FREC 240 Exam #1 (revised) Name_______________________________

advertisement

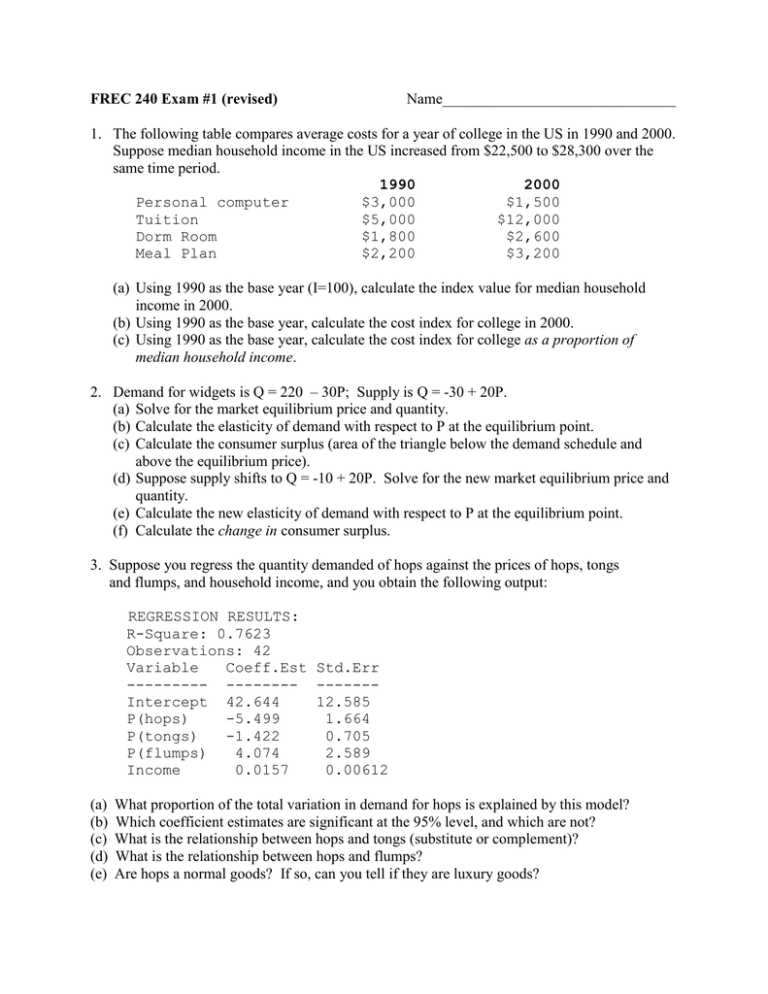

FREC 240 Exam #1 (revised) Name_______________________________ 1. The following table compares average costs for a year of college in the US in 1990 and 2000. Suppose median household income in the US increased from $22,500 to $28,300 over the same time period. 1990 2000 Personal computer $3,000 $1,500 Tuition $5,000 $12,000 Dorm Room $1,800 $2,600 Meal Plan $2,200 $3,200 (a) Using 1990 as the base year (I=100), calculate the index value for median household income in 2000. (b) Using 1990 as the base year, calculate the cost index for college in 2000. (c) Using 1990 as the base year, calculate the cost index for college as a proportion of median household income. 2. Demand for widgets is Q = 220 – 30P; Supply is Q = -30 + 20P. (a) Solve for the market equilibrium price and quantity. (b) Calculate the elasticity of demand with respect to P at the equilibrium point. (c) Calculate the consumer surplus (area of the triangle below the demand schedule and above the equilibrium price). (d) Suppose supply shifts to Q = -10 + 20P. Solve for the new market equilibrium price and quantity. (e) Calculate the new elasticity of demand with respect to P at the equilibrium point. (f) Calculate the change in consumer surplus. 3. Suppose you regress the quantity demanded of hops against the prices of hops, tongs and flumps, and household income, and you obtain the following output: REGRESSION RESULTS: R-Square: 0.7623 Observations: 42 Variable Coeff.Est Std.Err --------- -------- ------Intercept 42.644 12.585 P(hops) -5.499 1.664 P(tongs) -1.422 0.705 P(flumps) 4.074 2.589 Income 0.0157 0.00612 (a) (b) (c) (d) (e) What proportion of the total variation in demand for hops is explained by this model? Which coefficient estimates are significant at the 95% level, and which are not? What is the relationship between hops and tongs (substitute or complement)? What is the relationship between hops and flumps? Are hops a normal goods? If so, can you tell if they are luxury goods? 4. To obtain the derivative of any polynomial function Y = f(X) you drop the constant terms, pre-multiply each X term by the exponent of X, and reduce each exponent by one. For example, Y = a + bX1 + cX2 + dX3 + … + mXN dY/dX = bX0 + 2cX1 + 3dX2 + … + NmX(N-1) The derivative function dY/dX tells you the slope of the parent function Y at any value of X. Wherever the slope dY/dX = 0, the parent function Y must be at a maximum or minimum. Now suppose a competitive firm’s total cost of producing output level Q is TC = 128 + 0.001Q3. (The 128 is Fixed Cost, the rest is Variable Cost.) Suppose the firm’s marginal revenue (the market price of Q) is constant at $7.50 per unit of Q. (a) What is the firm’s profit function TR - TC? (b) What is the average total cost function (TC/Q)? (c) What is the average variable cost function (VC/Q)? (d) What is marginal cost function (dTC/dQ)? (e) What is the profit-maximizing level of output? (Solve for Q where MC = $7.50) (f) What is the firm’s profit at that price and output level? (g) What is the firm’s break-even price—the minimum value of ATC? (Solve for Q when dATC/dQ=0; then calculate the value of ATC at that level of Q.) (h) Is there a minimum point on the AVC schedule (a short-term shutdown point) where Q is positive?