EFP ROTENBERG LLP 280 KENNETH DRIVE ROCHESTER, NY 14623 COMPEER INC.

926340

04-24-09

EFP ROTENBERG LLP

280 KENNETH DRIVE

ROCHESTER, NY 14623

COMPEER INC.

259 MONROE AVENUE

ROCHESTER, NY 14607

!146072!

Caution: Forms printed from within Adobe Acrobat products may not meet IRS or state taxing agency specifications. When using Acrobat 5.x products, uncheck the "Shrink oversized pages to paper size" and uncheck the "Expand small pages to paper size" options, in the Adobe "Print" dialog. When using Acrobat

6.x and later products versions, select "None" in the "Page Scaling" selection box in the Adobe "Print" dialog.

CLIENT'S COPY

CLIENT: 337100

SEPTEMBER 10, 2010

COMPEER INC.

259 MONROE AVENUE

ROCHESTER, NY 14607

S T A T E M E N T

PREPARATION OF 2009 EXEMPT ORGANIZATION TAX RETURN(S) .....

SEPTEMBER 10, 2010

COMPEER INC.

259 MONROE AVENUE

ROCHESTER, NY 14607

ENCLOSED ARE THE 2009 EXEMPT ORGANIZATION RETURNS, AS

FOLLOWS...

2009 FORM 990-EZ

2009 NEW YORK ANNUAL FILING FOR CHARITABLE ORGANIZATIONS

EACH ORIGINAL SHOULD BE DATED, SIGNED AND FILED IN ACCORDANCE

WITH THE FILING INSTRUCTIONS. THE COPY SHOULD BE RETAINED

FOR YOUR FILES.

PLEASE REVIEW THE RETURN FOR COMPLETENESS AND ACCURACY.

WE SINCERELY APPRECIATE THE OPPORTUNITY TO SERVE YOU. PLEASE

CONTACT US IF YOU HAVE ANY QUESTIONS CONCERNING THE TAX

RETURN.

VERY TRULY YOURS,

EFP ROTENBERG LLP

TAX RETURN FILING INSTRUCTIONS

FORM 990-EZ

FOR THE YEAR ENDING

Prepared for

COMPEER INC.

259 MONROE AVENUE

ROCHESTER, NY 14607

Prepared by

Amount due or refund

Make check payable to

Mail tax return and check (if applicable) to

EFP ROTENBERG LLP

280 KENNETH DRIVE

ROCHESTER, NY 14623

NOT APPLICABLE

NOT APPLICABLE

NOT APPLICABLE

Return must be mailed on or before

Special

Instructions

NOT APPLICABLE

THIS RETURN HAS BEEN PREPARED FOR ELECTRONIC FILING. IF YOU

WISH TO HAVE IT TRANSMITTED ELECTRONICALLY TO THE IRS, PLEASE

SIGN, DATE, AND RETURN FORM 8879-EO TO OUR OFFICE. WE WILL

THEN SUBMIT THE ELECTRONIC RETURN TO THE IRS. DO NOT MAIL A

PAPER COPY OF THE RETURN TO THE IRS.

900941

05-20-09

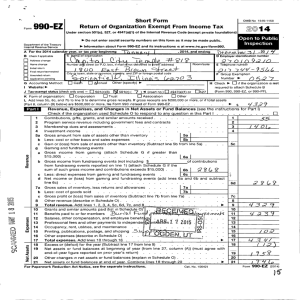

Form

990-EZ

Department of the Treasury

Internal Revenue Service

Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except black lung benefit trust or private foundation)

|

Sponsoring organizations of donor advised funds and controlling organizations as defined in section 512(b)(13) must file Form 990. All other organizations with gross receipts less than $500,000 and total assets less than $1,250,000 at the end of the year may use this form.

| The organization may have to use a copy of this return to satisfy state reporting requirements.

OMB No. 1545-1150

2009

Open to Public

Inspection

A

B

For the 2009 calendar year, or tax year beginning

Check if applicable: Please

Address change

Name change use IRS label or return

Termin-

Amended

Application pending print or type.

See

Specific

Instructions.

C Name of organization

COMPEER INC.

Number and street (or P.O. box, if mail is not delivered to street address)

259 MONROE AVENUE

City or town, state or country, and ZIP + 4

ROCHESTER, NY 14607 and ending

¥ Section 501(c)(3) organizations and 4947(a)(1) nonexempt charitable trusts must attach a completed

Room/suite

G

D Employer identification number

E

F

11-3798675

Telephone number

585-546-8280

Group Exemption

Accounting method:

I

J

K

Number |

Cash

X

Accrual

Check |

Schedule A (Form 990 or 990-EZ).

Other (specify) |

Website: |

WWW.COMPEER.ORG

Tax-exempt status (check only one)

X § (insert no.) 4947(a)(1) or if the organization is not a section 509(a)(3) supporting organization and its gross receipts are normally not more than $25,000. A Form 990-EZ or

Form 990 return is not required, but if the organization chooses to file a return, be sure to file a complete return.

H Check | if the organization is not

527 required to attach Schedule B

(Form 990, 990-EZ, or 990-PF).

296,363.

L Add lines 5b, 6b, and 7b, to line 9 to determine gross receipts; if $500,000 or more, file Form 990 instead of Form 990-EZ ••• |

Part I

1

Revenue, Expenses, and Changes in Net Assets or Fund Balances

Contributions, gifts, grants, and similar amounts received ~~~~~~~~~~~~~~~~~~~~~~~~~~~ 1

$

(See the instructions for Part I.)

2

3

Program service revenue including government fees and contracts

Membership dues and assessments

~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

2

3

7,500.

247,319.

31,675.

4

5 a

6 b c a b c

7 a

8 b c

Investment income ••••••••••••••••••••••••••••••••••••••••••••

Gross amount from sale of assets other than inventory ~~~~~~~~~~~~~

Less: cost or other basis and sales expenses ~~~~~~~~~~~~~~~~~

5a

5b

Gain or (loss) from sale of assets other than inventory (Subtract line 5b from line 5a) ~~~~~~~~~~~~~~~

Special events and activities (complete applicable parts of Schedule G). If any amount is from gaming , check here |

Gross revenue (not including $ of contributions reported on line 1) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Less: direct expenses other than fundraising expenses ~~~~~~~~~~~~~

Net income or (loss) from special events and activities (Subtract line 6b from line 6a)

Gross sales of inventory, less returns and allowances ~~~~~~~~~~~~~

Less: cost of goods sold ~~~~~~~~~~~~~~~~~~~~~~~~~~

Gross profit or (loss) from sales of inventory (Subtract line 7b from line 7a)

Other revenue (describe |

6a

6b

~~~~~~~~~~~~~~~

7a

7b

~~~~~~~~~~~~~~~~~~~

SEE STATEMENT 4

10

11

9 Total revenue.

Add lines 1, 2, 3, 4, 5c, 6c, 7c, and 8 ••••••••••••••••••••••••••• |

Grants and similar amounts paid (attach schedule) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Benefits paid to or for members ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

12 Salaries, other compensation, and employee benefits ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

13

14

Professional fees and other payments to independent contractors

Occupancy, rent, utilities, and maintenance

~~~~~~~~~~~~~~~~~~~~~~~~

SEE STATEMENT 5

15

16

Printing, publications, postage, and shipping

Other expenses (describe |

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

SEE STATEMENT 1

17 Total expenses.

Add lines 10 through 16 •••••••••••••••••••••••••••••••• |

18

19

Excess or (deficit) for the year (Subtract line 17 from line 9) ~~~~~~~~~~~~~~~~~~~~~~~~~~

Net assets or fund balances at beginning of year (from line 27, column (A))

(must agree with end-of-year figure reported on prior year's return) ~~~~~~~~~~~~~~~~~~~~~~~

4

5c

6c

11

12

13

14

7c

8

9

10

15

16

17

18

9,869.

296,363.

86,102.

24,151.

12,844.

2,461.

135,965.

261,523.

34,840.

19

-124,142.

Part II

22

20

21

Other changes in net assets or fund balances (attach explanation) ~~~~~~~~~~~~~~~~~~~~~~~~

Net assets or fund balances at end of year. Combine lines 18 through 20 •••••••••••••••••• |

Balance Sheets.

If Total assets on line 25, column (B) are $1,250,000 or more, file Form 990 instead of Form 990-EZ.

(See the instructions for Part II.)

Cash, savings, and investments ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

(A) Beginning of year

1,037.

20

21

22

-89,302.

(B) End of year

63,451.

23

24

25

26

Land and buildings ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Other assets (describe |

Total assets

Total liabilities (describe |

SEE STATEMENT 2

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

SEE STATEMENT 3

27 Net assets or fund balances (line 27 of column (B) must agree with line 21) •••••••••

26,432.

27,469.

151,611.

-124,142.

23

24

25

26

27

21,801.

85,252.

174,554.

-89,302.

LHA For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions.

1

Form

990-EZ

(2009)

12080910 101824 337100 2009.04020 COMPEER INC. 337100_1

Form 990-EZ (2009)

COMPEER INC.

Part III Statement of Program Service Accomplishments

What is the organization's primary exempt purpose?

(See the instructions for Part III.)

MENTAL HEALTH REHABILITATION

Describe what was achieved in carrying out the organization's exempt purposes. In a clear and concise manner, describe the services provided, the number of persons benefited, and other relevant information for each program title.

28

SEE STATEMENT 7

11-3798675 Page 2

Expenses

(Required for section 501(c)(3) and 501(c)(4) organizations and section 4947(a)(1) trusts; optional for others.)

29

(Grants $ ) If this amount includes foreign grants, check here ••••••••••• | 28a

208,267.

30

(Grants $ ) If this amount includes foreign grants, check here ••••••••••• | 29a

31

(Grants $ ) If this amount includes foreign grants, check here ••••••••••• |

Other program services (attach schedule) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

30a

(Grants $ ) If this amount includes foreign grants, check here ••••••••••• |

|

31a

32 Total program service expenses (add lines 28a through 31a) ••••••••••••••••••••••••••

Part IV List of Officers, Directors, Trustees, and Key Employees.

32

208,267.

List each one even if not compensated. (See the instructions for Part IV.)

(d) Contributions

(a) Name and address

(b) Title and average hours per week devoted to position

(c) Compensation

(If not paid, enter

-0-.) to employee benefit plans & deferred compensation

(e) Expense account and other allowances

PHILIP A. FAIN, 2000 TECHNOLOGY

PARKWAY, NEWARK, NY 14513

PAM GIAMBRONE, 297 WILLOWEN DRIVE,

ROCHESTER, NY 14609-3234

J. THEODORE SMITH

255 EAST AVENUE, ROCHESTER, NY 14604

PATRICK J. SOLOMON, ESQ.

693 EAST AVENUE, ROCHESTER, NY 14607

MARTIN L. STERN, 1735 NEW YORK

AVENUE NW, WASHINGTON, DC 20006-5209

BOARD CHAIRMAN

0.50

BOARD MEMBER

0.50

0.

0.

COMPEER ROCHESTER BOARD LIASO

0.50

0.

0.

COMPEER ROCHESTER BOARD LIASO

0.50

BOARD MEMBER

0.50

0.

0.

0.

0.

0.

0.

0.

0.

0.

0.

0.

Form

990-EZ

(2009)

2

12080910 101824 337100 2009.04020 COMPEER INC. 337100_1

Form 990-EZ (2009)

Part V

COMPEER INC.

Other Information

(Note the statement requirements in the instructions for Part V.)

11-3798675 Page 3

33

34

35

36 b

41

42a

43 a

37 a b

38 a b

39 a b

40a b c d e b c

Did the organization engage in any activity not previously reported to the IRS? If "Yes," attach a detailed description of each activity ~~~~~

Were any changes made to the organizing or governing documents? If "Yes," attach a conformed copy of the changes ~~~~~~~~~~

If the organization had income from business activities, such as those reported on lines 2, 6a, and 7a (among others), but not reported on Form 990-T, attach a statement explaining why the organization did not report the income on Form 990-T.

Did the organization have unrelated business gross income of $1,000 or more or was it subject to section 6033(e) notice, reporting, and proxy tax requirements? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

If "Yes," has it filed a tax return on Form 990-T for this year? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Did the organization undergo a liquidation, dissolution, termination, or significant disposition of net assets during the year? If "Yes," complete applicable parts of Sch. N ••••••••••••••••••••••••••••••••••••••••••••••

Enter amount of political expenditures, direct or indirect, as described in the instructions. ~~~~~ | 37a

0.

Did the organization file Form 1120-POL for this year? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Did the organization borrow from, or make any loans to, any officer, director, trustee, or key employee or were any such loans made in a prior year and still outstanding at the end of the period covered by this return? ••••••••••••••••••••••••••

If "Yes," complete Schedule L, Part II and enter the total amount involved ~~~~~~~~~~~~~~ 38b

N/A

Section 501(c)(7) organizations. Enter:

Initiation fees and capital contributions included on line 9 ~~~~~~~~~~~~~~~~~~~~~

Gross receipts, included on line 9, for public use of club facilities ~~~~~~~~~~~~~~~~~~

39a

39b

N/A

N/A

Section 501(c)(3) organizations. Enter amount of tax imposed on the organization during the year under: section 4911 |

0.

; section 4912 |

0.

; section 4955 |

Section 501(c)(3) and 501(c)(4) organizations. Did the organization engage in any section 4958 excess benefit transaction during the

0.

33

34

35a

35b

36

37b

38a

N/A

X

X

X

X

X

X year or is it aware that it engaged in an excess benefit transaction with a disqualified person in a prior year, and that the transaction has not been reported on any of the organization's prior Forms 990 or 990-EZ? If "Yes," complete Schedule L, Part I ~~~~~~~~~~~

Section 501(c)(3) and 501(c)(4) organizations. Enter amount of tax imposed on organization managers or disqualified persons during the year under sections 4912, 4955, and 4958 ~~~~~~~~~~~~~~~ |

0.

Section 501(c)(3) and 501(c)(4) organizations. Enter amount of tax on line 40c reimbursed by the organization ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ |

All organizations. At any time during the tax year, was the organization a party to a prohibited tax shelter

0.

40b transaction? If "Yes," complete Form 8886-T ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

List the states with which a copy of this return is filed. |

The organization's books are in care of

Located at |

|

NY

DANA FRAME

259 MONROE AVENUE, ROCHESTER, NY

Telephone no. |

40e

585-546-8280

ZIP + 4 |

14607

At any time during the calendar year, did the organization have an interest in or a signature or other authority

X

X over a financial account in a foreign country (such as a bank account, securities account, or other financial account)? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

If "Yes," enter the name of the foreign country: |

42b

See the instructions for exceptions and filing requirements for Form TD F 90-22.1, Report of Foreign Bank and Financial Accounts.

At any time during the calendar year, did the organization maintain an office outside of the U.S.? ~~~~~~~~~~~~~~~~~~~~ 42c

X

If "Yes," enter the name of the foreign country: |

Section 4947(a)(1) nonexempt charitable trusts filing Form 990-EZ in lieu of Form 1041 - Check here •••••••••••••••••••••• | and enter the amount of tax-exempt interest received or accrued during the tax year ~~~~~~~~~~~~~~~~~ | 43

N/A

44

45

Did the organization maintain any donor advised funds? If "Yes," Form 990 must be completed instead of

Form 990-EZ ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Is any related organization a controlled entity of the organization within the meaning of section 512(b)(13)? If "Yes," Form 990 must be completed instead of Form 990-EZ ••••••••••••••••••••••••••••••••••••••••••••••

44

Yes No

X

45

X

Form 990-EZ (2009)

3

12080910 101824 337100 2009.04020 COMPEER INC. 337100_1

Form 990-EZ (2009) COMPEER INC.

11-3798675 Page 4

Part VI Section 501(c)(3) organizations and section 4947(a)(1) nonexempt charitable trusts only.

All section 501(c)(3) organizations and section 4947(a)(1) nonexempt charitable trusts must answer questions 46-49b and complete the tables for lines 50 and 51.

46

47

48

49 a b

50

Did the organization engage in direct or indirect political campaign activities on behalf of or in opposition to candidates for public office? If "Yes," complete Schedule C, Part I ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Did the organization engage in lobbying activities? If "Yes," complete Schedule C, Part II ~~~~~~~~~~~~~~~~~~~~~

Is the organization a school as described in section 170(b)(1)(A)(ii)? If "Yes," complete Schedule E

Did the organization make any transfers to an exempt non-charitable related organization?

~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~

46

47

48

49a

If "Yes," was the related organization a section 527 organization?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 49b

Complete this table for the organization's five highest compensated employees (other than officers, directors, trustees and key employees) who each received more than $100,000 of compensation from the organization. If there is none, enter "None."

X

X

X

X

(a) Name and address of each employee paid more than $100,000

NONE

(b) Title and average hours per week devoted to position

(c) Compensation

(d) Contributions to employee benefit plans & deferred compensation

(e) Expense account and other allowances

51 f Total number of other employees paid over $100,000 ~~~~~~~~~~~~~~~~ |

Complete this table for the organization's five highest compensated independent contractors who each received more than $100,000 of compensation from the organization. If there is none, enter "None."

NONE

(a) Name and address of each independent contractor paid more than $100,000 (b) Type of service (c) Compensation d Total number of other independent contractors each receiving over $100,000 ~~~~~~~~~~~~~~ |

Sign

Here

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than officer) is based on all information of which preparer has any knowledge.

=

Signature of officer Date

= DANA FRAME, PRESIDENT

Type or print name and title

Paid

Preparer's

Use Only

Preparer's signature|

Firm's name (or yours

BRUCE A. NEWMAN, CPA

EFP ROTENBERG LLP if self-employed), address, and ZIP + 4

=

280 KENNETH DRIVE

ROCHESTER, NY 14623

Date Check if selfemployed |

Preparer's identifying number (See instr.)

EIN |

Phone no.

|

(585) 427-8900

May the IRS discuss this return with the preparer shown above? See instructions ••••••••••••••••••••••••••• |

X

Form

Yes

990-EZ

No

(2009)

4

12080910 101824 337100 2009.04020 COMPEER INC. 337100_1

SCHEDULE A

(Form 990 or 990-EZ)

Public Charity Status and Public Support

OMB No. 1545-0047

2009

Department of the Treasury

Internal Revenue Service

Complete if the organization is a section 501(c)(3) organization or a section

4947(a)(1) nonexempt charitable trust.

| Attach to Form 990 or Form 990-EZ. | See separate instructions.

Open to Public

Inspection

Name of the organization

COMPEER INC.

Part I Reason for Public Charity Status

(All organizations must complete this part.) See instructions.

Employer identification number

11-3798675

The organization is not a private foundation because it is: (For lines 1 through 11, check only one box.)

3

4

1

2

A church, convention of churches, or association of churches described in section 170(b)(1)(A)(i).

A school described in section 170(b)(1)(A)(ii).

(Attach Schedule E.)

A hospital or a cooperative hospital service organization described in section 170(b)(1)(A)(iii).

A medical research organization operated in conjunction with a hospital described in section 170(b)(1)(A)(iii).

Enter the hospital's name, city, and state:

5 An organization operated for the benefit of a college or university owned or operated by a governmental unit described in

6

7

X section 170(b)(1)(A)(iv). (Complete Part II.)

A federal, state, or local government or governmental unit described in section 170(b)(1)(A)(v).

An organization that normally receives a substantial part of its support from a governmental unit or from the general public described in

8

9 section 170(b)(1)(A)(vi).

(Complete Part II.)

A community trust described in section 170(b)(1)(A)(vi).

(Complete Part II.)

An organization that normally receives: (1) more than 33 1/3% of its support from contributions, membership fees, and gross receipts from activities related to its exempt functions - subject to certain exceptions, and (2) no more than 33 1/3% of its support from gross investment

10

11 f e g h income and unrelated business taxable income (less section 511 tax) from businesses acquired by the organization after June 30, 1975.

See section 509(a)(2).

(Complete Part III.)

An organization organized and operated exclusively to test for public safety. See section 509(a)(4).

An organization organized and operated exclusively for the benefit of, to perform the functions of, or to carry out the purposes of one or more publicly supported organizations described in section 509(a)(1) or section 509(a)(2). See section 509(a)(3).

describes the type of supporting organization and complete lines 11e through 11h.

Check the box that a Type I b Type II c Type III - Functionally integrated d Type III - Other

By checking this box, I certify that the organization is not controlled directly or indirectly by one or more disqualified persons other than foundation managers and other than one or more publicly supported organizations described in section 509(a)(1) or section 509(a)(2).

If the organization received a written determination from the IRS that it is a Type I, Type II, or Type III supporting organization, check this box

Since August 17, 2006, has the organization accepted any gift or contribution from any of the following persons?

(i)

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

A person who directly or indirectly controls, either alone or together with persons described in (ii) and (iii) below, Yes No

(ii)

(iii) the governing body of the supported organization?

A family member of a person described in (i) above?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

A 35% controlled entity of a person described in (i) or (ii) above?

Provide the following information about the supported organization(s).

~~~~~~~~~~~~~~~~~~~~~~~~

11g(i)

11g(ii)

11g(iii)

(i) Name of supported organization

(ii) EIN

(iii) Type of organization

(described on lines 1-9 above or IRC section

(see instructions) )

(iv) Is the organization in col. (i) listed in your governing document?

(v) Did you notify the organization in col.

(i) of your support?

Yes No Yes No

(i)

(vi) Is the organization in col.

organized in the

U.S.?

Yes No

(vii) Amount of support

Total

LHA For Privacy Act and Paperwork Reduction Act Notice, see the Instructions for

Form 990 or 990-EZ.

Schedule A (Form 990 or 990-EZ) 2009

932021 02-08-10

5

12080910 101824 337100 2009.04020 COMPEER INC. 337100_1

Schedule A (Form 990 or 990-EZ) 2009

COMPEER INC.

11-3798675

Part II Support Schedule for Organizations Described in Sections 170(b)(1)(A)(iv) and 170(b)(1)(A)(vi)

(Complete only if you checked the box on line 5, 7, or 8 of Part I.)

Section A. Public Support

Calendar year (or fiscal year beginning in)|

1 Gifts, grants, contributions, and membership fees received. (Do not include any "unusual grants.") ~~

(a) 2005 (b) 2006 (c) 2007 (d) 2008 (e) 2009

Page 2

(f) Total

313,024. 297,553. 286,494. 897,071.

2 Tax revenues levied for the organization's benefit and either paid to or expended on its behalf ~~~~

3 The value of services or facilities furnished by a governmental unit to the organization without charge ~

4

5

Total.

Add lines 1 through 3 ~~~

The portion of total contributions by each person (other than a governmental unit or publicly supported organization) included on line 1 that exceeds 2% of the amount shown on line 11, column (f) ~~~~~~~~~~~~

313,024. 297,553. 286,494. 897,071.

6 Public support.

Subtract line 5 from line 4.

Section B. Total Support

Calendar year (or fiscal year beginning in)|

7

8

Amounts from line 4 ~~~~~~~

Gross income from interest, dividends, payments received on

9 securities loans, rents, royalties and income from similar sources ~

Net income from unrelated business activities, whether or not the business is regularly carried on ~

(a) 2005 (b) 2006 (c) 2007 (d) 2008 2009

897,071.

(f) Total

10 Other income. Do not include gain

11

12

13 First five years. If the Form 990 is for the organization's first, second, third, fourth, or fifth tax year as a section 501(c)(3) organization, check this box and stop here ••••••••••••••••••••••••••••••••••••••••••••• |

Section C. Computation of Public Support Percentage

14

15

Public support percentage for 2009 (line 6, column (f) divided by line 11, column (f))

Public support percentage from 2008 Schedule A, Part II, line 14

~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~

14

15

96.88

96.98

%

%

16 a or loss from the sale of capital assets (Explain in Part IV.) ~~~~

16,674.

2,331.

Total support. Add lines 7 through 10

Gross receipts from related activities, etc. (see instructions) ~~~~~~~~~~~~~~~~~~~~~~~ 12

9,869.

28,874.

925,945.

33 1/3% support test - 2009. If the organization did not check the box on line 13, and line 14 is 33 1/3% or more, check this box and stop here. The organization qualifies as a publicly supported organization ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ |

X b

17 a b

33 1/3% support test - 2008. If the organization did not check a box on line 13 or 16a, and line 15 is 33 1/3% or more, check this box and stop here. The organization qualifies as a publicly supported organization ~~~~~~~~~~~~~~~~~~~~~~~~~~~~ |

10% -facts-and-circumstances test - 2009. If the organization did not check a box on line 13, 16a, or 16b, and line 14 is 10% or more, and if the organization meets the "facts-and-circumstances" test, check this box and stop here. Explain in Part IV how the organization meets the "facts-and-circumstances" test. The organization qualifies as a publicly supported organization ~~~~~~~~~~~~~~~ |

10% -facts-and-circumstances test - 2008. If the organization did not check a box on line 13, 16a, 16b, or 17a, and line 15 is 10% or

18 more, and if the organization meets the "facts-and-circumstances" test, check this box and stop here. Explain in Part IV how the organization meets the "facts-and-circumstances" test. The organization qualifies as a publicly supported organization ~~~~~~~~ |

Private foundation. If the organization did not check a box on line 13, 16a, 16b, 17a, or 17b, check this box and see instructions ••• |

Schedule A (Form 990 or 990-EZ) 2009

932022

02-08-10

6

12080910 101824 337100 2009.04020 COMPEER INC. 337100_1

Schedule A (Form 990 or 990-EZ) 2009

Part III Support Schedule for Organizations Described in Section 509(a)(2)

Section A. Public Support

Page 3

(Complete only if you checked the box on line 9 of Part I.)

Calendar year (or fiscal year beginning in)|

1 Gifts, grants, contributions, and membership fees received. (Do not

(a) 2005 (b) 2006 (c) 2007 (d) 2008 (e) 2009 (f) Total include any "unusual grants.") ~~

2

3

4

Gross receipts from admissions, merchandise sold or services performed, or facilities furnished in any activity that is related to the organization's tax-exempt purpose

Gross receipts from activities that are not an unrelated trade or business under section 513 ~~~~~

Tax revenues levied for the organization's benefit and either paid to or expended on its behalf ~~~~

5 The value of services or facilities furnished by a governmental unit to the organization without charge ~

6

7 a

Total.

Add lines 1 through 5 ~~~

Amounts included on lines 1, 2, and

3 received from disqualified persons b Amounts included on lines 2 and 3 received from other than disqualified persons that exceed the greater of $5,000 or 1% of the amount on line 13 for the year ~~~~~~ c Add lines 7a and 7b ~~~~~~~

8 Public support

(Subtract line 7c from line 6.)

Section B. Total Support

Calendar year (or fiscal year beginning in)|

9

10a

Amounts from line 6 ~~~~~~~

Gross income from interest, dividends, payments received on securities loans, rents, royalties and income from similar sources ~

(a) 2005 (b) 2006 (c) 2007 (d) 2008 (e) 2009 (f) Total b Unrelated business taxable income

(less section 511 taxes) from businesses acquired after June 30, 1975

~~~~

11 c Add lines 10a and 10b ~~~~~~

Net income from unrelated business activities not included in line 10b, whether or not the business is regularly carried on ~~~~~~~

12

13

14 First five years. If the Form 990 is for the organization's first, second, third, fourth, or fifth tax year as a section 501(c)(3) organization, check this box and stop here •••••••••••••••••••••••••••••••••••••••••••••••••••• |

Section C. Computation of Public Support Percentage

15

Other income. Do not include gain or loss from the sale of capital assets (Explain in Part IV.) ~~~~

Total support

(Add lines 9, 10c, 11, and 12.)

Public support percentage for 2009 (line 8, column (f) divided by line 13, column (f)) ~~~~~~~~~~~~

16 Public support percentage from 2008 Schedule A, Part III, line 15 ••••••••••••••••••••

Section D. Computation of Investment Income Percentage

15

16

%

%

17

18

19 a

Investment income percentage for 2009 (line 10c, column (f) divided by line 13, column (f))

Investment income percentage from 2008 Schedule A, Part III, line 17

~~~~~~~~

~~~~~~~~~~~~~~~~~~

17

18

%

%

20 b

33 1/3% support tests - 2009. If the organization did not check the box on line 14, and line 15 is more than 33 1/3%, and line 17 is not more than 33 1/3%, check this box and stop here.

The organization qualifies as a publicly supported organization ~~~~~~~~~~ |

33 1/3% support tests - 2008. If the organization did not check a box on line 14 or line 19a, and line 16 is more than 33 1/3%, and line 18 is not more than 33 1/3%, check this box and stop here.

The organization qualifies as a publicly supported organization ~~~~ |

Private foundation. If the organization did not check a box on line 14, 19a, or 19b, check this box and see instructions •••••••• |

Schedule A (Form 990 or 990-EZ) 2009

932023 02-08-10

7

12080910 101824 337100 2009.04020 COMPEER INC. 337100_1

Schedule B

or 990-PF)

Department of the Treasury

Internal Revenue Service

Name of the organization

COMPEER INC.

Organization type (check one):

Filers of:

Form 990 or 990-EZ

Form 990-PF

Schedule of Contributors

| Attach to Form 990, 990-EZ, or 990-PF.

Section:

X

501(c)(

3

) (enter number) organization

4947(a)(1) nonexempt charitable trust not treated as a private foundation

527 political organization

501(c)(3) exempt private foundation

4947(a)(1) nonexempt charitable trust treated as a private foundation

501(c)(3) taxable private foundation

OMB No. 1545-0047

2009

Employer identification number

11-3798675

Check if your organization is covered by the General Rule or a Special Rule.

Note. Only a section 501(c)(7), (8), or (10) organization can check boxes for both the General Rule and a Special Rule. See instructions.

General Rule

For an organization filing Form 990, 990-EZ, or 990-PF that received, during the year, $5,000 or more (in money or property) from any one contributor. Complete Parts I and II.

Special Rules

X

For a section 501(c)(3) organization filing Form 990 or 990-EZ that met the 33 1/3% support test of the regulations under sections

509(a)(1) and 170(b)(1)(A)(vi), and received from any one contributor, during the year, a contribution of the greater of (1) $5,000 or (2) 2% of the amount on (i) Form 990, Part VIII, line 1h or (ii) Form 990-EZ, line 1. Complete Parts I and II.

For a section 501(c)(7), (8), or (10) organization filing Form 990 or 990-EZ that received from any one contributor, during the year, aggregate contributions of more than $1,000 for use exclusively for religious, charitable, scientific, literary, or educational purposes, or the prevention of cruelty to children or animals. Complete Parts I, II, and III.

For a section 501(c)(7), (8), or (10) organization filing Form 990 or 990-EZ that received from any one contributor, during the year, contributions for use exclusively

for religious, charitable, etc., purposes, but these contributions did not aggregate to more than $1,000.

If this box is checked, enter here the total contributions that were received during the year for an

exclusively

religious, charitable, etc., purpose. Do not complete any of the parts unless the General Rule applies to this organization because it received nonexclusively religious, charitable, etc., contributions of $5,000 or more during the year. ~~~~~~~~~~~~~~~~~ | $

Caution.

An organization that is not covered by the General Rule and/or the Special Rules does not file Schedule B (Form 990, 990-EZ, or 990-PF), but it must answer "No" on Part IV, line 2 of its Form 990, or check the box on line H of its Form 990-EZ, or on line 2 of its Form 990-PF, to certify that it does not meet the filing requirements of Schedule B (Form 990, 990-EZ, or 990-PF).

LHA For Privacy Act and Paperwork Reduction Act Notice, see the Instructions for Form 990, 990-EZ, or 990-PF.

Schedule B (Form 990, 990-EZ, or 990-PF) (2009)

923451 02-01-10

8

12080910 101824 337100 2009.04020 COMPEER INC. 337100_1

Schedule B (Form 990, 990-EZ, or 990-PF) (2009)

Name of organization

COMPEER INC.

Part I Contributors

(see instructions)

(a)

No.

(b)

Name, address, and ZIP + 4

1 ORTHO MCNEIL JANNSSEN PHARM INC

(a)

No.

(a)

No.

(a)

No.

1000 US ROUTE 202 SOUTH

RARITAN, NJ 18869

(b)

Name, address, and ZIP + 4

(b)

Name, address, and ZIP + 4

(b)

Name, address, and ZIP + 4

Page

1 of

11-3798675

1

Employer identification number of Part I

$

(c)

Aggregate contributions

7,500.

(d)

Type of contribution

Person

Payroll

Noncash

X

(Complete Part II if there is a noncash contribution.)

$

(c)

Aggregate contributions

(d)

Type of contribution

Person

Payroll

Noncash

(Complete Part II if there is a noncash contribution.)

$

(c)

Aggregate contributions

(d)

Type of contribution

Person

Payroll

Noncash

(Complete Part II if there is a noncash contribution.)

$

(c)

Aggregate contributions

(d)

Type of contribution

Person

Payroll

Noncash

(Complete Part II if there is a noncash contribution.)

(a)

No.

(b)

Name, address, and ZIP + 4

$

(c)

Aggregate contributions

(d)

Type of contribution

Person

Payroll

Noncash

(Complete Part II if there is a noncash contribution.)

(a)

No.

(b)

Name, address, and ZIP + 4

(c)

Aggregate contributions

(d)

Type of contribution

$

Person

Payroll

Noncash

(Complete Part II if there is a noncash contribution.)

923452 02-01-10

Schedule B (Form 990, 990-EZ, or 990-PF) (2009)

9

12080910 101824 337100 2009.04020 COMPEER INC. 337100_1

COMPEER INC. 11-3798675

}}}}}}}}}}}} }}}}}}}}}}

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

FORM 990-EZ OTHER EXPENSES STATEMENT 1

}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}

DESCRIPTION AMOUNT

}}}}}}}}}}} }}}}}}}}}}}}}}

OMH PASS THROUGH

PAYROLL TAXES

CONFERENCES

INSURANCE

PUBLIC RELATIONS

MEETINGS & TRAVEL

MISCELLANEOUS

SUPPLIES

CLIENT ENRICHMENT

DUES & SUBSCRIPTIONS

SERVICE CHARGE

INTEREST EXPENSE

OFFICE EXPENSE

GRANT EXPENSE

TOTAL TO FORM 990-EZ, LINE 16

99,000.

5,939.

7,773.

4,456.

1,894.

3,581.

1,529.

3,202.

1,022.

357.

12.

5,616.

737.

847.

}}}}}}}}}}}}}}

135,965.

~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

FORM 990-EZ OTHER ASSETS STATEMENT 2

}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}

DESCRIPTION BEG. OF YEAR END OF YEAR

}}}}}}}}}}} }}}}}}}}}}}}}} }}}}}}}}}}}}}}

ACCOUNTS RECEIVABLE

PREPAID EXPENSES

OTHER DEPRECIABLE ASSETS

TOTAL TO FORM 990-EZ, LINE 24

25,625.

0.

20,389.

408.

807.

1,004.

}}}}}}}}}}}}}} }}}}}}}}}}}}}}

26,432.

21,801.

~~~~~~~~~~~~~~ ~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

FORM 990-EZ OTHER LIABILITIES STATEMENT 3

}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}

DESCRIPTION BEG. OF YEAR END OF YEAR

}}}}}}}}}}} }}}}}}}}}}}}}} }}}}}}}}}}}}}}

ACCOUNTS PAYABLE

ACCRUED PAYROLL & PAYROLL TAXES

PAYABLE TO AFFILIATE

LOAN PAYABLE - AFFILIATE

DEFERRED REVENUE

TOTAL TO FORM 990-EZ, LINE 26

16,866.

3,658.

2,300.

96,912.

1,972.

6,660.

2,399.

89,617.

31,875.

}}}}}}}}}}}}}}

73,906.

}}}}}}}}}}}}}}

151,611.

174,554.

~~~~~~~~~~~~~~ ~~~~~~~~~~~~~~

10 STATEMENT(S) 1, 2, 3

12080910 101824 337100 2009.04020 COMPEER INC. 337100_1

COMPEER INC. 11-3798675

}}}}}}}}}}}} }}}}}}}}}}

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

FORM 990-EZ OTHER REVENUE STATEMENT 4

}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}

DESCRIPTION AMOUNT

}}}}}}}}}}} }}}}}}}}}}}}}}

DEBT FORGIVENESS

PRODUCT SALES

TOTAL TO FORM 990-EZ, LINE 8

9,288.

581.

}}}}}}}}}}}}}}

9,869.

~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

FORM 990-EZ OCCUPANCY, RENT, UTILITIES AND MAINTENANCE STATEMENT 5

}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}

DESCRIPTION AMOUNT

}}}}}}}}}}} }}}}}}}}}}}}}}

DEPRECIATION

OTHER EXPENSES

TOTAL TO FORM 990-EZ, LINE 14

602.

12,242.

}}}}}}}}}}}}}}

12,844.

~~~~~~~~~~~~~~

11 STATEMENT(S) 4, 5

12080910 101824 337100 2009.04020 COMPEER INC. 337100_1

COMPEER INC. 11-3798675

}}}}}}}}}}}} }}}}}}}}}}

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

FORM 990-EZ INFORMATION REGARDING TRANSFERS STATEMENT 6

ASSOCIATED WITH PERSONAL BENEFIT CONTRACTS

}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}

A) DID THE ORGANIZATION, DURING THE YEAR, RECEIVE ANY FUNDS,

DIRECTLY OR INDIRECTLY, TO PAY PREMIUMS ON A PERSONAL

B) DID THE ORGANIZATION, DURING THE YEAR, PAY PREMIUMS,

X

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

12 STATEMENT(S) 6

12080910 101824 337100 2009.04020 COMPEER INC. 337100_1

COMPEER INC. 11-3798675

}}}}}}}}}}}} }}}}}}}}}}

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

990-EZ PG 2 STATEMENT 7

}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}

PROGRAM SERVICES IN CONNECTION WITH SUPPORTING AND DISSEMINATING, ON A

NATIONAL AND INTERNATIONAL BASIS, THE COMPEER MODEL FOR PROVIDING VOLUNTEER

COMPANION SERVICES TO INDIVIDUALS BEING TREATED FOR MENTAL ILLNESSES OR

OTHER EMOTIONAL ISSUES.

13 STATEMENT(S) 7

12080910 101824 337100 2009.04020 COMPEER INC. 337100_1

Form

4562

Department of the Treasury

Internal Revenue Service (99)

Name(s) shown on return

9

Depreciation and Amortization

9

990EZ

(Including Information on Listed Property)

See separate instructions.

Attach to your tax return.

Business or activity to which this form relates

OMB No. 1545-0172

2009

Attachment

Sequence No.

Identifying number

67

COMPEER INC.

FORM 990-EZ PAGE 1 11-3798675

Part I

1

Election To Expense Certain Property Under Section 179 Note: If you have any listed property, complete Part V before you complete Part I.

Maximum amount. See the instructions for a higher limit for certain businesses ~~~~~~~~~~~~~~~~ 1

250,000.

2

3

4

5

6

Total cost of section 179 property placed in service (see instructions)

Threshold cost of section 179 property before reduction in limitation

Reduction in limitation. Subtract line 3 from line 2. If zero or less, enter -0-

Dollar limitation for tax year. Subtract line 4 from line 1. If zero or less, enter -0-. If married filing separately, see instructions

(a) Description of property

~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~

(b) Cost (business use only)

••••••••••

(c) Elected cost

2

3

4

5

800,000.

9

10

7

8

11

Listed property. Enter the amount from line 29 ~~~~~~~~~~~~~~~~~~~

Total elected cost of section 179 property. Add amounts in column (c), lines 6 and 7

7

~~~~~~~~~~~~~~

Tentative deduction. Enter the smaller of line 5 or line 8 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Carryover of disallowed deduction from line 13 of your 2008 Form 4562 ~~~~~~~~~~~~~~~~~~~~

Business income limitation. Enter the smaller of business income (not less than zero) or line 5 ~~~~~~~~~

12 Section 179 expense deduction. Add lines 9 and 10, but do not enter more than line 11

13 Carryover of disallowed deduction to 2010. Add lines 9 and 10, less line 12

Note: Do not use Part II or Part III below for listed property. Instead, use Part V.

Part II

••••

9 ••••••••••••

13

Special Depreciation Allowance and Other Depreciation (Do not include listed property.

)

10

11

8

9

12

14 Special depreciation allowance for qualified property (other than listed property) placed in service during the tax year ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

15 Property subject to section 168(f)(1) election ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

16 Other depreciation (including ACRS)

Part III

•••••••••••••••••••••••••••••••••••••

MACRS Depreciation (Do not )

Section A

17

18

14

15

16

MACRS deductions for assets placed in service in tax years beginning before 2009 ~~~~~~~~~~~~~~

•••

17

If you are electing to group any assets placed in service during the tax year into one or more general asset accounts, check here

J

Section B - Assets Placed in Service During 2009 Tax Year Using the General Depreciation System

(a) Classification of property

(b) Month and year placed in service

(c) Basis for depreciation

(business/investment use only - see instructions)

(d) Recovery period

(e) Convention (f) Method

560.

(g) Depreciation deduction

19a b c d f e g

3-year property

5-year property

7-year property

10-year property

15-year property

20-year property

25-year property

800. 5 YEARS

25 yrs.

HY 200DB

S/L h Residential rental property

/

/

27.5 yrs.

27.5 yrs.

MM

MM

S/L

S/L i

/ 39 yrs.

MM S/L

Nonresidential real property

/ MM S/L

Section C - Assets Placed in Service During 2009 Tax Year Using the Alternative Depreciation System

S/L 20a b

Class life

12-year c 40-year

Part IV

Summary (See instructions.)

21

22

/

12 yrs.

40 yrs.

MM

Listed property. Enter amount from line 28 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Total. Add amounts from line 12, lines 14 through 17, lines 19 and 20 in column (g), and line 21.

Enter here and on the appropriate lines of your return. Partnerships and S corporations - see instr. •••••••

S/L

S/L

21

22

23 For assets shown above and placed in service during the current year, enter the portion of the basis attributable to section 263A costs •••••••••••••••• 23

LHA

42.

602.

Form 4562 (2009)

12080910 101824 337100 2009.04020 COMPEER INC. 337100_1

Form 4562 (2009)

Part V

Listed Property

COMPEER INC.

11-3798675

Page recreation, or amusement.)

Note: For any vehicle for which you are using the standard mileage rate or deducting lease expense, complete through (c) of Section A, all of Section B, and Section C if applicable.

only 24a, 24b, columns (a)

2

(Include automobiles, certain other vehicles, cellular telephones, certain computers, and property used for entertainment,

24a

Section A - Depreciation and Other Information (Caution: See the instructions for limits for passenger automobiles.

)

Do you have evidence to support the business/investment use claimed?

Type of property

(list vehicles first )

(b)

Date placed in service

(c)

Business/ investment use percentage

(d)

Cost or other basis

Yes

(e)

No 24b

(f)

Basis for depreciation

(business/investment use only)

If "Yes," is the evidence written?

Recovery period

(g)

Method/

Convention

(h)

Depreciation deduction

Yes

(i)

Elected

No section 179 cost

25 Special depreciation allowance for qualified listed property placed in service during the tax year and used more than 50% in a qualified business use•••••••••••••••••••••••••••••

Property used more than 50% in a qualified business use:

25

26

%

%

%

27

28

29

Property used 50% or less in a qualified business use:

! !

%

%

%

S/L -

S/L -

S/L -

Add amounts in column (h), lines 25 through 27. Enter here and on line 21, page 1 ~~~~~~~~~~~~ 28

Add amounts in column (i), line 26. Enter here and on line 7, page 1 ••••••••••••••••••••••••••• 29

Section B - Information on Use of Vehicles

Complete this section for vehicles used by a sole proprietor, partner, or other "more than 5% owner," or related person.

If you provided vehicles to your employees, first answer the questions in Section C to see if you meet an exception to completing this section for those vehicles.

30

31

32

33

Total business/investment miles driven during the year ( do not include commuting miles) ~~~~~~

Total commuting miles driven during the year ~

Total other personal (noncommuting) miles driven~~~~~~~~~~~~~~~~~~~~~

Total miles driven during the year.

Add lines 30 through 32~~~~~~~~~~~~

(a)

Vehicle

(b)

Vehicle

(c)

Vehicle

(d)

Vehicle

(e)

Vehicle

(f)

Vehicle

34

35

Was the vehicle available for personal use during off-duty hours? ~~~~~~~~~~~~

Was the vehicle used primarily by a more than 5% owner or related person? ~~~~~~

Yes No Yes No Yes No Yes No Yes No Yes No

36 Is another vehicle available for personal use? •••••••••••••••••••••

Section C - Questions for Employers Who Provide Vehicles for Use by Their Employees

Answer these questions to determine if you meet an exception to completing Section B for vehicles used by employees who are not owners or related persons.

more than 5%

37

38

39

40

Do you maintain a written policy statement that prohibits all personal use of vehicles, including commuting, by your employees?~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Do you maintain a written policy statement that prohibits personal use of vehicles, except commuting, by your employees? See the instructions for vehicles used by corporate officers, directors, or 1% or more owners ~~~~~~~~~~~~

Do you treat all use of vehicles by employees as personal use? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Do you provide more than five vehicles to your employees, obtain information from your employees about the use of the vehicles, and retain the information received? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Yes No

41 Do you meet the requirements concerning qualified automobile demonstration use? ~~~~~~~~~~~~~~~~~~~~~~~

Note: If your answer to 37, 38, 39, 40, or 41 is "Yes," do not complete Section B for the covered vehicles.

Part VI

Amortization

(a)

Description of costs

(b)

Date amortization begins

(c) (d) (e)

Amortization period or percentage

(f)

42

43

Amortization of costs that begins during your 2009 tax year:

! !

Amortization of costs that began before your 2009 tax year ~~~~~~~~~~~~~~~~~~~~~~~~~~ 43

44 Total.

Add amounts in column (f). See the instructions for where to report ••••••••••••••••••• 44

916252 11-04-09

15

Form 4562 (2009)

12080910 101824 337100 2009.04020 COMPEER INC. 337100_1

Form

8879-EO

Department of the Treasury

Internal Revenue Service

Name of exempt organization

IRS e-file Signature Authorization for an Exempt Organization

For calendar year 2009, or fiscal year beginning , 2009, and ending

| Do not send to the IRS. Keep for your records.

| See instructions.

,20

OMB No. 1545-1878

2009

Employer identification number

COMPEER INC.

11-3798675

Name and title of officer

Part I

DANA FRAME

PRESIDENT

Type of Return and Return Information

(Whole Dollars Only)

Check the box for the return for which you are using this Form 8879-EO and enter the applicable amount, if any, from the return. If you check the box on line or

1a, 2a, 3a, 4a, 5a, below, and the amount on that line for the return for which you are filing this form was blank, then leave line complete more than 1 line in Part I.

1b, 2b, 3b, whichever is applicable, blank (do not enter -0-). But, if you entered -0- on the return, then enter -0- on the applicable line below. Do not

1a

2a

3a

4a

5a

Form 990 check here

Form 990-EZ check here

Form 990-PF check here

Form 8868 check here

|

|

|

X b Total revenue, if any (Form 990, Part VIII, column (A), line 12)~~~~~~~ b Total revenue, if any (Form 990-EZ, line 9) ~~~~~~~~~~~~~~

Form 1120-POL check here

|

| b Total tax (Form 1120-POL, line 22) ~~~~~~~~~~~~~~~~ b Tax based on investment income b Balance Due (Form 8868, line 3c)

(Form 990-PF, Part VI, line 5) ~~~

~~~~~~~~~~~~~~~~~~~~

1b

2b

3b

4b

5b

296363

Part II Declaration and Signature Authorization of Officer

Under penalties of perjury, I declare that I am an officer of the above organization and that I have examined a copy of the organization's 2009 electronic return and accompanying schedules and statements and to the best of my knowledge and belief, they are true, correct, and complete. I further declare that the amount in Part I above is the amount shown on the copy of the organization's electronic return. I consent to allow my intermediate service provider, transmitter, or electronic return originator (ERO) to send the organization's return to the IRS and to receive from the IRS

(a) an acknowledgement of receipt or reason for rejection of the transmission, processing the return or refund, and (d)

(b) an indication of any refund offset, (c) the reason for any delay in the date of any refund. If applicable, I authorize the U.S. Treasury and its designated Financial Agent to initiate an electronic funds withdrawal (direct debit) entry to the financial institution account indicated in the tax preparation software for payment of the organization's federal taxes owed on this return, and the financial institution to debit the entry to this account. To revoke a payment, I must contact the U.S. Treasury Financial Agent at 1-888-353-4537 no later than 2 business days prior to the payment (settlement) date. I also authorize the financial institutions involved in the processing of the electronic payment of taxes to receive confidential information necessary to answer inquiries and resolve issues related to the payment. I have selected a personal identification number (PIN) as my signature for the organization's electronic return and, if applicable, the organization's consent to electronic funds withdrawal.

Officer's PIN: check one box only

X

I authorize

EFP ROTENBERG, LLP

ERO firm name to enter my PIN

14600

Enter five numbers, but do not enter all zeros as my signature on the organization's tax year 2009 electronically filed return. If I have indicated within this return that a copy of the return is being filed with a state agency(ies) regulating charities as part of the IRS Fed/State program, I also authorize the aforementioned ERO to enter my PIN on the return's disclosure consent screen.

As an officer of the organization, I will enter my PIN as my signature on the organization's tax year 2009 electronically filed return. If I have indicated within this return that a copy of the return is being filed with a state agency(ies) regulating charities as part of the IRS Fed/State program, I will enter my PIN on the return's disclosure consent screen.

Officer's signature | Date |

Part III Certification and Authentication

ERO's EFIN/PIN. Enter your six-digit EFIN followed by your five-digit self-selected PIN.

16278114607 do not enter all zeros

I certify that the above numeric entry is my PIN, which is my signature on the 2009 electronically filed return for the organization indicated above. I confirm that I am submitting this return in accordance with the requirements of e-file

Providers for Business Returns.

Pub. 4163, Modernized e-File (MeF) Information for Authorized IRS

ERO's signature | Date |

ERO Must Retain This Form - See Instructions

Do Not Submit This Form To the IRS Unless Requested To Do So

LHA

923051

03-02-10

For Paperwork Reduction Act Notice, see instructions.

Form

8879-EO

(2009)

16

12080910 101824 337100 2009.04020 COMPEER INC. 337100_1

TAX RETURN FILING INSTRUCTIONS

NEW YORK FORM CHAR500, ANNUAL FILING REPORT

FOR THE YEAR ENDING

Prepared for

COMPEER INC.

259 MONROE AVENUE

ROCHESTER, NY 14607

Prepared by

Mail tax return to

Return must be mailed on or before

Special

Instructions

EFP ROTENBERG LLP

280 KENNETH DRIVE

ROCHESTER, NY 14623

NEW YORK STATE DEPARTMENT OF LAW

CHARITIES BUREAU - REGISTRATION SECTION

120 BROADWAY

NEW YORK, NY 10271

PLEASE MAIL AS SOON AS POSSIBLE.

NEW YORK FORM CHAR500 MUST BE SIGNED AND DATED BY BOTH OF THE

AUTHORIZED INDIVIDUALS. ALSO BE SURE THAT THE ATTACHED COPY

OF FEDERAL FORM 990-EZ HAS BEEN PROPERLY SIGNED AND DATED.

ENCLOSE A CHECK FOR $50 MADE PAYABLE TO NYS DEPARTMENT OF LAW.

INCLUDE THE ORGANIZATION'S STATE REGISTRATION NUMBER(S) ON THE

REMITTANCE.

900082

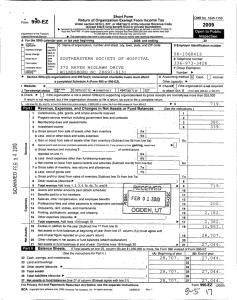

05-20-09

Form

CHAR500

Annual Filing for Charitable Organizations

New York State Department of Law (Office of the Attorney General)

Charities Bureau - Registration Section

This form used for

Article 7-A, EPTL and dual filers

(replaces forms CHAR 497,

CHAR 010 and CHAR 006)

1. General Information a. For the fiscal year beginning (mm/dd/yyyy)

New York, NY 10271 http://www.charitiesnys.com

01/01/2009

120 Broadway and ending (mm/dd/yyyy) 12/31/2009 b.

Check if applicable for NYS:

Address change

Name change

Initial filing

Final filing

Amended filing

NY registration pending c. Name of organization

COMPEER INC.

Number and street (or P.O. box if mail not delivered to street address)

259 MONROE AVENUE

City or town, state or country and ZIP + 4

ROCHESTER, NY 14607

Room/suite d.

2 0 0 9

Open to Public

Inspection

Fed. employer ID no. (EIN)

11-3798675 e.

NY State registration no.

40-18-58 f.

Telephone number

585 546-8280 g.

2. Certification - Two Signatures Required

We certify under penalties of perjury that we reviewed this report, including all attachments, and to the best of our knowledge and belief, they are true, correct and complete in accordance with the laws of the State of New York applicable to this report.

a. President or Authorized Officer b. Chief Financial Officer or Treas.

Signature

Signature

DANA FRAME

Printed Name

J. THEODORE SMITH

Printed Name

PRESIDENT

BOARD

MEMBER

Title

Date

Date

3. Annual Report Exemption Information a.

Article 7-A annual report exemption (Article 7-A registrants and dual registrants)

Check

.

if total contributions from NY State (including residents, foundations, corporations, government agencies, etc.) did not exceed

$25,000 and the organization did not engage a professional fund raiser (PFR) or fund raising counsel (FRC) to solicit contributions during this fiscal year.

NOTE: An organization may claim this exemption if no PFR or FRC was used and federated fund, United Way or incorporated community appeal

$25,000 or 2) it received all or substantially all of its contributions from one government agency to which it submitted an annual report similar to that required by Article 7-A.

and either: 1) it received an allocation from a contributions from other sources did not exceed b.

EPTL annual report exemption (EPTL registrants and dual registrants)

Check

.

if gross receipts did not exceed $25,000 and assets (market value) did not exceed $25,000 at any time during this fiscal year.

For EPTL or Article 7-A registrants claiming the annual report exemption under the one law under which they are registered and for dual registrants claiming the annual report exemptions under both laws, simply complete part 1 (General Information), part 2 (Certification) and part 3 (Annual Report Exemption Information) above.

Do not submit a fee, do not complete the following schedules and do not submit any attachments to this form.

4. Article 7-A Schedules

If you did a.

not check the Article 7-A annual report exemption above, complete the following for this fiscal year:

Did the organization use a professional fund raiser, fund raising counsel or commercial co-venturer for fund raising activity in NY State? ~

* If "Yes", complete Schedule 4a.

b.

Did the organization receive government contributions (grants)? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

* If "Yes", complete Schedule 4b.

X

Yes*

Yes*

X

No

No

5. Fee Submitted: See last page for summary of fee requirements .

Indicate the filing fee(s) you are submitting along with this form: a.

Article 7-A filing fee ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ $ b.

c.

EPTL filing fee

Total fee

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

$

$

25.

25.

50.

Submit only one check or money order for the total fee, payable to "NYS Department of Law"

6. Attachments - For organizations that are not claiming annual report exemptions under both laws, see last page for required attachments

...

1

968451

12-29-09 1019 CHAR500 - 2009

2

12080910 101824 337100 2009.04020 COMPEER INC. 337100_1

COMPEER INC.

Schedule 4b: Government Contributions (Grants)

If you checked the box in question 4.b. on page 1, complete the following schedule for each government contribution (grant). Use additional copies of this page if necessary to list each government contribution (grant) separately.

Government Agency Name

NEW YORK STATE

LIVINGSTON COUNTY

Total Government Contributions (Grants)

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

Grant Amount

197,224.

50,095.

247,319.

1019

3 968471 12-29-09 CHAR500 - 2009

3

12080910 101824 337100 2009.04020 COMPEER INC. 337100_1

COMPEER INC.

5. Fee Instructions

The filing fee depends on the organization's Registration Type. For details on Registration Type and filing fees, see the Instructions for

Form CHAR500.

Organization's Registration Type Fee Instructions

¥ Article 7-A Calculate the Article 7-A filing fee using the table in part a below. The EPTL filing fee is $0.

¥

¥

EPTL

Dual

Calculate the EPTL filing fee using the table in part b below. The Article 7-A filing fee is $0.

Calculate both the Article 7-A and EPTL filing fees using the tables in and EPTL filing fees together to calculate the total fee. Submit a parts a and b single below. Add the Article 7-A check or money order for the total fee.

a) Article 7-A filing fee

Total Support & Revenue more than $250,000 up to $250,000 *

Article 7-A Fee

$25

$10 b) EPTL filing fee

Net Worth at End of Year

Less than $50,000

$50,000 or more, but less than $250,000

$250,000 or more, but less than $1,000,000

$1,000,000 or more, but less than $10,000,000

$10,000,000 or more, but less than $50,000,000

$50,000,000 or more

* Any organization that contracted with or used the services of a professional fund raiser

(PFR) or fund raising counsel (FRC) during the reporting period must pay an Article 7-A filing fee of $25, regardless of total support and revenue.

EPTL Fee

$25

$50

$100

$250

$750

$1500

6. Attachments - Document Attachment Check-List

Check the boxes for the documents you are attaching.

For All Filers

Filing Fee

X

Single check or money order payable to "NYS Department of Law"

Copies of Internal Revenue Service Forms

IRS Form 990

All required schedules (including

Schedule B)

IRS Form 990-T

X

X

IRS Form 990-EZ

All required schedules (including

Schedule B)

IRS Form 990-T

IRS Form 990-PF

All required schedules (including

Schedule B)

IRS Form 990-T

Additional Article 7-A Document Attachment Requirement

Independent Accountant's Report

X

Audit Report

(total support & revenue more than $250,000)

Review Report

(total support & revenue $100,001 to $250,000)

No Accountant's Report Required

(total support & revenue not more than $100,000)

1019

4 968481 12-29-09 CHAR500 - 2009

4

12080910 101824 337100 2009.04020 COMPEER INC. 337100_1