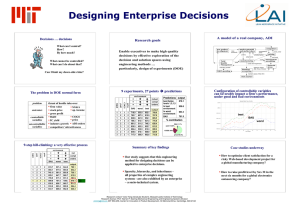

Corporate Decision Analysis: An Engineering Approach Product Lifecycle Team Victor Tang

advertisement

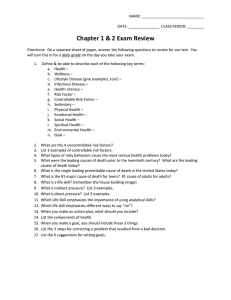

Corporate Decision Analysis: An Engineering Approach Victor Tang Product Lifecycle Team April 2006 2 Observations from corporate experience about senior-executive decisions under uncertainty. Data quality largely untested Range of alternatives considered narrow Importance of decision variables largely unaddressed Uncontrollable variables largely unaddressed Impact of uncontrollable variables largely unaddressed Predictive power low 3 Decision outcome = f(what’s controllable & uncontrollable) 4 In situ experiment #3 High-tech manufacturing company (US) • $700 M/year global high-tech manufacturer failing to generate profit. • Company de-listed from stock exchange. • Board of directors appoints new president. Wants an assessment of his turnaround strategy, survey of alternatives and their prospects to generate profit. 5 engagement process president working group president working group Problem definition decision decisionsituation situation goals goals&&objectives objectives Goal & objectives controllable controllableand and uncontrollable factors uncontrollable factors Data collection & de-biasing sample samplescenarios scenarios scenarios’ scenarios’forecasts forecasts working group Generating alternatives working group Analyzing alternatives analyze analyzewhat-if’s what-if’s president working group Selecting an alternative commit committo toaction action president Final report documentation documentation what-if what-ifconstructions constructions 6 Frame the problem problem outcomes controllable variables uncontrollable variables Survival Profitability in 6 Months 1. Sales, general & admin expenses, SG&A 2. Cost of goods sold, COGS 3. Capacity utilization 4. Customer portfolio structure 5. Sales 6. Financing 1. Customer base changes 2. Senior management interaction 3. Banker actions 4. Loss of critical skill 7 Boundaries of the solution and uncertainty space Î 729 alternatives and 54 uncontrollable environments Controllable 1. 2. 3. 4. SG&A COGS plant capacity customer portfolio mix 5. sales 6. financing BAU Uncontrollable level 1 level 2 level 3 +10 % +2 % 40 % current mix $ 54 M $ 651 M 60 % dev<10%, a/t<6%, mfg.<4% $ 690M Mexico action, + $12 M annualized -10 % -2 % 80 % dev<20%, a/t<12%, mfg.<8% +5 % China action, + $25 M annualized current best no change weak management unity no change no change net gain >5%GM strong management unity US banks relax terms gain 1 or 2 skills -5 % $10M short worse 1. cust. base change net loss >5% GM 2. senior executives’ = current interactions US banks drop 3. banker actions lose 3 skills 4. critical skills 8 controllable factors 2 1 2 3 2 3 1 3 1 2 2 3 1 1 2 3 3 1 2 1 3 1 1 financing 1 1 2 3 2 3 1 1 2 3 3 1 2 3 1 2 2 3 1 1 3 1 3 sales 2 1 2 3 1 2 3 2 3 1 3 1 2 2 3 1 3 1 2 3 1 3 3 portfolio 2 1 2 3 1 2 3 1 2 3 1 2 3 1 2 3 1 2 3 1 3 3 2 capacity 2 1 1 1 2 2 2 3 3 3 1 1 1 2 2 2 3 3 3 3 1 1 3 COGS SG&A BAU uncontrollable factor levels 1 1 2 3 3 1 2 2 3 1 2 3 1 3 1 2 1 2 3 3 3 3 1 level 2 level 2 level 2 level 2 level 1 level 2 level 1 level 1 level 3 level 3 level 3 level 3 current worst best Collect and analyze the data. 9 Debiasing Îdispersions decline and confidence rises F ORECAS T [ CURRENT] r ound1 & 2 F ORECAS T [ WORS T] r ound 1 & 2 Normal Normal 25 F ORECAST [ BEST] r ound 1 & 2 Normal 40 80 70 20 30 10 50 Frequency Frequency 15 40 30 20 10 20 5 10 0 -10.8 -9.0 -7.2 -5.4 PROFIT $ M -3.6 0 -1.8 forecasts = stdev È -16 -14 -12 -10 PROFIT $ M -8 -6 -4 0 -10 -8 -6 -4 -2 PROFIT $ M 0 2 forecasts È stdev È forecasts Ç stdev È C O N F D E N C E ( 1 - 5 ) r o u nd 1 & 2 Normal 20 15 round 1 round 2 Frequency Frequency 60 confidence rises stdev È 10 5 0 1.5 2.0 2.5 3.0 3.5 PROFIT $ M 4.0 4.5 5.0 10 Unconstrained exploration of what if’s Contribution of each variable to the outcome COGS Cportfolio SG&A 72 % 9% 7% sales 7% What if ? BAU BAU BAU BAU BAU BAU BAU BAU U + + + + + + + business as usual COGS+ cust. portfolio+ SG&A+ sales+ financing+ plant capacity+ COGS+ + portfolio+ financing 3% capacity 2% profit $ M current -5.54 -2.04 -3.99 -4.35 -4.43 -4.90 -5.16 -0.40 worst -9.40 -5.90 -7.73 -8.28 -8.27 -8.17 -8.43 -4.24 best -2.89 +0.43 -1.15 -1.68 -1.90 -2.41 -2.72 +2.18 11 Manufacturing company results: Plan versus actual controllable factors SG&A COGS plant utilization portfolio actions sales financing results level 3 2.5 2 2 1.5 1.5 Plan values (level) $54 M-10% $651 M – 1% 60 % no change $690 M -2.5% shortfall ~$5 M derived $ -1.13M actual performance level values (level) vs. plan 3 same = 2.5 same = Ç 2.5 70 % Ç 2.5 improved mix È 1 $690 M - 5% È shortfall ~$10 M 1 reported to SEC $ 1M derived $ 0.41 M • loss of $16 M same quarter last year • loss of $13 M previous quarter 12 Services company results: Plan versus actual Post-BAU plan 3 Project approach 2 Cost contingency 2 Project delivery 3 derived results 3.6 3.8 4.1 change project leader & program mgr. 3 waves. Focus US & Japan use some contingency meet delivery date environment worst current best delivered values (level) level Project leadership values (level) agreed result level level controllable factors values (level) 3 = 3 = 2 = 2 = 2 = 2 = 3 = 2 environment - 2.7 2.9 slip 2-3 months environment worst current 4.1 best 3.2 actual resultxxÎx 3.5 best 13 Executives were enthusiastic about the method “Let’s take this to our board of directors.” “Approach will make better decisions.” “... excellent, rational ...Understand risk with factors cannot control.” “Value of this process is in the process not the conclusions.” “This process visualizes the decision … instead of intuition.” 14 Measurement system analysis 15 Forecasts vs. derived estimates give an indication of an operator’s repeatability across forecasts. participant 3 participant 2 participant 1 10.0 10.0 10.0 5.0 5.0 5.0 0.0 0.0 131333 133113 222121 313113 0.0 131333 323311 133113 222121 313113 323311 131333 133113 222121 313113 323311 -5.0 -5.0 -5.0 -10.0 -10.0 -10.0 particpant 5 participant 4 10.0 10.0 5.0 5.0 0.0 0.0 131333 133113 222121 313113 131333 323311 -5.0 -5.0 -10.0 -10.0 source: gage r&r calculations.xls Individual forecasts 133113 222121 313113 323311 Derived estimates using L18 operator data 16 Individual forecasts of 5 (test) treatments gives us an indication of reproducibility across “operators” Profit forecasts $M 10.0 5.0 p1 p2 0.0 p3 131333 133113 222121 313113 323311 p4 p5 -5.0 -10.0 17 Can identify source of low quality data actual variation part-part variation over all treatments overall variation in measurements (forecasts) measurem’t system variation Gage R&R repeatability variation in forecast by one operator for a given treatment 48 % 82 % 3% 49 % reproducibility variation in forecasts of different operators for a given treatment 11 % 7% all w/o op 4 18 New approach to ... senior-executive decisions under uncertainty. Data quality can be improved Range of alternatives considered entire solution space Importance of decision variables can be determined Uncontrollable variables can be determined Impact of uncontrollable variables can be determined Predictive power higher 19 NEW WAY TO ... Analyze corporate decision-making Controllable variables Uncontrollable variables Explore the entire solution space Systematically and economically Explore outcomes over entire space of uncertainty Unconstraint range of what-if scenarios 20 Experiment power power of experiment 1 power 0.8 0.6 0.4 0.2 1. 8 1. 6 1. 4 1. 2 1 0. 8 0. 6 0. 4 0. 2 0 0 difference from BAU profit $M Power is the ability to detect a difference when one exists. Power is the probability that you will reject a premise when it should be rejected. 21