REIMBURSEMENT COMPARISON FOR TEMPORARY QUARTERS

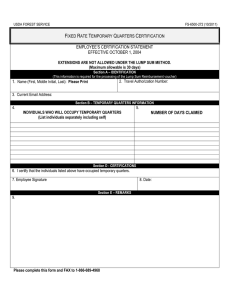

advertisement

USDA Forest Service ASC-140b (6/2005) REIMBURSEMENT COMPARISON FOR TEMPORARY QUARTERS (Actual Expense Method v Fixed Amount Reimbursement Method) NOTE: If relocation contract is used, 30 days is the maximum number of days for temporary quarters. ACTUAL EXPENSE METHOD: Actual reimbursement cannot exceed actual expenses or the maximum allowed under the regulations, whichever is less. Maximum Allowances 1 Multiply # of Family Number Members by this Factor: of Days First 30 Over 30 (30 or 60) days Days # of Family Members in Each Group Applicable Per Diem Rate 2 1 129.00 1.00 .75 Spouse and dependents age 12 or older 129.00 .75 .50 Dependents under 12 years of age 129.00 .50 .40 Employee (or spouse if unaccompanied) Total Total Maximum Allowance $ 1 The Maximum Allowance is determined by multiplying the number of family members in each group by the maximum daily per diem rate by the entitlement factor shown for the applicable 30-day period by the number of days in temporary quarters. 2 Within CONUS, the standard CONUS per diem rate applies; outside CONUS, the OCONUS locality rate applies. FIXED AMOUNT REIMBURSEMENT METHOD: The Fixed Amount TQSE reimbursement will be based on actual number of days incurred, up to the maximum of 30 days. No extensions are allowed. Maximum Allowances 1 # of Family Members in Each Group Employee Immediate family members; e.g., spouse and dependents (all ages) 1 Applicable Maximum Locality Per Diem Rate 2 Fixed TWSE Reimbursement Factor # of TQSE Days Authorized .75 30 .25 30 Total Maximum Allowance Total Fixed TQSE Reimbursement $ 1 The maximum payment for the employee will be three quarters (.75) of the maximum locality per diem rate multiplied by the number of days of TQSE authorized. The maximum payment for immediate family members will be one quarter (.25) of the maximum locality per diem rate times the number of days of TQSE authorized. 2 For both within and outside CONUS, the maximum per diem rate prescribed in chapter 301 for the locality of the new official station. The employee has two choices for temporary quarters: 1) Actual, or 2) Fixed The following rules apply when you select the fixed amount reimbursement for Temporary Quarters Subsistence Expense (TQSE): You will not receive additional reimbursement if the fixed amount is not adequate to cover TQSE. A maximum of 30 days will be allowed. No extension will be granted for whatever reason under the fixed amount selection. No receipts are required. Employee MUST indicate in Section 24, Remarks – “Employee has selected Fixed Amount for Temporary Quarters” on the 6500-140 Individual’s Request for Authorization. Once a reimbursement method has been established on the AD-202, it cannot be changed. No deductions will be made for the day(s) the employee is on TDY while in temporary quarters. No deductions will be made for the day(s) the employee is in leave status. To claim Fixed Temporary Quarters reimbursement, employee must complete R4-6500-145b, which provides a signed statement to the relocation coordinator of the exact number of days in temporary quarters. To determine the amount of the payment under the fixed amount reimbursement: Multiply 30 days by .75 times the maximum per diem rate (lodging plus meals and incidental expenses) for the locality of the new official duty station. Then, for each member of the immediate family (spouse and dependants), multiply the same number of days by .25 times the same per diem rate. The payment will be the sum of these calculations.