Document 10705940

Expert Meeting on

THE IMPACT OF ACCESS TO FINANCIAL SERVICES,

INCLUDING BY HIGHLIGHTING THE IMPACT ON REMITTANCES ON

DEVELOPMENT: ECONOMIC EMPOWERMENT OF WOMEN AND YOUTH

12-14 November 2014

SESSION 3:

INNOVATIVE BUSINESS MODELS AND FINANCIAL SERVICES

Mr. Ade Shonubi

Managing Director

Nigerian Interbank Settlement Scheme

5 0

1 9 6 4

P R O S P E R I T Y F O R A L L

5 0

1 9 6 4

5 0

PROSPERIDAD PARA TODOS

5 0

1 9 6 4

1 9 6 4

P R O S P É R I T É P O U R T O U S

П Р О Ц В Е Т А Н И Е Д Л Я В С Е Х

5 0

1 9 6 4

5 0

ﻊﻴﻤﺠﻠﻟ ءﺎﺧﺮﻟا

䍮 ਇ Ր 䇤

ާ ੂ ሂ 㼋

Our Journey to

Tomorrow

November, 2014

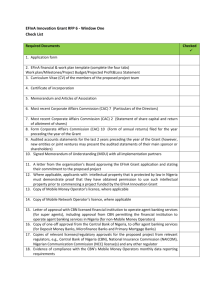

Biometric Identification

With the launch of the banks biometric solution, all banks are mandated to capture the biometric information of their customers.

The Biometric information will help;

Transaction authentication.

Reduce fraud

Improve retail credit

Customer identification

2

e-Reference Platform

The NIBSS offer shared infrastructure platforms like e-Reference which adds value to both banks and customers.

The e-Reference platform is a work flow platform that allow banks share references electronically with each other

TAT for account opening is improved.

Cost for account opening is reduced

3

Person 2 Person Payment – Square mii

As retail payment system continue to evolve, we are creating a platform that will enable people exchange payments with people using a registered ID (Aliases) e.g. email or phone number.

4

NIBSS instant Pay

The NIBSS instant pay is an interbank transfer service that offer customers two key things:

Instant confirmation of beneficiaries via name enquiry

Instant value to recipients

5

Central Pay using both card, account and mobile money

NIBSS central pay is designed for two factor authentication whether using cards, account option or mobile wallet.

Customers get the option to pay by selecting their bank and pay using their internet banking credentials.

The credentials page belong to the bank and leverages their security.

For online shopping, transaction is concluded based on service/product delivery and there is a guarantee of refund for nondelivery.

6

NIBSS as a shared services company

CBN NIBSS is positioned in the centre of financial services in Nigeria and this empowers us to deploy shared services that can be used by various entities.

Processors/

MNOs Switches

Aggregators NIBSS Banks

7

Nigeria Inter-Bank Settlement System Plc

… Improving the Nigeria Payments System

1230b Ahmadu Bello Way Victoria Island,

Lagos, Nigeria

Tel: +234 1 2716071-4 www.nibss-plc.com

THANK YOU

8