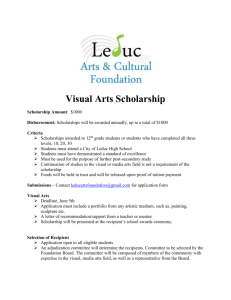

KICK Summer Camp Scholarship Application

advertisement

KICK Summer Camp Scholarship Application Application to apply for a scholarship for your child – complete this form and return it to Kirkwood Community College – Continuing Education. Please attach your child’s KICK camp registration form to this scholarship application. If you need help or have questions, please contact Jerilyn Garnant at 319-398-5529. Part 1 – Child’s Name Last First Date of Birth Grade Entering Camp Attending Camp Section # Camp Tuition Part 2 – Monthly Income Names of all adults living in the home and anyone earning income Name: Last, First Check if No Income List all income received last month on the same line with the person who received it. You must list gross income (before taxes). Age Other Monthly Income: Gross Wages (before taxes) I am paid this amount Weekly Every 2 Weeks Pension, Welfare, Retirement, Child Support Twice Per Month Once per Month Part 3 – Household Size Please list the number of children under age 18 in the household: Part 4 – Certification and Signature Required of all applicants: I certify (promise) that all information on this application is true and that all income is reported if required. I understand that I will receive benefits from state funds based on information I give. I understand that officials may verify (check) the information. I understand that if I give false information, my child may lose the scholarship benefit and I may be prosecuted. A letter from your child’s school or Dept. of Food and Nutrition stating that your child is eligible for free and reduced meals benefits is acceptable. Please attach a copy of this letter to your child’s scholarship application. Signature of Parent or Guardian Part 5 – Parent or Guardian Information Name Phone Contact _ _ Street Address City/State/Zip _ Date _ _ KCC – CE OFFICE USE ONLY – do not write in this section Food Assistance or FIP Eligibility Determination: Total Income Scholarship Per: Denied due to: Week, Every 2 Weeks, Over income limits Determining Official’s Signature Date Confirming Official’s Signature Date Follow-up Official’s Signature Effective Date Date Twice A Month, No fund available Month, Year _ _ Important things to know. Scholarships are available on a first come, first serve basis. Scholarships are limited to one per child. 1. A scholarship application is required for every child per camp. To apply for a scholarship, please fill out the application as soon as possible. 2. Fill out one application per camp, per child. 3. Please answer all questions on the form. 4. Sign the form and return it to Kirkwood Community College – Continuing Education. 5. Notification – within approximately 10 working days after your scholarship application is received you will be sent a letter telling you whether or not your student will receive a scholarship. 6. Your child’s registration for the camp will be processed after scholarship eligibility is determined. Application can be returned to: Kirkwood Community College, Continuing Education P.O. Box 2068 6301 Kirkwood Blvd., SW, Cedar Rapids, IA 52406 Like help with your application? If you have questions or need help filling out the form, call Jerilyn Garnant at 319-398-5529. We provide confidential help. Income Eligibility Guidelines Parents: If your total household income is within the limits listed below, your child may be eligible for a camp scholarship. Complete parts 1, 2 and 3 on the application. Return to KCCE – CE. Household Size 1 2 3 4 5 6 7 8 Yearly Monthly Twice a Month Every two weeks Weekly 23,540 31,860 40,180 48,500 56,820 65,140 73,460 81,780 1,962 2,655 3,348 4,042 4,735 5,428 6,122 6,815 981 1,328 1,674 2,021 2,368 2,714 3,061 3,408 905 1,225 1,545 1,865 2,185 2,505 2,825 3,145 453 613 773 933 1,093 1,253 1,413 1,573 What should be reported as income? Monthly Income: List the income (BEFORE deductions) each person received last month and where it is from, such as wages, retirement, or welfare. (Part 2) If you have a household member for whom last month’s income was higher or lower than usual, list an average monthly income by taking the income of the last several months and dividing it by the number of months. Kirkwood CE has the right to request verification of the information you supply at any time. Purposeful misrepresentation is subject to prosecution. Types of income to report: Wages Pensions Public Assistance Alimony Annuities Child support payments Strike benefits Supplemental security income Salaries Unemployment compensation Social security benefits Interest Tips Workmen’s compensation Disability income Welfare payments Commissions Veteran’s subsistence benefits Retirement income Cash withdrawals from savings, investments or trusts Do not report income from: Educational benefits Scholarships Babysitting Shoveling Grass Cutting Food Stamps What if my income is not always the same? List the amount you typically earn. For example, if you generally earn $1000 each month, but you missed some work last month and only earned $900, write down that you earn $1000 per month. If you routinely work overtime, include it, but do not include overtime if you work it occasionally. Will the information I give on my application be checked? Yes, we may ask you to send written proof.