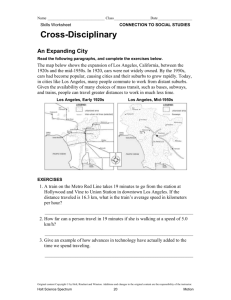

by B.A., English Cornell University

advertisement