1 8 National Income

advertisement

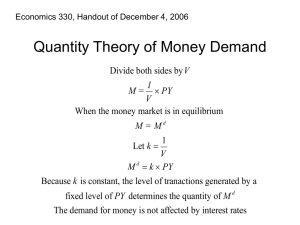

Macro / Topic 8-3 / P. 1 8 National Income Unit 3 : The IS-LM Model I II III IV The Basic Aim of the IS-LM Model The Basic Analytic Model of National Income : The Simple Keynesian Model The IS-LM Model 1 The Product Market : The IS Curve 2 The Money Market : The LM Cuvre 3 The Equilibrium of The Two Markets 4 The Relative Effectiveness of The Fiscal & Monetary Policies 5 The Extreme Cases & Limitations of The Two Policies 6 The IS-LM Model : An Overview The IS-LM Curves & AD, AS Curves * I * * The Basic Aim of the IS-LM Model The IS-LM model itself concentrates on the interaction between the product market and the money market on the level of national income and interest rate, with the labour market being assumed to be in equilibrium. The Keynesian economists argue that an insufficient aggregate demand leads to unemployment. The solution is a stimulus to the aggregate demand by some means – the fiscal policy. II The Basic Analytic Model of National Income : The Simple Keynesian Model It is simple because both the money market and labour market are assumed to be in equilibrium. The policy recommended is a change in taxes or government expenditures or both to affect the level of aggregate demand. III The IS-LM Model ( John Hicks & Alvin Hansen ) The major revision on the simple Keynesian model is a consideration of the effect of interest rate on the level of investment expenditure in the product market as well as the effect of interest rate on the demand and supply of money in the money market. The effect of interest rate on the two markets will further affect the effectiveness of the fiscal and monetary policies. The theme of the model is that for an equilibrium level of national icnome, there exists a corresponding level of interest rate to ensure the state of equilibrium of the two markets. 1 The Product Market : The IS Curve The IS ( investment & savings ) curve is defined as the combination of the (real) interest rate and real national income at which the product market is in equilibrium, i.e. aggregate expenditure = aggregate supply or national output. The Equation of The IS Curve – The 3 Sector Model To begin with : AE=C+I+G And A S = Y or National Income Assumptions : Investment expenditure is negatively related with interest rate – the MEI function. Consumption expenditure is a function of disposable income. Government expenditure is an exogenous variable. There is a lump-sum tax.. In equilibrium, AE = AS, Y = a + b ( Y – T ) + I (r) + G Y = a + b. Y – b. T + c – d. r + G (1–b).Y = a + c + G – b. T – d. r where I (r) = c – d.r Macro / Topic 8-3 / P. 2 (1–b).Y = A – b. T – d. r Y = A – b. T 1–b _ where A = a + c + G __d___ . r 1–b The Graphical Approach ( 3 Sectors ) I r IV I+G II y S+T III The Implication of the IS Curve Income (y) is positively related to the autonomous expenditure (A) and negatively related to the lump-sum tax in this case. Interest rate (r) is negatively related to income. The IS curve is downward-sloping. Important Concepts of The IS Curve Movement along the IS curve : By definition any point on the IS curve represents a state of equilibrium with the level of aggregate demand equal to that of aggregate supply or national output, i.e. the product market is in equilibrium. Slope of The IS curve : It depends on the slope of the investment function (MEI) or the interest elasticity of investment ; the slope of the savings function or the value of MPS and the value of the (proportional) tax rate. Exogenous variables : G ; S ; Lump-sum Tax ; Autonomous consumption expenditure (a) and MPC. Endogenous variables : (real) income ; (real) interest rate ; investment expenditure. Behavioural of Households & Firms : The MPC affects the slope of the LS curve through the consumption function. The MEI schedule reflects the actions of firms based on a certain rate of interest. Macro / Topic 8-3 / P. 3 Factors Shifting The IS Curve : Change In Exogenous Variables Factors Effects on the IS curve A rise in government expenditure. shift out to the right Effect on Income expansionary A fall in government expenditure. shift in to the left contractionary A rise in lumpsum tax. shift in to the left contractionary A fall in lumpsum tax. shift out to the right expansionary A rise in tax rate. steeper slope contractionary A fall in tax rate. flatter slope expansionary A rise in savings. shift in to the left. contractionary Interest elasticity of investment : inelastic / elastic slope of the IS curve becomes : steeper / flatter A rise in M P S The spending is less sensitive to income. The IS curve is steeper. A fall in M P S The value of M P C is greater with a greater multiplier effect, i.e. a flatter IS curve. Y = a + b(Y–T) + c - d.r + G An Overview of The Product Market ( Aggregate ) Demand Side ( Aggregate ) Supply Side Product Market : AD or AE = C + I + G Production Function : y = f ( N, K ) Investment Function : I = I (r) Labour Market : D ( N ) = S ( N ) Variables : y , r , price level. Variables : y , N , price level. In the short run, K is a constant. There are 4 equations with 4 variables ( y, r, N, p ). If the price level is known, we have 3 variables and a state of equilibrium of the product market can be found. Implication of The IS Curve Given a consumption function and a production function, the level of aggregate output or supply can be found ( due to the assumption of an equilibrium labour market so that the equilibrium value of N is known ). The IS curve tells the various levels of interest rates required to support the corresponding level of real income or AS. The desired interest rate depends on the situation of the money market. 2 The Money Market : LM Curve The LM ( liquidity-preference and money ) curve is defined as the combination of interest rate and income at which the money market is in equilibrium, i.e. the level or quantity of real money demand is equal to that of real money supply ; given a certain level of money supply and price level. Assumptions Money includes cash balances and demand deposits. They are accepted media of exchange without any interest return. Assets include : Money and all interest-earning assets collectively termed “bonds”. Wealth = Money + Bonds Macro / Topic 8-3 / P. 4 The underlying implication is that the equilibrium of the money market automatically implies an equilibrium of the bond market when wealth and price are constant in the short run. Keynes suggested three motives of holding money ( instead of holding bonds ) by the people : transactions demand for money = f ( r, y ) precautionary demand for money = f ( r, y ) speculative demand for money = f ( r, price of bond ) Money demand refers to a desire of people for liquidity or flexibility / convenience, i.e. the so-called liquidity preference put forward by Keynes. Money Demand : Keynesian View Transactions Demand For Money In the basic IS-LM model, the transactions demand for money also includes the precautionary demand for money and it varies with the level of income. The higher the income, the greater the desire to hold money to consume by the people, thus the larger the quantity of money demand for transaction will be. The demand for transaction is also called a demand for real balances when the price level is constant. Asset or Speculative Demand For Money Money is a form of asset. People have a choice of portfolio in their wealth. People will always hold money for more gain ( generally called speculation ). i.e. they hold money with a desire to increase their wealth through speculation or investment. An asset demand for money refers to the demand for money by wealth-holders ( speculators ) who expect the prices of assets ( bonds in the simplified case ) to fall later. The bond prices are treated as too high to buy at the moment. As a result, they will gain by holding money and wait even though they lose the interest earnings. A bond is a debt agreement between the borrower ( seller ) and the holder ( buyer ) of the bond, with a promise from the seller to pay the holder a certain fixed amount of dollar per year ( the coupon ) and to pay back the face value of the bond at a specified future date ( maturity date ). In general, Coupon Yield = US$ 1 000 X Interest Rate Bonds can be freely exchanged in a money or capital market. As the yield has already specified by the seller, the price of bonds varies inversely as the market interest rate. Example Initial Case Case I : interest rises Case II : interest falls Market price of bonds $ 1 000 $ 500 $ 2 500 Market interest rate 5% 10 % 2% Annual Interest $ 50 $ 50 $ 50 In general when interest rate is at a relatively low level, people will tend to think that interest rate would rise later, i.e. they anticipate a fall in bond price later. As a result, they will choose to hold money rather than buying bonds at that moment. Demand Side of The Money Market Supply Side of The Money Market ( Real ) Demand for Money = MD / P = T(y) + S(r) ( Real ) Money Supply = MS / P = constant With a constant price level, the demand for money Money supply is fixed by the central bank in is a function of interest rate and income, i.e. MD = the short run. f ( r, y ) Macro / Topic 8-3 / P. 5 Derivation of The LM Curve The money demand curve ( demand for real balances ) is a downward-sloping curve. The money supply curve is a vertical straight line with the amount set by the central bank. If the level of income rises, the amount of money held for transaction would increase. With a fixed amount of money supplied, the quantity of money demanded becomes greater than before, i.e. there is an excess demand for money. There is a pressure to lead the market interest rate to rise. The rising interest rate implies a falling price of bond. Based on the new demand for money schedule, people would prefer to hold more bonds instead of money. There is a movement along the new schedule until a new state of equilibrium is reached again. As a result, a higher level of (real) income required a higher level of interest rate to ensure a money market equilibrium. The LM curve slopes upwards. r Market Demand & Supply Curves MS The Derived LM Curve r MD1 MD2 O M O y The Graphical Approach ( 3 Sectors ) I r IV S (r) y II III T(y) Macro / Topic 8-3 / P. 6 Concepts of the LM Curve If income rises, the level of transaction demand for money will rise also. With a fixed amount of money supply, a higher amount of transaction demand for money would imply a smaller amount of asset demand for money in order to maintain an equilibrium of the money market. A smaller amount of asset demand for money requires a higher interest rate. Thus income and interest rate are directly related with each other to bring about an equilibrium of the money market. Assumptions The parameters of the money demand function are constant. The amount / level of money supply is fixed. The price level is assumed to be constant for simplicity. Exogenous variables : price level ; ( real ) money supply ; supply of bonds. Endogenous variables : r ; y ; S (r) ; T (y). Factors Shifting The LM Curve : Change In Exogenous Variables Factors Effects on the IS curve Effect on Income Money supply rises. shift out to the right expansionary Money supply falls. shift in to the left contractionary The supply of bonds rises shift in to the left contractionary The supply of bonds falls. shift out to the right expansionary The money demand function shifts up. shift in to the left The money demand function shifts down. shift out to the right Interest elasticity of money demand : Zero / Small / large / Income elasticity of money demand : Small / large slope of the LM curve becomes : vertical / steep / flat / horizontal slope of the LM curve becomes : flatter / steeper A rise in money supply would create an excess supply at the original level of equilibrium interest rate. The market interest rate will fall, ceteris paribus. Given the same level of income, a state of equilibrium requires a lower interest rate. The LM curve shifts to the right. The interest elasticity of money demand affects the slope of the LM curve. The interest elasticity of investment affects the slope of the IS curve. The Case of An Excess Money Demand Or An Excess Money Supply r Any point not lying on the LM curve denotes an excess money demand or an excess money supply. LM The adjustment, in theory, takes the form of a change in the interest rate or in the form of a change in income. *A O y Macro / Topic 8-3 / P. 7 3 The Equilibrium of The Product & Money Market The intersection point of the IS and LM curves denote a state of equilibrium of both the product and money market, assumed the factor market is also in equilibrium. Since production takes time to adjust to itself whereas the interest rate can be changed in a relatively faster rate. The money market adjusts more rapidly than the product market in general, i.e. the adjustment path of the economy, say at a point A, is closer to the LM curve in a dynamic sense. 4 Effect of A Change In G with/Without Tax Effect of A Change In Money Supply The actual path is not a movement along the LM curve because the adjustment is dynamic. The interest rate may rise higher than the new equilibrium level of interest rate during the process of dynamic adjustment. Adjustment Mechanism Excess money demand Interest rate rises Income increases with a multiplier effect Excess Aggregate Supply The level of MD falls until it is equal to MS. Income falls Investment expenditure falls The level of MD falls until it is equal to MS. The Relative Effectiveness of The Fiscal & Monetary Policy Effective Ineffective Fiscal Policy steep IS ; flat LM flat IS ; steep LM Monetary Policy flat IS ; steep LM steep IS ; flat LM Fiscal Policy In Practice : U. S. A. 1961 1964 1965 1966 : : : : 1966-68 1970-80 Unemployment rate = 6.7 % Kennedy-Johnson Tax Cut : Personal income tax cut by 20 % and business tax by 10 %. Unemployment rate = 4.8 % Unemployment rate = 3.8 % ; GNP grew by 5.5 % and it was treated as the most successful period of the use of fiscal policy ... Vietnam War : the level of aggregate demand increased with government expenditure and inflation started to harm the economy. Rational expectation ( New Classical economists versus Keynesian economists. ) Macro / Topic 8-3 / P. 8 5 Economic Indicators 1963 1965 Unemployment rate Growth rate of money supply Bond interest rate Growth rate of GNP ( * 1964 ) 6.7 3.7 4.0 5.4 * 4.8 4.7 4.3 5.5 The Extreme Cases & Limitations of the Fiscal & Monetary Policies Crowding-out Effect : In General With a rise in G, income rises with the multiplier effect and IS curve shifts to the right. Crowding-out effect = The steeper the LM curve, the greater the crowding-out effect will be. Crowding-out Effect : Balanced Budget Assume the tax is a lump-sum tax. There is a crowding-out effect between r0 and r1. AB = BD = Liquidity Trap Keynes suggested that at a sufficiently low level of interest rate, say at r0 , more people will expect the future interest rate would become higher, i.e. they anticipate a fall in bond price forthcoming. If they hold bonds at the moment, the interest gained may be outweighed by the future capital loss due to a fall in the bond price. Thus, they choose to hold money instead of bonds. Their level of demand for money or liquidity preference rises. In other words, when interest rate is low enough ( based on public anticipation and judgement ), people choose to hold money or cash balances, both the money demand curve and the LM curve will become horizontal. Macro / Topic 8-3 / P. 9 With a horizontal LM curve, an expansionary monetary policy could only shift the upper portion of the LM curve to the right. If the IS curve intersects the LM curve at its horizontal portion, monetary policy cannot affect the level of equilibrium income. Monetary policy becomes totally ineffective and the horizontal portion of the LM curve is called a liquidity trap ( monetary policy is trapped by the preference on liquidity of people ). The Financing of Fiscal Policy A pure fiscal policy refers to the change of tax revenue or tax rates so as to affect the level of disposable income and consumption expenditure ( one component of the aggregate demand ). The fiscal policy with a change in the government expenditure has other side effects, depending on the method of financing. Financing By Taxes Taxes will decrease the disposable income as well as consumption expenditure. The same generation will be affected. Financing By Money Supply If the central bank increases the money supply and lends the money to the government to support the fiscal expenditure, the LM curve will shift to the right. The IS curve also shifts to the right due to a change in government expenditure. The government is said to be monetized the budget, the so-called money-financed fiscal policy. Financing By Bonds In the very short run, the increase in bond supply will contract the amount of money supply. The LM curve will shift to the left to offset the effect of government expenditure on national income. This bond-financed (expansionary) fiscal policy may pose a debt burden on the future generations when bonds are redeemed or matured because the government has to find funds to redeem bonds. What are the effect of government expenditure on the economy if government expenditure supported by bond financing is used : on capital projects ; on transfer payments ? Price Rigidity Keynes believed that prices ( of goods; of services; and of assets ) are capable of rising but are unlikely to fall, i.e. in Keynes words, these prices are sticky downward or the term price rigidity. Prices of commodities are rigid, i.e. deflation is unlikely to exist. Wages ( price of labour ) are rigid causing a large scale of unemployment. Interest rates ( price of holding money ) are rigid causing the liquidity trap. That explains why Keynes and Keynesian believed that : IS curve is steep, i.e. investment is interest inelastic; and LM curve is flat, i.e. asset demand for money is interest elastic. Fiscal policy is a major tool to stabilize the economy and eventually leading to growth. 6 The IS-LM Model : An Overview The Nature & Purpose of The Model This is an economic model developed by John Hicks to make the Keynes’s original model more powerful in explanation. This model is capable of examining the interaction of various economic variables and their implications in affecting the level of national income and employment. The main features of the model include : a determination of the level of employment and the level of full-employment income, given a production function ( with a capital stock and a level of technology ) and the demand and supply condition of a labour market ; and a determination of a state of comparative static equilibrium of both the product and money markets based on selected exogenous and endogenous variables ( involving stocks, flows, ex-ante and ex-post variables ). Macro / Topic 8-3 / P. 10 The Product Market : IS Curve The IS curve deals with the real flow of goods and services both in an ex-ante and ex-post sense. The term real also implies the determination of income and interest rate by some real variables like the flow of savings, consumption expenditure and investment expenditure. The consumption function describes the consumer behaviour. The marginal efficiency of investment (MEI) schedule describes the decision of firms. Together with a production function, the MEI schedule reflects the level of productivity of the economy. In fact, this view is similar to the classical view that it is the real variables that determine the level of income and the interest rate in a product market. The Money Market : LM Curve The LM curve deals with the monetary variables in the interchange of different forms of assets – money and (interest-earning) bonds. The theory of money demand or liquidity preference suggests that interest rate is determined by monetary variables – the demand for and supply of money. Money demand is a form of liquidity preference. The theory of liquidity preference also gives an implication of the concept of price rigidity and liquidity trap which are important Keynesian arguments for the use of fiscal policy. The IS & LM Together The IS-LM model combines the two views on the product and money markets so that income and interest rate are both determined by real and monetary variables. The simple Keynesian model is said to be a model of partial equilibrium in the determination of interest rate and income whereas the IS-LM model is a more generalized Keynesian model. IV The IS-LM Curves & AD, AS Curves ( Optional Part ) The Aggregate Demand ( AD ) Curve It shows the different combinations of the price level and real output or real income at which the product and money markets are in equilibrium. It slopes downwards because a lower price (index) implies a higher real money supply, thus lowering the interest rate and stimulates the planned expenditure which requires an increase in the actual real income to keep the product market in equilibrium. It describes the general equilibrium of the economy with the position of the AD curve depends on the factors (except the price level) that shift the IS and LM curves. The steeper the LM curve, the flatter the aggregate demand curve. A steep LM curve implies that money demand is not sensitive to interest rate. Given a fall in the price level, the real money supply rises and the LM curve shifts out, leading to a higher level of real output. The Aggregate Supply ( AS ) Curve It shows the different amounts of output that firms are willing to produce at different price levels. It shows the profit-maximizing level of real output or GNP for different price levels. It slopes upwards because a higher price index reduces the real wage and leads to an increase in production ( with unemployed resources initially ). A higher level of employment raises the level of real output or GNP as a result. * * * Macro / Topic 8-3 / P. 11 Derivation of the IS Curve Product Market Given : C = 10 + 0.8 YD I = 90 – 200 r T = 0.2 Y G = 280 AE = C + I + G AS = C + S + T In equilibrium, Y=C+I+G OR : I+G=S+T r (%) 10 46 100 Y Macro / Topic 8-3 / P. 12 Derivation of The LM Curve Money Market S (r) = 60 – 200 r T (Y) = 0.4 Y MS = 440 In equilibrium, MD = MS r(%) 12 10 8 6 4 Y S(r) T(Y)