Document 10678688

advertisement

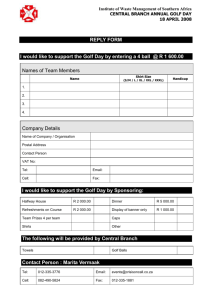

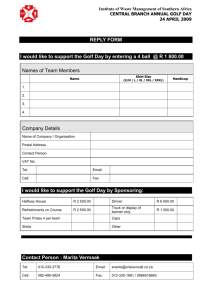

A new direction and business plan for the golf business in Korea: Strategies to attract customers to the domestic market By Ikhwan Kim B.A. Art Studies, Hankuk University of Foreign Studies, 2012 M.B.A. Sungkyunkwan University, 2014 SUBMITTED TO THE MIT SLOAN SCHOOL OF MANAGEMENT IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTER OF SCIENCE IN MANAGEMENT STUDIES AT THE MASSACHUSETTS INSTITUTE OF TECHNOLOGY JUNE 2014 MASSACHUSETTS M"TUTE OF TECHNOLOGY JUN 18 20 UIBRARIES C 2014 Ikhwan Kim. All Rights Reserved. The author hereby grants to MIT permission to reproduce and distribute publicly paper and electronic copies of this thesis document in whole or in part in any medium now known or hereafter created. Signature redacted Signature of Author:__________________ MIT Sloan School of Management May 9, 2014 Certified By: Signature redacted U Accepted By: Michael A. Cusumano SMR Distinguished Professor of Management Thesis Supervisor Signature redacted, Michael A. Cusumano SMR Distinguished Professor of Management Program Director, M.S. in Management Studies Program MIT Sloan School of Management 1 [Page intentionally left blank] 2 A new direction and business plan for the golf business in Korea: Strategies to attract customers to the domestic market By Ikhwan Kim Submitted to the MIT Sloan School of Management on May 9, 2014, in partial fulfillment of the requirements for the degree of Master of Science in Management Studies ABSTRACT The golf industry in South Korea has been flourishing and has maintained high profitability. However, the South Korean market is not adequately prepared for the increasingly globalized world economy and resulting changes in the business environment. There is a need for research to guide the Korean golf industry based on long-term projections of the Korean economy and future market trends. An increasing number of golf customers are traveling abroad to enjoy high quality golf services at more affordable prices. Golf courses in China and Southeast Asia are actively attracting golf tourists by promoting their competitive pricing. The Korean golf industry must identify and promote its competitive advantages to survive in this increasingly competitive environment. The main purpose of this study is to identify various strategies to increase customer demand for Korean golf courses. This paper also illustrates the correlation between economic trends and the golf industry in South Korea. Moreover, a business plan based on the factors that determine the choice of golf clubs, the competitive advantages of South Korean golf clubs, and potential marketing strategies indicate future directions for the Korean golf industry. Thesis Supervisor: Michael A. Cusumano Title: SMR Distinguished Professor of Management 3 [Page intentionallyleft blank] 4 ACKNOWLEDGEMENTS First and foremost, I would like to take this opportunity to thank my thesis advisor Professor Michael A. Cusumano for giving me a chance to work on this interesting topic. He has been a great source of advice and guidance throughout this dissertation. His expertise on the industry and strategies added considerably to my graduate experience. His constant feedback and encouragement provided me with extra motivation to complete this work within the given time period. In addition, I want to acknowledge the people who are working in golf industry, especially at the Haeundae country club. The materials that I have received were invaluable resources that enriched the contents of this thesis and provided different perspectives into the golf business. Also, through the experiences that I had at the golf country club, I have acquired the knowledge to think about the golf industry and their potential problem that would face in the near future. This motivated me a lot to work further on this thesis topic. I would also like to thank Chanh Q Phan and Julia Sargeaunt for giving me great support and encouragement while writing this thesis. Moreover, I would like to give my special thanks to all my Masters in Management Studies (MSMS) classmates. The MSMS experiences that I had surrounded by these people were precious and I have learned a lot from them. Last but not least, I always appreciate my parents to give me an endless support. It would never have been possible to finish MBA-MSMS program without their support and encouragement. 5 [Page intentionally left blank] 6 TABLE OF CONTENTS ABSTRACT.................................................................................................3 ACKNOWLEDGEMENTS..............................................................................5 1. INTRODUCTION......................................................................................8 - BU SIN ESS A N A LY TIC S................................................................................................. 9 2. SITUATION ANALYSIS IN THE GOLF INDUSTRY: SOUTH KOREA...............12 - HISTORICAL CHANGES IN THE GOLF INDUSTRY: SOUTH KOREA........................................12 - RECENT TRENDS IN THE KOREAN ECONOMY: CORRELATION WITH THE GOLF IND U ST R Y ............................................................................................................ - . . .. 17 SUPPLY AND DEMAND IN THE GOLF BUSINESS OVER RECENT YEARS: SALES, PROFIT & LOSS ............................................................................................................................. ..21 3. BUSINESS PLAN: STRATEGIES FOR ATTRACTING CUSTOMERS TO THE DOMESTIC MARKET...............................................................................28 - PROPOSE NEW GOLF COUNTRY CLUB MANAGEMENT POLICY IN SOUTH KOREA.................28 - MARKETING STRATEGIES FOR MEMBERSHIP GOLF CLUB .............................................. 33 - ATTRACTING CUSTOMERS FROM NEIGHBORING COUNTRIES ........................................... 36 - BENCHMARKING 'CAESARS' DATA-DRIVEN CRM SYSTEM.............................................41 4. CONCLUSION..........................................................................................45 - IMPROVE GOLF CLUB OPERATIONAL COMPETITIVENESS...............................................46 - ATTRACT CUSTOMERS IN RECESSION..........................................................................47 - COST MANAGEMENT IN RECESSION..............................................................................48 5. REFERENCES.........................................................................................49 7 1. INTRODUCTION 1.1 The South Korean golf industry The golf industry is among the highest value-added businesses in the service industry. As national income and awareness of the service industry continue to grow in South Korea, the demand for golf courses has been steadily increasing. Moreover, global trends indicate that golf is becoming more prominent in Asia, alongside rapid urbanization, growth of wealth, and technological development. South Korean female golfers have been dominant in global golf tournaments such as those on the Ladies Professional Golf Association (LPGA) tour, which indicates that golf is spreading very quickly across Asia (HSBC report, 2012). "Korea has only 0.7% of the world's population, and hardly any room for golf courses. Yet four of the top 10 female golfers in the world are Korean" (The Economist, 2012). However, since golf has been recognized as a luxury sport that is relatively expensive to play, it is likely that many golf business owners could face problems during economic downturns. This study focuses on the South Korean golf industry by analyzing the country's recent economic conditions and their effects on this industry. In addition to the golfing population, the number of golf country clubs has increased rapidly in Korea. However, the number of domestic golf customers is limited relative to the growing number of golf country clubs. Therefore, the objective of this study is to research the distinct features of the Korean golf industry and golf courses to propose a new business plan focused on attracting foreign customers to the domestic market. Before addressing the main subject, I introduce the concept of business analytics, an analytic technique that has been implemented and applied to data-based decision making by 8 Caesars, a casino, hotel, and entertainment company. Since customer relationship management (CRM) is one of the most crucial factors in maintaining and attracting more golf customers, business analytics could be applied to the golf country club business, and the case of Caesars could serve as a benchmark for how this approach could be applied to the golf industry. "Not only the economy, but some of the changes in society, resulting in people not having the time it takes for golf Time is a bigger threat to our industry, I think, than the economy: it just seems people have trouble finding the five hours to carve out and go play golf because you've got husbands and wives who work and kids who are in four or five different activities during the year. "(in 2014) - Bob Barrett, co-Jounder and CEO of 'HonoursGolf 1.2 Business analytics Business management based on data rather than intuition The concept of business analytics refers to a business management approach under which a company makes decisions that are based on facts, which become information through the collection and analysis of data. Only a decade ago, the term business analytics was associated with global companies possessing capital and technology. However, given the increasing sophistication of information technology (IT) and the progress in data arrangement and reading data processing technology, business analytics has become a general term that can be associated 9 with any company. In fact, as of recently, there may not be any companies that do not arrange and analyze their product and customer data such that they can be reflected in their strategies. Consequently, academic interest in business analytics has recently increased. A paper titled "Big Data, Analytics, and the Path From Insights to Value," published by the MIT Sloan Business Review in 2010, arranged data surveyed by MIT and IBM from about 3,000 companies from over 108 countries. As is clear from the title, the subject of this survey was each company's level of business analytics. The analyzed companies generally appear to base their management activities on data. Almost 92% of surveyed companies stated that they utilize internally gathered data in making major strategic decisions and one out of four surveyed individuals replied that they check data every day and incorporate them in day-to-day activities (MIT Sloan Management Review, 2010). Figure 1 - Utilization of gathered data Q8. How often do you use information and analytics to inform your actions and support decision making in your day-to-day role? 1% Never Source: http://sloanrevicw.mit.cdu/article/big-data-analytics-and-the-path-from-insights-to-value/ 10 Secret weapon of high-performing companies The survey mentioned above also showed that business analytics influence company performance. When divided into two groups - high and low performing companies, based on sales - high-performing surveyed companies were shown to use data rather than intuition five times more often than average in making decisions. In particular, high-performing companies were found to incorporate business analytics into all areas, from establishing future strategies, including new product development and marketing, to routine activities, such as customer complaint management and employee benefits Figure 2 - Influence of business analytics Tendency - App4y Tendency toAppir Intuition Amlytios Financial management and budgeting Operations and production Stratgy and busineas development Sasand mrktino Customer "Meeic Product research and development General mans emant Top Performars r Lower Performers Risk management Customer experience management Brand or market management Work force planning and allocation Overall Average o 1 2 2 4 s a 7 a Source: http://sloanreview.mit.edu/article/big-data-analytics-and-the-path-from-insights-to-value/ The remainder of this paper is organized as follows. Chapter 2 explains historical changes in the golf industry using statistical data and determines whether these are correlated with economic conditions. In addition, a profit and loss analysis is conducted to better understand recent market conditions. Chapter 3 suggests strategies to maintain and sustainably develop the golf business in 11 Korea based on an analysis of the factors that influence the choice of golf course from the perspective of the customer. In addition, Caesars data-driven CRM system, which could serve as a benchmark for the golf industry, is introduced. The final chapter briefly addresses how to improve golf club operational competitiveness and attract customers in recession. Also, cost management of golf business will be touched for the future direction of the golf industry. 2. SITUATION ANALYSIS IN THE GOLF INDUSTRY: SOUTH KOREA 2.1 Historical changes in the golf industry In Korea, people started to enjoy a range of sporting activities after the implementation of the five-day workweek in July 2004. Golf has also gradually become popular and golf country clubs are flourishing. There were only 60 golf country clubs in Korea at the end of 1991. However, this number increased nine-fold by 2013; the population of golf players has also increased dramatically, reaching about 30 million people (Korea Golf Course Business Association). In addition, although the average growth rate of golf country clubs has dramatically increased, the supply of golf clubs has far exceeded demand in the last few years. This could cause many problems because most of the golf courses under construction could suffer from lack of funds. Moreover, golf membership prices have decreased dramatically, which could represent a significant burden to golf club owners because they are obligated to refund membership fees if requested by customers. 12 Before the economic crisis in South Korea, many people jumped into the golf business, not only because the government simplified the golf country club construction approval process, but also because it was easy to borrow money from banks at low interest rates. When the crisis hit Korea, many golf businesses suffered, setting off a bankruptcy crisis. Another difficulty for golf club owners in Korea is the high sales tax (Korea Institute of Public Finance). Specifically, total sales revenues from 18-hole golf clubs were about 13 billion won in 2009. However, taxes on sales revenues, including real estate, property and indirect taxes, were about 6 billion won. In other words, taxes represented about 51% of total sales revenues. This tax policy affects golf business owners in addition to other burdens, including the refunding of membership fees. Japan has experienced a very similar situation since 2002. Many Japanese golf clubs went bankrupt during the recession because they did not have the ability to refund membership fees (Korea Golf & Condo Membership Exchange). In order to avoid the same path as these Japanese golf clubs, indiscriminate golf course development should be avoided, and countermeasures for the imbalance of supply and demand should be incorporated into the South Korean golf industry. In order to conduct a detailed analysis of the situation of the Korean golf industry, relevant golf industry indexes on total golf course visitors and the status of golf clubs in South Korea are listed below. 13 Figure 3 - Total golf club visitors in 2012 Total golf club visitors in Korea 2012 Provinces holes 52 143 42 39 36 24 23 38 40 913 2,829 773 775 657 384 374 690 726 clubs Gangwon Gyeonggi Chungbuk Gyeongnam Chunbuk Chunnam Chungbuk Chonnam Jeju 2011 No golf Nof Rate of change of Golf course visitors golf Nof holes N of golf clubs holes 2012 2011 48 138 42 38 30 22 19 33 40 841 2,703 743 766 558 348 302 573 726 8.3% 3.6% 0.0% 2.6% 20.0% 9.1% 21.1% 15.2% 0.0% 8.6% 4.7% 4.0% 1.2% 17.7% 10.3% 23.8% 20.4% 0.0% 2,482,013 10,369,856 3,511,430 3,403,018 2,068,636 1,374,155 1,250,637 2,350,062 1,795,360 2,227,227 10,179,061 3,115,239 3,194,245 1,737,151 1,315,779 1,164,294 2,175,619 1,796338 clubschnehag N Visitors per hole Rate of 2011e change 11.4% 1.9% 12.7% 6.5% 19.1% 4.4% 7.4% 8.0% -0.1% 2,719 3,666 4,543 4,391 3,149 3,579 3,344 3,406 2,473 2,648 3,766 4,543 4,391 3,149 3,579 3,344 3,406 2,473 Rate of g2012 2.7% -2.7% 8.3% 5.3% 1.1% -5.4% -13.3% -10.3% -0.1% Membership golf club visitors 2012 Provinces No golf 2011 Nof holes Gangwon Gyeonggi Chungbuk 25 84 558 1,953 19 432 Gyeongnam 26 18 11 5 14 25 227 630 378 207 90 315 549 5,112 Chungbuk Chonnam Jeju Total golf holes clubs _____________clubs Chunbuk Chunnam Rate of change Nof 24 84 20 26 16 11 4 12 26 223 540 1,935 441 630 342 207 72 261 576 5,004 N of golf Golf course visitors clubs N of holes 2012 2011 4.2% 0.0% -5.0% 0.0% 12.5% 0.0% 25.0% 16.7% -3.8% 1.8% 3.3% 0.9% -2.0% 0.0% 10.5% 0.0% 25.0% 20.7% -4.7% 2.2% 1,368,093 6,608,313 1,901,684 2,657,446 1,161,087 743,739 251,027 988,762 1,397,521 17,077,672 1,151,212 6,722,672 1,801,082 2,541,131 1,081,627 737,605 247,856 1,052,302 1,449,370 16,784,857 Visitors per hole Rate of change 2012 2011 Rate of change cag 18.8% -1.7% 5.6% 4.6% 7.3% 0.8% 1.3% -6.0% -3.6% 1.7% 2,452 3,384 4,402 4,218 3,072 3,593 2,789 3,139 2,546 3,341 2,132 3,474 4,084 4,034 3,163 3,563 3,442 4,032 2,516 3,354 15.0% -2.6% 7.8% 4.6% -2.9% 0.8% -19.0% -22.1% 1.2% -0.4% Public golf club visitors 2012 Provinces No golf 2011 Nof holes clubs Gangwon Gyeonggi Chungbuk Gyeongnam Chunbuk Chunnam Chungbuk Chonnam Jeju Total 27 59 23 13 18 13 18 24 15 210 golf Rate of change N of holes N of golf 301 768 302 136 216 141 230 312 150 2,556 clubschnehag 355 876 341 145 279 177 284 375 177 3,009 24 54 22 12 14 11 15 21 14 187 Golf course visitors Visitors per hole clubs N of holes 2012 2011 Rate of ch 12.5% 9.3% 4.5% 8.3% 28.6% 18.2% 20.0% 14.3% 7.1% 12.3% 17.9% 14.1% 12.9% 6.6% 29.2% 25.5% 23.5% 20.2% 18.0% 17.7% 1,113,920 3,761,543 1,609,746 745,572 907,549 630,416 999,610 1,361,300 397,839 11,527,495 1,076,015 3,456,389 1,314,157 653,114 655,524 578,174 916,438 1,123,317 346,968 10,120,096 3.5% 8.8% 22.5% 14.2% 38.4% 9.0% 9.1% 21.2% 14.7% 13.9% 14 3,138 4,294 4,721 5,142 3,253 3,562 3,520 3,630 2,248 3,831 Rate of 2011 Rae 3,575 4,501 4,352 4,802 3,035 4,101 3,985 3,600 2,313 3,959 -12.2% -4.6% 8.5% 7.1% 7.2% -13.1% -11.7% 0.8% -2.8% -3.2% e2012 Variations in golf club visitors over last 3 years Proines Provinces Gangwon Gyeonggi Chungbuk Gyeongnam Chunbuk Chunnam Chungbuk Chonnam JejU Total 2012 Nof 2011 clubs N of ho hls golf clubs 52 143 42 39 36 24 23 38 40 437 913 2,829 773 775 657 384 374 690 726 8,121 48 138 42 38 30 22 19 33 40 410 N of 2010 N of Golf course visitors Visitors per hole ho hls golf clubs No hoe hoe 2012 2011 2010 2012 2011 2010 841 2,703 743 766 558 348 302 573 726 7,560 38 122 37 27 22 15 14 25 39 339 661 2,391 656 558 405 270 238 477 681 6,337 2,482,013 10,369,856 3,511,430 3,403,018 2,068,636 1,374,155 1,250,637 2,350,062 1,795,360 28,605,167 2,227,227 10,179,061 3,115,239 3,194,245 1,737,151 1,315,779 1,164,294 2,175,619 1,796,338 26,904,953 2,251,788 10,078,480 3,062,713 2,869,421 1,681,896 1,143,185 979,156 1,822,784 2,019,563 25,908,986 2,719 3,666 4,543 4,391 3,149 3,579 3,344 3,406 2,473 3,522 2,648 3,766 4,193 4,170 3,113 3,781 3,855 3,797 2,474 3,559 3,407 4,215 4,669 5,142 4,153 4,234 4,114 3,821 2,966 4,089 Source: www.kgba.co.kr The total number of golf visitors has been gradually increasing since 2010. In 2012, about 28 million people visited golf courses, representing an increase of 6.3% from the previous year. Although the number of visitors per hole decreased by about -1% in 2012 relative to 2011, the rate of decline remained steady, implying a low risk that the South Korean golf club bubble would collapse. The number of public golf course visitors also increased remarkably in 2012, by about 13.9%. This indicates that there has been a shift from membership to public golf clubs as people now tend to prefer inexpensive golf clubs due to the economic downturn. The number of average visitors per hole normally represents a management index for individual golf clubs. The data show that per-hole visitors to membership and public golf clubs decreased by 0.4% and 3.2%, respectively. In 2012, the number of visitors to 18-hole membership golf clubs was 60,377, which represents a continued decrease, but at a decreasing rate. In the three years from 2010 to 2012, the number of 18-hole golf course visitors decreased by 9,718, and the number of visitors to 18-hole public golf courses decreased by 12,908. Also, the difference in the number of visitors to membership and public golf courses has diminished from 12,010 to 8,820. In terms of the region, Kyondbuk had the highest average number of golf club visitors per hole, 15 whereas Jeju had the lowest. In addition, Chungbuk and Jeju had more visitors to public golf courses, which are not normal for Korean golf clubs. Figure 4 - Status of golf clubs in South Korea in 2013 o Total rA egion - Section Total Member Nonmember o 545 269 276 0 8 6 2 0 0 2 9 3 6 1 1 e - . -. 4 4 1 1 3 3 4 2 2 4 3 1 2 4 2 2 3 157 1 2 88 69 29 6 23 43 17 26 50 22 28 46 24 22 45 27 18 23 5 34 28 18 21 40 18 22 9 40 25 15 5 1 4 7 2 5 10 2 8 5 2 3 4 3 1 3 2 1 8 3 5 0 0 0 72 43 37 1 22 35 21 15 52 25 27 36 18 19 9 10 13 8 5 0 0 0 3 1 2 5 1 4 7 4 3 7 4 3 4 1 3 1 0 26 11 1 Operating egion rSection -~~ otal Member Nonmember o 437 227 210 7 5 2 0 0 0 2 1 1 6 2 4 1 3 2 137 1 1 82 55 0 14 5 9 18 13 19 Under Construction Region Section Total 64 Member 22 Nonmember 142 o ~I~5 - 0 0 0 0 0 0 0 0 0 2 0 2 0 0 0 0 0 0 0 0 0 0 0 Planned Region ft ft Section Total Member Nonmember t 44 20 24 0 0 1 1 0 0 1 1 0 0 0 0 0 0 0 1 0 1 0 1 0 1 0 0 6 1 5 1 Source: www.kgba.co.kr 16 In 2013, 44 new golf clubs were approved, which is 32 more than in 2012. This shows that the number of golf clubs has continuously increased. Although the golf club approval process should take three to four years, the total approximate number of new approved golf clubs reached 300 during the last decade. Given the area and population of South Korea, it is highly likely that supply will exceed demand sometime soon. In addition, including those under construction, there are around 560 golf clubs, for the first time exceeding 10,000 holes in terms of 18-hole courses. There is a certain amount of balance between public and membership golf clubs, meaning that they are almost equal in number (Korea Golf Course Business Association). 2.2 Recent Trends in the Korean economy Prior to analyzing the Korean economy, several global corporate trends that Korean companies are considering for their future strategies should be mentioned (http://www.mosf.go.kr). With regard to corporate strategy, renewal and exploration are significant trends that companies should focus on. By transforming corporate structures and brands, companies will be able to establish footholds in global markets to become leaders. Also, through realignment, global companies can extend their businesses to emerging markets, which is likely to bring large opportunities. In these cases, coalitions, convergence, and low price strategies could help global companies to understand customer values. In addition, economic conditions in South Korea have been steadily worsening .since the beginning of this year. Korea experienced economic contagion, in which the economic problems 17 of one nation spread to another. The center of this economic contagion was Thailand, and it spread to Malaysia, Indonesia, the Philippines, and South Korea. Many currency speculators attacked undervalued currencies and the Korean stock market was affected. Due to the volatile stock market situation, many export and import companies suffered massive losses (http://www.hofstra.edu). Figure 5 - Annual growth rate of South Korean GDP SOUTH KOREA GOP ANNUAL GROWTH RATE 10- -10 8.7 7.6 8- -8 6.3 64- 5.59 4.4 7~ 3.3 4.5 2- 4.3 -3.5 -6 3.6 3.4 -..- - 3.339 2.8 2.4 2.3 1. 1 6 1.5 1.5 F -2 0- -0 .2- --4~- -4 -3.3 -- 2 -2.1 -- 4 -4.2 L- 2008 2010 2012 2014 The primary reason for the economic crisis was snowballing foreign debt in developing countries. In most developing countries, the standard of living is far lower than in developed 18 countries. One way for poor countries to increase their standards of living is by borrowing money from developed countries and purchasing manufacturing equipment, such as metal stamping or sewing machines. With this equipment, poor countries can produce products that developed countries want to import. However, foreign debt accumulated rapidly in underdeveloped nations due to global economic stagnation. South Korea was one of the greatest victims of this economic contagion. Figure 6 - Economic growth in South Korea 8 % change p.a. % change p.a. 8 6 6 4 4 2 2 t 0 I- 0 -- r- -2 -2 -4 -4 08 09 10 11 12 External demand Government consumption Private consumption Inventory changes 13e 14f Gross fixed investment - - -Overall economic growth https://economics.rabobank.com/publications/2014/february/country-report-south-korea/ 19 Figure 7 - South Korean exchange rate i.600 - U.S.$ / KRW 1500 400 - 1,2001.100 114W 1.000 -- ____ 900 800 7001 Source:Bloomberg With regard to the correlation between the golf industry and the economic situation in South Korea, it is obvious that the golf industry suffered greatly during the economic recession in 2007 and 2008. Golf customers who used to play at luxury membership golf courses stopped going to expensive golf clubs and shifted toward public courses because of their lower prices. Therefore, the sales revenues of membership golf clubs dropped significantly during this period. When the actual economic sentiment of consumers started to improve in 2009, the golf market gradually rebounded. The number of golf visitors increased and an increasing number of golf courses received construction approval in Korea. However, a number of membership golf clubs were still suffering from a lack of visitors. As a result, many membership golf clubs faced the dilemma of transforming themselves into public golf courses. 20 2.3 Supply and demand in the golf business over recent years (Korea, Japan, and China) In contrast to Korea's economic conditions, the country's golf industry is flourishing along with a boom in the construction of golf clubs. The number of golf clubs has doubled since 2004 and more than 50 clubs are currently under construction. However, this dramatic increase in the number of Korean golf clubs could have many side effects for the golf industry because supply is exceeding demand. Many golf clubs are having difficulties in selling their memberships, which are their main source of revenue. In addition, golf customers are dispersed among many different golf clubs, which also affects revenue. Specifically, there are two types of golf clubs: public and membership clubs. In this year, the average revenues of membership golf clubs were 13 billion won, which is 4.6% lower than in the previous year; operating profits were 7.4% lower as well. In fact, the operating profits of membership golf clubs have been diminishing since 2002, when profits reached a peak. Detailed information on the status of sales revenues for all golf clubs in 2011 and 2012 is presented below (GMI Consulting Group, 2012). Figure 8 -Sales Revenues for all golf clubs (Unit: million won) 18 Hole 27 Hole Capital area Yeongnam, area Honam area Chungebeong area Gangwon area Average 2012 11,327 8,987 7,721 9,560 7,900 9,788 2011 11,705 8,753 7,983 9,617 7,868 10,193 Over last year -378 234 -262 -58 32 -405 Rate of change -3.2% 2.7% -3.3% -0.6% 0.4% -4.0% 2012 14,867 11,610 11,153 9,632 9,667 11,800 6,227 2011 JeJu 15,727 12,012 12,362 9,653 9,659 12,359 6,484 Over last year -860 -420 -1,209 -21 9 -558 -257 Rate of change -5.5% -3.3% -9.8% -0.2% 0.1% -4.5% -4.0% 21 36 Hole 18-hole converted average 2012 19,983 18,407 15,476 14,997 20,017 32,782 2011 Over last year 20,651 -668 19,904 16,472 16,269 20,480 28,634 -1,496 -996 -1,272 -463 4,148 Rate of change -3.2% -7.5% -6.0% -7.8% -2.3% 14.5% 2012 10,490 8,442 6,999 7,743 7,094 9,037 9,911 2011 10,867 8,598 7,460 7,828 7,176 9,326 9,026 Over last year -377 -155 -461 -85 -82 -290 885 Rate of change -3.5% -1.8% -6.2% -1.1% -1.1% -3.1% 9.8% Source: www.kgba.co.kr Golf country clubs utilize their budgets to promote sales through various types of marketing and other activities. Reducing variable costs such as personnel or operating expenses is one of the primary tasks of golf club owners. The average sales revenues in the chart above indicate recent trends, based on golf club size. Average sales revenues for 18-, 27-, and 36-hole clubs were declined by 4.0%, 4.5%, and 2.3%, respectively, from 2011 to 2012. Although the number of golf club visitors has been increasing since the economic crisis in 2009 due to marketing efforts and government tax policies, sales revenues and business profits have been continually decreasing. Figure 9 - Sales revenue trends for all golf clubs 14 000 12000 40o It - 20% 10.000 10 *.000 00-1 6000 -10 4,000 -20o 2 000 . 2011 2012 -m Rate of cbms http://www.gmigolf.co.kr/category/ 22 Or Still, there is good news. The number of golf customers has been steadily increasing since 2003. According to the Korean golf management association, there were 13.7% more golf course visitors in 2012 than in the previous year. In addition, theumber of visitors exceeded 20 million for the first time. Above all, there is a clear increasing trend among golfers who prefer to play in public golf clubs, which means that golf is becoming more popular and accessible to those who were not regular customers in the past. Figure 10 - Trends in golf club visitors 2&605167 29.000.000 28.000 000 76,000 74.000 794 26904953 27.000,000 72000 7000 66000 766 25.000,000 ,24,0M000 6a0A0 72.,404 26,000.000 24Z" ,0" 62.000 2300.000 60,000 22.000 000 S&O00 56,000 21.000,000 08 09 Golf course visitors 10 11 12 1IS Hole converted basis visitors http://www.gmigolf.co.kr/category/ However, although the amount of total golf club visitors has been increasing, the number of individual golf club visitors has declined due to the supply of new golf country clubs. This led to a drop in sales given the delayed economic recovery. However, operating profits appeared to decline during 2012 because the rate of cost reduction was about 1.5% against sales. Only the 23 Yeongnam and Chungcheong areas showed increases in operating profits. Enforcement of the regulation on tax reductions and exemptions for golf clubs in certain regions seemed to affect operating profits in 2011, but had a small impact in 2012 (The Korea Economic Daily, 2012). In addition, some golf club owners are looking overseas to seek new opportunities from foreign golf customers. For example, China's golf industry has been undergoing impressive development in recent years. Thanks to the country's rapid economic growth, China's newly rich are investing large amounts of money in the golf industry. As a result, some Chinese golf courses hold international golf tournaments and many foreign pro golfers and celebrities come to visit Chinese golf clubs (Korea Weekly Chosun, 2014). In this sense, China's golf industry has a very bright future not only because of their economic growth, but also due to their rising total population. China's golf population is increasing by an average of 30% every year. All these facts show that China's golf industry could be a potential market for the Korean golf industry. Figure 11 - Trends in Chinese golf club visitors 410 350 40' 10 f/sprtssoh http:/sot 24 oucom/20120318/n338084525.shtml However, China's golf industry is facing some difficulties. Although the Chinese economy is growing quickly, the gap between the rich and the poor is widening, which causes many social problems in Chinese society. In other words, only rich people can afford to play golf. In addition, the rising cost of raw materials is a problem faced by Chinese golf club owners because they have to import all the prime sources, such as golf course grass lawn and lawn mowers. More importantly, there is a shortage of professionals who understand the golf business because China's golf industry is still in its early stages. In all likelihood, the Chinese golf industry could represent an opportunity for Korean golf club owners since the Korean golf industry is mature enough to deal with the problems that the Chinese industry is currently facing. Figure 12 -Numbers of golf clubs and customers in China * )Wbtc Of &W =WWMW% 1700 8) <990 19 ........ 19 b . o. ....... <Thie Aumibier .of golf.clubs. andrcustomers > ................. 25 .s In contrast to the Chinese economic situation, Japan has been experiencing a severe economic crisis. Before the collapse of the economic bubble in Japan, there were more than 2,400 golf clubs in the country. However, after the economic bubble collapsed, the market value of golf clubs fell dramatically; as a result, 300 golf clubs were bought by foreign investors and 800 golf clubs approached bankruptcy. In other words, the Japanese golf industry is even more mature than the Korean golf industry with regard to the oversupply issue (Samsung Economic Research Institute, 2009). In recent years, hoping to pull its economy out of recession, Japan's government unveiled a new plan aimed at fighting deflation. However, Japanese golf clubs are still suffering from diminishing numbers of golf tourists due to reductions in employee leisure time as well as a declining population. Most golf clubs rely heavily on foreign Asian golf tourists. According to the Japanese Golf Business Association, the total number of golf club visitors in 2012 was about 10% lower than in the previous year. In these circumstances, foreign investors such as Goldman Sachs or Loan Star are poised to sell their shares of Japanese golf clubs (Japanese Golf Business Association, 2012) Figure 13 -Total sales in the Japanese golf industry .p..u....... 1900 192 IS9 T 19W9 200>'20M 2004 <Golf industry total sales> 26 206* 20 Figure 14 - Number of bankrupt golf clubs and total liabilities in Japan (Unit: Billion yen) 1991 1992 1993 1994 1995 1996 1997 1998 1999 Total bankruptes 3 5 3 8 7 6 8 22 20 82 liabilties 87 - 348 66.7 213 -40.0 42 112 48 360 461 477 2,148 166.7 -12.5 -14.3 33.3 175.0 -9.1 Bankruptcy variation_(%)______________________ - 300.0 -38.8 -80.3 166.7 -57.1 650.0 28.1 3.5 2000 2001 2002 2003 2004 2005 2006 2007 2008 Total 26 53 109 90 87 65 54 49 28 561 1,601 936 2,195 2,023 1,757 1,148 636 689 355 11,340 -23.1 103.8 105.7 -17.4 -25.3 -16.9 -9.3 -42.9 -44.6 8.3 variation %) bnkrupte s l liabilities______ Bankruptcy variation_(%) Liability, variation_(%) ,__________ -70.2 _____ _____ __________ -41.5 __________ 134.5 -3.3 _____ -7.8 -13.1 __________ __________ -34.7 _____ ____ _____ __________ -48.5 ____ Source: Korea Leisure Research Center Although the Japanese golf club and golf goods industries are far more developed than their Chinese counterparts, golf business owners are helpless against a declining golf population. The main causes of the collapse of the golf industry in Japan are the oversupply of golf clubs, the bubble in golf membership prices, and the prolonged recession. More than 2,000 golf clubs had already been built by 1992, and there were more than ten million golf visitors until 1992. However, the number of golf visitors has been declining dramatically since 2000, leading many golf clubs to go bankrupt. There are over 600 bankrupt golf clubs in Japan, and this number is expected to rise unless there is a breakthrough in the industry. 27 3. BUSINESS PLAN 3.1 Proposal for new golf country club management policies in South Korea Creating customer relationship management (CRM) systems for marketing The following steps should be followed in order to enhance marketing efforts in the Korean golf industry. - Implementation of customer-oriented management systems for customers with special needs to continuously attract new golf customers. - Construction of a service system based on existing customer databases in order to create new golf customers through the database. - Creation of service linkages between neighboring golf clubs so that golf customers have a wider range of choices among golf courses. Some Japanese golf clubs are providing benefits that allow golf customers to use the same services in various golf clubs if they buy group golf memberships. In Korea, purchasing multiple golf memberships would be difficult because membership prices have become very high. Therefore, as an alternative, service linkages could help to attract more golfers by sharing information from customer databases. Environmentally friendly golf country club operations 28 As the standard of living has been steadily improving and the market has also been shifting towards becoming more customer-oriented, sustainability has become one of the most important issues for business owners. In order to achieve competitiveness, golf business owners should consider the following sustainable golf course management practices. - Introduction of advanced pest control systems for golf courses. For the environmentally friendly usage of agricultural chemicals, the implementation of an incentive system would be helpful to motivate disinfection service companies to avoid overusing chemicals. Also, the development of biotic pesticides should be encouraged. - Offering tax exemption benefits to golf clubs that take the initiative to implement environmentally friendly management systems. " Provision of on-the-job training for employees to establish eco-friendly marketing strategies. Implementation of advanced golf-related laws and regulations A revision of golf-related laws is required to promote membership golf clubs that are in financial difficulties and avoid a series of bankruptcies. Specifically, taxes on golf club admissions, such as a special consumption tax for entrance fees and promotional funds for sports, should be abolished. This would help reduce the burden of playing golf and contribute to making the sport more popular. Also, reforming regulations to crack down on illegally operated public clubs is important to ensuring fair competition. Moreover, establishing an open market for the trading of golf memberships or introducing an Escrow user account management system could stabilize and revitalize the golf membership trade market. 29 Figure 15 - Escrow agent system Seller provides clear title to the Buyer provides money property Escrow Agent Escrow carries out closing instructions according to the sales contract! Source: http://www.spendsavelive.com/2009/6/24/costs-of-selling-your-house-escrow Settle as a prestige golf club It is unfortunate that the golf industry has been seized with the desire of only creating prestigious golf clubs. Certainly, every club wants to build a good reputation but sometimes they seem to have little understanding of the requirements for prestigious golf courses. Further, it is incorrect for them to just blindly seek to enhance their reputations. There are almost 200,000 golf courses in the United States (US) and 3,000 in Japan. However, only 100 US courses are well-regarded, and a mere 1% are esteemed in Japan. After all, the concept of prestige is relative. Because not all clubs can be prestigious, clubs can achieve competitiveness by developing their own settingand operation-related characteristics. Experts consistently say that a supplier-led golf course industry will transform into a demand-centered market. In this case, golf course owners and managers need to think deeply about business management focused on customers and work to build prestigious golf clubs that are actually attractive to customers. In this new market, in which 30 customers choose golf clubs, it is also equally important to learn the factors that people do not like in golf courses to understand how to achieve prestige. Figure 16 - Prestigious golf club Source: http://www.haeundaecc.co.kr People will, of course, avoid golf courses with poor green quality and a high proportion of bare ground on the fairway. However, very few courses have such characteristics. There are other aspects that could potentially make customers want to avoid a golf course, if not considered significantly in the future, in addition to green quality, fairway cleanliness, and good service 31 provision. One good example of an undesirable characteristic is when the out-of-bounds (OBs) densely lines both sides of the fairway. It is not acceptable if these OBs are not designed for proper shot estimation but rather for the convenience of staff and course operations. There are some clubs that use the OBs to demarcate between holes in cases when there was originally no obstacle. Sometimes, the so-called OB tee from nowhere, stands in the middle of the fairway. No specialist would attribute any prestige whatsoever, no matter the strength of the claim, to a golf course with such a characteristic. The so-called OB tee is set up at a point, from time to time, where no long-drive hitter could ever reach so an OB-gaining player gets hole-out with a higher score than the other who got within the fairway. Teeing ground limits are also another source of user complaints. Golf is scientifically designed so that poor performers can play with stronger golfers on equal footing. One factor that makes this possible is the provision of separate teeing grounds but it is general among male players to block the use of teeing ground in the first place for no handicap trade. They claim that this is done for faster and more efficient game play but if any game efficiency is put even over the game rule, then it would be better to make holes larger than the regulation. In addition, golf course administrators need to change their ways of thinking and carefully review general practices, which are followed without having a clear idea about how customers regard golf courses and clubs. Golf course visitors want to be comfortable and happy. Escaping from crowded cities, they want to come to a golf course to relieve their stress in a natural environment. Fortunately, more golf club chief executive officers (CEOs) are trying to catch up with the changing times by focusing on customer service. Some clubs provide their clients with cool wet cloths in the summer or masks during the yellow dust season. Some also open as many as six 32 tees for clients to choose from. Others remove shades and operate mobile carts serving drinks and snacks. Such administrative styles and services impress visitors and reflect the hard work of golf course CEOs. However, prestigious golf clubs can be created through very basic golf course elements. 3.2 Marketing strategies for membership golf clubs Changes in the golf business market environment In order to create appropriate marketing strategies or brand concepts for the golf business, it is crucial to understand changes in perceptions toward the golf industry. In the past, golf was regarded as a luxury sport that was relatively expensive to play in comparison with other sports. In addition, many people have criticized the building of golf courses because they claimed that it could destroy the environment. However, these perceptions started to gradually change as national income increased. Although South Korea has been through a few economic recessions, the country's national income has been increasing quickly and steadily enough to enlarge the golf-playing population. In addition, due to the development of Internet technology, golf customers can easily obtain information about various types of golf courses, which could be one of the factors that is gradually increasing golf's popularity among the general population. With regard to the average age for enjoying golf, it has expanded to all age groups. Since Korean female golfers are performing well international golf tournaments, golf has also become popular 33 among women, which makes it important for golf business owners to consider marketing toward female golf customers. Figure 17 - Changes in golf business market environment Past * Noble sport " Luxury sport * Urban sport * Negative sport Present [i U [J National income increment Enlargement of golf population base * Internet acthfion Remarkable activities of female golfers a Become popular sport @Sport for health * Expansion of age group -Over 40 under 10 Marketing strategy Based on an appropriate understanding of changing trends, the following steps are proposed to attract customers to golf clubs. Since the age range of customers has been extended and women are increasingly starting to play golf, it is crucial to cultivate these potential golf customers. In addition, creating a database of effective demand to determine the target marketing group is one of the other objectives and it ought to be based on causing the interest of service in business contents. Well-established objectives could lead to the setting of primary marketing strategy goals. Core customers, such as opinion leaders, have great power to influence people who are considering taking up golf. Therefore, establishing an opinion-leader oriented marketing strategy should be the main goal related to maximizing effectiveness. 34 Specifically, the determination of target customers should change to a relation- rather than customer-oriented approach and it should be based on an effective demand database of existing and potential golf customers. Marketing methods should be closely related to increasing commercial value through media or news advertisements. Also, getting feedback from golf customers is really important to create sales effects. The detailed comments of customers regarding all golf club experiences should be reflected in provided services and marketing messages. Lastly, the development of materials oriented toward professionals, such as membership sales guidelines, could also be an effective marketing approach. Figure 18 - Marketing strategy " Objective Discover and retain potential golf customers " Provide continuity of service in business content to raise interest " Create effective demand database to determine targetmarketing group Goal Target Method " Attract core customers (opinion leaders) " Establish opinion-leader-oriented marketing strategy " Shift toward relation orientation " 'Irget market-oriented customers " Effective demand based on existing data base " Increase commercialvalue through media or news advertisements * Create sales effects with database feedback via D.M. orT.M. methods " Develop materials that are oriented towards professionals, such as membership sales guidelines " Hire experienced counselors to increase customer satisfaction 35 In order to entice existing and potential golf customers, it is important to develop a distinct direction for a brand concept. The most effective way to attract not only domestic but also foreign golf customers from neighboring countries could be to build a prestigious golf club brand image. Specifically, golf club owners should emphasize differentiating factors such as accessibility, services, and social status. Also, customer trust can be built by providing wellorganized booking and feedback systems. This could lead to the creation of a prestigious golf country club that has a well-respected social status and coexists with authentic Korean culture. Figure 19 - Directions for brand concept Directions for brand concept Emphssi Emphasize Class e a Emphasize differentiated status C High class golf a Dlsetrnettwnmembership "Differentiated service - Easily accessible " Well-respected social cls a Build trust for booldng " Build trust in the number of golf club members Leader in Korean Emphasize Lifestyle - igh standard of living Coeist with culture society 3.3 Attracting customers from neighboring countries (China and Japan) In addition to implementing the marketing strategies mentioned above, golf business owners could carry out the following steps in the future. These tactics are mostly based on the cultural characteristics of each country. 36 First, the two most important Chinese business cultural factors are "Guanxi" and "Mianzi." Guanxi, which simply means "relationships" or "connections" and refers to a network of elaborate relationships promoting trust and co-operation, has historically been the main approach to doing business in China. This means that building mutual respect and trust is crucial in initiating business in China. Mianzi is a mark of personal pride and forms the basis of an individual's reputation and social status. Humiliating or inappropriate attitudes towards others, especially in public, can seriously damage business relationships. In contrast, giving compliments or showing respect could be the best way to earn loyalty during negotiations (Chinese cultural code, Jinsung Kang 2004). Moreover, Confucianism is considered to be the basic ethical belief system in China. Confucianism emphasizes the elements of responsibility and obligation. Chinese society, including the business world, is still strongly affected by Confucianism. In addition, punctuality is an important requirement for success. In business meetings, being on time is essential for the success of a business deal. Chinese society and business organizations are based on a hierarchical system. It is important to understand the Chinese hierarchical system and respect its customs. Last, humility and patience are critical to success during negotiations. Japanese business culture is quite different from its Chinese counterpart. One of the most fundamental concepts in Japanese is "Wa," which simply means harmony. Wa is often regarded as an essential business concept in Japan and is employed to avoid self-assertion, individualism and maintain good relationships. The Japanese language's indirect expression for "no" may have stemmed from "Wa" culture. Also, "Kao," which means "face," is a fundamental factor in Japanese social culture. Japanese people tend to highly value personal reputations and social 37 status. Avoiding direct criticism or confrontation is crucial in maintaining business relationships with Japanese people. In addition, efficiency is essential when it comes to making business decisions. This concept might be a little different from the Japanese business culture that was prominent in the past, which focused on unhurriedness. Punctuality is also important because lateness is regarded as disrespectful to other parties. Like China, Japan has a strongly hierarchical structure in business, which is usually reflected in the negotiation process. Specifically, business decisions are often made using a top-down approach, that is, from the executive to the middle-management level. Finally, showing respect to the eldest involved parties is crucial in Japanese business culture. In other words, age and social status are closely connected in Japanese culture. Understanding the varied business cultures of different countries is quite helpful in setting up viable and practical future strategies for the golf business. The first proposed plan, which is focused on advancement in the Chinese market, would be to target VIPs who are living in large cities such as BeijingI and Shanghai. The number of newly rich Chinese individuals has recently been growing quickly, and their purchasing power is significant. Providing high quality services with authentic golf courses could attract high-class Chinese golf tourists to Korean golf clubs. In addition, associating with Korean-style activities would be helpful to promote Korean golf clubs. Since Chinese people have great interest in experiencing Korean culture and foods, an effective strategy would be to establish contracts with other tourism companies in order to provide high quality services. Moreover, forming partnerships with neighboring golf clubs and hosting events such as golf festivals would be profitable not only for my golf club, but also for other Korean http://www.chinabooking.net.cn/kr/shownews.asp?id= 172 38 golf clubs. By doing so, many Korean golf clubs would be able to create new jobs for local communities in other to meet high demand. Figure 20 - Golf clubs in China Wo ;it4iaoning- Shanxi Shaanxi (i'an "handong- Hutmi Whn ,Ant- Hunan Jingxi GuanFxjia Source: Google map Future strategies targeting Japan would be a little different from those focused on China since Japan has a different economic situation and business culture. Most famous Japanese golf clubs 2 are located in the vicinity of Tokyo, particularly around Tokyo's international airport. Since ease of access is crucial in attracting golf customers, targeting Japanese people who live near metropolitan areas could be a viable way to promote Korean golf clubs. Furthermore, entering into strategic alliances with major Japanese tourism companies should be helpful. Specifically, 2http://www.pacificgolf.co.jp/kr/ 39 the number of Japanese tourists in Korea has been steadily increasing due to the Korean wave as well as the strengthening Japanese yen. A connection with the tourism industry would therefore be a good way to promoter Korean golf clubs. Lastly, sharing the company's value by donating a small portion of revenues to Japanese charitable organizations could help to promote a Korean golf club's brand image to Japanese golfers. Figure 21 - Golf clubs in Japan 947r Source: Google map In conclusion, in order to successfully attract customers from neighboring countries like China and Japan, strategies should be executed based on thorough research on those countries. Also, Korean golf clubs will face several challenges in the future. Government corruption is one of the biggest issues for foreign companies that want to enter Chinese market. In addition, competition with local golf clubs and inflation are potential challenges. Further, some members of Japan's older generations hold negative stereotypes about Korean companies. Convincing those older 40 generations to have a good impression of Korean companies will be critical to attracting more golf customers from Japan. 3.3 Benchmarking Caesars data-driven CRM system Three stages examined through an example: Harrah's (Caesars) Harrah's is a big company engaging in the hotel, restaurant, wedding, and other comprehensive entertainment businesses, including concerts. It earned one billion dollars in net profits in 2009 and has more than 100,000 regular employees. This company had been in third place in the industry until it acquired Caesars, the market leader, in June of 2005. Presently, the company is the unrivaled industry leader and dominates 60% of the market. This success is partially attributable to the use of scientific business analytics. 1) Data collection and analysis Almost 30 million people visit Harrah's casinos each year. In addition, the company is confident that it can track data for all the customers visiting its 28 casinos in 12 US states because all customers are automatically issued Total Rewards Cards. This type of point-based card, which is also frequently used in Korea, works by depositing points whenever customers make a payment. Harrah's card is classified into four levels - gold, platinum, diamond, and seven-star - depending on the number of visits and the amount used by customers. Because the information derived from this card is integrated throughout all of the company's entertainment businesses as well as its 41 casinos, customers can access the company's ancillary facilities by using points accumulated on the card. Although it appears to be a simple point card, there are three characteristics that make this card unique. First, the customer information required to sign up for Total Rewards Cards is collected "in all areas of its businesses at the same level," including Harrah's casinos, restaurants, and hotels located throughout the US. This is not only the most fundamental and important factor but also the area in which many companies make mistakes. Anyone that has ever worked to integrate company-wide information, such as through internal CRM or enterprise resource planning (ERP) systems, is well aware of how difficult it is to collect and analyze these data using a "common language." The biggest reason for this difficulty is that "the purpose of collecting data" is often not clearly defined. There are cases in which many companies think, "let's collect data for no good reason," without considering the types of information that would be acquired through those data. This just ends up wasting resources and energy. Upon implementing the Total Rewards Cards in 2004, Harrah's set up five questions for customers to answer prior to receiving the card: - Which game was played? - How much money was used for the game? - What was the total amount spent? - How much did the customer lose or win? - How frequently does the customer visit casinos? The company used these questions to distinguish among levels of customers and established strategic guidelines to apply to its entertainment businesses. Similarly, companies willing to 42 conduct business analytics must go through the stages of clarifying the purpose of data collection and data utilization method. 2) Informatization of data The second factor that makes Total Reward Cards special is that it influenced future strategy because it went beyond comprehensive customer management and provided information. Harrah's discovered that two of its initial hypotheses were wrong. First, Harrah's thought that the customers spending the most money were tourists, but discovered that the highest spenders were actually "persons who love and enjoy gambling itself." In that case, the company had to identify the type of people who enjoy gambling itself. The hypothesis that these were gambling addicts was also wrong. It was discovered that people who enjoy gambling were residents living close to casinos who have ordinary occupations such as carpenters or teachers. Based on these discoveries, Harrah's started to use totally different strategies from existing casinos. Other casinos, including Caesars, targeted tourists as their main customers, decorating their casinos with exotic interiors and carrying out marketing strategies connected with tourist agencies. In addition, in order to make gambling addicts spend more time in casinos, they placed many addictive gambling machines, such as slot machines, in their facilities. In contrast, Harrah's targeted "dutiful citizens living nearby who continuously visit and enjoy gambling as a hobby" as its main customers. In order to focus on this segment, Harrah's created a casino atmosphere compatible with family entertainment and started holding various events for them (See picture 1). Moreover, the company's marketing efforts frequently aimed to connect with local communities. Through various types of cooperation with nearby restaurants and companies, 43 the company naturally induced customers to visit its casinos. Many companies put a lot of effort into collecting data but fail to utilize this information in their follow-up strategies. Data are useful only when they are transformed into information or knowledge. It is important to remember that only the people that establish strategies can do this, not systems or programs. 3) Implementation, verification, and improvement Since it started its Total Reward Card service in January of 2004, Harrah's has continuously carried out customer management based on the Total Reward Cards. The only change it made during this time is to make use of the Total Reward Cards more convenient through cooperation with card companies. The fact that more than 80% of the company's revenues can be tracked through Total Reward Cards shows that Harrah's has high company-wide integration and rates of customer use. Harrah's did not stop there. Discovering that local residents visit more frequently than tourists, the company added an item on the "distance between the casino and customer's home" to its standard customer classification. The closer a customer's home is to one of its casinos, the higher the probability that this person will visit Harrah's again. Therefore, the company felt it was necessary to manage these customers separately. In addition, considering various factors such as frequently played games, amounts bet at one time, and hours spent in the casino, Harrah's created 60 levels for internal customer management as well as four levels for giving instructions to customers. In addition, it began providing elaborately customized incentives to increase customer satisfaction and sales. For instance, in the case of a customer who typically enjoys games for an average of one hour, the casino would offer that customer a coupon about 55 44 minutes after he or she arrived at the casino, thereby encouraging the customer to stay for a longer period. The result of such customized incentives is that since the implementation of the Total Reward Cards in 2004, Harrah's has never yielded the top position in the customer satisfaction rating in the US. It is no exaggeration to say that business analytics involve an endless process of data verification and implementation. Even though companies collect data and transform them into knowledge, this knowledge can never positively influence companies if it is not implemented and improved upon. If any hypothesis goes through verification and is proved wrong, companies must be ready to make corrections and collect and analyze data again. Gary Loveman, appointed the CEO of Harrah's in 2003, has been a great driving force behind the company's success. He joined the company to introduce CRM in 2003 and ended up taking the position of CEO. The only question he asks employees coming to him to make a report is "Do we think, or do we know?" In order to make business analytics take root in an organization, it is necessary for leaders to be friendly toward it. This does not mean disregarding their intuition but distinguishing between the situations requiring intuition and those requiring data. Leaders who are good with numbers and who question numbers will lead their companies to brighter futures. 4. CONCLUSION Golf has grown beyond being a simple sport to exercising an enormous amount of economic impact as a full-fledged industry. In this study, the golf industry is reviewed for its contribution to national economic growth, job creation, relevant industry development, and national leisure 45 activity enhancement. At this juncture, we need to enhance industrial competitiveness by promoting more systemized and efficient golf club operations. Further, I hope that the golf industry will become widely popular among the general public as in countries with an advanced golf playing culture, nurture many golf talents to further develop the industry, and establish golf as a national sport that is broadly enjoyed in the country. 4.1 Improving the operational competitiveness of golf clubs The characteristics of golf course services can be divided into pre- and post-service open phases. The pre-open period requires (1) large-scale investment projects and (2) the sale of golf course memberships, whereas the post-open period requires (1) attracting customers and (2) the sale of limited resources. In this sense, the golf club business requires accurate financial demand estimations and a thorough plan (including in relation to borrowing and membership sales) to procure the required significant investment. It is very risky to start this business just with a simple projection of membership sales. Careful pre-open plans need to be established to minimize the required investment amount in order to ensure price competitiveness at the membership sales stage. Otherwise, any golf club would be easily rejected by customers. After service open, given the nature of the golf club business, which is characterized by low sales and limited resource availability, strategies for economic downturns should be explored, including (1) diverse marketing activities to attract more customers and (2) management of costs to improve profits. 46 4.2 Attracting customers during recessions First, it is important to maintain customer trust. In a period of recession, customers want to have the same level of satisfaction as they did previously, at a set price, and wish to be reassured that they have made the right choice. Therefore, golf clubs should choose to either increase their price competitiveness to maintain the same level of customer satisfaction at a lower price than their rivals, or improve their service quality more than others to increase the amount of customer service satisfaction for the current price. Second, it is crucial to carefully identify customer needs and provide one-to-one customized service. To this end, golf businesses need to build a D/B of customer characteristics, debate separate price structures according to customer needs, and diversify served foods and drinks or pro-shop product configurations. Third, golf companies should incorporate diverse sales promotions. Some promotion approaches include: - Price discounts (non-peak season, early morning hours, etc.) - Premium sales (one free round for every 10 rounds, etc.) - Coupons - Refund schemes (for weather, service dissatisfaction, etc.) - Partnerships and other business-connected sales - Contests, game operations (golf contest draw, game, etc.) - Gifts (low-priced but useful pens, caps, etc.) 47 With such promotional measures as those mentioned above, clubs can safeguard their competitive edges over others to stimulate customer intentions to buy again. 4.3 Cost management during recessions First, golf course operation cost structures must be thoroughly investigated and any transactions, activities, and processes for which it is possible to reduce costs must be re-designed. The cost structures of golf courses are relatively simple. Thus, golf course managers can identify raw material losses in each process and work to visualize and quantify them. In this manner, raw material costs can be reduced. Other cost-saving methods should also be identified, including changes in process-specific purchasing methods and strategies, strategic product specifications, and partner company management methods. Second, management must be rationalized via operational system innovation. For example, work outsourcing has been frequently utilized in Japan to innovate its operational systems and escape from the 10-year recession. According to a 2004 investigation by Japan's research institute on golf course administration, 31% of restaurants, 28% of course management, 30% of nighttime security, 25% of cleaning, and 25% of linen-related services were outsourced, indicating that outsourcing is a widespread practice. In South Korea, if golf clubs experience reductions in visitors and sales due to lower membership fees in the future, they may have to cut costs through the cost management methods discussed above, among others, to an extent that will offset sales decreases. 48 References 1. Steve LaValle, Eric Lesser, Rebecca Shockley, Michael S. Hopkins and Nina Kruschwitz (2011) "Big Data, Analytics and the Path From Insights to Value", MIT Sloan Management Review. Retrieved from http://sloanreview.mit.edu/article/big-data-analytics-and-the-pathfrom-insights-to-value/ 2. Total golf club visitors (2012), Korean Golf Course Business Association. Retrieved from http://www.kgba.co.kr 3. The Prospects for the economy (2013), Ministry ofStrategy and Finance.Retrieved from http://www.mosf.go.kr/ upload/bbs/62/attach/20121227182309720.pdf 4. Prof. Keun S. Lee (1998) "Financial Crisis in Korea and IMF: Analysis and Perspectives", The Merrill Lynch Centerfor the Study of InternationalFinancialServices and Markets. Retrieved from http://www.hofstra.edu/pdf/biz MLC Lee l.pdf 5. Trading Economics. "South Korea Annual Growth Rate: Percent Change in GDP". Retrieved from http://tradingeconomics.com/ 6. Country Report South Korea (2014), Economic Research Department.Retrieved from https://economics.rabobank.com/publications/2014/february/country-report-south-korea/ 7. Chun,Byung-Wook, Oh,Yoon (2010) "Taxation Policy for Golf Industry in South Korea", Hanyang University. Retrieved from http://www.taxforum.or.kr/main4/paperI0-3/10.pdf 8. Exchange Rate in South Korea (2011) Retrieved from http://www.bloomberg.com/ 9. Sales Revenues for all golf clubs (2012), GMI Consulting Group. Retrieved from http://www.gmigolf.co.kr/gmi-13-04-17-2012 3 -010. u - c01 k..-. / 10. Trends in Chinese golf club visitors (2011) Retrieved from http://sports.sohu.com/20120318/n338084525.shtml 11. Analysis of Japanese Golf Industry (2009), Samsung Economic Research Institute. Retrieved from http://www.seriworld.org/ 49 12. The total number of golf club visitors in Japan (2008), Japan Golf Course Industry Association. Retrieved from http://www.jgia.org/ 13. Number of bankrupt golf clubs and total liabilities in Japan (2008). Retrieved from http://www.gc4989.com/bbs/board.php?bo table=golf news&wr id=180 14. Escrow agent system. Retrieved from http://www.spendsavelive.com/2009/6/24/costs-ofselling-your-house-escrow 15. Prestigious golf club in South Korea, Haeundae Country Club. Retrieved from http://www.haeundaecc.co.kr 16. Jinsung Kang (2004) "Chinese cultural code" 17. Current status of golf country club in China. Retrieved from http://www.chinabooking.net.cn/kr/shownews.asp?id= 172 18. Golf Course in Japan, Pacific GolfManagementRetrieved from http://www.pacificgolf.co.ip/kr/ 19. Golf's 2020 Vision: The HSBC Report (2012), The Futures Companyfor HSBC. Retrieved from http://thefuturescompany.com/wp-content/uploads/2012/09/The Future of Golf.pdf 20. Measures to overcome a crisis for Membership golf clubs in South Korea (2014). Retrieved from http://www.etoday.co.kr/news/section/newsview.php?idxno=886968 21. Nathan Schwartzman (2008) "Should South Korea Build More Golf Courses?" Retrieved from http://asiancorrespondent.com/2241 0/should-south-korea-build-more-golf-courses/ 22. Korean Golfers: The magic formula (2012) "Game theory", The Economist. Retrieved from http://www.economist.com/blogs/gametheory/2012/01 /korean-golfers 23. The number of golf clubs and golf population in China (2010). Retrieved from httD://weeklv.chosun.com/client/news/viw.asn?nNewsNumb=002130100027&ctcd=C06 50