(1968)

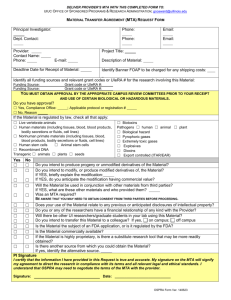

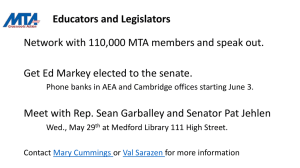

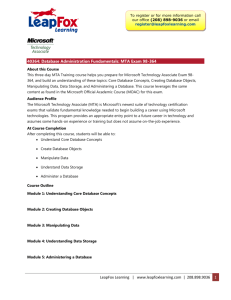

advertisement