increasing percentage

of their revenue, from 1% of total sales today to 9% for fiscal year 2001.

Manufacturers already selling online project that the Internet will represent 7% of

their total revenue by their fiscal year 2001.

" Consumers who are online but don't buy through the Net cite two main reasons: the

fear of giving out credit card information and the need to see the product before

buying it.

" Companies that view the Internet as an 'either-or' proposition are missing the point.

Web can be an influential sales channel, but it also can be a powerful medium for

driving purchases through more traditional channels.

" Why are computers, books, clothing, music, gifts, and consumer electronics among

the most popular purchases of online shoppers? It is a function of several things: the

demographics of Web buyers; the attributes of products and services they are most

31

comfortable buying through this new medium; and who has been selling the longest

on the Web to date.

* Who do retailers fear most in cyberspace? None other than the growing number of

startup companies whose storefronts exist only in the digital world - companies with

no physical investments to protect, no channel relationships to massage, and

comparatively less internal corporate politics with which to contend.

*

Manufacturers of consumer products got more aggressive about selling direct to

consumers through the Internet in 1998, yet the majority still do not sell online today

and have no plans to do so in the future - particularly those with annual sales of more

than $1 billion.

The impact technology (like the Internet) can have on the traditional business structures

is dramatically highlighted by the case of Encyclopaedia Britannica (Evans & Wurster,

1997), which was completely devastated by the advent of CD-ROM encyclopaedia. Since

1990, sales of the Encyclopaedia Britannica multi-volume sets have decreased by more

than 50 percent. The reason is simple: it costs in the range of $1500-$2200 to buy the

paper version, while an encyclopaedia on CD-ROM, such as Microsoft Encarta, sells for

about $50 and customers often get it free because it is bundled with their personal

computers as CD-ROMs. Interestingly, the largest part of Britannica's cost structure was

not the editorial content, which constituted only about 5 per cent of costs, but the direct

sales force. When Britannica realized the threat from CD-ROM encyclopaedias it created

a CD-ROM version, but to avoid undercutting its sales force, the company included it

free with the printed version and charged anyone buying the CD-ROM alone $1000.

Revenues continued to decline, the best salespeople left, and Britannica's owner, a trust

controlled by the University of Chicago, finally sold out. Under new management, the

company is now trying to rebuild the business around the Internet.

This case highlights the two most important issues in e-commerce:

1. Fundamental changes in business are required to adapt to the new environment.

2. Managing this transition is likely to be painful to the existing players because of the

inherent conflict with their existing business.

32

3 Research Hypothesis:

It is clear that the traditional role of intermediaries

is now undergoing major

transformation. Two factors have been primarily responsible for this:

1. Growth of the Internet.

2. Growth of small parcel logistics services.

These two factors combined have enabled the creation of an alternative marketing

channel in which the information service to consumers (or customer interface/ transaction

management) is provided by information while logistics service is provided by third party

logistics companies (like FedEx).

Before Internet:

Manufacturers

1,Wholesalers

Retailers

Consumers

After Internet:

Information

Intermediaries

Manufacturers

Wholesalers

Retailers

Consumers

33

The information intermediaries may be providing information to the consumer by

accessing information owned by (or available with) the manufacturer, wholesaler or

retailer. Similarly, the logistics service providers may be delivering goods to the

consumer after picking directly from the manufacturer, wholesaler or retailer.

It is apparent from the above discussion that there are various (dis)intermediation

possibilities depending on which channel structure is more efficient in satisfying

consumer needs and at the same time allowing the commercial channel (manufacturers

and intermediaries) to make profits in the long run. The normative channel structure may

be expected to be different for different industries based on consumer needs,

expectations, buying behavior and product characteristics.

The key hypotheses of this thesis are as follows:

HJ: The Internet will lead to a reorganization of vertical markets in terms of the

functions performed by various players, instead of complete disintermediation.Multiple

(dis)intermediation scenarios may emerge based on which player performs what

function.

H2: Traditionalintermediaryfunctions will split into distinctfunctions of information (or

transactionmanagement) and logistics. In certain industries, value-added intermediaries

will emerge that will support Internet commerce by filling the functional gap of trust and

service support.

H3: Growth of information intermediaries will be much faster than other types and its

impact on traditional intermediaries will depend on the consumers needs and product

characteristics.

34

Logistics

Intermediaries

Traditionally, retailers have provided both logistics and information services to

consumers; and wholesalers in turn have provided the same to retailers. The logistics

services include:

1. Reducing delivery lot size to consumers (they can't buy a truck/ pallet load of an

item).

2. Reducing waiting time for consumers (they can pick up goods from retail outlets

rather than waiting for delivery after ordering).

3. Providing easy accessibility to consumers.

4. Providing product assortment from different manufacturers.

The information services include helping consumers in:

1. Product search.

2. Merchant search.

3. Price search.

Besides these services, intermediaries also facilitate negotiation between buyers and

sellers; and, help in building trust in the market mechanism. However, with rapid

diffusion of the Internet, information flow can be de-linked with the logistics flow since

an alternate channel that is more efficient is now available. The exponential growth of the

35

Internet will lead to a much more rapid growth of intermediaries that provide information

services, in comparison to the logistics intermediaries. And to support commerce in the

new channel so created, new types of intermediaries will also emerge that will fill the

functional gap of trust and service support.

36

4 Restructuring of intermediary functions:

This chapter explores in greater detail the form and structure of the three types of

intermediaries introduced in the previous chapter. Section 4.1 describes the reason for

rapid growth of information intermediaries and the different types of information

intcrmCdiaries that have already come into existence. Section 4.2 describes the different

types of logistics intermediaries that allow sellers to sell directly to end consumers

without traditional intermediaries. Section 4.3 describes the types of value-added

intermediaries that are coming into existence to support e-commerce.

4.1 Information intermediaries

Based on model developed by Baligh and Richartz (1967), it can be argued that the

number of information intermediaries on the Internet will grow much faster than

traditional intermediaries or intermediaries providing logistics services. To illustrate this,

let's take a fictitious example where number of sellers (M) = 100, number of buyers (N)

= 1000 and the contact and communication cost (C) is $5. Let's assume that the

minimum level of return on investment (ROI) acceptable to any new intermediary

entering the market is 20% and fixed cost (F) associated with entry of information

intermediary is about

1/ 1 0 th

that of traditional intermediaries (in absolute terms, say

$5000 and $50000 respectively).

In equilibrium, the number of intermediaries (say Z) in the system will be determined as

follows: According to Balderston (1958) model, new intermediaries will continue to enter

the system till such point that the transaction cost in direct channel (M*N*C) becomes

equal to the cost in the indirect channel ((M+N)*C*Z). However, according to Baligh &

Richartz (1967), the entry of new intermediaries will stop much earlier due to the entry

barriers associated with the fixed cost (investment) needed for entry. The profit potential

is based on the difference in transaction cost between the direct and indirect channel. If

37

this profit potential falls below the expected minimum return on investment, new entrants

will be discouraged from entering the channel. Hence, in equilibrium, F*ROI*Z will be

equal to (M*N*C - (M+N)*C*Z). Therefore,

Number of intermediaries in equilibrium

= M*N*C/(F*ROI + (M+N)*C)

= 100*1000*5/(50000*0.2 + 1100*5)

=32

After the advent of the Internet, the number of intermediaries in equilibrium will be:

= 100*1000*5/(5000*0.2 + 1100*5)

= 77

Hence, the number of intermediaries more than doubles! The above example is highly

simplified but illustrates how the Internet can potentially impact the number of

intermediaries in a channel, though it is relevant only to the information function of the

channel. Hence the number of information intermediaries is likely to increase

dramatically in comparison to traditional intermediaries. As some part of the value added

by traditional intermediaries is taken away by these new information intermediaries, the

number of traditional intermediaries may actually come down over a period of time.

Sarkar, Butler & Steinfield (1998) argue that the ability of electronic networks to reduce

transaction costs will not result in bypassing of intermediaries in the electronic markets.

On the contrary, it will reinforce the position of traditional intermediaries and also

promote the growth of a new generation of intermediaries called "cybermediaries".

Based on this argument, they identify several types of cybermediaries that have already

come into existence:

1. Directories: these services help consumers find sellers by providing structured menus

to facilitate

navigation

and search.

Examples

are

general

directories

like

www.yahoo.com and commercial directories like 'The Embroidery Directory' by

www.ud.net.

38

2. Search services: allow users to conduct keyword searches of web sites. Examples are

www.lycos.com and http://infoseek.go.com/ (which have now actually grown out of

the search engines category and become more of Internet portals/ gateways).

3. Malls: allow consumers to visit commercial sites that are listed in this 'mall'. These

malls can have a geographic focus, like 'The Alaskan Mall' at http://alaskan.com/ or

an

aggregation

of

variety

of products/

sellers

like

'Cybersuperstores'

at

www.cybersuperstores.com.

4. Virtual resellers: are e-retailers that carry inventory in a few central locations and

sell their products to the consumers on the Net. Examples are www.amazon.com that

sells books, music, video etc., www.hugestore.com that sell men's apparel and

'International Shopping Club' at www.intsc.com that sells consumer electronics.

5. Web site evaluators/ Auditors: help consumers to reduce some risk by providing

some form of evaluation of web sites. Examples include GNN. Firms like Nielsen

(www.nielsen-netratings.com ) on the other hand help sellers evaluate the efficacy of

different sites for advertising effectiveness by providing audience measurement

services.

6. Financial intermediaries: are intermediaries that facilitate payment transaction

between buyer and seller. Examples include credit card companies like MasterCard

(www.mastercard.com/shoponline) and others like www.checkfree.com that provide

electronic equivalents of writing checks.

7. Spot market makers: allow buyers and sellers to transact in ad-hoc spot markets.

Examples

of

such

services

are

www.ebay.corn

and

BarterNet

at

http://www.telepot.con-dtpdx/bnhome.htm.

8. Intelligent agents: are software programs that allow users to specify the search

criteria to find products/ merchants that satisfy the criteria. Examples are

BargainFinder (started by Anderson Consulting, but now discontinued) and

www.firefly.com.

Hagel and Rayport (1997) argue that new technologies such as smart cards, World Wide

Web browsers and personal financial management software will allow consumers to take

ownership of information about themselves and demand value in exchange for it.

39

However, consumers will probably not bargain with sellers directly, but through

companies called "infomediaries". These infomediaries will act as custodians, agents

and brokers of customer information, marketing it to businesses on behalf of the

consumers, while protecting their privacy at the same time.

They argue further that the best candidates to play this role are companies that have

ongoing relationships with customers in a variety of commercial activities and have

earned their customers' trust. In this respect, banks for example will be better positioned

to become infomediaries than say retailers, who in turn will be better positioned than

individual manufacturers. Over time, this industry may become concentrated because of

economies of scope and increasing returns. Infomediaries with large and diverse

customer base will enjoy economies of scope over those with narrower customer base. In

addition, trust will provide increasing returns to the infomediaries and will raise the

barriers to entry for newcomers.

4.2 Logistics intermediaries

According to consulting company Deloitte & Touche (Wilder, 1997), there is a big

potential that distributors who do not add value can get replaced by freight companies.

Companies like FedEx and UPS, who have an established logistics network, are well

positioned to take this place in e-commerce. NEC for example (Fortune, 1994), has an

agreement with FedEx to manage its entire distribution network, enabling it to reduce

distribution cost from 2.6% of sales to 1.9%. It is not surprising therefore, that FedEx and

UPS have vowed (Computerworld, 1996) that everything a customer does today will

soon be done online- and their financial future depends on it. Both offer web-based

package tracking solutions with 10,000 to 13,000 users using the site for tracking

everyday.

Logistics services can also be provided by companies, who have developed an expertise

in direct order fulfillment, like Fingerhut (www.fingerhut.com). Fingerhut Business

40

Services (FBS) offers order fulfillment services to companies that do not own the

infrastructure to sell their products through catalog or online. For instance, Fingerhut has

a relationship with Levi's (www.levi.com) that works as follows: the customer places an

order for a pair of jeans on Levi's web site. The order is not handled by Levi's but by

FBS. FBS receives the order, packs the merchandise that is warehoused at one of FBS

distribution centers, and mails it to the customer. All service and product returns issues

are handled by FBS on behalf of Levi's. Similar services are provided by Hanover Direct

(www.hanoverdirect.com) through their Keystone Fulfillment Division.

4.3 Value-added intermediaries

By 2002, Gartner Group (www.gartner-group.com) predicts that 60% of wholesale

distributors will earn most of their profits from post-sale services such as installation,

warranty and training. Many value-added intermediaries have already come into

existence to support the trust and service requirements of consumers in e-commerce. For

instance, virtually all Dell warranty services are provided by third party vendors like

Unisys

Corp.

and

Wang

Global

through

their

PowerEdge

services

(www.dell.com/products/poweredge/service).

Similarly, for providing trust services, independent rating companies are coming up fast

in the e-commerce arena. www.bizrate.com continuously surveys thousands of actual

customers, as they buy online, compiling their shopping experiences into reliable

merchant ratings consumers can trust to shop online. A rating for computer seller

Cyberian Outpost (www.outpost.com) for instance, looks like below:

41

out of five stars

.................................

Rating

I Overall

..........

Ease of Ordering

Product Selection

Product Information

Price

Website

4*1|t

4|r*

4*ig**

4*lir

*4l& *4

Customers Surveyet 5546

ClearCommerce

On-Time Delivery

***1

Product Representation 1***

Customer Support

* ***

Privacy Policies

1**

Shipping & Handling

**

TIs PerIod: 2379

*

|1

Report Ped:d 1/5 /99 - 4 /5 /99

(www.clearcommerce.com),

a member

of the SET committee

established by MasterCard and Visa, provides an array of services, including credit card

authorizations, online order and payment processing, and fraud detection. During

processing, a buyer's credit card information is transformed into an unreadable format

after performing multiple checks for fraud. The fraud module verifies name and address,

defends against credit card number-generating programs, and locks out suspect card

numbers and IP addresses. Similarly, Verisign (www.verisign.com) is one of the leading

providers of Internet trust services.

42

5 Developing an integrated framework:

In this chapter, various theories of distribution channels, reviewed in chapter 2 are

integrated into a common framework with the objective of analyzing the sectoral impact

of the Internet on intermediaries. Section 5.1 outlines the key factors that affect

distribution channel structure and explains why certain parameters (like price) have not

been included in this thesis for analyzing the impact of the Internet. Section 5.2 describes

the impact of the Internet on these variables and relates it to the hypothesis outlined in

chapter 3, that three distinct types of intermediaries (information, logistics and valueadded intermediaries) can come together to provide an alternative to the traditional

distribution channels. Section 5.3 describes how consumer buying behavior can modify

the simplistic assumptions of section 5.1 and 5.2 and how it can be used to develop a

decision flowchart that can be used to understand the sectoral differences

in

disintermediation. Section 5.4 describes the flowchart and possible disintermediation

scenarios that may emerge.

The framework uses the following inputs to explore the changes in channel structure:

" Consumer needs/ preferences.

" Product characteristics.

" Environmental factors.

Integrated

Framework

43

The following steps were followed in creating a framework that can be used to

differentiate the impact of the Internet on distribution channel structure for different

industries:

1. Identify key variables affecting channel structure.

2. Exclude variables outside the scope of this research.

3. Identify the impact of the Internet on the selected variables.

4. Create a logical decision flow to understand difference among industries.

5. Evaluate different disintermediation scenarios based on the decision flow chart.

5.1 Key factors affecting distribution channel structure

From a review of the literature, following factors emerge as critical from the point of

view of determining the normative channel structure:

Key variable

Lot size

Reference

Bucklin (1966)

Waiting time

Bucklin (1966)

Assortment

Alderson (1957)/

Bucklin (1966)

Huff (1981)/

Balasubramanian

(1998)

Inconvenience

cost

Risk of purchase

error

Sarkar et al

(1998)

Search/

transaction cost

Balderston

(1958)/

Williamson

(1979)

Sarkar et al

(1998)

Service support

Customization

Bucklin (1966)

Relevance to channel structure

Smaller the lot size required by the consumer,

greater the need for logistics intermediaries.

Lesser the consumers' willingness to wait, greater

the need for logistics intermediaries.

More the assortment need of consumers, more the

need for aggregation intermediaries.

Higher the inconvenience cost of retail purchase

for consumers, higher the intensity of retail

distribution required; and higher the threat from a

direct marketer.

Higher the risk of purchase error in direct

purchases without physical inspection, higher the

need for intermediaries.

Greater the search cost for consumers, greater the

need for information intermediaries.

Greater the service support required by

consumers, greater the need for value-added

intermediaries who can provide after sales

service.

Higher the customization required by consumers,

higher the viability of shorter channel.

44

The impact of these key variables on the channel structure can be summarized in the

following influence diagram:

inconvenience

cost

risk

search cost

service support

customization

need satisfaction