Document 10715039

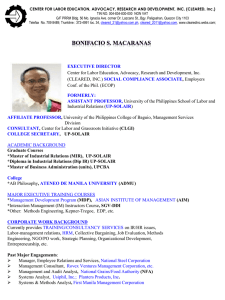

advertisement