S I H P

advertisement

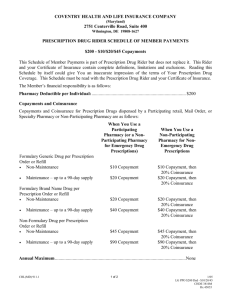

STATE OF IOWA HEALTH INSURANCE PLAN COMPARISON EFFECTIVE JANUARY 1, 2016 This comparison is only a summary of benefits. Benefits will be administered as described in each plan’s Summary of Benefits & Coverage. For further details, refer to those documents or call Wellmark Blue Cross Blue Shield at 1-800-622-0043. If there are discrepancies between this summary and Wellmark’s benefit certificates, the certificates will govern in all cases. Managed Care Plans PPO Plans Indemnity Plan Blue Access Iowa Select Program 3 Plus In Network Out-of-Network (Select Provider) (Non-Select Provider) General Conditions of Coverage Benefits Available from NonParticipating Providers You are responsible for any amounts between the billed charge and the maximum allowable fee paid by Wellmark. These amounts will not accumulate towards the medical out-of pocket maximum. Coinsurance Percentage None, unless prescribed and referred by a participating physician and approved by Wellmark, or in an emergency medical situation. Normal plan benefits for network providers. Deductible Family deductible is reached from amounts accumulated on behalf of any family member or combination of family members. Not applicable unless noted below. 10% 20% 20% for all services None Single: $250 Family: $500 Single: $250 Family: $500 Single: $300 Family: $400 Applies to both inpatient and outpatient services. Waived for services provided in office/clinic setting of select provider. Applies to both inpatient and outpatient services. Inpatient services only. Normal plan benefits for nonnetwork providers. Normal plan benefits. The entire family deductible must be met before benefits payments are made. Dependent Child Age Limit • • • Medical Maximum Out-ofPocket (MOP) Single: $750 Family: $1500 Single: $650 Family: $1,450 Single: $650 Family: $1,450 Single: $650 Family: $1,450 Family maximum out-of-pocket is reached from amounts accumulated on behalf of any family member or combination of family members. All copayments and coinsurance go toward out-of-pocket limit. Applies to services provided both in- and out-of-network. All deductibles, coinsurance, and copayments go toward out-ofpocket limit. Emergency Room copayment continues to apply after out-of-pocket limit is met. Applies to services provided both in- and out-of-network. All deductibles, coinsurance, and copayments go toward out-ofpocket limit. Emergency Room copayment continues to apply after out-of-pocket limit is met. All deductibles, coinsurance, and copayments go toward out-of-pocket limit. Lifetime Benefit Maximum None None None New Employee Preexisting Condition Waiting Period No preexisting conditions No preexisting conditions No preexisting conditions Children through the end of the year in which they turn age 26 regardless of marital status or residency. Unmarried children over the age of 26 who are full-time students in an accredited institution of post secondary education. Unmarried children who are totally and permanently disabled, physically or mentally, regardless of age. The disability must have existed before the child turned age 27 or while a full-time student. Revised 03/2016 Page 1 NOTE: The Wellmark Blue Cross and Blue Shield (BCBS) plan’s coverage percentage for hospital and other facility services does not reflect the actual payment to the provider. The actual payment to the provider is based on BCBS’s contract with the provider. The percentage is used in this document for comparison purposes only. On any given claim, the amount represented by the coverage percentage times the covered charge may be satisfied by BCBS’s payment to the provider plus any amounts the provider agrees to waive under its contract with BCBS. Please see your coverage manual for more information. STATE OF IOWA HEALTH INSURANCE PLAN COMPARISON EFFECTIVE JANUARY 1, 2016 Managed Care Plans PPO Plans Indemnity Plan Blue Access Iowa Select Program 3 Plus In Network Out-of-Network (Select Provider) (Non-Select Provider) Monthly Premiums Note: Rates shown are 1/12 the annual cost Single Coverage Employee’s Contribution UNI’s Contribution $20.00 $601.10 $20.00 $829.04 $20.00 $831.66 $20.00 $1,435.20 $297.92 $1,690.77 $304.04 $1,690.77 Contract Holder $20 Contract Holder $707.60 Contributing Spouse $0 Contributing Spouse $727.60 Contract Holder $20 Contract Holder $974.35 Contributing Spouse $0 Contributing Spouse $994.35 Contract Holder $20 Contract Holder $977.41 Contributing Spouse $0 Contributing Spouse $997.41 $20.00 $1,435.20 $20.00 $1,968.69 $20.00 $1,974.81 Family Coverage Employee’s Contribution UNI’s Contribution 2 State Employees Coverage Employee’s Contribution UNI’s Contribution Employee’s Contribution UNI’s Contribution 2 UNI Employees Coverage Employee’s Contribution UNI’s Contribution Professional Office Services Office Visit $10 copayment $15 copayment $15 copayment $15 copayment Allergy Testing $10 copayment 10%, deductible waived 20%, after deductible 20%, no deductible Allergy Serum and Injections $10 copayment 10%, deductible waived 20%, after deductible 20%, no deductible Chiropractor $10 copayment, if approved 10%, deductible waived 20%, after deductible 20%, no deductible Routine Eye Exam $10 copayment $15 copayment $15 copayment Not covered *Limit of one exam per member per calendar year *Limit one exam per member per year. *Limit of one exam per member per calendar year $10 copayment $15 copayment $15 copayment *Limit of one exam per member per calendar year *Limit one exam per member per year. *Limit of one exam per member per calendar year Maternity 0% for delivery. $10 copayment for initial visit; remaining pre and postnatal visits paid in full 10%, deductible waived in office setting for pre and post-natal visits 20% after deductible 20%, no deductible for pre and post-natal office visits. Surgery, Radiology & Pathology (Office) $10 10%, deductible waived 20%, after deductible 20%, no deductible Routine Hearing Exam Not covered Revised 03/2016 Page 2 NOTE: The Wellmark Blue Cross and Blue Shield (BCBS) plan’s coverage percentage for hospital and other facility services does not reflect the actual payment to the provider. The actual payment to the provider is based on BCBS’s contract with the provider. The percentage is used in this document for comparison purposes only. On any given claim, the amount represented by the coverage percentage times the covered charge may be satisfied by BCBS’s payment to the provider plus any amounts the provider agrees to waive under its contract with BCBS. Please see your coverage manual for more information. STATE OF IOWA HEALTH INSURANCE PLAN COMPARISON EFFECTIVE JANUARY 1, 2016 Managed Care Plans PPO Plans Indemnity Plan Blue Access Iowa Select Program 3 Plus In Network Out-of-Network (Select Provider) (Non-Select Provider) Hospital Services Inpatient Hospital Services Preapproval of Inpatient Admission Required Required Required Required Inpatient Hospital Services 10% 10%, after deductible 20%, after deductible 20%, after deductible • Room & Board • Inpatient Physician Services • Inpatient Supplies • Inpatient Surgery Outpatient Hospital Services Ambulatory Surgical Center 10% 10%, after deductible 20%, after deductible 20%, no deductible Outpatient Diagnostic Lab, Radiology 10% 10%, deductible waived 20%, after deductible 20%, no deductible Ambulance 10% 20, after deductible 20%, after deductible 20%, no deductible Urgent Care Center 10% 10%, after deductible 20%, after deductible 20%, after deductible Hospital Emergency Room $50 copayment; waived if admitted $50 copayment; waived if admitted. 20%, after deductible 0%, no deductible Emergency Care Behavioral Health Services Inpatient Mental Health and Substance Abuse Treatment 10% 10%, after deductible 20%, after deductible 20%, after deductible Outpatient Mental Health and Substance Abuse Treatment 10% $0 copayment $0 copayment $0 copayment 10%, after deductible 20%, after deductible 20%, no deductible Outpatient Therapy Services • Chemotherapy • Physical Therapy • Occupational Therapy • Respiratory Therapy • Speech Therapy $10 copayment per visit 60 visit limit for each of the following services: Physical Therapy (excluding Chiropractic) Occupational Therapy Respiratory Therapy Speech Therapy Revised 03/2016 Page 3 NOTE: The Wellmark Blue Cross and Blue Shield (BCBS) plan’s coverage percentage for hospital and other facility services does not reflect the actual payment to the provider. The actual payment to the provider is based on BCBS’s contract with the provider. The percentage is used in this document for comparison purposes only. On any given claim, the amount represented by the coverage percentage times the covered charge may be satisfied by BCBS’s payment to the provider plus any amounts the provider agrees to waive under its contract with BCBS. Please see your coverage manual for more information. STATE OF IOWA HEALTH INSURANCE PLAN COMPARISON EFFECTIVE JANUARY 1, 2016 Managed Care Plans PPO Plans Indemnity Plan Blue Access Iowa Select Program 3 Plus Prescription Drug Coverage In Network Out-of-Network (Select Provider) (Non-Select Provider) Wellmark Drug List for all Plans http://www.wellmark.com (Select ‘Blue Rx Complete) Retail Quantity 30-day or 90-day supply for maintenance and non-maintenance drugs 30-day or 90-day supply for maintenance and nonmaintenance drugs 30-day or 90-day supply for maintenance and nonmaintenance drugs 30-day or 90-day supply for maintenance and nonmaintenance drugs Tier 1 Medications $5 copayment for a 30-day supply or $15 copayment for a 90-day supply per prescription or refill $5 copayment for a 30-day supply or $15 copayment for a 90-day supply per prescription or refill $5 copayment for a 30-day supply or $15 copayment for a 90-day supply per prescription or refill $5 copayment for a 30-day supply or $15 copayment for a 90-day supply per prescription or refill Tier 2 Medications $15 copayment for a 30-day supply or $45 copayment for a 90-day supply per prescription or refill $15 copayment for a 30-day supply or $45 copayment for a 90-day supply per prescription or refill $15 copayment for a 30-day supply or $45 copayment for a 90-day supply per prescription or refill $15 copayment for a 30-day supply or $45 copayment for a 90-day supply per prescription or refill Tier 3 Medications $30 copayment or 25%, whichever is greater, for a 30-day supply per prescription or refill. $90 copayment or 25%, whichever is greater, for a 90-day supply per prescription or refill $30 copayment for a 30-day supply per prescription or refill. $90 copayment for a 90-day supply per prescription or refill $30 copayment for a 30-day supply per prescription or refill. $90 copayment for a 90-day supply per prescription or refill $30 copayment for a 30-day supply per prescription or refill. $90 copayment for a 90-day supply per prescription or refill Tier 4 Medications Same as Tier 3 Same as Tier 3 Same as Tier 3 Same as Tier 3 Mail Order Prescription Drugs Tier 1 Medications $10 copayment for each prescription or refill up to a 90 day supply $10 copayment for each prescription or refill $10 copayment for each prescription or refill $10 copayment for each prescription or refill Tier 2 Medications $30 copayment for each prescription or refill up to a 90 day supply $30 copayment for each prescription or refill $30 copayment for each prescription or refill $30 copayment for each prescription or refill Tier 3 Medications $60 copayment for each prescription or refill up to a 90 day supply $60 copayment for each prescription or refill $60 copayment for each prescription or refill $60 copayment for each prescription or refill Tier 4 Medications $60 copayment for each prescription or refill up to a 90 day supply $60 copayment for each prescription or refill $60 copayment for each prescription or refill $60 copayment for each prescription or refill Single $5,850 Single $500 Single $500 Single $500 Family $11,700 Family $1,000 Family $1,000 Family $1,000 Family out-of-pocket is reached from amounts accumulated on behalf of any family member or combination of family members. Family out-of-pocket is reached from amounts accumulated on behalf of any family member or combination of family members. Family out-of-pocket is reached from amounts accumulated on behalf of any family member or combination of family members. Family out-of-pocket is reached from amounts accumulated on behalf of any family member or combination of family members. Pharmacy Out-of-Pocket Maximum Revised 03/2016 Page 4 NOTE: The Wellmark Blue Cross and Blue Shield (BCBS) plan’s coverage percentage for hospital and other facility services does not reflect the actual payment to the provider. The actual payment to the provider is based on BCBS’s contract with the provider. The percentage is used in this document for comparison purposes only. On any given claim, the amount represented by the coverage percentage times the covered charge may be satisfied by BCBS’s payment to the provider plus any amounts the provider agrees to waive under its contract with BCBS. Please see your coverage manual for more information. STATE OF IOWA HEALTH INSURANCE PLAN COMPARISON EFFECTIVE JANUARY 1, 2016 Glossary of Benefit Terms Blue Access Iowa Select Program 3 Plus Deductible Not Applicable Deductible The amount you owe for health care services your health insurance or plan covers before your health insurance or plan begins to pay. Deductible The amount you owe for health care services your health insurance or plan covers before your health insurance or plan begins to pay. Copayment A fixed amount you pay for a covered health care service, usually when you receive the service. Copayment A fixed amount you pay for a covered health care service, usually when you receive the service. Copayment A fixed amount you pay for a covered health care service, usually when you receive the service. In-Network Providers who contract with your health plan. Your payments may be less when seeking treatment from an in-network facility or physician. In-Network Providers who contract with your health plan. Your payments may be less when seeking treatment from an in-network facility or physician. In-Network Not Applicable Tier 4 Limited-value drugs Limited-value drugs are combination products, lifestyle drugs, or drugs with more costeffective options available on lower tiers (i.e. generics) Tier 4 Limitedvalue drugs Limited-value drugs are combination products, lifestyle drugs, or drugs with more cost-effective options available on lower tiers (i.e. generics) Tier 4 Limitedvalue drugs Limited-value drugs are combination products, lifestyle drugs, or drugs with more costeffective options available on lower tiers (i.e. generics) Max out-of-pocket (MOP) This is the most you could pay during a coverage period (usually one calendar year) for your share of the cost of covered services. This limit helps you plan for health care expenses. Max out-of-pocket (MOP) This is the most you could pay during a coverage period (usually one calendar year) for your share of the cost of covered services. This limit helps you plan for health care expenses. The in-network health and drug card maximum out of pocket amounts accumulate separately. Max out-of-pocket (MOP) This is the most you could pay during a coverage period (usually one year) for your share of the cost of covered services. This limit helps you plan for health care expenses. Note: Emergency Room copayment continues to apply after out-of-pocket limit is met. Single Single Single $750 Medical MOP $650 Medical MOP $650 Medical MOP $5,850 Rx MOP $500 Rx MOP $500 Rx MOP $6,600 Total MOP $1,150 Total MOP $1,150 Total MOP Family $1,500 Medical MOP Family $1,450 Medical MOP Family $1,450 Medical MOP $11,700 Rx MOP $1,000 Rx MOP $1,000 Rx MOP $13,200 Total MOP $2,450 Total MOP $2,450 Total MOP Revised 03/2016 Page 5 NOTE: The Wellmark Blue Cross and Blue Shield (BCBS) plan’s coverage percentage for hospital and other facility services does not reflect the actual payment to the provider. The actual payment to the provider is based on BCBS’s contract with the provider. The percentage is used in this document for comparison purposes only. On any given claim, the amount represented by the coverage percentage times the covered charge may be satisfied by BCBS’s payment to the provider plus any amounts the provider agrees to waive under its contract with BCBS. Please see your coverage manual for more information. STATE OF IOWA HEALTH INSURANCE PLAN COMPARISON EFFECTIVE JANUARY 1, 2016 Revised 03/2016 Page 6 NOTE: The Wellmark Blue Cross and Blue Shield (BCBS) plan’s coverage percentage for hospital and other facility services does not reflect the actual payment to the provider. The actual payment to the provider is based on BCBS’s contract with the provider. The percentage is used in this document for comparison purposes only. On any given claim, the amount represented by the coverage percentage times the covered charge may be satisfied by BCBS’s payment to the provider plus any amounts the provider agrees to waive under its contract with BCBS. Please see your coverage manual for more information.