Document 10629944

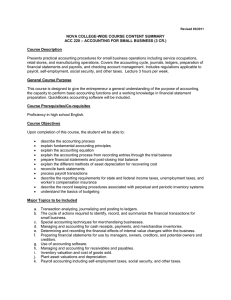

advertisement