GKN acquires Volvo Aero for £633 million

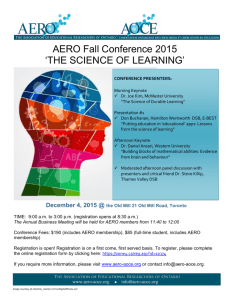

advertisement

NEWS RELEASE 5 July 2012 GKN acquires Volvo Aero for £633 million GKN plc (“GKN”) or (“Group”) today announces its agreement to acquire Volvo Aero (the aero engine division of AB Volvo). Volvo Aero designs, engineers and manufactures components and sub-assemblies for aircraft engine turbines. It supplies all the major aero engine manufacturers and has positions on most major civil aerospace platforms that are set to increase as aircraft build rates ramp up. Volvo Aero employs some 3,000 people based in Sweden, Norway and the USA. Nigel Stein, Chief Executive, GKN plc, said: “This is a highly attractive acquisition for GKN creating a market leader in aero engine components. With excellent technology and strong life-of-programme positions on most civil aero engines, Volvo Aero will significantly enhance GKN Aerospace’s engine components business.” The acquisition enterprise value is SEK6.9 billion (£633 million) comprising SEK5.6 billion (£513 million) of equity value (consideration) together with an anticipated Volvo Aero pension settlement (£50 million) and working capital refinancing (£70 million). The acquisition is expected to complete during the third quarter, subject to regulatory approvals. It will be funded by new debt and a £140 million placing of new ordinary shares, representing approximately 5% of GKN’s current market capitalisation. For the year ended 31 December 2011, AB Volvo reported audited results attributable to Volvo Aero of sales of SEK6.5 billion (£600 million), EBITDA of SEK0.8 billion (£75 million), EBIT of SEK0.3 billion (£30 million) and gross assets of SEK9.3 billion (£855 million). In 2012, GKN expects Volvo Aero’s sales to be around SEK7.3 billion (£670 million) with EBITDA anticipated to be approximately SEK1.1 billion (£100 million). The acquisition enterprise value equates to an expected 2012 sales multiple of 0.9 times and an expected Volvo Aero 2012 EBITDA multiple of 6.3 times. In 2013, the first full year of ownership, the transaction is expected both to be enhancing to GKN’s earnings per share on a management basis and to generate a return on invested capital that exceeds the Group’s pre-tax weighted average cost of capital of 12%. The Volvo Aero operating margin is expected to meet the GKN Aerospace target range of 11-13% in 2013 due to operational process improvements and cost savings, which are expected to total 3-4% of Volvo Aero sales by 2014. The combination of GKN Aerospace and Volvo Aero creates a world leader in both aero structures and aero engine components. Within aero engines, GKN’s composite leadership together with Volvo Aero’s strong metallic technology provides a unique offering to customers who are focused on lightweight, high performance engine solutions. Volvo Aero has strong life-of-programme positions on existing platforms and a pipeline of new technology, offering a long-term revenue stream and opportunities for growth. This transaction supports the growth strategy of GKN Aerospace, increasing its pro forma 2011 sales to more than £2 billion, of which two thirds would have been to the civil aerospace market. On the same pro forma basis, GKN Aerospace would have represented around 31% of GKN Group sales and 37% of Group trading profit. 1 Nigel Stein added: “Volvo Aero has invested heavily to secure positions on new engine programmes, offering a long-term platform for growth. Its strong standing with customers, together with its skilled workforce and high quality engineering team, will be a valuable addition to GKN Aerospace. GKN Aerospace will now be a leader in the aero engine sector, complementing its leading position in composite aero structures.” GKN Trading update GKN’s business performance in April and May continued in line with the first quarter of the year. Overall, Group sales for the five months to 31 May 2012 increased 17%, with underlying sales up 9%. Management trading profit increased 23%, up 13% on an underlying basis. In GKN Driveline, underlying sales growth was 10%, temporarily flattered by last year’s Tsunami effect. Excluding the Getrag Driveline Products acquisition, which performed ahead of expectations, GKN Driveline’s year to date margin was similar to 2011. Powder Metallurgy achieved 9% underlying sales growth and profit and margin continue to show good progress. GKN Aerospace’s underlying sales grew 9%, ahead of expectations due to variation in delivery schedules which should normalise for the year as a whole. Profit progressed in-line with expectations. GKN Land Systems sales increased 16%, up 6% on an underlying basis, although the rate of growth is slowing reflecting weaker European industrial markets. GKN Land Systems’ margin at 10% continues to show improvement helped by the contribution from Stromag. First half free cash flow is expected to be broadly neutral reflecting normal seasonality, increased capital investment to support growth and working capital requirements. Free cash flow for the second half is expected to be ahead of the comparable period in 2011. The Board continues to expect that 2012 will be another year of good progress and anticipates increasing the interim dividend by 20% to 2.4 pence per share, when the half year results are announced on 31 July 2012. Exchange rate: £1 to SEK10.9 used throughout this press release. Nothing in this announcement is intended to be a profit estimate for any period or a forecast of future profits and statements relating to earnings accretion should not be interpreted to mean that the earnings per GKN share for the current or future financial periods will necessarily match or exceed its historical published earnings per share. 2 Financial information set out in this announcement, unless otherwise stated, is presented on a management basis which aggregates the sales and trading profit of subsidiaries (excluding subsidiary businesses sold and closed) with the Group’s share of the sales and trading profit of joint ventures. Trading margin is trading profit expressed as a percentage of sales. Management profit or loss before tax is management trading profit less net subsidiary interest payable and receivable and the Group’s share of net interest payable and receivable and taxation of joint ventures. These figures better reflect performance of continuing businesses. Where appropriate, reference is made to underlying results which exclude the impact of acquisitions/divestments as well as currency translation on the results of overseas operations. Further information: Analysts/Investors: Guy Stainer Investor Relations Director GKN plc T: +44 (0)207 463 2382 M: +44 (0)7739 778187 E: guy.stainer@gkn.com Media: Chris Fox Group Communications Director GKN plc T: +44 (0)1527 533238 M: +44 (0)7920 540051 E: chris.fox@gkn.com Andrew Lorenz FTI Consulting T: +44 (0)207 269 7113 M: +44 (0)7775 641807 There will be an analyst and investor meeting today at 8.30am at UBS, Ground Floor Presentation Suite, 1 Finsbury Avenue, London EC2M 2PP. A live audiocast of the presentation will be available at http://www.gkn.com/investorrelations/Pages/Webcasts.aspx Slides will also be available to download from here. A live dial in facility will be available on +44 (0) 1452 580 111, conference ID 98407781. A replay of the call will be available until 18 July 2012, using conference ID 98407781#, on: International dial in: +44 (0) 1452 55 00 00 UK free call: 0800 953 1533 USA free call: 1866 247 4222 This announcement together with the attached financial information thereto may be downloaded from our website. www.gkn.com/media/Pages/default.aspx . 3 Notes to Editor Volvo Aero is an engineering business that designs and manufactures components for aircraft engine and gas turbines including: turbine, combustor and compressor structures; fan cases; compressor rotors; low pressure turbine cases; shafts and vanes. GKN plc is a global engineering business serving the automotive, aerospace and land systems markets. It has operations in more than 30 countries, around 45,000 employees in subsidiaries and joint ventures and sales of £6.1 billion in the year to 31 December 2011. GKN plc is listed on the London Stock Exchange (LSE: GKN). GKN Aerospace is the aerospace operation of GKN plc, serving a global customer base and operating in North America and Europe. With sales of £1.5 billion in 2011, the business is focused around three major product areas - aerostructures, engine products and transparencies, plus a number of specialist products - electro-thermal ice protection, fuel and flotation systems, and bullet resistant glass. The business has significant participation on most major civil and military programmes. GKN Aerospace is a major supplier of integrated composite structures, offers one of the most comprehensive capabilities in high performance metallics processing and is the world leading supplier of cockpit transparencies and passenger cabin windows. Disclaimer This Announcement contains certain "forward-looking statements" with respect to certain of the Company's plans and its current goals or expectations relating to its future financial condition and performance and which involve a number of risks and uncertainties. Forward looking statements are typically identified by the use of forward looking terminology such as 'aims', 'believes', 'expects', 'may', 'will', 'could', 'should', 'intends', 'estimates', 'plans', 'assumes' or 'anticipates' or the negative thereof or other words of similar meaning. Examples of such forwardlooking statements include, among others, statements regarding the Company's business strategy, future plans, present or future events, or objectives for future operations that involve risks and uncertainties and are not historic fact. Such forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond the Company's control and all of which are based on the Company's current beliefs and expectations about future events. Such statements are based on current expectations and, by their nature, are subject to a number of risks and uncertainties that could cause actual results and performance to differ materially from any expected future results or performance, expressed or implied, by the forward-looking statement. No assurance can be given that such forward-looking statements results will be achieved. Factors that might cause forwardlooking statements to differ materially from actual results include, among other things, the following: global economic conditions, economic conditions in the jurisdictions in which the Company operates, the effects of continued volatility in credit markets, exchange rate fluctuations and legislative, fiscal and regulatory developments. The forward-looking statements contained in this Announcement speak only as of the date of this Announcement and the Company assumes no obligation to, and does not intend to update or revise publicly any of them whether as a result of new information, future events or otherwise, except to the extent required by the FSA, the London Stock Exchange or by applicable law, the Prospectus Rules, the Listing Rules and the Disclosure and Transparency Rules. This Announcement is for information purposes only and shall not constitute an offer to buy, sell, issue, or acquire, or the solicitation of an offer to buy, sell, issue, or acquire any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful. Any failure to comply with these restrictions may constitute a violation of the securities laws of such jurisdictions. This Announcement does not constitute or form part of any offer to issue or sell, or the solicitation of an offer to acquire, purchase or subscribe for, any securities in the United States, Australia, Canada, Japan or any other state or jurisdiction into which the same would be unlawful. In particular, the Company's securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "Securities Act") and may not be offered, sold or transferred, directly or indirectly, within the United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and the securities laws of any state or other jurisdiction of the United States. No public offering of the Company's securities is being made in the United States, Australia, Canada, Japan or any other country. 4 This Announcement has been issued by and is the sole responsibility of the Company. No representation or warranty, express or implied, is or will be made as to, or in relation to, and no responsibility or liability is or will be accepted by any other party, any adviser to the Company or by any of their Affiliates or agents as to, or in relation to, the accuracy or completeness of this Announcement or any other written or oral information made available to or publicly available to any interested party or its advisers, and any liability therefore is expressly disclaimed. Any adviser to the Company is acting for the Company and for no-one else in connection with the matters referred to in this Announcement and will not be responsible to any person other than the Company for providing the protections afforded to their clients or for providing advice to any other person in relation to any other matter referred to in this Announcement. The distribution of this announcement to persons not resident in the United Kingdom may be affected by the laws of the relevant jurisdictions. Such persons should inform themselves about and observe any applicable requirements. The price of shares and the income from them may go down as well as up and investors may not get back the full amount invested on disposal of the shares. Past performance is no guide to future performance and persons needing advice should consult an independent financial advisor. Neither the content of the Company's website nor any website accessible by hyperlinks on the Company's website is incorporated in, or forms part of, this Announcement. 5