Housing Market Dynamics and the Utilization 312

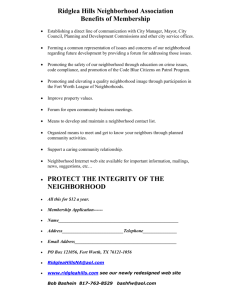

advertisement