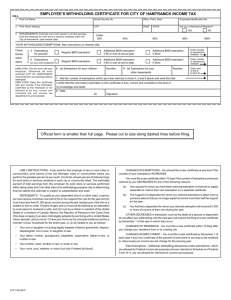

SAMPLE W-4

advertisement

University of Delaware HR & Payroll Systems SAMPLE W-4 EMPLOYEE'S WITHHOLDING EXEMPTION CERTIFICATE FOR FEDERAL, DELAWARE, MARYLAND, AND LOCAL INCOME TAXES If Answer is NO must provide VISA No & Country U.S. CITIZEN: X Yes No VISA NO. ____________COUNTRY FED STATE STATE (All) OF DE OF MD (All) IF SINGLE, and you claim an exemption, write the Fugure "1" If you claim no exemptions, write "0" 2 - 2 2 - 3 3 3 3 NAME-LAST FIRST MIDDLE Doe, Jane A ………………………………………. ………………………………………………………………….. STREET IF MARRIED, one exemption each for husband and wife if not claimed on another certificate 123 Any Street (a) If you claim both of these exemptions, write the figure "2" CITY STATE ZIP CODE (b) If you claim one of these exemptions, write the figure "1" Anytown DE 12345 c 3 1 1 1 Please Print (All) Non-resident aliens may claim only single with one exemption 1 SOCIAL SECURITY NUMBER If you claim neither of these exemptions, write "0" 2 ……………………………………………….. 2 Exemptions for age and blindness. (applicable only to you and your spouse but not dependents) FOR REHIRES: NAME WHEN PREVIOUSLY EMPLOYED (a) If you or your spouse will be 65 years of age or older at the end of the year, and you claim this exemption, write the figure "1": if both will be 65 or older, and you claim both exemptions, write the figure "2" Birth date (b) If you or your spouse are blind, and you claim the exemption, write the figure "1", if both are blind, and you claim both of these exemptions, write the figure "2" 4 ……………….. 1 Original Hire Date EMPLOYMENT FACULTY AFSCME CLASSIFICATION: STUDENT MISC WAGE STAFF PART TIME (check all applicable) X …. Allowance(s) for itemized deductions. (This allowance is used solely for the purpose of figuring your withholding tax, and cannot be claimed when you file your tax return) 6 1 If you claim exemptions for one or more dependents, write the number of such exemptions (Do not claim exemptions for a dependent unless you are qualified under existing regulations) 5 5/7/1964 ……………………………………………….. STATUS: Presently Employed X New Rehire ……………….. Add the number of exemptions which you have claimed above and write the total FOR CITY OF WILMINGTON TAX DEDUCTIONS 3 3 Yes X No Yes X No DO YOU LIVE IN THE CITY LIMITS OF WILM.? I certify under penalty of perjury that the number of withholding exemptions claimed on this certificate does not exceed the number which I am entitled. IS YOUR UNIVERSITY EMPLOYMENT IN THE CITY LIMITS OF WILMINGTON? Newark HR & Payroll Systems Signature Date EMPLOYMENT LOCATION X X X X X X X 10/29/2002 DEPARTMENT When completing a W-4 form, all of the areas in RED must be completed. Exemptions - please make sure the employee is consistant with the exemptions. If claiming Single, do not place exemptions in the married boxes. Do not place zeros (0) in the unused ememption boxes. Please have the employee verify the total number of exemptions equal the total number entered. Only place exemptions in the STATE of MD, if you are a Maryland resident. A new W-4 needs to be completed for an existing employee when the employee needs to change exemptions or has a name change. If an employee has a change of address a new W-4 DOES NOT need to be completed, unless they are changing tax jurisdiction (I.e. changing states, or within Wilmington City limits)