WHY DO MARKETS FAIL TO FULLY INSURE AGAINST RECLASSIFICATION RISK? Contract

advertisement

WHY DO MARKETS FAIL TO FULLY INSURE

AGAINST RECLASSIFICATION RISK? Contract

Incompleteness vs. Limited Commitment in the Life

Insurance Industry

Denrick Bayot

University of Chicago

Abstract

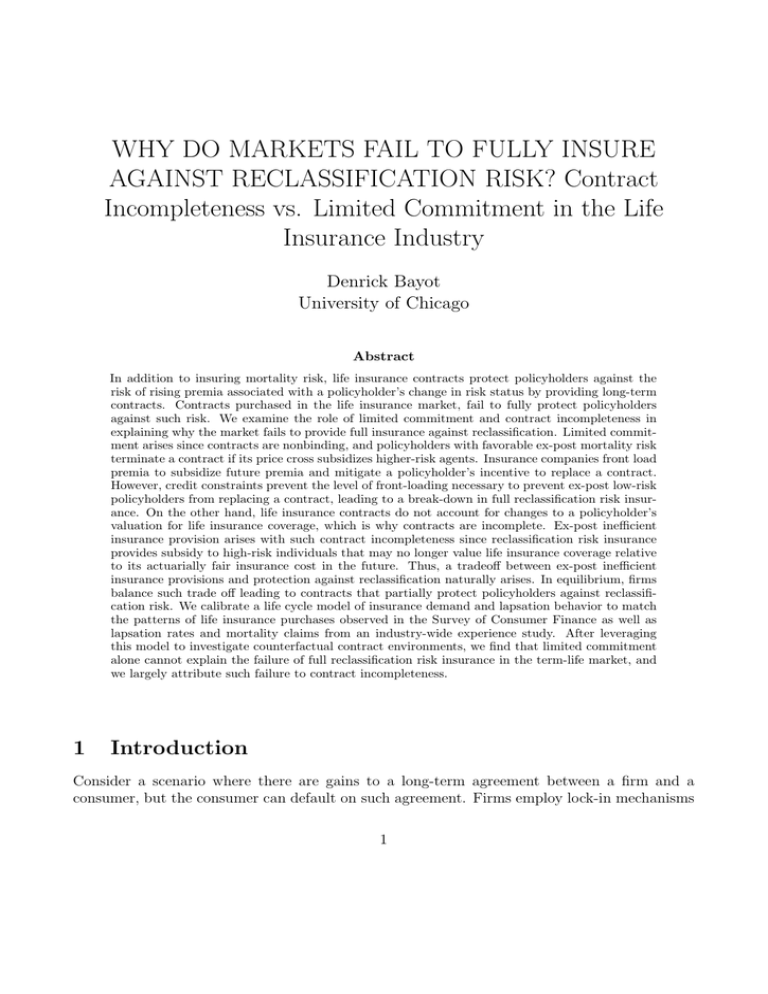

In addition to insuring mortality risk, life insurance contracts protect policyholders against the

risk of rising premia associated with a policyholder’s change in risk status by providing long-term

contracts. Contracts purchased in the life insurance market, fail to fully protect policyholders

against such risk. We examine the role of limited commitment and contract incompleteness in

explaining why the market fails to provide full insurance against reclassification. Limited commitment arises since contracts are nonbinding, and policyholders with favorable ex-post mortality risk

terminate a contract if its price cross subsidizes higher-risk agents. Insurance companies front load

premia to subsidize future premia and mitigate a policyholder’s incentive to replace a contract.

However, credit constraints prevent the level of front-loading necessary to prevent ex-post low-risk

policyholders from replacing a contract, leading to a break-down in full reclassification risk insurance. On the other hand, life insurance contracts do not account for changes to a policyholder’s

valuation for life insurance coverage, which is why contracts are incomplete. Ex-post inefficient

insurance provision arises with such contract incompleteness since reclassification risk insurance

provides subsidy to high-risk individuals that may no longer value life insurance coverage relative

to its actuarially fair insurance cost in the future. Thus, a tradeoff between ex-post inefficient

insurance provisions and protection against reclassification naturally arises. In equilibrium, firms

balance such trade off leading to contracts that partially protect policyholders against reclassification risk. We calibrate a life cycle model of insurance demand and lapsation behavior to match

the patterns of life insurance purchases observed in the Survey of Consumer Finance as well as

lapsation rates and mortality claims from an industry-wide experience study. After leveraging

this model to investigate counterfactual contract environments, we find that limited commitment

alone cannot explain the failure of full reclassification risk insurance in the term-life market, and

we largely attribute such failure to contract incompleteness.

1

Introduction

Consider a scenario where there are gains to a long-term agreement between a firm and a

consumer, but the consumer can default on such agreement. Firms employ lock-in mechanisms

1

to ensure consumer participation, and such mechanisms allow both parties to capture the gains

achieved through commitment. This paper discusses a cost to binding these consumers that

naturally arises when there are non-contractible, idiosyncratic uncertainties about the value

consumers place on their relationship with firms. These uncertainties, paired with the lock-in

mechanisms used to mitigate default, lead to ex-post inefficient contract participation.

We illustrate this scenario in the market for term-life insurance contracts. In addition to

providing insurance against mortality risks, insuring against reclassification risk (an increase in

premia caused by an unfavorable evolution of mortality risk) is a significant component of life

insurance contracts. However, a consumer/policyholder can walk out of a contract simply by

ceasing to pay the premia, and policyholders with favorable ex-post mortality lapse a contract

if its price cross-subsidizes agents with higher mortality risk. Such strategic lapse behavior

plays a key role in shaping contract profiles in the life insurance industry (Hendel and Lizzeri

(2003)). Policy payment schedules are front-loaded to subsidize subsequent premia, thereby

reducing the policyholder’s incentive to lapse.

We find that policyholders seek insurance against reclassification risks and prefer contracts

with longer level-term premium duration. A lion’s share of contracts purchased specify a

20-year or more level-term duration (LT20+contracts). Despite the heavy-front loading of

premia in these longer-term contracts, almost 40% of policy holders lapse halfway through

the level-term duration. This persistent lapsation points to the existence of shocks affecting

the policyholder’s demand for mortality risk insurance, such as changes to bequest motives

and liquidity-constraint shocks. Lapse patterns in the Health and Retirement Survey indicate

that newly divorced agents are more likely to lapse than married individuals. Indeed, divorce

increases lapsation probability by about 300%. Patterns of life-insurance holdings across marital

status support this view: divorced-male and never-married male individuals share the same life

insurance holding patterns. This suggests that at all stages of the lifecycle, changes to bequest

motives, especially owing to a recent divorce, affect the policyholder’s valuation of mortality

risk insurance.

This paper proposes that front-loading premia in these contracts leads to excessive ex-post

mortality-risk insurance provisions. The subsidy of future premia locks in future policy holders

whose ex-post valuation for mortality risk insurance is less than the cost of providing such

insurance. We emphasize that this inefficiency stems from an inability to contract uncertainties

that affect contract valuation. Were firms able to contract these uncertainties, contingent

rebates could provide appropriate incentives for policy holders to efficiently lapse. Thus this

paper highlights the inefficiency that arises from an incomplete contract environment when

contract participation is not enforceable.

Although the theoretical literature on incomplete contracting has matured, empirical analyses of the effect of incomplete contract environments continues to lag, as does work that

quantifies the extent of the inefficiency arising from these environments. Our paper fills this

gap by quantifying the ex-post inefficient contract participation that arises from the incomplete

market setting in term-life contracts, as discussed above. To our knowledge, we are the first to

move beyond empirical analyses of the economic arrangements caused by incomplete contracts

and expand the process to include welfare analysis.

2

We use this calibrated model to impute the welfare cost associated with contract incompleteness and limited commitment. To do this, we consider fixed-payment contracting environment

where firms charge an entry payment at the time of contracting and a fixed annual premia.

Firms in this environment can specify the contract length for up to age 70, and we consider the

equilibrium contracts offered for a 40-year old male individuals. We calculate equilibrium contracts in an environment where consumers can commit to not recontracting with another firm

(full commitment) and firms can specify participation contingencies that ensure efficient ex-post

life insurance holdings (quasi-completeness). We then compare the equilibrium contracts in this

baseline environment to the ones that arise without full commitment and quasi-completeness.

We find that moving from a quasi-complete and full commitment environment to one with

limited commitment and contract incompleteness leads to a substantial welfare loss (more than

$1B dollars). Moreover, the problem arising from limited commitment accounts for only 17%

of this loss.

Policyholders in the life insurance industry continue to face substantial reclassification risks.

Indeed, most contracts purchased typically shield the agents against reclassification risk for at

most 20 years. Hendel and Lizzeri (2003) argue that such failure arises from the policyholder’s

limited-commitment and credit constraints. In particular, they surmise that a policyholder’s

credit constraint prevents the level of front-loading necessary to prevent strategic lapsation. The

anticipated default of healthy policyholders then leads to a break-down in reclassification risk

insurance. We investigate this premise and find that limited commitment alone fails to explain

the break-down in full reclassification risk insurance observed in the life-insurance industry.

In particular, we find that the average contract length in quasi-complete equilibrium without

full commitment is almost equal to the contract environment’s upper bound length (27.5 years

versus 30 years). Instead, we find that failure of full long-term insurance or reclassification risk

insurance in the life insurance market can be mostly attributed to contract incompleteness. For

example, we find that the average contract length in an incomplete contract environment with

full commitment is 18.2 years. Adding limited commitment to this environment decreases the

average contract length by less than two years (16.7 years).

Our result suggests that the non-contractible uncertainty in the policyholders’ valuation for

life insurance coverage led to a failure of full reclassification risk insurance in the life-insurance

market. The intuition on why such contract incompleteness led to this failure is as follows. By

its very nature, a reclassification risk insurance provides subsidy to unhealthy individuals. Thus,

individuals in an unhealthy state in the future will receive a discount even without contract

front loading. The same unhealthy individual may no longer value life insurance coverage

relative its contracting cost in the future. Simply put, the individual’s willingness-to-pay for

life insurance coverage may no longer exceed the actuarially fair insurance cost (spot price).

But, if the individual’s willingness-to-pay exceeds that of the discounted price, then she will

choose to maintain life insurance coverage, leading to ex-post inefficient insurance provisions. In

a perfectly competitive market, policyholders ultimately bear this inefficiency and is reflected

in the ex-ante contract pricing. Thus, in an environment with contract incompleteness in

the policyholders’ valuation for life insurance coverage, a tradeoff between ex-post inefficient

insurance provisions and protection against reclassification naturally arises. In equilibrium,

3

firms balance such trade off leading to contracts that partially protect policyholders against

reclassification risk.

Although this paper focuses on the term life insurance industry, examples of contract features that bind agents are present in many markets with limited commitments. Prepayment

penalties in mortgages, infidelity clauses in prenuptial agreements and early-termination fees

in utility markets are but a few examples of these mechanisms. Policy makers have questioned

whether these lock-in mechanisms lead to inefficient agreements, akin to the ex-post inefficient

life insurance holdings observed in this paper. Indeed, such concerns resulted in a series of judicial decisions and regulations that prevent firms in many industries from drawing agreements

that bind consumers.1

Our analysis does not favor these laws. While our paper acknowledges the ex-post inefficiencies that could arise from these lock-in mechanisms, we do not claim that such mechanisms

are ex-ante inefficient and should therefore be eliminated. In fact, we acknowledge the necessity

of these mechanisms when contracts are not enforceable but there are gains to commitment.

Rather than prevent agents from drawing contracts that help policyholders commit, regulators

should understand the nature of the ex-post loss and seek alternative solutions to mitigating

these losses. One such solution, which this paper advocates, encourages firms to compete in a

more complete contracting environment.

2

Life Insurance

We focus our analysis on term life insurance policies. Unlike cash-value policies, term lifecontracts simply provide coverage to a policy holder’s beneficiary for a specified time frame

and the simplicity of their terms makes them fairly homogenous. These contracts can be

compared in terms of the coverage period, schedule of payments and the face value (amount

paid to the beneficiary in the event of the policy-holder’s death within the coverage period)

specified. If the policyholder survives after the coverage period, the contract ceases and no

additional benefits are given to the policyholder.2

Almost all term life contracts guarantee fixed coverage until the late stages of the lifecycle

(typically 85), provided policyholders continue to pay premia,3 but these contracts vary in their

payment schedule. Annual renewable term (ART) contracts have premium levels that increase

over time, while level-term (LT) contracts fix the premia for a specified number of years with

1

See, for example, the recent cap on prepayment penalties imposed by the Dodd-Frank Act Section 1414.

For the cellular phone industry, a summary of recent cases and state laws against early termination fees can be

found here: http://cell-phone-termination-fee.whocanisue.com/.

2

While cash-value insurance (particularly, whole-life insurance) account for a large share of the number of

policies issued (51.8% versus 23.9% for term insurance according to the 2009 LIMRA persistency study), term

insurance account for a large share of the face amount in force (52.3% by 2004). This is the case since cashvalue policy owners tend to purchase contracts with lower face value. The average face amount exposed for all

whole-life contracts in 2004 was $ 39,000, while buyers of term policies purchased contracts with an average face

value amount of $309,000. This suggests that agents primarily used cash-value policies as a savings instrument

rather than to insure their beneficiaries.

3

A small percentage (approximately 1%) provide decreasing death benefit (Jr. Kenneth Black (2013))

4

increases thereafter according to a pre-specified (current) schedule of payments akin to an ART

contract. 4 The degree of premium front loading varies by contract type, with longer level term

contracts exhibiting higher up-front payments.

Policyholders face non-trivial reclassification risk

The degree of risk reclassification policyholders face is not trivial. Life insurance risk categories tend to be coarse. Agents who qualify for contracts in the standard LI market are

typically placed in 2-4 risk categories (e.g., standard, preferred, preferred plus, etc.), but not

all consumers qualify for life insurance contracts.

Health conditions, such as heart failure, diabetes, or cancer, can prevent an agent from participating in the standard insurance market (Hendren (2013)). While there are some significant

risks to changes in risk category, the biggest reclassification risk stems from not being able to

requalify for a standard-underwritten insurance contract. Indeed, we find that agents have a

high likelihood of falling into a substandard category.

Table 1.1 tabulates the one-year hazard rate of a 40-year -old male individual falling into a

substandard category based on the National Health and Nutrition Examination (NHANES) III

Survey. We use the age of first exposure to a disease that would prevent a prospective insuree

from participating in the standard life insurance market to create this “life table”. We follow

Hendren (2013) in using a list of diseases most-cited by life insurance underwriting guidelines

that would preclude a prospective policyholder from participating in standard life insurance.

An agent is in a substandard class if he/she has had one of the following conditions: cancer

(except for melanoma), heart failure, diabetes or obesity. Male individuals face substantial

reclassification risk; the risk of falling into a substandard class for a 40-year-old male amounts

to almost 8% within the next 10 years.5

As pointed out by Hendel and Lizzeri (2003), font-loading contracts enables insurance companies to insure against reclassification risks despite the policy holders’ incentive to strategically

lapse. In particular, front-loading premia in these contracts allows for a premium subsidy in

subsequent periods and reduces the agent’s incentive to lapse and repurchase a new contract.

In their analysis, Hendel and Lizzeri (2003) find that all term contracts offered in 1997 tended

to be front-loaded in that the ratio of premium payments over mortality risk declines over time.

Since their analysis, the characteristics of ART contracts have drastically changed. premia for

ART contracts during the first few years of a contract dropped substantially, perhaps due to

reduced search costs (Brown and Goolsbee, 2002). However, such a decrease was paired with

a steep rise in premia over the contract duration. Thus, ART contracts offered in the market

today no longer exhibit their front-loaded characteristic and closely resemble spot-market insurance contracts. Given this change and the high risks that policyholders face of falling into

a substandard risk category, it doesn’t come as a surprise that life-insurance buyers shifted

4

The contract also includes a “guaranteed” schedule. In practice, insurance companies do not deviate from

the “current” scheduled specified in the contract.

5

Note that bunching every five years is operative. We attribute this to agents rounding ages when reporting

age of first diagnosis.

5

Interval

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

Exposure Count

5172

4979

4809

4627

4467

4347

4191

4066

3933

3814

3723

3571

3478

3343

3235

3138

3011

2913

2807

2709

2618

Hazard (One-YearI)

0.0064

0.0034

0.0044

0.0054

0.0036

0.0110

0.0064

0.0057

0.0074

0.0052

0.0212

0.0064

0.0104

0.0102

0.0093

0.0137

0.0086

0.0093

0.0114

0.0137

0.0302

Survival Rate

1.0000

0.9966

0.9921

0.9866

0.9831

0.9721

0.9658

0.9603

0.9531

0.9480

0.9277

0.9217

0.9120

0.9026

0.8942

0.8817

0.8740

0.8658

0.8558

0.8441

0.8180

Table 1.1: Substandard Classification Risk

This table tabulates the risks of falling into an uninsured class by age. We used the age of first exposure to the disease that renders the individual

uninsurable (exposure to non-melanoma cancer, heart failure, diabetes and obesity) as the failure event. Individuals that did not report a disease at

the time of the survey are counted as a censored observation. We use individuals ages 40 and above from the NHANES III that did not report exposure

to one of the diseases before age 40.

their purchases away from these ART contracts towards LT contracts. In fact, LT contracts

with level term durations lasting 20 years or longer are the most commonly purchased term

contracts today. Figure 1.2 highlights this fact, where we observed that LT contracts account

for almost the entire share of term contracts purchased across all age groups.

Nevertheless, policyholders continue to face nontrivial reclassification risk post level term.

For example, almost 15% of 40-year old policyholders own LT 10 contract, and, as mentioned

earlier these policyholders face a nontrivial risk of not being able to qualify for a new insurance

contract. Why do agents policyholders opt to expose themselves to nontrivial uninsurability

risk? Hendel and Lizzeri (2003) argue that credit-constrained individuals cannot afford the

level of front-loading necessary to commit a life-insurance policy, causing them to purchase

shorter term contract. Given that the cost of life insurance coverage is small relative to average

annual consumption (see table 2), we find such reason suspect.

6

Figure 1.2: Distribution of Contract Types by Age

This figure displays the lapsation pattern of level term contracts. Panel A provides the mean lapse rate, while panel B calculates the cumulative

proportion of individuals that lapse the contract by year. This figure is baed on a large-scale industry-wide experience study from a top actuarial

consulting firm. Cumulative lapse rate is calculated based on the mean lapse rates. We exclude policies that were issued for individuals under age 20

and over age 65.

Uncertainty in the valuation of life insurance coverage

In this paper, we argue that any uncertainty the policyholders’ valuation for life insurance

coverage leads to a failure of reclassification risk insurance. How? By its very nature, a

reclassification risk insurance provides subsidy to unhealthy individuals. So those that end

up in an unhealthy state in the future will always receive a discount even without contract

front loading. This same unhealthy individuals may no longer value life insurance coverage

relative its contracting cost in the future. Simply put, that individual’s willingness-to-pay

life insurance coverage may no longer exceed the actuarially fair insurance cost. However, if

the individual’s willingness-to-pay exceeds that of the discounted price, then she will choose

to maintain life insurance coverage leading to an ex-post inefficient insurance provision. In a

perfectly competitive market, policyholders ultimately bear this inefficiency and is reflected in

the ex-ante contract pricing. If such cost exceed the value to insuring reclassification risk, then

the equilibrium contracts limit the level of protections agents receive against such risk. In this

section, we provide evidences that suggest that policyholders do face tremendous uncertainty

in how they value life insurance coverage.

7

Figure 1.3 illustrates the extent of lapsation patterns for level-term contract holders and

depicts the average lapse rate for both LT10 and LT20 contracts. LT20 policyholders are less

likely to lapse than LT10. This is expected given that premia for LT20 are more likely to

be front-loaded relative to LT10. Despite the heavy front-loading of both contract types, we

find substantial lapsation. More than half of LT10 contract-holders lapse before the end of the

level term, while almost 40% of LT20 contract-holders drop out halfway through the level-term

duration. Not surprisingly, LT10 contracts exhibit a jump in lapsation (“shock lapse”) in the

post-level term period with almost all existing contract holders dropping two years after the

level-term period.

Figure 1.3: Mean Lapse Rate by Contract Type

This figure displays the distribution of term contract by type. ART includes all contract with non-level premia. LT10 are level term contracts with a

10-year level premium duration. Similarly LT20+ include contracts with level term duration lasting more than 20 years. The figure is based on policies

issued in between the years 2004 and 2011 and comes from a large-scale actuary experience study.

In the HL framework, the front-loading level necessary to achieve full insurance against

reclassification may not be achieved if agents find the large outlay of premia too costly. Distortions relating to optimal consumption smoothing are likely to be limited given that premia

for these contracts tend to be small relative to average annual household consumption and

8

income. For example, the level premium for a 40-year-old male who purchases 20-year term

insurance with a half-a-million coverage amounted to an annual premium of $592 in 2004. This

expenditure accounted for about 1.3% of the median household income.67 .

It thus begs the question why firms fail to increase the level of front-loading to curtail the

sizable lapsation observed in these contracts. Our theory provides an alternate explanation to

this question. Changes to the valuation of life insurance contracts, owing perhaps to changes

in bequest motives or income shocks, makes front-loading contracts costly even without credit

constraints. The front-loading of contracts leads to inefficient insurance take up when there

are ex-post uncertainties to the value of the component of LI contracts that insures against

mortality risks. Given this cost, firms shy away from excessive premium front-loading.

We do not dismiss the notion that some of these lapses are strategic and involve a replacement of LI contracts. In fact, our theory does not preclude the existence of strategic lapsation.

We find, however, that the contracts offered in the market leave little incentive for individuals to

strategically lapse due to a favorable ex-post mortality shock. Table 1.2 tabulates the average

premia (based on the lowest 15 contracts observed in Compulife) of standard-class level term

contracts for a non-smoking male individual. We use a face value amount of 1 million dollars as

an illustration. Notice that it does not behoove the policyholder to lapse an LT contract and

repurchase the same type of LT contract, unless the agent wishes to extend the level-premium

duration. Of course, an agent in an LT20 contract can lapse and repurchase an LT10 contract.

The savings for doing this, however, are quite minimal. For example, the savings for a 30-yearold male during the first few years is less than $100 annually and is non-existent after the 8th

year. Moreover, dropping a contract during those early years lessens the level-term period and

exposes the agent to a higher reclassification risk. Admittedly, the savings from this type of

lapsation increases for older individuals, although these individuals would have to drop their

LT 20 contract by year 4-5 to realize some form of savings.

Actuarial studies dating back to the 1980s emphasize the role of lapsation in deteriorating the insured pool over time, 8 and understanding lapse behavior continues to be of keen

interest in the life insurance industry (Black and Skipper, 2012). Unsurprisingly, various explanations abound as to why individuals drop their existing life insurance contracts beyond

the “replacement hypothesis” (i.e., the conjecture that individuals strategically lapse). Most of

these studies examine lapsation behavior for cash-value life insurance contracts and focus on

two main hypotheses: the interest-rate and the emergency-fund hypothesis. The interest-rate

hypothesis strictly applies to cash-value insurance policies since they are related to lapsation

behavior due to households taking advantage of higher market interest rates. The emergency

fund hypothesis, which suggests that households drop their insurance when faced with wealth

or income shocks, applies to both term life and cash-value policies, and various empirical works

find evidence consistent with this hypothesis (see, for example, Fier and Liebenberg (2013) and

surrender and lapse rates with economic variables (2005)).

6

Based on the SCF 2004 survey.

During the sample periods Hendel and Lizzeri (2003) analyzed, insurance loads were substantially higher.

Credit constraints may have played an important role during these periods

8

See for example, Dukes and MacDonald (1980), and Shapiro and Snyder (1981))

7

9

Age

30

32

34

36

38

40

42

44

46

48

LT10

929.5

933

940

991

1112.5

1250

1424

1634.5

1889.5

2197

LT20

1184

1243.5

1309

1418

1590.5

1808.5

2120.5

2476

2896.5

3408

Age

50

52

54

56

58

60

62

64

66

68

70

LT10

LT20

2555.5

4002

2971.5

4745

3475

5581.5

4092.5

6764.5

4883

8169.5

5869.5

9875

7167

13180.5

8902.5 16699.5

11022.5 26423.75

13738

39416

17220 46546.67

Table 1.2: Level-term Prices

This table tabulates the prices for lever-term contracts in 2004. premia are calculated for a standard-class 40-year old individual with a coverage

amount of $1M. We take the 15-lowest price in the Compulife Historical Data and use average the premia.

In this subsection we explore the role of changes to a policyholder’s bequest motives in

determining lapsation. Bequest motives, particularly protection against income loss or expenses

associated with death, are cited as the primary reasons why families purchase life insurance

(LIMRA Barometer 2014). Indeed, term-life insurance holding patterns from the SCF data

bolster this view (see Table 1.3). In particular, we find that adult men who remained single

at the time of the survey (i.e., those who have never married) are less likely to own termlife insurance than currently married individuals (22% vs. 49%). Moreover, the face-value

of contracts held by married individuals tends to be larger ($100k) relative to the contracts

purchased by men who never married. This difference in ownership rate and amount purchased

holds even when one controls for age, assets, income and number of children. We also find that

take-up rates by divorced males and the face-value of these LI purchases parallels that of the

individuals who never married.

It’s not obvious why divorced males are less likely to hold term-life insurance contracts than

their married counterparts. It’s tempting to conclude, based on these patterns, that lapsation or

termination of contracts ensues after a divorce or moments leading to a divorce. This pattern may

simply reflect ex-ante marital attributes (present at the beginning of marriage) that affect the likelihood

of a divorce. For example, in efficient household models that account for limited commitment (Voena,

2012), households with a bad match quality at the time of marriage are less likely to purchase insurance

during marriage and are more likely to divorce. We do not observe the take-up rates for these divorced

individuals during their marriage years so we cannot test the hypothesis that lapsation leads to this

stark difference in ownership rates.9

Following Fang and Kung (2012) and Fier and Liebenberg (2013), we used the Household and

Retirement Survey (HRS) to examine the impact of divorces on lapsation. The HRS panel contains

information on life insurance holdings and purchase behavior for older individuals (above 50). Besides

9

We explored using the SCF’s short 2007-2009 panel. We find no changes in the marital status, however,

over these two-sample periods.

10

VARIABLES

Ownership

(2)

(3)

(4)

0.00697

(0.0152)

-0.00754

(0.0168)

-0.0933***

(0.0210)

-0.192***

(0.0157)

-0.131***

(0.0148)

0.0278*

(0.0157)

0.101***

(0.0167)

0.0397**

(0.0180)

0.134***

(0.0207)

38.94***

(11.36)

2.986

(11.32)

-33.41**

(14.90)

-105.0***

(13.36)

-91.14***

(10.62)

0.487***

(0.0127)

0.00604

(0.0155)

-0.0213

(0.0170)

-0.166***

(0.0204)

-0.241***

(0.0159)

-0.191***

(0.0148)

0.0383**

(0.0160)

0.113***

(0.0172)

0.0341*

(0.0185)

0.430***

(0.0172)

NO

9,212

0.067

NO

9,212

0.073

YES

9,212

0.123

(1)

Age: 40-60

Age: 50-60

Age: 60-65

Never Married

Divorced

0.00234

(0.0154)

-0.0455***

(0.0160)

-0.209***

(0.0184)

-0.270***

(0.0151)

-0.198***

(0.0147)

1 Child

2 Children

3 or More children

Constant

Controls:

Income + Networth

Observations

R-squared

Face Amount

(5)

(6)

298.0***

(8.606)

41.58***

(11.43)

16.74

(12.61)

-7.510

(16.58)

-86.36***

(13.82)

-87.77***

(10.54)

27.59**

(11.85)

46.01***

(12.10)

34.21**

(14.60)

264.5***

(12.37)

32.90***

(11.29)

-0.790

(12.55)

-22.90

(16.53)

-76.10***

(13.65)

-72.53***

(10.60)

30.27***

(11.58)

45.57***

(11.87)

35.81**

(14.41)

195.1***

(19.74)

NO

3,008

0.042

NO

3,008

0.048

YES

3,008

0.093

Table 1.3: Life Insurance Demand Patterns from the SCF Households

Source: Survey of Consumer Finance 2001, 2004 and 2007 waves. Notes: We restrict our households to households with male head of the household in

between the ages 30 and 65. We exclude households with networth above the 95% in our analysis. Networth is calculated using the standard SCF’s

program for calculating networth. We use the CPI index to adjust all monetary variables (networth, family income and face-value amount) so that

they are in 2004 $. Sample weights are used in the regression. Lastly, we use the first implicate in our analysis.

11

allowing us to track changes in life insurance holdings, the HRS explicitly asked individuals whether

they “voluntarily” lapsed a life insurance policy between the two waves.10

We mimic the analysis in Fang and Kung (2012) to identify lapse determinants, but we focus on

lapsation behavior without contract replacements (i.e., optimal lapsation). We only use HRS waves

after 2001: HRS 2002, 2004, 2006, 2008, 2010. This restriction allows us to focus on optimal lapsation

as opposed to strategic lapsation. Life insurance premia started to decline during the early 1990s and

continued to do so in a monotonic fashion until 2001. Thus, individuals were likely to strategically

lapse and waited on repurchasing a policy until premia stabilized to their lower, competitive level.11

Furthermore, we restricted our analysis to male individuals less than 85-years-old who were married

during the first sample wave (2002). Individuals without a life insurance policy throughout the sample

or those that only owned a life insurance policy during the last wave (2010) are excluded in the analysis.

After taking into account all of our restrictions, our data set contains 5,408 males. The bulk of these

individuals were only observed for two years, with about 42% surveyed for at least 3 years.

Lapsation for the individuals in our HRS sample tends to be lower (averaging around 4.8% in

between the sample waves) than the reported average annual lapse rate observed in Figure 1.2. We

expect this discrepancy given that the HRS sample is comprised of older individuals who face relatively

minimal income shocks. Moreover, life insurance holdings in the HRS data include cash-value holdings,

and these policies tend to exhibit lower lapse rates (LIMRA persistency study, 2008). The majority

of these reported lapses were voluntary (77%) and almost all voluntary lapses during our sample

period are optimal lapsations. In particular, roughly 94% of these lapses were not associated with an

insurance replacement.

We considered two sets of shocks that possibly affect lapsation. The first set is comprised of

characteristics that affect life insurance demand but are unrelated to health or mortality risk. These

include wealth (measured as the log of income), percent change in income, the logarithm of the ratio

of medical expense to income and changes to marital status. The second set of shocks captures the

policy holders’ risk class and includes health specific variables. These include various health conditions,

BMI, self-reported health status and a dummy variable (whether the individual had been admitted to

a hospital in between waves).

Table 1.4 reports a reduced-form logit model of voluntary lapsation behavior without insurance

replacement on these two groups of shocks and determinants. 12 All models control for age, education

and year fixed effects. We find that recently divorced individuals as well as those with high medical

expenditures relative to their wealth are likely to lapse. This holds true even when one controls for

health shocks. Moreover, these health shocks do not appear to be correlated with the first set of lapse

determinants, given that the coefficients on the first set of shocks do not change when one controls for

the policyholder’s health characteristics.

We also find evidence of anti-selective behavior (i.e., healthier individuals are more likely to lapse),

which is consistent with our conjecture that unhealthy individuals are less likely to completely opt out

10

In particular, the survey asked whether the individual lapsed an LI policy. Furthermore, they ask if the

“lapse or cancellation [was] something [the agent] chose to do, or was it done by the provider, [an] employer, or

someone else [besides the agent]?”.

11

See, for example, the slides from the 2013 SOA Life & Annuity Symposium which provide evidence of this

behavior: https://www.soa.org/Files/Pd/Las/2013/2013-las-session-28.pdf

12

We omit reporting the self-reported health category and the dummy variable capturing hospital visits; these

variables were insignificant and followed signs consistent with the idea that individuals with higher mortality

risk are less likely to lapse.

12

VARIABLES

(1)

Shocks

(2)

Health State

(3)

Shocks + Health State

-11.93

(7.314)

-0.300*

(0.169)

-0.171

(0.142)

-0.423

(0.272)

-0.00824

(0.0905)

0.000293

(0.00143)

-14.99**

(6.298)

-0.00996

(0.0206)

1.477**

(0.656)

-1.241

(1.016)

1.180

(1.136)

-0.000531

(0.000775)

0.0455*

(0.0254)

0.00790

(0.0690)

-0.329*

(0.188)

-0.207

(0.154)

-0.358

(0.278)

0.00513

(0.0901)

4.11e-05

(0.00138)

-11.09

(7.377)

9,095

Yes

HH

13,315

Yes

HH

9,018

Yes

HH

%4 Income

-0.0108

(0.0224)

Recently Divorced

1.474**

(0.653)

Recently Married

-1.202

(1.008)

Recently Widowed

1.178

(1.117)

Mortgage-to-Wealth

-0.000437

(0.000619)

Log Medical Expense

0.0405*

(0.0208)

Log Income

0.0392

(0.0707)

Cancer

Heart Attack

Stroke

BMI

BMI2

Constant

Observations

Demographic FE

Cluster

Table 1.4: Lapse Determinants

Note: Logit estimates are based on a sample from the 2002-2010 HRS Wave. We restrict the sample to individuals that owned life insurance for since

2002 or purchased a life insurance contract before 2010. Only male individuals under the age of 85 are considered in the sample. Lapsation is defined

as a voluntary lapsation without contract replacement. Models in columns (2) and (3) also include other health shocks, such as self-reported health

and hospital visitation in between waves. These variables were not statistically significant.

13

of the life insurance market. Simply put, risk class affects the valuation of the life insurance contract,

where individuals with a high mortality risk are more likely to maintain some form of life insurance

coverage. This result casts doubt on an assumption typically made in risk-reclassification models,

which assume that agents may simply have no need for an insurance contract in subsequent periods

(e.g., a change in bequest motive) independent of their risk class. In these models, optimal lapsation

(lapsation without replacement) does not depend on the risk class. 13

To put these numbers into perspective, we used estimates from the logit model with both sets of

shocks and imputed the likelihood of a voluntary lapsation without replacement (optimal lapsation)

conditional on various divorce status and health conditions (e.g., cancer and heart attack). Values for

the covariates are calculated at the mean for an individual with a “poor” reported health status. We

find that divorce increases the likelihood that agents optimally lapse by more than three-fold (from

8% to 29% for an individual with cancer or a history of heart attack). Such a substantial percentage

increase in lapsation is true across different types of self-reported cancer/heart attack conditions. Antiselective behavior is present for individuals with cancer or a history of heart attack, though divorce

has a larger effect on lapsation behavior. Specifically, while divorce increases the probability of lapsing

by about 300%, the existence of cancer or heart condition merely decreases the probability of lapsing

by about a third.

Using the HRS has some disadvantage in that it does not distinguish between term policy and

cash-value policy. Moreover, life-insurance demand wanes during retirement years (see table 1.3, and

one must be cautious when extrapolating the effect of divorces on the lapsation of policies to younger

individuals. Nevertheless, we believe that the results from the HRS data, paired with the evidence

on life insurance holdings patterns of younger individuals, suggest that divorce leads to substantial

lapsation during all adulthood-lifecycle stages.

3

Lifecycle model of life insurance demand

Results from the previous section suggest that one cannot solely attribute the policyholder’s lapsation

behavior to a strategic lapsation. Voluntarily lapsed contracts in the HRS sample were likely to not

be replaced by another contract. Moreover, we find that these type of lapsation are largely drive by

factors unrelated to mortality risks, such as changes to a policyholder’s bequest motives when couples

divorce. Within the context of our theoretical model, these results aline to the existence of a nondegenerate ex-post contract valuation φ that is not contracted upon. Our theoretical model points

out to an ex-post inefficiency inherent in this environment; that is, excessive and inefficient insurance

against mortality risks are likely to ensue over the contract duration.

Quantifying the extent of this ex-post inefficiency, not only requires observing factors affecting life

insurance demand unrelated to risk, but also requires knowledge of how front loading prevents efficient

lapsation. For example, in the HRS data one would need to know the level of front-loading in premia

the policy holder faces when choosing to lapse. Furthermore, one must tease out the variations in

premium front-loading that cannot be attributed to selection. Consumers with different ex-ante belief

of how likely they are to value the contract ex-post 14 may sort into contracts that vary in their degree

of front-loading; in this case, the relation between front-loading and lapsation may simply reflect the

unobserved component of ex-post valuation.

13

14

As in the Daily, Hendel, and Lizzeri (2008) and Fang and Kung (2010) model.

Within the context of our model, this amounts to differences in the distribution of θ

14

We do not know of a dataset that contains household-level information on lapses and also exogenous

variation in premium front-loading,15 but we would like to be able to understand the magnitude of

this inefficiency in the life insurance industry. To do this, we create a lifecycle model of insurance

demand and lapsation behavior that takes into account the relevant shocks that household face when

determining optimal life insurance holdings. We calibrate this model to match patters on LI holdings,

lapsation and mortality claims found in the data. We then use this model to estimate the welfare

losses associated with contract incompleteness and limited commitment.

3.1

The lifecycle model

We employ a unitary household lifecycle model with bequest motives for married individual. Male

policy holders account for most of the life insurance policies purchased (Hong and Rı́os-Rull (2012)).

So, our model focuses on life insurance demand on contracts with the male spouse as the primary

insurance holder (i.e., the beneficiaries include everyone in the household but the husband). Following

the literature on annuity demand (De Nardi, French, and Jones (2009), and Lockwood (2010)), the

household head in our model receives utility from bequeathing individuals at the time of the husband’s

death. This bequest motive can be fulfilled through savings or the purchase of a life insurance contract.

Households in our model face various risks that affect their demand for life insurance and the need

to insure against mortality risks. Thus, agents in our model decide on the optimal savings, insurance

purchase and life insurance policy lapsation.

We are not the first to apply lifecycle household model in life insurance demand. Examples can be

found in Hong and Rı́os-Rull (2012), Hosseini (2007), Hosseini (2008) and Inkmann and Michaelides

(2012). But, none of these models account for reclassification risk insurance and assumes that agents

face a static, spot-market contract choice set. In these models agents purchase a spot-market contract

that is equal to its actuarially fair value plus some insurance load. To our knowledge, we are the first

to construct a model that allows for a richer contracting set, one that insures against reclassification

risk. In particular, we mimic the contract set currently displayed in the market, which comprises

primarily of level term contracts.

This section proceeds as follows. We first provide details to each of the model’s components:

the shocks agents face, the contracting set, the budget constraints and the agent’s problem. We

then discuss parametric assumptions used in our calibration. This subsection is then followed by a

discussion on the first-stage calibrated parameters (parameters that can be estimated independent of

the lifecycle model) and the information used to impute these values. We then discuss the moments

used to calibrate the rest of the parameters that rely on the lifecycle model for identification. Finally,

we discuss the fit of our calibrated parameters.

Health state and Morality risk We consider two health states ht in our model: insurability

(ht = 1) and uninsurability (ht = 0). Agents in our model start the lifecycle with an insurable

health state, but health state evolves stochastically according to the law πh (ht+1 |ht ). Mortality risk

depends on the health state in each period. We denote the probability of not surviving in period t + 1

conditional on being alive in period t by δtht .

15

The HRS data provides virtually no information on premia paid. In particular, the survey stopped collecting

information on premia for term-life insurance in the year 2000.

15

As mentioned earlier, standard LI underwriting typically precludes individuals from purchasing

when they fall into a health category deemed uninsurable. We use adverse health conditions that

most life insurers use in their criteria in defining uninsurability. In particular, a person is uninsurable

if she has the following health condition: cancer (except for melanoma), heart failure, heart attack,

diabetes and extreme obesity. In most cases, LI underwriting prevent individuals from purchasing

standard LI contracts if they’ve had a history of these adverse health conditions. We thus assume

that πh (ht+1 = 1|ht = 0) = 0.

Life Insurance Contracts

Previous life-cycle models of demand typically assume that households can only purchase spot-market contracts. As mentioned earlier, this assumption does not align

with the observed contracts in the market. In our model, households can purchase long-term contracts,

and we focus on the two-types of contracts typically purchased in the market: 10-year and 20-year

lever term.

We characterize these contracts by their per-dollar premia, Pt , face value, Ft and tenureship, dt .

These contracts are non-binding so that households at any point in time can choose to lapse by ceasing

payment. Households in our model pay the premia at the beginning of the period, and a payment

insures the agent against mortality risk in that period. At the end of the level-term, households are

left uninsured and can either continue being insured against mortality risk in the spot-market market

or purchase a new level-term contract.

The linearity assumption of premia in face value is not an innocuous assumption and reflects the

limited role of adverse selection in the life insurance industry. In practice, most contracts are linear

with some bulk discounts for contracts with large face values (Cawley and Philipson (1999)).

Income shocks and the household budget constraint We allow for income shocks to

capture the effect of liquidity constraints on lapsation. In particular, household income follows the

following process:

ln yit = µi + it

it = ρi,t−1 + ηit

In this equation yit is the per-period income and exp(µi ) captures the income at the beginning of the

household’s lifecycle, and the innovation ηit is assumed to be independent across time and individuals.

These permanent income shock end at retirement, and during such phase households earn a pension

equivalent to their end-of-retirement income multiplied by a replacement ratio. A household in possession of a term contract with premia Pt and face value Ft faces the following capital accumulation

constraint if she chooses to keep the contract and pay the premia:

at+1 = [at + yit − (ct + Pt F )] (1 + r)

In this equation at denotes the asset, ct is the per-period household expenditure beyond lifeinsurance purchases and r is the market interest rate. We assume that individuals cannot leave debt

so that paired with a positive mortality risk we have at ≥ 0. Households may opt out of keeping or

purchasing a long-term contract, in which case the asset accumulation follows the usual form:

at+1 = [at + yit − ct ] (1 + r)

16

.

Preferences and Household Problem Our model of household preference closely follows the

unitary household model with bequest motive in Lockwood (2013) in that the agent receives utility

from leaving a bequest at the time of his death. Bequest can either come from assets accumulated

and the face value of a life insurance contract held, if any. In particular, if the agent dies in between

period t and t + 1, has accumulated assets at+1 for use in the next period, and purchased a contract

with face value F , then the agent receives the following bequest utility:

v(at+1 + F |Mt , ξt )

Bequest motives depend on the marital state Mt and an unobservable preference shock ξt . These

unobservable preference shock are persistent and follows a random walk: ξt = ξt−1 + ηt . Let Ct =

(Pt , F, dt ) denote the agents current life insurance holding with Ct = ∅ with no insurance holdings.

Agents in each period can choose to maintain their contract, lapse and purchase a new contract among

the set Ct0 of contracts available in the market, assuming the agent is insurable (ht = 1), or opt out

of the insurance market. Thus the agents choice set Ct (ht , Ct ) depends on the health status and

current-periods insurance ownership:

Ct (ht , Ct ) = Ct0 ∪ C̃t (Ct ) ∪ ∅ if ht = 1

Ct (ht , Ct ) = C̃t (Ct ) ∪ ∅ o.w.

Here C̃t ((Pt , Ft , dt )) = (Pt , Ft , dt + 1) if the duration is within the level-term period; otherwise, we

let it be the empty set. The empty set represents the option to opt out of the life insurance market,

and agents in this case can only bequeath through savings. Let ωt = (at , Ct , yit , ht , Mt , ξt ) denote the

agents current-period state. The agent in each period chooses his optimal consumption, savings and

life-insurance purchase decision. The following bellman equation describes this intertemporal decision:

h

i

ht

ht

0

0

Vt (ωt ) =

max

u(c

)

+

β

δ

v(a

+

F

|M

,

ξ

)

+

(1

−

δ

)E[V

(ω

|ω

,

c

,

C

)]

t

t+1

t

t

t+1

t+1

t

t

t

t

t

0

0

0

ct ,Ct =(Pt ,F 0 ,dt )

s.t. budget constraint and

Ct0 ∈ Ct (ht , Ct )

3.2

3.2.1

Calibration and Parameterization

Parametric form

The households felicity function takes on the standard constant relative risk aversion (CRRA) form :

1−σ

u(c) = c1−σ . Our parametric form of bequest motives v(·|Mt , ξt ) closely follow Lockwood’s threshold

crossing model but allow for bequest motives to vary across age, marital status and an unobservable

preference shock. In particular, we assume the following form;

!

σ

φt (Mt , ξt )

(κ(Mt ) + b)1−σ

vt (b|Mt , ξt ) =

1 − φt (Mt , ξt )

1−σ

17

φ(·) captures the bequest intensity and admits a logit specification:

φt (Mt , ξt ) =

exp(αo + αm Mt + αξ ξt )

1 + exp(αo + αm Mt + αξ ξt )

κ(Mt ) = κo (1 − Mt ) + κm Mt reflects the threshold consumption level below which households prefer

not to bequeath an actuarially-fair mortality insurance contract as discussed by Lockwood (2013).

We assume a parametric survival function when estimating the mortality risk. As in Finklestein and

Porterba (2004), we model the hazard function using the Gompertz distribution and estimate these

hazard functions by health type. To be exact, for each health type h, we let the the survival function

with respect to mortality take on the form Sh (t) = exp −λh γh−1 (exp (γh t) − 1) . These functions are

h (t)

then used to impute each period’s mortality risk δtht = Sh (t−1)−S

.

Sh (t−1)

3.2.2

Assumptions on the stochastic components of the model

Agents in our model face income uncertainty, divorce shocks (i.e., Mt is stochastic), uninsurable

health shock, mortality risks and an unobservable bequest shock. With the exception of mortality

risk and health shocks, we assume that shocks are drawn independently of one another. We make

such assumption since the processes are estimated from various data sources (see next subsection).

Admittedly, medical studies linking divorce to poor health conditions flood the medical literature

(Sher and Noth (2013)). Thus, our estimates on the gains to divorce contingent rebate–conversely,

the lock-in inefficiency–is likely to be conservative figure (bias downwards). This is the case since the

cost of locking consumers in is higher for unhealthy individuals with high mortality risk. While we

do not impose any parametric assumption when estimating the income process, we assume that ηit

is normally distributed in our simulations. We also assume that the unobservable bequest shock’s

innovation follows a normal distribution; that is, ηξ ∼N (0, 1) so the preference innovation has variance

αξ2 .

3.2.3

First-stage parameters

We divide our estimation procedure into two stages. Our first-stage estimates involve parameters that

are identified without solving the lifecycle model. These include the income process, reclassification

and divorce risk. We then use these estimates as calibrated parameters in the lifecycle model. We

calibrate the remaining parameters by matching simulated patterns based on our lifecycle model. In

particular, we seek out values of the parameter that result in simulated lifecycle profiles that closely

matches the patterns of life-insurance demand, lapsation and mortality experience in the data.

Income We use information from the biannual 1997-2011 waves of Panel Study of Income Dynamics

(PSID) to estimate the household income process. We use the PSID’s measurement of pretax total

family income including transfers. Details of the sample selected in our analysis can be found in

Appendix B.I.

Our estimation consists of two parts. First, we project this measurement on annual dummies, headof-the-household’s age, education and race. We then match the moments of the estimated residuals to

estimate the parameters of the income-shock process (ρ and ση2 ) using a standard method of moment

18

ρ

0.5895

(0.0228)

ση

0.0053

(0.0005)

Table 1.5: Income-process estimates

Source: PSID 1997-2011. Refer to the main text for the estimation strategy.

approach. 16 In our analysis, the time window in between t and t + 1 consists of a two year period.

Table 1.5 reports these estimated parameters, where we find considerable dispersion in the innovation

and a persistent shock. We use these estimates and assume that η follows a N (0, σ 2 ) in our lifecycle

simulations.

Reclassification risk and the uninsurable mortality risk

We employ the NHANES III to

estimate reclassification risk. The NHANES III provides information on the age at which an exhibited

an uninsurable health condition. We previously discussed this risk in the life table tabulated in table

1.1. As mentioned earlier, there appears to be some bunching around certain years, most likely due to

respondents rounding their age in the survey. We attempt to smooth this by fitting a nonparametric

survival curve that captures reclassification risk. In particular, we first take the restricted sample

and fit a cox proportional model with sex and smoker proportionally affecting the baseline hazard.

We then non parametrically fit the baseline survival function using the a cubic specification on log

survival function: ln S R (t) = βoR + β1R t + β2R t2 . Details of our sample restriction and the variables

from NHANES used to define uninsurability can be found in Appendix B.II.

Table 1.6 lists the estimated parameters for this survival function as well as the effect of sex

and smoker-status on the hazard function. Consistent with the lifetable found in Table 1.1, we find

considerable reclassification risk. For example, the probability of falling into uninsurable category

within 10 years for a 45-year old male individual , conditional possessing an insurable health status

at this age, is approximately 14.34%. Not surprisingly, smoking status substantially increases the

reclassification risk (the hazard rate increases by 23 .61%)

We restrict our sample to uninsurable individuals and estimate a cox-proportional hazard model

on mortality risk. As in the reclassification risk model, we allow sex and smoker status to affect

the baseline hazard model. We use a Gompertz distribution to fit the baseline hazard. While our

data allows us to non-parametrically estimate this baseline function, we find that the Gompertz

distribution provides a good fit relative to the nonparametric fit. This assumption is also consistent

with our parametric assumption on the mortality risk of policyholders (insurable individuals), where

we make such assumption for computational tractability (see second-stage estimation section). Table

1.7 tabulates the parameters of the Gompertz distribution.

Divorce risk Our model takes divorce risk as exogenous, and we let divorce risk vary by age.

Admittedly, divorce risk varies by marital duration but this effect can be captured by the age-specific

divorce rate. Considering both age and duration specific divorce probabilities significantly increases

the dimension the state space in our computation. We use the NSFG 2006-2010 data on married

16

In particular, we match the following moment conditions E[2it ] = ση2 and E[it it−j ] = ρj ση2 for j >= 1. A

diagonal weighting matrix is used, and we calculate the standard errors using a bootstrap method.

19

(1)

First-stage cox (exp(β 0 x))

t

(2)

ln Ŝt

0.0174***

(0.000251)

-0.000303***

(2.88e-06)

t2

Female

-0.274***

(0.0357)

0.212***

(0.0563)

Smoker

Constant

-0.252***

(0.00476)

Observations

R-squared

19,999

20,005

0.990

Table 1.6: Cox Regression

This table reports estimates of the uninsurable hazard function. Column 1 reports the first-stage cox-proportion hazard function where uninsurability

is the failure event. We then nonparameterically fit the estimated base-line survival curve as a quadratic function of time. The estimates for such fit

is displayed in column (2). Refer to the main text for the estimation strategy. Standard errors in parentheses. *** p<0.01, ** p<0.05, * p<0.1

Parameters

Female

Smoker

Constant

Observations

(1)

ln λ

(2)

γ

-0.377***

(0.0426)

0.820***

(0.0685)

-9.220***

(0.274)

0.128***

(0.00505)

3,285

3,285

Table 1.7: Baseline Death Hazard for Uninsurable Adults

This table reports estimates of the death hazard function for uninsurable class using the NHANES III data and the Mortality File Supplement.

Calculations are based on the MLE, where we use the parametric form h(t) = λ exp γt. Estimates are based on a sample of adult individuals age 30

and over. Time is reset so that t = 0 corresponds to the 30th year. Standard errors are calculated using the replicate weight method suggested in the

guidebook.*** p<0.01, ** p<0.05, * p<0.1

20

male individuals ages 30 and above to calculate the two-year divorce rates by age. We first estimate a

cox proportional hazard model of divorce without parametrically specifying the baseline hazard and

allow it to depend on marriage at the time of marriage. We then non parametrically fit the estimated

survival function and use this to calculate the marital survival function for a 30-year old male. Figure

1.4 plots the divorce risk across the lifecycle considered and shows a nontrivial rate of divorce up until

age 55. In fact, conditional on being married at age 30, a male individual has a 20% chance of getting

divorced within 10 years.

1

0.95

0.9

0.85

0.8

0.75

0.7

0.65

30

35

40

45

50

55

60

65

Age

Figure 1.4: Marital Survival Function

We use the NSFG 2006-2010 data on married male individuals ages 30 and above to calculate the two-year divorce rates by age. We first estimate a

cox proportional hazard model of divorce without parametrically specifying the baseline hazard wit age of marriage as a factor affecting the hazard

rate. We then non parametrically fit the estimated survival function and use this to calculate the marital survival function for a 30-year old male.

Life insurance Pricing We use data provided by Compulife to impute the term-life insurance

prices. For each age, we take the average of the 15 lowest premia in the dataset for a nonsmoker,

standard class individual issued in 2004. Table 2.1 lists these premia.

Other Calibrated Parameters We do not estimate the CRRA parameter σ but use previous

studies to calibrate its value. In particular, as in Lockwood (2013) we set this value to 3. The annual

discount rate is set at 3%.

3.3

Second-stage calibration and simulation procedure

Our second-stage procedure calibrates the remaining preference parameters characterizing bequest

motives (αo , α1 , α2 , αm , αξ ) and the parameters governing the insured’s mortality risk profile (βI , λI ).

21

To do this, we use our lifecycle model and simulate insurance purchase behavior, lapse decision and

the insured’s mortality experience and chose parameters that match the patterns in data. We target

the following moments in our calibration:

1. Ownership Rate: [m1 ] and [m2 ] - We take a sample of male-household heads from the SCF

(waves 2001, 2004 and 2007) that were married at some point in their life. These include

divorced individuals at the time of the survey. We then calculate the average ownership rate

conditional on current marital status: An individual owns a term-life insurance contract if she

holds a contract with a face value amounting to at least $75,000. We make such restriction

to better approximate individual-life ownership as oppose to group-life or employer-sponsored

policies that tend to have low face amounts. We also restrict the sample to household heads

in between the age of 30 and 50. The average ownership rate for divorced individuals (m̂1 ) is

equal to 28.14%, while 53.17% of married individuals owned a term-life insurance in our sample

(m̂2 ).

2. Face value: [m3 ] and [m4 ] We take a subsample of households discussed in the preceding

paragraph that owned a life insurance at the time of survey and calculate their average face

amount. The face value of insurance purchased by divorced individuals in our sample amounts

to about $219k, while married individuals purchase contracts with substantially higher face

values ($310k).

3. Lapse rate: [m5 ]. We use information for a large-scale actuary persistency and experience study

to impute the 10-year lapse rate of LT20 and consider only contracts issued for male policy

holders with ages in between 35 and 45. We restrict the sample to policies issued for a nonsmoker, fully underwritten contract with a face value exceeding $50k. Approximately 37.62%

of these policy holders lapse by year 10.

4. Mortality rate: [m6 ], [m7 ], [m8 ], [m9 ] We use the same large-scale actuary to calculate mortality

rates during the first 10 years for polices issued at various age groups: 30-34, 35-39, 40-44, 45-49,

and 50-54. We take the total number of claim counts within the first 10-years of the contract

and divide it by exposure counts (measured as a year and policy). Thus, one can view this

statistic as the average mortality rate within the first 10-year of the contract duration. These

numbers are .00035, .0004704, .000814, .001272, and .002024 , respectively.

We start the lifecycle for a married individual at age 30. We initialize the unobservable bequest

parameter by setting ξ = 0 across all simulation, but we allow for heterogeneous starting values for

income and assets. The distribution of initial income and assets is drawn from a sample of married

male individuals ages 25 to 40 in the SCF. We draw (with replacement and randomly up to the SCF

household weights) from a sample of 500 individuals, and for each individual we simulate 1000 lifecycle

decisions.

To match the first two patterns in the data, we take a cross-section from our simulated life profile.

To be exact, for each simulated life, we choose a particular point in the simulated lifecycle profile

based on the age distribute of the subsample used to estimate m1 and m2 . We then use this simulated

cross-sectional data to calculate the simulated moment moments on take up rates and face-value by

marital status. For the moments relating to lapse and mortality rates, take our simulated lifecycle

and emulate the experience and lapse data. We then use this data to calculate simulated lapse and

22

mortality rates by age group. Simulated method moments are formed for each parameter guess β, say

mSim (β).

Our calibration method uses the same technique as a simulated method of moment approach.

We minimize the distance between the the simulated and the empirical moments, where we use the

diagonal variance-covariance matrix of the empirical moments variance Σ. In particular, our calibrated

parameters is based on minimizing the following objective function:

min (mSim (β) − m̂)0 Σ (mSim (β) − m̂)

(1)

β

Although we use the same empirical approach as SMM, we do not feel comfortable calling our calibration as estimates and imputing standard errors at this stage. First, we make no formal identification

claims, but we suspect that the moments m1 through m5 identify the parameters relating to bequest

motive. Similarly, the survival function for insured individuals are likely to be identified by attempting to fit the mortality rates m6 through m9 . Also, given that our use of multiple datasets, properly

accounting properly for standard errors is a nontrivial task, and we feel that such exercise, while

important in itself, is secondary to the paper’s intent. We are currently working on addressing these

two issues, but at the moment we use our calibrated parameters for our counterfactual analysis.

3.4

Model fit

Table 1.8 displays the calibrated values found by minimizing the expression (1) using a simulated annealing algorithm, β̂. This table also provides a comparison between the simulated moments mSim (β̂)

evaluated at β̂ and our observed empirical moment. With the exception of the average face value

of term-life holding ([m4 ] and [m5 ]) our model reasonably fits the targeted patterns in the data.

Threshold-crossing level of consumption in our model ($6, 613.1 for divorced individuals and $5, 488.5)

for married individuals) is substantially lower than the ones estimated in Lockwood (2013) for older

individuals. This result doesn’t come as a surprise given the large take-up rate of term life insurance

in the data for ages 30-50 individuals.

Parameter

αξ

κo

αo

αm

κm

o

λo

γo

Estimated Parameter

0.0990

6, 613.1

1.2898

1.1047

5, 488.5

exp(-11.4947)

0.0825

Moment

Divorced Ownership Rate

Marriage Ownership Rate

Avg Face

Avg Face (Married)

First-10 year lapse

30-35 Mort

35-40 Mort

40-45 Mort

45-50 Mort

50-55 Mort

Empirical

28.14%

53.17%

219k

310k

37.62

.0004

.0005

.0008

.0013

.002

Table 1.8: Second-stage parameter estimates

23

Matched

27.16%

50.78%

123k

183k

37.14%

.0004

.0005

.0007

.0008

.001

4

Welfare Loss: Fixed-Payment Contracting Environments

To impute the welfare loss that stem from the policyholder’s lack of commitment and incomplete

contracting, we consider a fixed-payment contracting environment. In particular, we define the set of

all feasible fixed-payment contracts as follows:

Definition 1. A feasible fixed-payment contract signed in date t is a tuple Ct = {pto , pt , T̄ t , lt } that

specifies:

1. an entry payment pto : Ωt → R,

2. a fixed annual premia pt : Ωt → R,

3. a contract length: T t : Ωt → N+ ,

t )T −t , where for each j = 1, · · · , T − j lt

4. and a participation rule lt = (lt+j

t+j : Ωt × Ωt+j → {0, 1}

j=1

dictates wether a person receives coverage in period t + j. Hence, for each ωt+j and t with

t (ω , ·) = 0.

t + j > T t (ωt ), we have that lt+j

t

The contract above mimics the standard term-life insurance market that specifies a level premia

for a specified number of years. Unlike the life insurance contracts we observe in the market, we allow

for a richer contracting set, one that allows for contracts to depend on the agent’s current state ωt ,

including the unobservable bequest shocks. We also allow firms to front load or back load payments

via an entry payment, pto . Lastly, the contracts specify a contingent participation rule that depend on

the realized states in the future. Such rule allow firms to eliminate any ex-post inefficient life insurance

holdings if possible. We thus look at environments where this rule is left unrestricted (we refer to this

environment as a quasi-complete contracting space) and compare it with an environment where no

such rule exists (an incomplete contracting space).

−t

Given a set of contracts specified for each age t, say (Ct )Tt=1 , let Vt (ωt , Ct (ωt )|(Ct+j )Tj=1

) denote

each policyholder’s value function for contract Ct , conditional on the set of contracts the policy holder

−j

can possibly purchase in a future date (Ct+j )Tj=1

. In particular, policy holders at any date t0 > t

can possibly drop a contract and repurchase the new contract Ct0 . Similarly, let Rt (ωt , Ct (ωt )|(Cj )j6=t )

and Mt (ωt , Ct (ωt )|(Cj )j6=t ) be the expected revenue and mortality/claims cost associated, respectively,

with the contract Ct . We are now in a position to characterize a set of equilibrium contracts in the

fixed-payment contract environment.

Definition 2. A set of contracts (CtE )Tt=1 is an ¯l-equilibrium contract in the fixed-payment contract

environment if

1. Each policy has a load of ¯l:

E )T −t )

Mt (ωt ,CtE (ωt ),(Ct+j

j=1

E )T −t

Rt (ωt ,CtE (ωt ),(Ct+j

j=1

= 1 − ¯l, for any ωt ∈ Ωt and t = 1, · · · , T .

2. For any other fixed-payment contract with the same load factor ¯l, we have that

−t

E T −t

Vt (ωt , Ct (ωt )|(Ct+j )Tj=1

) ≤ Vt (ωt , CtE (ωt )|(Ct+j

)j=1 )

for any ωt ∈ Ωt and t = 1, · · · , T .

24

EI

EII

EIII

EIV

(1)

Participation

(2)

Annual Premia

(3)

Length

(4)

Face

(5)

Take-up

(6)

Total 4 Welfare

-3,548

-5,242

2,432

592

1,775

2,378

1,240

1,682

30

18.2

27.5

16.7

353k

181k

257k

172k

63%

49%

59%

43%

$1,081.43 (3.51%)

$160.21 (0.52%)

$1,312.51 (4.26%)

Table 1.9: Average Equilibrium Outcome

We set the load factor to 42.1%, which is the average load observed for the LT10 and LT20 contracts found in the market. Columns 1-4 report the

average participation fee, annual premia, contract length, and face value across all the equilibrium contracts for a 40-year old individual. Columns 5

and 6 calculates the take-up rate and welfare loss (moving from EI to an alternate environment) for all contracts found in equilibrium. A monte-carlo

simulation is used to calculate the averages. Averages are taken over the distribution of assets and income found in the SCF data for ages 35-45 male

household head. Marital states and bequest shocks are drawn independently when forming these average profiles. We set the maximum length to age 70.

EI reports the results for a contracting environment with full commitment and quasicompleteness. EII reports the results for a contracting environment

with full commitment only. EIII reports the results for a contracting environment with limited commitment and quasicompleteness. Lastly, EIV reports

the results for a contracting environment with limited commitment and contract incompleteness.

In this definition, ¯l is the load associated with each contract. An equilibrium dictates that no

other firm can offer a set of contract that makes some consumers better off. In this section, we

consider four types of contracting environments and consider the equilibrium contracts found in these

environments. We first consider the baseline contracting environment where we assume that firms can

force individuals to drop out of the contract in a given period–that is, the rule lt is unrestricted. We

refer to such environment as a “quasi-complete” contracting environment since it allows for efficient

ex-post participation. We also consider two forms of policyholder commitment.

Table 1.9 details the average contract profile for an insurable 40-yr old male individuals in various

contracting environments. A monte carlo simulation is used to calculate the averages. Averages are