FINANCIAL by SUBMITTED FULFILLMENT

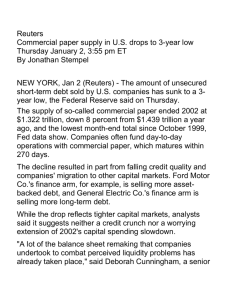

advertisement