The Limits of Price Discrimination

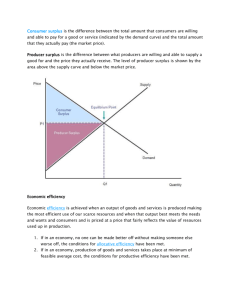

advertisement