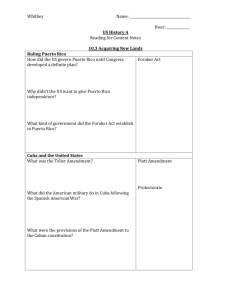

ACT THE COMMONWEALTH OF PUERTO RICO ASSESSMENT Nancy Cantonnet

advertisement