DPI Reports NCASBO Conference March 1, 2006

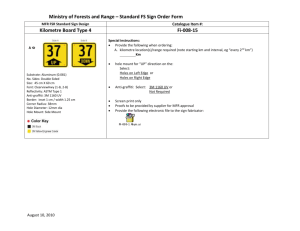

advertisement

DPI Reports NCASBO Conference March 1, 2006 Importance of LEA Information Used by: Legislature Governor Federal Government Media Parents DPI Fiscal Research Governor’s Report Card “No Child Left Behind” Analysis concerning Legal issues (LEANDRO) UERS Reporting Calendar http://www.ncpublicschools.org/fbs/reports.htm Remaining FY05-06 UERS Data Transfer Schedule 2006 February 03/02/06 (Thursday) March 04/03/06 (Monday) April 05/03/06 (Wednesday) * May 06/01/06 (Thursday) June 06/30/06 (Friday) AFR (Preliminary) 07/06 (Final) 08/06 (* Transfer includes ESC data for previous quarter) LEA Data Flow LEA LEA completes Monthly work & Closes month DPI DPI pulls monthly data PR, AP, Summary, MFR, Ret., ESC Global changes, Print Initial Reports Pass Retirement data Pass ESC data Review Reports Update Salary System with Detailed PR data Update MFR System Run and Download Final reports Update MSA with Summary Data Monthly Cash Zero out Process Run and Download Final reports Apply BUD batches Update FTD files With Detailed PR & AP data LEA Data Flow LEA LEA completes Monthly work & Closes month DPI DPI pulls monthly data PR, AP, Summary, MFR, Ret., ESC Global changes, Print Initial Reports Pass Retirement data Pass ESC data Review Reports Update Salary System with Detailed PR data Update MFR System Run and Download Final reports Update MSA with Summary Data Monthly Cash Zero out Process Run and Download Final reports Apply BUD batches Update FTD files With Detailed PR & AP data LEA Data Flow LEA LEA completes Monthly work & Closes month DPI DPI pulls monthly data PR, AP, Summary, MFR, Ret., ESC Global changes, Print Initial Reports Pass Retirement data Pass ESC data Review Reports Update Salary System with Detailed PR data Update MFR System Run and Download Final reports Update MSA with Summary Data Monthly Cash Zero out Process Run and Download Final reports Update FTD files With Detailed PR & AP data Apply BUD batches • Date changes, code changes, installment indicators LEA Data Flow LEA LEA completes Monthly work & Closes month DPI DPI pulls monthly data PR, AP, Summary, MFR, Ret., ESC Global changes, Print Initial Reports Pass Retirement data Pass ESC data Review Reports Update Salary System with Detailed PR data Update MFR System Run and Download Final reports Update MSA with Summary Data Monthly Cash Zero out Process Run and Download Final reports Update FTD files With Detailed PR & AP data Apply BUD batches • Record Count, invalid codes, duplicate records LEA Data Flow LEA LEA completes Monthly work & Closes month DPI DPI pulls monthly data PR, AP, Summary, MFR, Ret., ESC Global changes, Print Initial Reports Pass Retirement data Pass ESC data Review Reports Update Salary System with Detailed PR data Update MFR System Run and Download Final reports Update MSA with Summary Data Monthly Cash Zero out Process Run and Download Final reports Update FTD files With Detailed PR & AP data Apply BUD batches • Invalid codes, revenue not = expenses LEA Data Flow LEA LEA completes Monthly work & Closes month DPI DPI pulls monthly data PR, AP, Summary, MFR, Ret., ESC Global changes, Print Initial Reports Pass Retirement data Pass ESC data Review Reports Update Salary System with Detailed PR data Update MFR System Run and Download Final reports Update MSA with Summary Data Monthly Cash Zero out Process Run and Download Final reports Apply BUD batches Update FTD files With Detailed PR & AP data LEA Data Flow LEA LEA completes Monthly work & Closes month DPI DPI pulls monthly data PR, AP, Summary, MFR, Ret., ESC Global changes, Print Initial Reports Pass Retirement data Pass ESC data Review Reports Update Salary System with Detailed PR data Update MFR System Run and Download Final reports Update MSA with Summary Data Monthly Cash Zero out Process Run and Download Final reports Apply BUD batches Update FTD files With Detailed PR & AP data LEA Data Flow LEA LEA completes Monthly work & Closes month DPI DPI pulls monthly data PR, AP, Summary, MFR, Ret., ESC Global changes, Print Initial Reports Pass Retirement data Pass ESC data Review Reports Update Salary System with Detailed PR data Update MFR System Run and Download Final reports Update MSA with Summary Data Monthly Cash Zero out Process Run and Download Final reports Apply BUD batches Update FTD files With Detailed PR & AP data LEA Data Flow LEA LEA completes Monthly work & Closes month DPI DPI pulls monthly data PR, AP, Summary, MFR, Ret., ESC Global changes, Print Initial Reports Pass Retirement data Pass ESC data Review Reports Update Salary System with Detailed PR data Update MFR System Run and Download Final reports Update MSA with Summary Data Monthly Cash Zero out Process Run and Download Final reports Update FTD files With Detailed PR & AP data Apply BUD batches • Balance LEA books to DPI’s • Check allotments, salary exceptions Monthly Reports Downloaded from DPI to LEAs Reconcile Monthly Reports -- DPI downloads & netviews the following monthly reports: JHA360EG - Cash zero out (state), JHA903EG - Cash zero out (federal), JHA351EG - Allotment Balance (state), JHA856EG - Certification History (state), JHA305EG - Budget Balance (federal), JHA314EG - Cash Balance (federal), JHA406CO - Allotment Balance (bonds), JHA407CO - Project Balance (bonds), These reports must be reconciled to the general ledger. Monthly Reports Downloaded from DPI to LEAs Reconcile Monthly Reports (con’t.) -- DPI downloads & netviews the following monthly reports: Monitoring Letter (Financial Data Report Card) JHA899EG – MFR/DBS Match report, PGA10RP4-E – MFR Error Messages Issued, PGA10RP4-V – MFR Verification Messages Issued, PGA10RP1 – Records Dropped due to Invalid Data, PGA10RP2 – Information Dropped Per Finance Officer’s Request, PGA10RP5 – MFR Revenue & Expenditure Summary These reports must be reconciled to the general ledger. Monthly Expenditure Reports Cash Zero-Out Reports State Cash Zero-out Report (JHA360EG) To notify the LEA of the amount of the monthly cash zeroout for the State Public School Fund(SPSF) and the School Technology Fund(ST). If the balance is positive (cash remaining) then we do a negative certification. If the balance is negative (cash deficit) then we do a positive certification. Monthly Expenditure Reports Cash Zero-Out Reports Federal Cash Zero-out Report (JHA903EG) A summary report by program (PRC) to notify the LEA of the amount of the monthly cash zero-out for the Federal funds, by PRC. The Cash Advance Account (22430000) is the mirror image of the Cash Account (11010000). Therefore, the 22430000 Account carries a credit balance. Credit = Positive Balance. Monthly Expenditure Reports Cash Zero-Out Reports Federal Cash Zero-out Report (continued) If the balance in the 22430000 Account is a CREDIT, the zero-out will process a NEGATIVE certification. If the balance in the 22430000 Account is a DEBIT, the zero-out will process a POSITIVE certification. Monthly Expenditure Reports State Public School Fund Allotment Balance Report (JHA351EG) This report is grouped by PRC. Shows the most recent allotment; beginning YTD transaction balance; current month transactions, including adjustments and refunds by account code; source code of transaction; YTD transactions; and remaining allotment balance. Used in the reconciliation process. See MFR Report “899”. Monthly Expenditure Reports State Public School Fund Certification History Report (JHA856EG) This report shows you the certifications received for each month, the expenditures recorded for each month, and your ending cash balance for the month. Used to reconcile the cash certifications which have posted for your LEA. Should match the Zero-Out Report. Monthly Expenditure Reports Federal Grants Fund Budget Balance Report (JHA305EG) Report is grouped by PRC. Shows the most recent budget; current month transactions, including adjustments and refunds; source code of transaction; YTD transactions; and remaining budget balance. Used in the reconciliation process. See MFR Report “899”. Monthly Expenditure Reports Federal Grants Fund Cash Balance Report (JHA314EG) Shows the beginning fiscal year cash balance, certifications recorded, cash transactions recorded, and the ending calculated cash balance. Used to reconcile the cash certifications which have posted for your LEA. An Asterisk (*) in the “Error Flag” column: calculated cash balance does not equal the “22430000” Cash Advance Account balance. Should match the Zero-Out Report. Monthly Expenditure Reports School Building Bonds Allotment Balance Report (JHA406CO) Shows Current, YTD, and Life-to-date (LTD) expenditures for each project by account number. The Allotment Balance is the remaining cash allotment after LTD expenditures. Used in the reconciliation process. See Summary Project Analysis – Cash balance Report. Monthly Expenditure Reports School Building Bonds Project Balance Report (JHA407CO) Shows the approved project amount, the allotment amount (cash available to draw), and the cash certifications by project. Allotment Balance = Amount of Cash Available to draw for each project. Project Balance – Amount of Funding Available to be Allotted Used in the reconciliation process. See Summary Project Analysis – Cash balance Report. Monthly Expenditure Reports School Building Bonds Summary Project Analysis – Cash Balance Report Combines information from the “406” and “407” reports. Shows “At-A-Glance” Allotment Balance and Cash Balance. Error Flag ** - Expenditures charged to invalid projects or expenditures exceed Total Project Amount. Use to determine the Cash Zero-Out Amount. Monthly Expenditure Reports Monitoring Letter Financial Data Report Card Part 1: UERS Compliance Part 2: Monthly Cash Zero-Out Part 3: Expenditure Code Errors Monthly Expenditure Reports MFR Reports DBS/MFR Match Report (JHA899EG) Shows the comparison MTD and YTD between the DBS data (Datafile and BUD) and the MFR data (LEA general ledger) for Funds 1 and 3. Any differences on this report must be reconciled. Monthly is recommended. This is Your Reconciliation Report. Matches to JHA351 and JHA305 reports. Monthly Expenditure Reports MFR Reports MFR Error Messages Issued (PGA10RP4-E) Lists Account Code and Posting Errors. Edits State and Federal codes against the defined Uniform Chart of Accounts for these funds. Edits Local codes against the Uniform Chart of Accounts. Purpose code & Object code must be valid; PRC can not equal Zero for expenditures. All items on this report need to be corrected by the final 13th Period reporting. This includes all funds: State, Federal, and Local. Monthly Expenditure Reports MFR Reports MFR Verification Messages Issued (PGA10RP4-V) Notification of unusual transactions / conditions. Expenditure codes with “negative” balances. Code notices: “Object 421 for State Textbooks”. Items on this report do not have to be corrected if they are valid transactions. If they are not valid transactions, you need to correct your general ledger only. You do not need to notify DPI of these corrections. Monthly Expenditure Reports MFR Reports MFR Records Dropped due to Invalid Data (PGA10RP1) Types of invalid data include: Fiscal Year or period not current. YTD Balance not numeric. Fund Code not 1-9. First digit of Purpose Code not 1-9. New in FY04 for expenditures in funds 1-8: PRC or Object Code = 000. Monthly Expenditure Reports MFR Reports Information Dropped Per Finance Officer’s Request (PGA10RP2) Includes items that were dropped at the LEA Finance Officer’s request. To request that certain funds and/or PRC’s be excluded for per-pupil calculations, complete the “Funds and/or PRC’s to exclude for MFR Process” request form located on DPI’s website. You may not exclude Fund 1 or Fund 3 codes/PRCs. Monthly Expenditure Reports MFR Reports MFR Revenue & Expenditure Summary (PGA10RP5) Report is grouped by PRC. Shows all revenue and expenditure codes. Transactions categorized by Fund: State, Federal, and Local. For each Fund, shows Total Revenues, Total Expenditures, and any Difference. Are State, Federal, and Local flags set correctly? AFR/MFR Reminders The MFR File is picked up at same time as UERS financial files. ALL items on the Error Report for ALL funds must be corrected. Items on the Verification Report are “ticklers”. “MFR Exclude” Form on website www.ncpublicschools.org/fbs/mfr-excludeform.pdf AFR/MFR Reminders Verify that your local PRCs are flagged correctly so the expenditures are in the appropriate column (state, federal, or local) on Report 5. The DBS/MFR match report (899) reconciles your books to DPI’s books for Funds 1 and 3. All YTD Discrepancies should be corrected. AFR/MFR Reminders Review the AFR/MFR Recommendations posted on the Financial and Business Services web page to ensure you have reported your Per Pupil expenditures accurately. www.ncpublicschools.org/fbs/afr-mfr04.html In Periods 10 – 13, review the preliminary Per Pupil reports to see how your numbers look compared to prior years. If there are major discrepancies between years, you need to be able to explain these. AFR/MFR Reminders For Periods 10, 11 and 12: If the numbers on your MFR report 5 do not match the numbers on your MFR 899 report, the difference is ENCUMBRANCES. For Periods 10, 11 and 12, DPI includes encumbrances in the MFR reports because we run preliminary PER Pupil numbers. Including the encumbrances with the expenditures helps DPI give the LEAs more accurate Per Pupil numbers. For all other Periods (1 – 9 and 13), encumbrances are not included. AFR/MFR Reminders All Funds (State, Federal, & Local) MUST use standard coding guidelines. Coding errors could lead to an unintentional misrepresentation of the Per Pupil Expenditure data. Workshop Expenses - Object 312 ONLY used with Purpose Codes 5930, 6930 and 7930. Object 421 only used to record State Textbook Account transactions in Fund 2. Even when a PRC has an Open Chart, the Purpose and Object codes have to go together - 142 only goes with a 5XXX purpose code. Invalid Budget Codes If invalid budget codes continue to be used by LEAs, DPI might: Go to a financial warning status for LEAs (as is currently done for charter schools). Ignore, rather than move, expenditures reported on invalid codes, as is currently done with expenditures reported on liability codes. This would effect the zero out and bank reconciliation. Add invalid code errors to the Finance Officer’s award criteria with updates to State Board members and a letter to the superintendent. MFR/AFR Q & A Q - What if the 899 report shows a $100.00 difference on one expenditure code and a negative $100.00 difference on another? A - It could be one of several things: The code used to record the expense was invalid and DPI posted the expense to another code. Do an AJE to move the expense on LEA’s books and mark the invalid code as unusable. MFR/AFR Q & A LEA did an AJE to move an expense but did not do a 202 for DPI to make the corresponding change. To correct, send a 202 to DPI but do not interface to LEA GL. LEA sent a 202 to DPI but did not interface the entries to LEA GL. To correct, post AJEs to LEA books. LEA sent a 202 to DPI and interfaced the entries to LEA GL but BUD batch was rejected. To correct, correct the BUD batch and resend the batch to DPI but do not interface to LEA GL. MFR/AFR Q & A Q - What if the 899 report shows a difference on a salary code and it is not the net or gross of a payroll check written from that code? A - It probably is an employee deduction amount(s) resulting from one of the following: MFR/AFR Q & A If an employee’s payroll check is voided at the end of the month and either not rewritten or re-written for a smaller amount, credits will remain outstanding to the vendor and the 899 will show MTD and YTD differences. When the credits are included in the next check to the vendor in the next month, the next 899 will show offsetting MTD differences but 0 YTD differences. Verify deduction amount(s) and be patient. MFR/AFR Q & A If a payroll related vendor check is voided at the end of the month and not re-written until the following month, the 899 will show MTD and YTD differences. When the check is written to the vendor in the next month, the next 899 will show offsetting MTD differences but 0 YTD differences. Verify deduction amount(s) and be patient. Depending on the amount of the check this could have an impact on the zero out and you may need to rerequest the cash for next month. MFR/AFR Q & A If a payroll related vendor check is not dated within the current month, DPI will not see the expenditures and the 899 will show MTD and YTD differences. Verify deduction amount(s) differences. The check date will determine when and if DPI will pick up the expenditures through data file in a future pay period. A paper 202 would be needed if a prior period check date was used. MFR/AFR Q & A If a payroll invoice was accrued to an incorrect vendor, liability codes can be used to easily move the payment to the correct vendor. Credit the incorrect vendor and then debit/invoice the correct vendor, using the same liability code for each entry. If the credit to the incorrect vendor results in a zero/deselected payment, you must write a manual zero net check to the incorrect vendor to zero out the liability, clear the invoices to the vendor and report the correct deduction expenses to DPI. Failure to write a zero net check will result in MTD and YTD differences on the 899 report. MFR/AFR Q & A Q - What if the differences between DBS (DPI’s books) and MFR (LEA’s books) are due to differences between installment accruals and actual installment expense? A – To correct, post AJEs to move the differences from the current year expenditure codes to the installment collapse codes. The three collapse codes are 1-5100-001-122, 15910-001-212 and 1-5910-001-222. Escheating Checks In most cases, the easiest way to escheat a check is to simply accrue the invoice against the cash account. This will debit the expense code (cash) and credit cash (cash) leaving a zero net effect on the LEA’s current year books, giving a history audit trail and producing a legal voucher. Remove/Clear the original voucher on the outstanding check list in bank recon. Replacing old checks If it is determined that the old check should be re-issued to the original payee, the same process can be followed as for escheating checks. Accrue an AP invoice to the original payee using the cash code and re-issue the check. This will debit the expense code (cash) and credit cash (cash) leaving a zero net effect on the LEA’s current year books, giving a history audit trail and producing a legal voucher. Remove/Clear the original voucher on the outstanding check list in bank recon. Escheating and Replacing Checks Since the cash code is being used on the AP invoice accrual entry for these two types of checks, you will receive a UERS edit stating that the purpose and object codes are invalid. Verify that there are no other errors and continue with check processing. E-mail Ally Barfield (abarfiel@dpi.state.nc.us) the check number and amount so DPI will not count the entry as a UERS error when we pick up your financial data. DPI Weekly Newsletter DPI’s weekly Newsletter via e-mail is an important source of information. Newsletter usually every Tuesday. Check your e-mail everyday. Urgent information could come any day. Newsletter also posted on the FBS website: www.ncpublicschools.org/fbs/newsletters.html To be added to the distribution list, please contact Debby Jackson @ 919-807-3603 or Debjacks@dpi.state.nc.us .