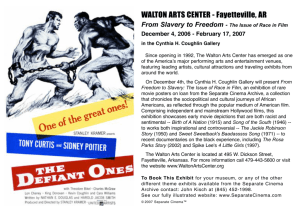

AND SCOTT "AN (1987)

advertisement