Taste for competition and the gender gap among young business professionals

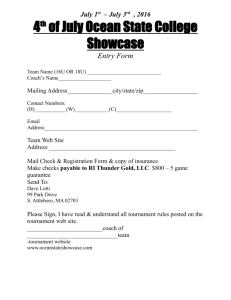

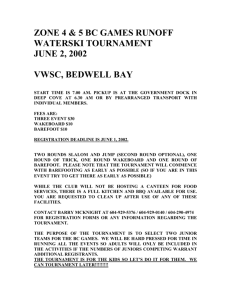

advertisement